New York City’s Guaranteed Income Program: The New York City Guaranteed Income Program is one of the boldest anti-poverty experiments happening in the U.S. today. Unlike traditional welfare systems that often require layers of documentation and come with restrictions on how funds are used, this program gives direct, recurring cash payments to people in need—no strings attached. It’s a modern, human-centered approach to economic support. This article covers everything you need to know: who qualifies, how the program works, how much money participants get, and why this model could change how we fight poverty across America.

Table of Contents

New York City’s Guaranteed Income Program

The New York City Guaranteed Income Program is reshaping how the city addresses poverty, housing instability, and economic opportunity. With monthly cash payments and no strings attached, these pilot programs show that trusting people with money works. From expectant mothers in unstable housing to young adults aging out of foster care, recipients are using the funds to take control of their lives—and the data shows it’s paying off. As policymakers look to the future, NYC’s experience offers a powerful case for expanding guaranteed income models nationally. And for the families involved, it’s more than a policy — it’s a path toward dignity, stability, and hope.

| Program Aspect | Details |

|---|---|

| Official Website | guaranteedincome.us/new-york-city |

| Main Target Groups | Expectant mothers facing housing insecurity, young adults (18–24) experiencing homelessness |

| Monthly Payments | Up to $1,200/month for youth; up to $1,000/month for mothers |

| One-Time Cash Bonus | $2,500–$5,000 depending on program |

| Program Duration | 9 months to 3+ years |

| Delivery Partners | NYC Council, The Bridge Project, Covenant House NYC |

| Purpose | Economic stability, improved health outcomes, housing security |

| Latest NYC Funding | $1.5 million allocated in FY2026 budget for youth cohort |

| National Momentum | Similar pilots in over 40 cities including Los Angeles, Chicago, and Denver |

What is a New York City’s Guaranteed Income Program?

A guaranteed income is a recurring cash payment distributed to individuals, regardless of employment status, with the goal of reducing financial instability. These payments are unconditional, meaning recipients don’t have to meet employment, training, or behavioral requirements.

This is different from Universal Basic Income (UBI), which proposes payments to all citizens regardless of income. Instead, NYC’s guaranteed income program is targeted, designed for those most in need—especially young adults experiencing homelessness and low-income pregnant people facing housing instability.

These programs operate under the philosophy that people are capable of making the best decisions for themselves when given the financial breathing room to do so.

Who is Eligible for the New York City’s Guaranteed Income Program?

Expectant Mothers Facing Housing Insecurity

The Bridge Project, launched in 2021, was the first guaranteed income program in New York City and focuses on pregnant women and new mothers living below the poverty line.

To be eligible, individuals must:

- Be pregnant or have an infant under 1 year old

- Live in New York City

- Be experiencing housing instability or be low-income

The Bridge Project began in Washington Heights and has since expanded across the five boroughs. Participants have included undocumented immigrants, teenage mothers, and parents in domestic violence shelters.

These mothers receive up to $1,000 per month, along with an initial one-time stipend of up to $2,500, depending on the cohort. In later stages of the pilot, some recipients were supported for as long as three years.

What makes this program unique is its accessibility: Some cohorts didn’t require a Social Security Number or immigration documentation, ensuring support reached the most vulnerable.

Young Adults (18–24) Experiencing Homelessness

In 2025, NYC expanded its guaranteed income initiative to include youth experiencing homelessness, particularly those enrolled in services at Covenant House NYC and similar transitional housing programs.

Eligibility includes:

- Age between 18 and 24

- Currently experiencing homelessness or housing insecurity

- Enrolled in a participating shelter or transitional program

Participants in this program receive:

- $1,200 per month for nine months

- A $5,000 one-time lump sum payment at any point during the program

- Benefits counseling to help with budgeting, job placement, education, and housing

These supports were introduced through the Cash with Care initiative, with funding allocated in NYC’s FY2026 city budget.

How the Program Works?

Here’s how individuals typically enroll in these guaranteed income programs:

- Determine Eligibility

Applicants must meet the criteria related to income, pregnancy status, age, and housing conditions. - Apply through a Partner Organization

These programs are run by nonprofits in partnership with NYC Council. For example:- The Bridge Project manages applications for pregnant women and mothers.

- Covenant House NYC helps enroll homeless youth.

- Start Receiving Payments

Once accepted, participants receive monthly payments through direct deposit or preloaded debit cards. There are no restrictions on how the funds are spent. - Optional Support Services

Counseling is offered to help participants manage finances, find housing, or access job training—but it is not required.

Real-Life Impact: Stories That Matter

Maria, a 24-year-old expectant mother from the Bronx, joined The Bridge Project during her second trimester. Previously juggling two part-time jobs while sleeping on her sister’s couch, she was struggling to save for a crib, diapers, and prenatal visits.

With monthly guaranteed income, she was able to move into a shared apartment, purchase essentials for her baby, and attend all prenatal appointments without missing work.

Jamal, a 19-year-old participant in the youth pilot, aged out of foster care and was living in a shelter. With $1,200/month and a $5,000 one-time payment, he was able to secure a rental room, take GED classes, and begin job training. He called the money “a lifeline, not a handout.”

These stories are not outliers—they reflect what researchers are finding in studies of guaranteed income: cash gives people the space to stabilize and grow.

The Research Behind New York City’s Guaranteed Income Program

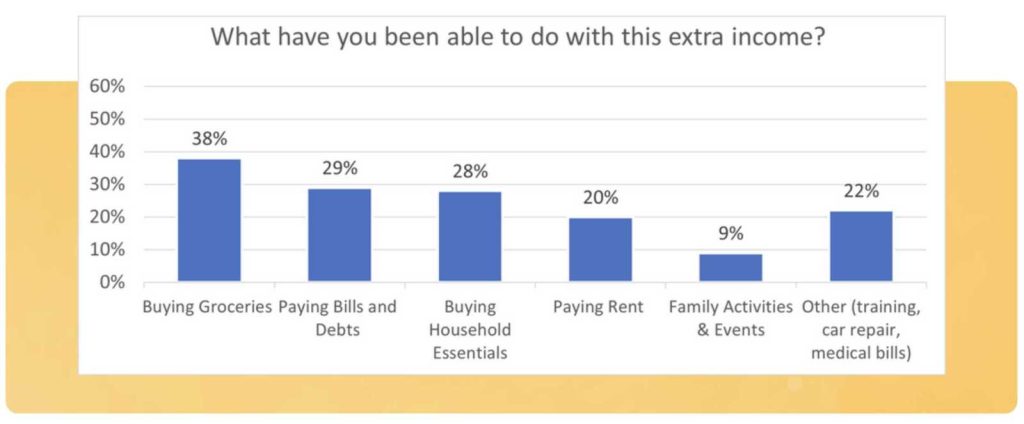

The NYC programs are part of a growing body of research into how unconditional cash transfers affect well-being, economic stability, and opportunity.

A 2023 study from the Center for Guaranteed Income Research at the University of Pennsylvania found that participants in similar pilots across the U.S. were:

- 2x more likely to secure full-time employment within one year

- Reported 30% improvements in mental health

- Spent funds mostly on essentials like rent, food, transportation, and child care

Another report from the Jain Family Institute showed that 75% of New Yorkers living below the poverty line would benefit from an income floor of $1,000/month, with no reduction in labor market participation.

In fact, many recipients reported that receiving cash enabled them to seek better, more stable jobs, as they could afford transportation, child care, or training they couldn’t access before.

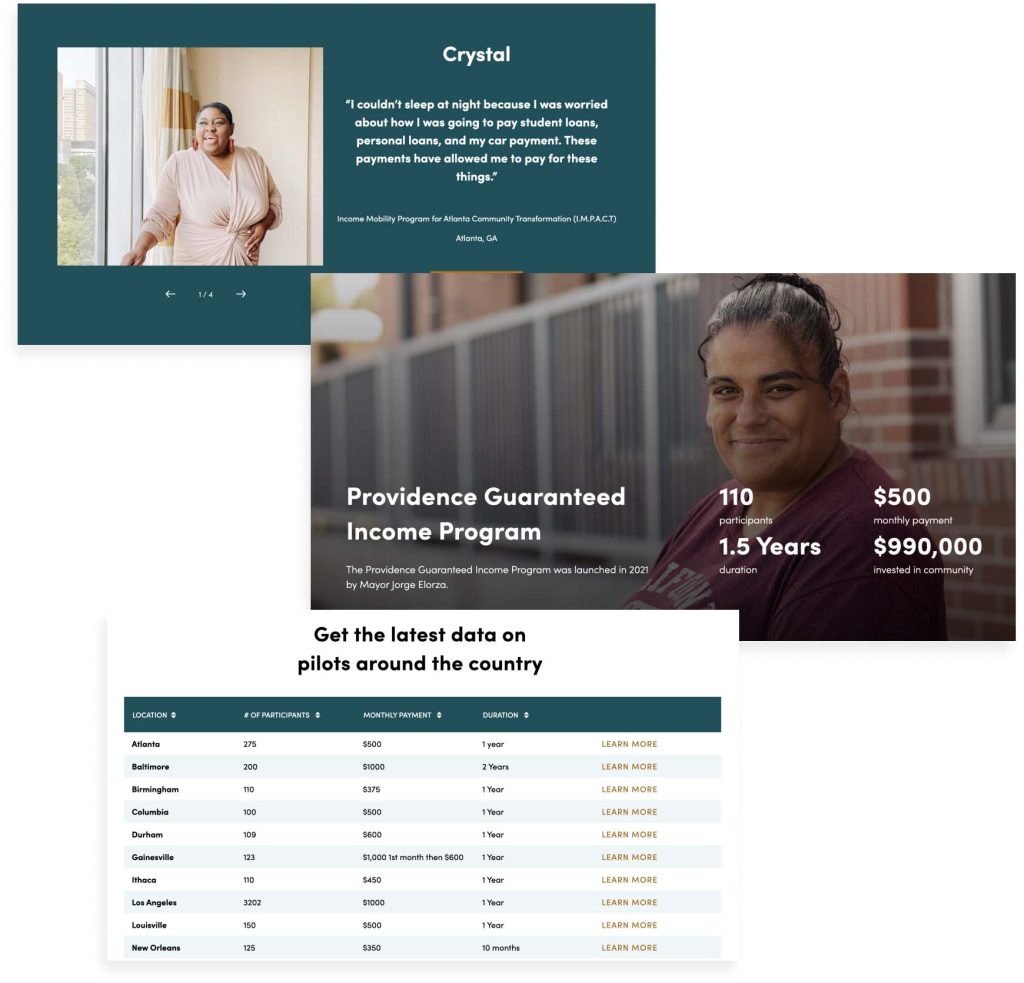

NYC’s Place in a National Movement

New York City isn’t alone. Across the country, mayors and city councils are testing guaranteed income through pilot programs, including:

- Los Angeles: 3,200 residents received $1,000/month for 12 months

- Chicago: 5,000 families received $500/month for a year

- Denver: Participants received up to $1,000/month, with a focus on homelessness prevention

These pilots are often funded by a mix of philanthropic grants, city budgets, and COVID-19 recovery funds.

Nationwide, the nonprofit Mayors for a Guaranteed Income now includes over 100 participating U.S. cities, signaling that what began as a fringe idea is quickly becoming mainstream policy.

Challenges and Criticisms

Despite the promising results, not everyone supports guaranteed income. Critics argue:

- It may discourage work

- It could be expensive to scale up nationwide

- It doesn’t address root causes of poverty like education or healthcare

However, research and real-world examples have so far countered these concerns:

- Participants continue working or go back to school at higher rates

- Programs are cost-efficient compared to shelters, incarceration, or emergency services

- Unrestricted funds give people the dignity and autonomy to build their own solutions

Still, scaling these programs will require sustained funding, robust policy design, and public support.

Maine increases minimum wage in 2026: Check the amount and date

Still Waiting on Your $400 New York Inflation Check? Here’s the Real Reason for the Delay

Medicare Update 2026: Some Prescription Drug Costs Expected to Drop by Half