New York raises overtime thresholds: If you work or run a business in New York, this one’s for you. New York raises overtime thresholds starting January 2026, and it’s not just another rule buried in bureaucracy—it’s a major pay shift for tens of thousands of salaried workers. This article breaks down exactly what’s changing, who it affects, and what you need to do to stay compliant and informed. From corner offices to kitchen counters, whether you’re leading a team or clocking long hours behind the scenes, this change could put more money in your pocket—or more pressure on your payroll. Let’s unpack it all with practical advice, real-world examples, and expert-backed insights that make it simple enough for a 10-year-old to understand but deep enough for HR pros, business owners, and legal experts to trust.

Table of Contents

New York raises overtime thresholds

The fact that New York raises overtime thresholds starting January 2026 is more than a policy update—it’s a sign of changing workplace standards and a push for fairer compensation. With more workers now eligible for overtime and more employers facing compliance pressure, preparation is everything. If you’re an employee, know your rights. If you’re an employer, get compliant now. And if you’re unsure? Get advice—don’t wing it.

| Category | Details |

|---|---|

| Effective Date | January 1, 2026 |

| NYC/LI/Westchester | $1,275/week ($66,300/year) threshold |

| Rest of NY State | $1,199.10/week ($62,353.20/year) threshold |

| Federal Threshold | $684/week ($35,568/year) → still applies to professional employees |

| Industries Affected | Retail, Hospitality, Healthcare, Nonprofits, Education, Admin Roles |

| Overtime Rate | 1.5× hourly rate for hours worked beyond 40/week |

| Tools & Resources | NY DOL Overtime Rules, DOL OT Calculator |

| Who’s Impacted | Salaried workers under new thresholds + employers across the state |

What’s Changing, and Why New York raises overtime thresholds Matters?

On January 1, 2026, the New York State Department of Labor (NYSDOL) will implement new salary thresholds that determine whether a salaried employee is exempt from receiving overtime pay.

Here’s what the new salary floors will look like:

New York City, Long Island, and Westchester County:

- New threshold: $1,275/week (equivalent to $66,300/year)

- Previous threshold: $1,237.50/week

Rest of New York State:

- New threshold: $1,199.10/week (equivalent to $62,353.20/year)

- Previous threshold: $1,161.65/week

If you’re salaried and you earn less than these thresholds, and you work more than 40 hours per week, your employer is required to pay you overtime at time-and-a-half your regular hourly rate.

This change doesn’t just update a number—it reshapes how overtime is calculated for tens of thousands of employees across the state.

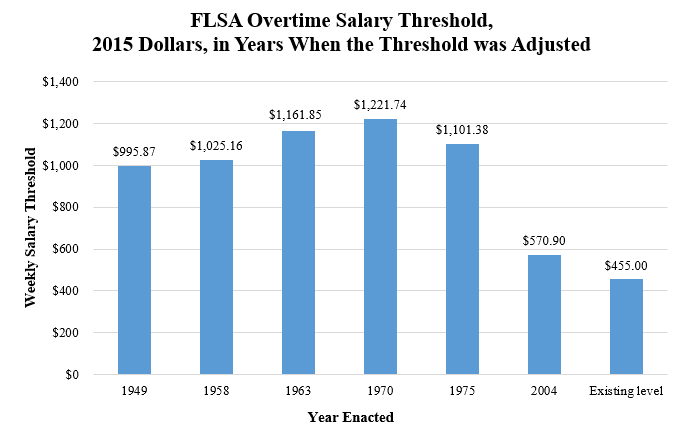

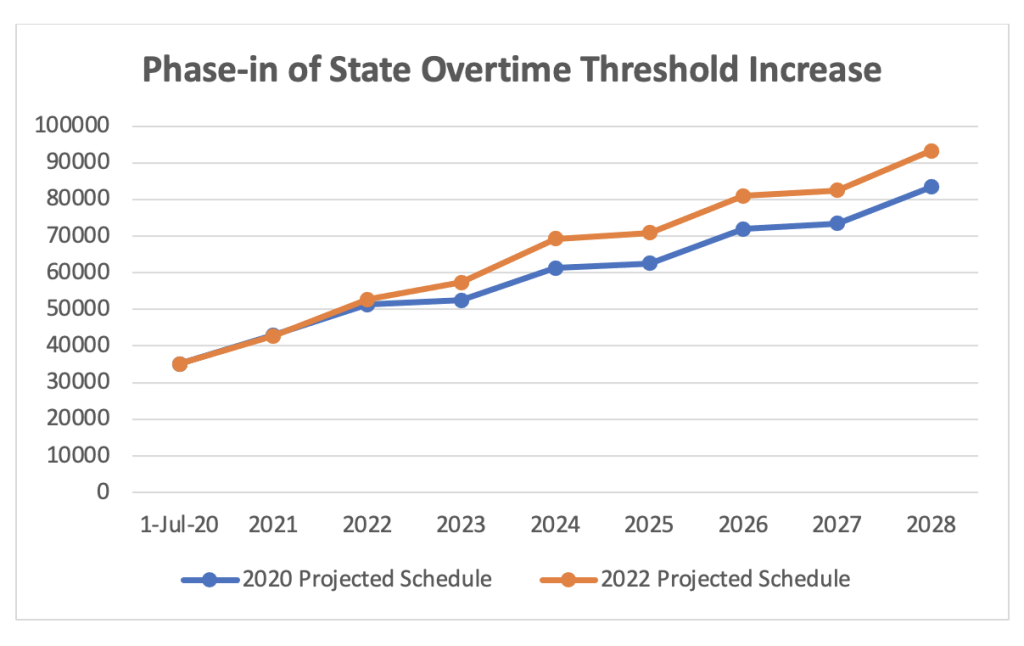

Comparing New York to Federal Law

To understand why this matters, you need to compare it to the federal Fair Labor Standards Act (FLSA). Federally, the salary threshold for overtime exemption is only $684/week, which equals about $35,568 annually.

New York, however, often chooses to raise the bar on worker protection. It’s been implementing higher thresholds since 2016, in phases.

Let’s stack them side by side:

| Region | Federal Threshold | New York Threshold (2026) |

|---|---|---|

| All U.S. States | $684/week | — |

| NYC, LI, Westchester | — | $1,275/week |

| Rest of NY State | — | $1,199.10/week |

These new thresholds reflect the rising cost of living, especially in metro areas. They also ensure that more salaried workers who are working long hours can qualify for additional pay.

Who This Affects: Employees and Employers Alike

Salaried Workers

If you’re in a salaried role and your weekly paycheck is below the new threshold, you’re likely entitled to overtime pay for any hours worked beyond 40 per week.

This affects a wide range of workers:

- Assistant store managers

- Retail shift leads

- Office administrators

- Restaurant supervisors

- Health clinic support staff

- Nonprofit program coordinators

- HR, payroll, and finance support

And remember: just being salaried doesn’t automatically mean you’re exempt. Both your salary and your job duties have to pass specific exemption tests under New York labor law.

Employers and Business Owners

If you employ people on a salaried basis, this is a huge compliance checkpoint.

You must now:

- Review employee classifications

- Evaluate who meets the “duties test” under executive, administrative, or professional categories

- Decide whether to raise salaries above the threshold—or start paying overtime

- Adjust payroll systems accordingly

Failure to do so can result in penalties, lawsuits, and back pay claims.

The Duties Test: It’s Not Just About the Paycheck

To be exempt from overtime in New York, a salaried employee must not only earn above the salary threshold, but also pass what’s called a “duties test.”

Let’s simplify these:

Executive Exemption:

- Primary duty: managing the business or a department

- Directs the work of two or more full-time employees

- Has authority to hire/fire or heavily influence those decisions

Administrative Exemption:

- Primary duty: non-manual work related to business operations

- Exercises independent judgment on significant matters

Professional Exemption:

- Work requires advanced knowledge (e.g., in law, medicine, education)

- Often applies to licensed professionals

If an employee doesn’t meet both the salary threshold and the duties test, they must be classified as non-exempt—and must be paid overtime.

Real-World Examples

| Position | Location | Weekly Salary | 2026 Status |

|---|---|---|---|

| Retail Manager | New York City | $1,250 | Not Exempt |

| Clinic Admin | Albany | $1,180 | Not Exempt |

| Civil Engineer | Buffalo | $1,300 | Exempt (Professional) |

| Office Coordinator | Long Island | $1,100 | Not Exempt |

| High School Teacher | Rochester | $850 | Exempt (Professional) |

What Should Employers Do Next?

Here’s your compliance checklist to avoid trouble in 2026:

- Audit All Salaried Roles

Review who’s currently exempt and check if their salary still qualifies under the new thresholds. - Evaluate Job Descriptions

Make sure the duties of each role align with executive, admin, or professional exemption categories. - Communicate Changes Internally

Train managers, update policies, and notify affected employees of reclassification and timekeeping policies. - Upgrade Payroll Systems

Ensure your systems can track time for newly non-exempt employees and accurately calculate OT. - Consider Salary Adjustments

For employees just below the new threshold, it may be cheaper long-term to raise salaries rather than pay ongoing overtime. - Consult Legal or HR Professionals

This is not the time to DIY labor compliance—legal counsel can help avoid expensive missteps.

What Should Employees Do As New York raises overtime thresholds?

- Review Your Pay Stub

Know exactly how much you make per week. If it’s under the threshold, you may be owed OT. - Ask HR About Your Classification

Don’t be shy—ask if your role will be reclassified and what that means for your work hours and pay. - Start Tracking Hours

If you may become non-exempt, start tracking hours now to understand your true workload. - Document Overtime Hours

If you work over 40 hours but don’t get paid for it, keep a written record. This could become legal evidence if needed. - Know Your Rights

Visit NY DOL’s wage protection page for updated info or to file a complaint.

How New York raises overtime thresholds Affects Specific Industries?

Let’s zoom in on a few sectors where this change will hit hard:

Retail

Retail stores often promote staff to salaried “manager” roles to avoid paying hourly OT—but many of these folks earn under $1,275/week. Come 2026, unless salaries rise, these workers must be paid for overtime hours worked during holidays, floor resets, and inventory seasons.

Hospitality

Hotels, restaurants, and catering companies rely on salaried supervisors who routinely work over 40 hours per week. Most of these positions will become non-exempt, which may lead to wage increases or staff restructuring.

Nonprofits

Nonprofits tend to operate on tight budgets and lean staff. Many admin and program coordinator roles will now require overtime pay unless salaries are raised. This may mean tighter programming—or reallocated resources.

Healthcare

Many clinic administrators and intake supervisors fall just shy of the threshold. With long shifts and unpredictable schedules, employers will need to either pay overtime or reassess role structure.

Expert Commentary

“This new threshold reflects the economic reality that many so-called ‘exempt’ employees are working 50–60 hour weeks without appropriate pay. The law is catching up with common sense.”

— Sandra Millis, Labor and Employment Attorney, NYC

“Businesses shouldn’t panic—but they do need a plan. Compliance isn’t optional, and misclassification can cost you big time.”

— Daryl Kim, HR Compliance Consultant

It’s Official: New York Announces 2026 Minimum Wage Hike; Here’s Who Benefits Most

Who is eligible for New York City’s Guaranteed Income Program? Check Benefits

San Diego Says Goodbye to Rock-Bottom Wages: New Minimum Wage Hike Coming January 2026!