New Tax Benefit for 1 Million Taxpayers: The IRS has made a significant announcement that could affect about 1 million taxpayers across the U.S. This new tax benefit is designed to provide financial relief for a specific group of individuals who might need it most. For many of these taxpayers, the benefit can offer substantial savings, simplifying their upcoming tax season. If you’re one of the eligible recipients or simply curious about how this new tax benefit works, this article will give you the full breakdown. Let’s dive in!

Table of Contents

New Tax Benefit for 1 Million Taxpayers

The IRS’s announcement of a new tax benefit for U.S. military service members is an exciting and important development. Eligible members will receive a one-time payment of $1,776, which will be fully tax-free, meaning no need to worry about taxes when filing in 2026. This financial relief will help service members and their families cope with rising costs without the burden of additional tax deductions. Whether you’re a service member, a family member, or someone who works closely with the military community, this tax-free benefit is good news. It’s straightforward, simple, and easy to use. If you’re eligible, you can expect your payment in your regular pay channel — no extra paperwork required. This benefit is a great example of how the U.S. government continues to support its military personnel and ensure they can focus on serving without unnecessary financial strain.

| Key Point | Details |

|---|---|

| Tax Benefit | A one-time tax-free payment for U.S. military service members, totaling $1,776. |

| Eligibility | Active-duty service members, National Guard, and Reserve members in specific pay grades. |

| Tax Status | The $1,776 payment is exempt from federal taxes—you don’t owe anything. |

| No Application Needed | Payments will be automatically issued via direct deposit or standard pay channels. |

| When It Applies | This benefit applies to those who were serving as of November 30, 2025, with payments distributed in December 2025. |

| Source | Official IRS Announcement IRS News |

What is the New Tax Benefit for 1 Million Taxpayers?

The IRS recently announced a new tax benefit for military personnel. The benefit is a tax-free, one-time payment of $1,776, designed to support active-duty U.S. military service members and certain reserve component members. This is part of a broader effort to ensure that those who serve in the military have the financial support they need, particularly as they prepare to file their 2025 tax returns in 2026.

The key takeaway? This money is tax-free, so you won’t need to worry about it counting as income on your tax return. If you’re one of the service members who will receive this benefit, it means you can keep the full $1,776. No deductions, no strings attached.

Who Is Eligible for New Tax Benefit for 1 Million Taxpayers?

Service Members Receiving the Benefit

This new tax benefit primarily targets military service members who fall into the following categories:

- Active-duty U.S. military personnel (including Army, Navy, Air Force, Marine Corps, and Space Force).

- National Guard and Reserve members, provided they were active as of November 30, 2025.

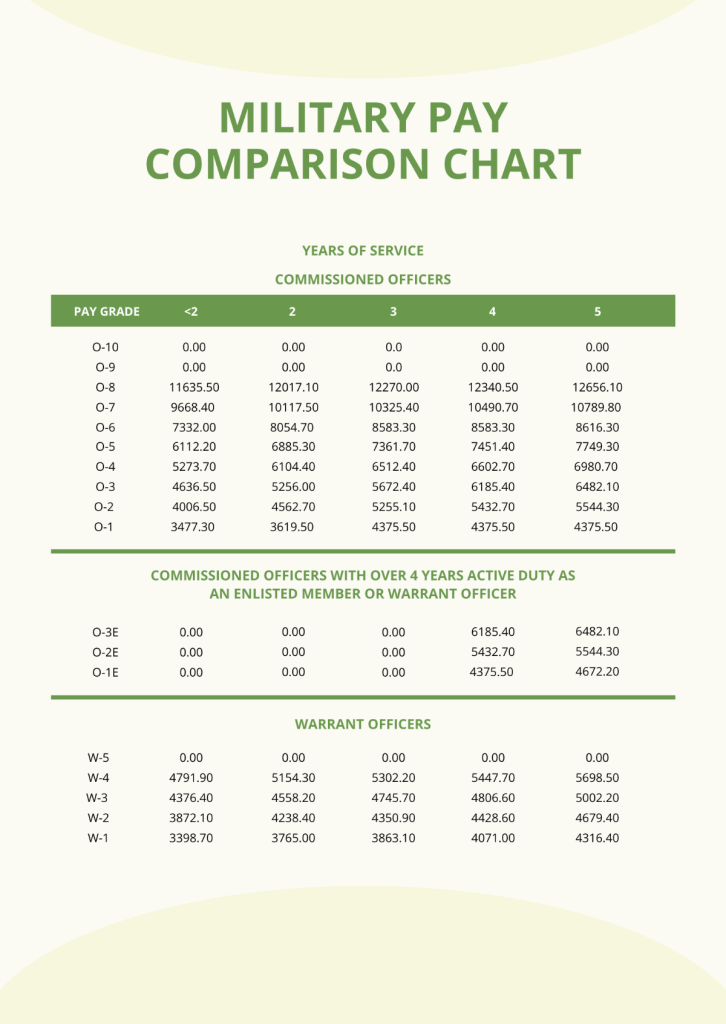

- Specific pay grades: The benefit applies to those in pay grades O-6 and below.

You don’t need to apply for this benefit; eligible service members will automatically receive the $1,776 payment via their regular pay channels or through direct deposit.

The total number of eligible recipients is estimated to be around 1.45 million service members. If you’re eligible, you’ll receive the full payment, and there’s no need to report it as income when you file your taxes.

Why Is This Benefit Important?

Support for Service Members and Their Families

For those who serve in the military, balancing financial stability with the demands of service can be tough. This new benefit comes at a time when many families are feeling the pressure of rising living costs, inflation, and other economic challenges. Having an extra $1,776 that doesn’t get taxed could help cover unexpected expenses or contribute to household savings.

Tax-Free Money

The best part of this benefit is that the $1,776 payment is fully tax-exempt. This means that, unlike a bonus or extra paycheck, you don’t have to worry about paying any federal taxes on the amount. This makes it one of the best perks for military service members, giving them more financial flexibility.

How Does This New Tax Benefit for 1 Million Taxpayers Work?

Let’s break it down step-by-step to help you understand how this will affect your tax filing in 2026.

Step 1: IRS Announcement and Eligibility

The IRS made an announcement confirming that $1,776 would be sent to eligible service members. This is a one-time payment, so if you’re in the right pay grade and meet the eligibility requirements, you’re in!

Step 2: Automatic Distribution

Unlike other benefits that require an application, the IRS will automatically distribute this payment to eligible service members. You don’t need to file any extra paperwork, and the payment will be sent to you via your military pay system.

Step 3: Tax Implications

Here’s the big part — the payment is tax-free. There are no strings attached, and you don’t need to report this payment on your 2025 tax return. It will not increase your taxable income, which means you won’t pay any taxes on it.

Step 4: Financial Planning

Since the $1,776 is tax-free, you can plan for it just like any other untaxed financial resource. You can use it for savings, paying bills, or even treating yourself. The key takeaway is that you get to keep the entire amount.

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies

Social Security January 2026 Payment Dates – Who Gets Paid First and Which Checks Arrive Early