New Social Security payment arrives: that’s the big headline making its way through living rooms, retirement communities, and financial planning offices across America. For millions of seniors, people with disabilities, and families relying on monthly checks, the timing and accuracy of that payment isn’t just important — it’s a vital piece of monthly life planning. Now, here’s what’s up: If your birthday lands between the 21st and 31st of any month, then Wednesday, December 24, 2025 is your day to get paid. That’s your regular Social Security retirement, survivor, or disability benefit deposit date — no holiday bonus, no double-dip. Just your standard benefit, served with a side of Christmas Eve cheer.

But December is a special month on the SSA calendar. There are quirks, early deposits, and even two payments for certain groups — all of which can make things confusing if you don’t have the right info. So, let’s break it all down clearly and simply. Whether you’re a 10-year-old asking about grandma’s check or a retirement advisor helping a client, this article has you covered.

Table of Contents

New Social Security Payment

The Social Security payment scheduled for December 24, 2025, applies to millions of Americans born from the 21st to the 31st of any month. This date is not a holiday bonus or a special check — just your regularly scheduled payment based on SSA’s calendar. However, December is packed with quirks: two SSI checks for some, early paydays for others, and upcoming COLA increases that kick in the following month. Understanding how the system works — and how to navigate it confidently — can make a real difference in your monthly budget and long-term planning. Whether you’re a retiree, someone receiving disability, or helping your family member manage their benefits, staying informed is the best way to take charge.

| Topic | Key Details |

|---|---|

| Dec 24, 2025 Payment | Social Security benefit for those born on the 21st–31st. |

| Full December Payment Schedule | SSI: Dec 1 & Dec 31; Early recipients (pre‑May 1997): Dec 3; Birthdays 1–10: Dec 10; 11–20: Dec 17; 21–31: Dec 24. |

| 2026 COLA (Cost-of-Living Adjustment) | 2.8% increase, boosting average monthly benefits by approx. $56. |

| SSI Federal Payment Standards (2026) | ~$994 (individual), ~$1,491 (couple). |

| Max Social Security Payment (2026) | Up to $5,430/month for high earners claiming at age 70. |

| Official SSA Website | https://www.ssa.gov |

Understanding the December 24, 2025 Payment

Social Security payments don’t all come on the same day for everyone. Instead, the Social Security Administration (SSA) uses a staggered payment system based on your birth date. If you were born between the 21st and the 31st, then your benefit is paid on the fourth Wednesday of each month — which in December 2025 falls on Wednesday, December 24.

This system helps prevent overload on financial institutions and SSA systems. Plus, it spaces out the massive outflow of funds — over $1 trillion annually in benefits — and ensures smoother processing.

If your birthday falls on:

- 1st to 10th → You’re paid on the second Wednesday (December 10).

- 11th to 20th → You’re paid on the third Wednesday (December 17).

- 21st to 31st → You’re paid on the fourth Wednesday (December 24).

If you started receiving benefits before May 1997, or you receive both SSI and Social Security, you get paid earlier — on December 3.

SSI Recipients — Two Payments in December

If you receive Supplemental Security Income (SSI), December is a little different. Normally, SSI is paid on the 1st of each month, but since January 1, 2026 is a federal holiday, January’s SSI payment will arrive early — on December 31, 2025.

So if you’re getting SSI, you’ll see:

- December benefit on December 1

- January benefit on December 31

This can feel like a “double payment,” but it’s not extra — it’s just a scheduling quirk due to the New Year’s Day holiday.

Who Qualifies for the December 24 New Social Security Payment?

The December 24 payment isn’t a special stimulus check or extra benefit. It’s a regularly scheduled payment for:

- Retired workers receiving Social Security benefits

- Disabled workers receiving SSDI

- Survivors such as widows, widowers, or dependent children

To receive your benefit on December 24, your birth date must fall between the 21st and 31st, and you must have already qualified for benefits.

Your payment amount depends on a few key factors:

- Your earnings history

- When you started claiming benefits

- Your work credits (especially for SSDI)

- Family situation (spousal or survivor benefits)

How Are Payment Amounts Calculated?

Let’s make it simple. Here’s how the SSA figures out what your check will look like:

1. Retirement Benefits

The longer you work and the more you earn (up to the SSA wage cap), the more you’ll get. If you claim benefits at your full retirement age (between 66 and 67), you get your primary insurance amount (PIA).

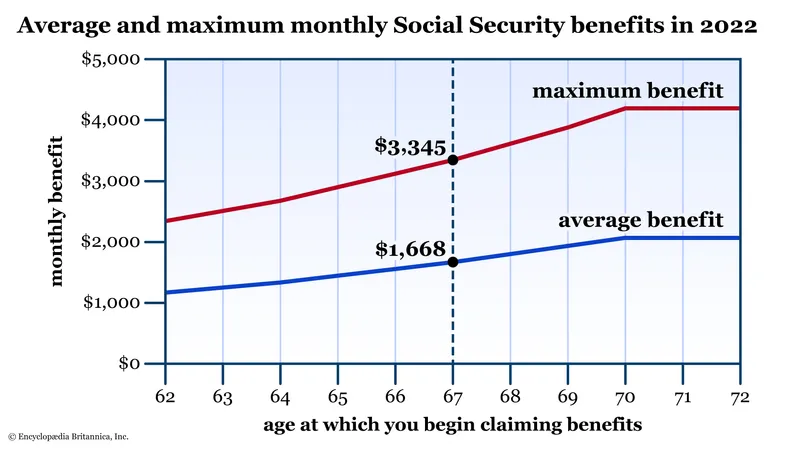

Claiming early at 62? You’ll get about 70–75% of your PIA. Wait until age 70, and you’ll get up to 132% of your PIA due to delayed retirement credits.

In 2025, the average Social Security retirement benefit is about $2,071/month. The maximum benefit for those retiring at age 70 with maximum earnings can reach $5,430/month in 2026.

2. SSDI (Social Security Disability Insurance)

SSDI benefits are based on your work history — not financial need. The average SSDI benefit is around $1,537/month. You must have a qualifying disability and sufficient work credits.

3. Survivors

Survivor benefits vary widely depending on the deceased worker’s earnings and the survivor’s age or disability. Widows and widowers may get up to 100% of the deceased spouse’s benefit, depending on when they claim.

What’s Changing in 2026? COLA and More

A big update: The Cost-of-Living Adjustment (COLA) for 2026 is set at 2.8%. That means:

- If you received $2,000/month in 2025, you’ll get about $2,056/month in 2026.

- SSI standards will rise to $994/month for individuals and $1,491/month for couples.

This helps offset inflation, though COLA rarely keeps up with the true cost increases many seniors face — especially in healthcare, housing, and energy.

Common Mistakes to Avoid

Even seasoned professionals and long-time beneficiaries make these errors:

1. Assuming Payments Are Always on the Same Day

Don’t expect your check to arrive on the 1st of the month. Your birth date determines your payment day — and it can vary month to month due to weekends and holidays.

2. Mixing Up SSI and Social Security

These are different programs:

- SSI is need-based — for low-income individuals who are aged, blind, or disabled.

- Social Security is earned through work credits — for retirees, disabled workers, and survivors.

3. Not Using a mySocialSecurity Account

This free SSA tool lets you check payment status, update banking details, and get real-time alerts. Too many beneficiaries still rely on mailed notices.

4. Not Understanding Taxes on Benefits

If you have other income, your benefits could be taxed. For individuals earning over $25,000/year or couples earning over $32,000, up to 85% of your benefit could be taxable.

Tips to Maximize New Social Security Payment

1. Delay Your Claim

If you can wait until age 70, your benefit could be 32% higher than if you claimed at 66 — or about 76% higher than if you started at 62.

2. Coordinate Spousal Benefits

Married couples should consider who claims first and how spousal benefits (up to 50% of the other spouse’s PIA) may help maximize household income.

3. Track Earnings Closely

Earnings above the SSA annual limit ($22,320 in 2025 for those under full retirement age) may temporarily reduce your benefit.

4. Use Online Calculators

SSA offers official tools to estimate your benefit. Plug in your info and see your projected amounts based on various claim ages.

Planning Retirement? Here’s the Average Social Security Payment in Every State for 2025

Four Ways to Boost Income in Retirement Without Reducing Social Security Payments

Why December’s Social Security Payments Will Follow a Modified Schedule This Year