No Social Security Payment: You may have seen it in Facebook posts, chain texts, or someone whispering at the community center: “They’re not sending out Social Security payments in February or March this year!” It’s causing a stir in households across America, especially among elders and fixed-income families who rely on every single dollar. But let’s pause for a moment, breathe, and break this down clearly.

Here’s the truth — Social Security and SSI payments are NOT being stopped or cut in February or March 2026. The confusion is due to calendar timing that affects when payments are deposited — something that’s happened for years, but is getting more attention lately thanks to social media chatter and inflation-related anxiety. This article explains what’s really going on, how to stay financially prepared, and what steps you can take to avoid stress or mistakes. Whether you’re drawing benefits, caring for an elder, or helping manage family finances, we’ve got your back.

Table of Contents

No Social Security Payment

Let’s wrap this up with clarity: Social Security and SSI payments are NOT being skipped. What’s happening is a shift in payment dates, something SSA has been doing for decades whenever the first of the month lands on a weekend. If you see two checks in January or February, don’t think it’s a bonus — it’s your next month’s income. Use that knowledge to budget smarter, avoid stress, and protect yourself and your loved ones from unnecessary worry or scams. In times of confusion, facts and community support matter.

| Topic | Details |

|---|---|

| Are Social Security checks cancelled? | No. Payments are still being issued — some are just sent earlier due to calendar adjustments. |

| February 2026 SSI Payment | Paid early on January 30, 2026, because Feb 1 is a Sunday. |

| March 2026 SSI Payment | Will be paid early on February 27, 2026, due to March 1 falling on a Sunday. |

| Other Social Security Benefits | Follow the Wednesday-based schedule based on the beneficiary’s birth date. |

| Wednesday Pay Dates (Feb 2026) | Feb 11, Feb 18, Feb 25 |

| Wednesday Pay Dates (Mar 2026) | Mar 11, Mar 18, Mar 25 |

| Government Shutdown Impact? | None. Social Security is a mandatory program and payments are protected. |

| Why Two Checks in January? | One for January, one early payment for February (SSI only). |

| SSA Official Payment Calendar | ssa.gov/payments |

Why It Looks Like No Social Security Payment?

The Social Security Administration (SSA) operates on a well-oiled schedule. But that schedule flexes when the 1st of the month lands on a weekend or federal holiday. When that happens, SSI checks (Supplemental Security Income) are paid early — usually the Friday before.

Here’s the breakdown:

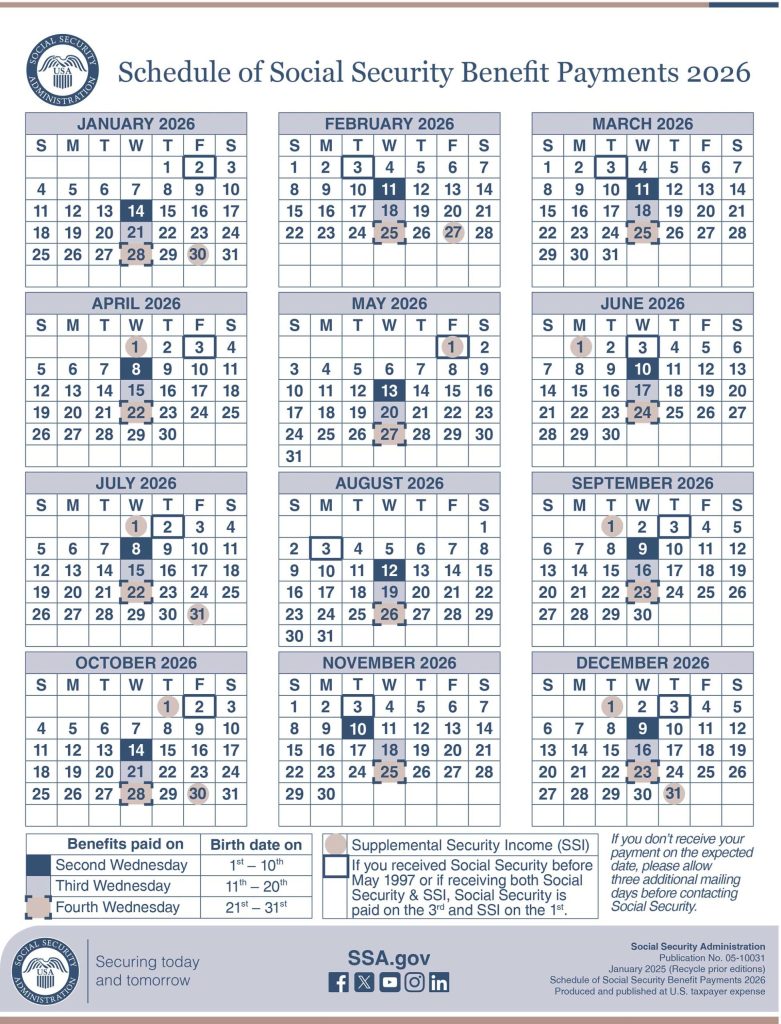

- February 1, 2026 falls on a Sunday, so SSI payments for February were made on Friday, January 30, 2026.

- March 1, 2026 is also a Sunday, which means the March SSI payment will be deposited on Friday, February 27, 2026.

Now, this isn’t new. It’s been this way for decades. But folks often forget or don’t notice — until they see no money showing up in their account during the actual month, leading to panic.

Important to note: This only affects SSI recipients. People receiving Social Security retirement, SSDI (disability), or survivor benefits are paid on a Wednesday schedule based on their birth date — and those dates remain intact.

Full Social Security Payment Schedule (Feb & Mar 2026)

SSI Recipients:

- Feb 2026 check: Paid on Jan 30, 2026

- Mar 2026 check: Paid on Feb 27, 2026

Social Security Retirement, SSDI, and Survivor Benefits:

Payment is issued based on your birthday:

- Born 1st–10th: 2nd Wednesday

- Born 11th–20th: 3rd Wednesday

- Born 21st–31st: 4th Wednesday

Payment Dates:

- February 2026: Feb 11, Feb 18, Feb 25

- March 2026: Mar 11, Mar 18, Mar 25

People who started receiving Social Security before May 1997 are typically paid on the 3rd of each month, or the preceding business day if that lands on a weekend.

How No Social Security Payment in February or March Can Impact Fixed-Income Households?

When your money shows up early, it can feel like a blessing — or a trap.

Here’s why:

- You might spend the January 30 check too fast and run short in February.

- The next check won’t hit until February 27, which still needs to stretch through March.

- This can create what feels like a “gap month,” especially for elders with limited digital banking access or who rely on in-person support.

Budgeting Tips:

- Label early payments as next month’s income.

- Create a basic written budget and plan monthly bills.

- Work with tribal community centers or aging programs that offer financial planning support.

- Try to keep $50–$100 aside (if possible) as a buffer for early months.

For Native communities — especially in rural or reservation areas — where costs for transportation, propane, or groceries are already high, this kind of planning can make a huge difference.

What Elders and Professionals Should Know?

Let’s not forget that nearly 9 million people receive SSI, and over 66 million Americans get Social Security checks every month, according to SSA data. That’s a huge part of our population. For Native American communities, elders and disabled individuals often rely on these funds not just for survival — but to support their households.

Here’s what professionals working in healthcare, aging services, housing, and nonprofits should keep in mind:

- Communicate clearly with clients and community members about adjusted payment dates.

- Provide simple printouts or reminders for those who don’t use online banking.

- Coordinate food pantry deliveries or community meals accordingly to avoid hunger during “tight” weeks.

- Use text alerts or radio PSAs to reach elders in remote areas.

What the SSA Says — Straight from the Source

The SSA has a long-standing policy to advance SSI payments when the 1st of the month is a weekend or federal holiday. This is fully outlined in the SSA’s official documentation, and no changes have been announced for 2026.

“Our payment schedule adjusts automatically. No one is losing benefits — the delivery date simply shifts,” said an SSA representative in a statement issued in January 2026.

No Social Security Payment in February or March: Common Mistakes to Avoid

With all the confusion, here are some key don’ts:

- Don’t assume your benefits were cut. Check your SSA account before panicking.

- Don’t give personal info to someone who calls or texts saying your “Social Security is suspended.” It’s a scam.

- Don’t spend your early check too fast. It’s for next month.

- Don’t miss bills. Some companies offer grace periods — call them before a payment is late.

Protect Yourself from Scams

This is peak season for Social Security scams. If someone emails, texts, or calls saying:

- “You must verify your account…”

- “There’s a problem with your Social Security Number…”

- “You owe money or benefits will be frozen…”

That’s a red flag.

The SSA will never:

- Ask for your Social Security number over the phone or by email

- Demand payment via gift cards or wire transfers

- Threaten arrest or suspension of benefits

Government Shutdown Watch — How February Social Security Payments Could Be Affected

Social Security Payment Schedule for February 2026 and COLA Increase Explained

February Social Security Payments — Check If Yours Is Coming Early or On Schedule