Next Social Security Checks: If you’re one of the millions of Americans relying on Social Security or SSI benefits, mark your calendar — the next Social Security checks arrive in four days. For many households, that deposit means more than just money — it’s peace of mind, a grocery trip, or the ability to pay bills right before the holidays. In this guide, we’ll break down exactly who gets paid first, how the December 2025 Social Security payment schedule works, and what updates you should know heading into 2026. Whether you’re new to Social Security or you’ve been collecting for decades, this article keeps it simple, factual, and practical.

Table of Contents

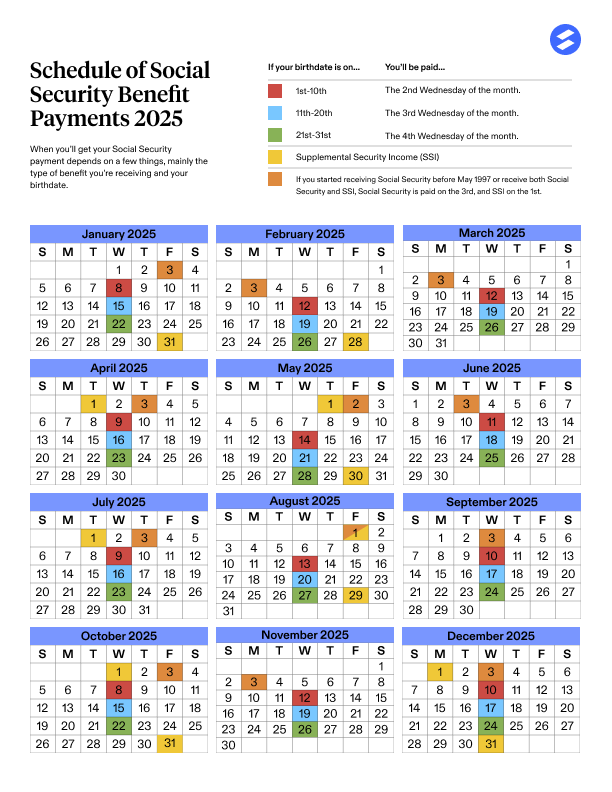

Next Social Security Checks

In summary, SSI recipients get paid first on December 1, followed by early beneficiaries on December 3, and regular Social Security payments throughout the month on December 10, 17, and 24. Plus, SSI recipients will see another payment on December 31, marking an early start to January’s benefits. Understanding your Social Security payment schedule isn’t just about dates — it’s about financial confidence, smart planning, and peace of mind. By staying informed and proactive, you can make sure every dollar works harder for you, now and into the new year.

| Category | Details (December 2025) |

|---|---|

| First Payment Date | December 1 — SSI recipients get paid first |

| Next Group Paid | December 3 — Beneficiaries before May 1997 or those receiving both SSI & SSA |

| Regular SSA Schedule | Birthdays 1–10: Dec 10 • 11–20: Dec 17 • 21–31: Dec 24 |

| Bonus Payment | Early SSI for January 2026 arrives Dec 31 |

| Average SSA Benefit (2025) | $1,918/month |

| Average SSI Benefit (2025) | $943 individual / $1,415 couple |

| Next COLA Adjustment | +2.8% for 2026 |

| Official Resource | SSA Payment Schedule PDF |

Understanding Next Social Security Checks Importance

Social Security isn’t just another government program — it’s the financial backbone of retirement for over 72 million Americans. Established in 1935, it was designed to protect older Americans and people with disabilities from poverty. Nearly nine decades later, the program distributes over $112 billion in benefits every month across retirees, disabled workers, survivors, and children of deceased beneficiaries.

The average monthly benefit for a retired worker in 2025 stands at $1,918, while disabled workers receive about $1,537. These payments may seem modest, but they keep millions afloat — especially amid rising living costs.

Why the Social Security Payment Schedule Matters?

When your Social Security check arrives can make or break your monthly budget. Many Americans structure their finances — rent, utilities, credit cards, and healthcare payments — around these benefit dates. With inflation still influencing costs in late 2025, knowing your exact payment day is essential for planning ahead.

If you depend on SSI or SSDI, understanding the schedule also helps you spot issues early, like delayed payments or incorrect deposits, and avoid scams pretending to be “payment updates.”

Who Gets Next Social Security Checks First in December 2025?

1. SSI Recipients — December 1, 2025

Supplemental Security Income (SSI) recipients kick off the month. SSI provides financial assistance to older adults (65 and older) and people with disabilities who have limited income and resources.

Those payments arrive on Monday, December 1, 2025, either by Direct Deposit, Direct Express card, or paper check (though checks can take a few extra days to arrive).

Average SSI amounts in 2025:

- Individuals: $943

- Couples: $1,415

If you use Direct Deposit, expect your funds to show up shortly after midnight Eastern Time. Paper checks, however, may not arrive until later in the week.

2. Early Beneficiaries — December 3, 2025

Next up are individuals who started receiving benefits before May 1997 or those who collect both Social Security and SSI. These recipients will see their payments on Wednesday, December 3.

This group tends to include long-time retirees, widows, and disabled individuals who have been part of the SSA system for decades. Their earlier payment schedule helps prevent conflicts between overlapping benefit systems.

3. Regular SSA Schedule (Based on Birthdays)

For everyone else, Social Security payments follow the standard three-Wednesday rule based on your birth date:

| Birthday Range | Payment Date (December 2025) | Example |

|---|---|---|

| 1st–10th | Wednesday, Dec 10 | Born on Dec 4 → Paid Dec 10 |

| 11th–20th | Wednesday, Dec 17 | Born on Dec 13 → Paid Dec 17 |

| 21st–31st | Wednesday, Dec 24 | Born on Dec 28 → Paid Dec 24 |

This system, introduced in 1997, ensures smoother distribution across tens of millions of beneficiaries. It’s designed to prevent system overloads and reduce banking delays during high-volume periods.

A Special December Twist — The Double SSI Payment

December 2025 comes with a little bonus: two SSI payments in the same month. Since January 1, 2026, is a federal holiday, the SSA will send January’s SSI payment early, on December 31, 2025.

This means SSI recipients will receive:

- December’s payment: December 1

- January’s payment: December 31 (early release)

It’s not technically “extra money,” but it does help many families start the new year with bills paid and a little cushion for post-holiday expenses.

How to Check Next Social Security Checks Status?

If you want to confirm your deposit or track changes, here’s how to do it efficiently.

1. Log into “My Social Security”

Head over to SSA.gov/myaccount. You can:

- Check upcoming payment dates

- Review your benefit history

- Update your address or banking details

- Access your annual benefits statement

2. Use the Direct Express App

If you receive payments through a Direct Express® Debit Mastercard, download the mobile app to monitor transactions instantly. You can also set alerts for each deposit.

3. Call SSA Support

For personal assistance, call 1-800-772-1213 (TTY 1-800-325-0778). Be ready to verify your identity and allow extra wait time during holidays.

Avoiding Delays and Common Payment Issues

While the SSA payment system is reliable, delays can occur due to:

- Federal holidays and bank closures

- Incorrect or outdated bank details

- Change of address not yet processed

- Postal service delays (for mailed checks)

Tip: Always update your information at least 30 days before a payment date, and opt for direct deposit to minimize issues.

Inflation, COLA, and What’s Next for 2026

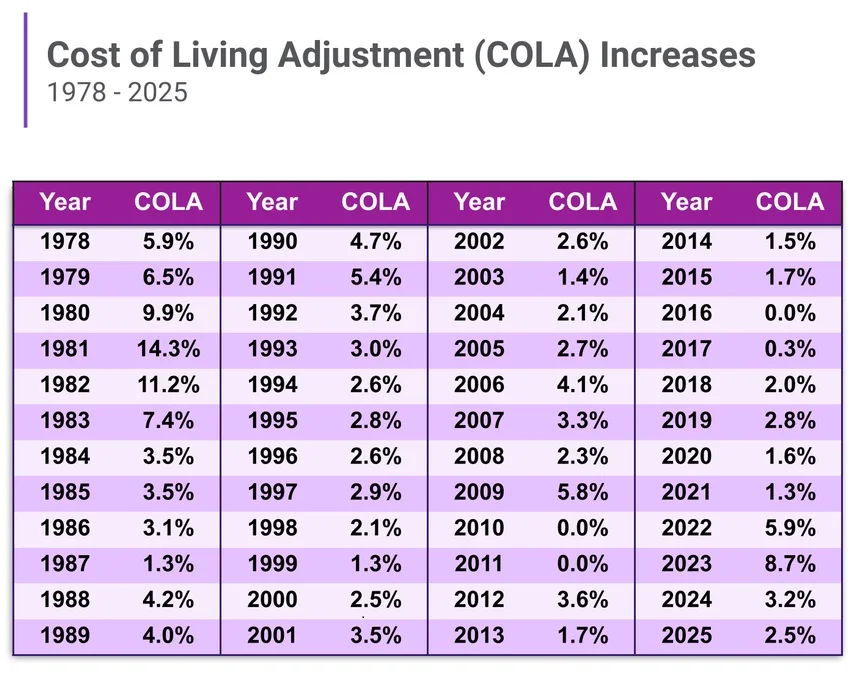

In 2026, beneficiaries will see a 2.8% Cost-of-Living Adjustment (COLA) — an increase designed to offset inflation. For the average retiree, this adds roughly $54 per month.

COLA adjustments are tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a federal measure of inflation. Although the 2026 increase is moderate, it helps maintain purchasing power amid rising healthcare, food, and housing costs.

Historically, COLA adjustments have ranged from as low as 0% (no change) to as high as 14.3% in 1980.

Taxes and State-Level Differences

Not every state treats Social Security benefits the same way.

- No tax states: Florida, Texas, Alaska, Nevada, Tennessee, Washington, and Wyoming do not tax benefits at all.

- Partial or full taxation: States like Colorado, Montana, and New Mexico may tax benefits based on income.

- Federal taxation: If your total income (including benefits, wages, and dividends) exceeds $25,000 as an individual or $32,000 jointly, up to 85% of your Social Security benefits may be taxable.

How Social Security Impacts American Families

According to the Center on Budget and Policy Priorities (CBPP), Social Security lifts nearly 22 million Americans out of poverty annually — including 15 million seniors. Without these benefits, elderly poverty rates would jump from about 10% to 40% nationwide.

For families with disabled members, Social Security Disability Insurance (SSDI) acts as a financial stabilizer, helping cover healthcare and living costs.

It’s a vital system that keeps the middle class afloat and ensures basic dignity in retirement.

Budgeting Around Your Social Security Income

Smart budgeting can stretch your monthly benefit further. Here’s a simple, tried-and-true method used by retirees and financial advisors alike:

- 50% for needs: Rent or mortgage, utilities, groceries, transportation.

- 30% for wants: Dining out, entertainment, travel.

- 20% for savings or debt reduction: Even a small monthly contribution builds financial resilience.

Budgeting apps like Mint, You Need a Budget (YNAB), or EveryDollar can make this process simple. They sync with your bank accounts to track income, expenses, and goals.

Real-Life Example: Meet Linda

Linda, a 67-year-old retired teacher from Ohio, receives both SSI and Social Security benefits. Her birthday falls on December 8, so she’ll receive her Social Security check on December 10 — and her SSI deposits on December 1 and 31.

“This time of year,” she says, “those payments make the holidays less stressful. I can plan my gifts and bills without worrying about timing.”

Linda’s experience mirrors that of millions who rely on consistent Social Security income to maintain independence and stability.

New York Social Security Schedule: Exact December 2025 Payment Dates

Why December’s Social Security Payments Will Follow a Modified Schedule This Year

Social Security Payment Up to $4,018 Scheduled for December 10 — Who Qualifies This Cycle