Minnesota Stimulus Payment 2026: If you’ve heard that Minnesotans are getting checks worth up to $1,423 in 2026, you might be thinking it’s another round of federal stimulus. But here’s the real deal: Minnesota has launched a new statewide Paid Family and Medical Leave (PFML) program—a benefit that can be just as impactful, but for a very different reason. This isn’t a federal giveaway. It’s a state-funded wage replacement program designed to support people who can’t work due to significant life events, such as serious illness, childbirth, or caring for a sick family member. And yes, eligible applicants can receive as much as $1,423 per week while on leave. Let’s break it all down in a clear, conversational, and professional way so you know exactly how this program works, who qualifies, and how to get started.

Table of Contents

Minnesota Stimulus Payment 2026

The Minnesota Stimulus Payment 2026, better understood as Paid Family and Medical Leave, is a modern benefit for modern workers. It ensures that people don’t have to choose between a paycheck and caring for their loved ones—or themselves—during life’s most vulnerable moments. It’s not a handout. It’s a smart investment in the workforce, helping Minnesotans stay financially stable while navigating health challenges, parenthood, or emergencies. With up to $1,423 per week available, it’s one of the most powerful benefits in the country today.

| Category | Details |

|---|---|

| Program Name | Minnesota Paid Family and Medical Leave (PFML) |

| Commonly Called | Minnesota Stimulus Payment 2026 |

| Program Type | Wage replacement benefit (not a one-time stimulus check) |

| Launch Date | January 1, 2026 |

| Maximum Weekly Payment | Up to $1,423 per week |

| Average Weekly Benefit | Around $1,100–$1,150 (varies by income) |

| Who Is Eligible | Workers earning at least $3,900 annually and working 50%+ in Minnesota |

| Qualifying Reasons | Medical leave, family care, childbirth/adoption, military-related leave |

| Maximum Leave Duration | 12 weeks medical + 12 weeks family (20 weeks combined per year) |

| Payment Frequency | Weekly payments |

| Funding Source | Payroll premium tax (0.88% of wages, split employer/employee) |

| Tax Status | Benefits are taxable income |

| Self‑Employed Eligibility | Yes, if opted into the program |

| Application Method | Online application through Minnesota DEED |

| Official Website | https://mn.gov/deed/programs-services/paid-family-medical/ |

What Is the Minnesota PFML Program?

The Minnesota Paid Family and Medical Leave (PFML) program is a public insurance initiative created to provide workers with partial wage replacement when they need time off for major life events.

Unlike federal stimulus programs that offer lump-sum payments to everyone, this program targets individuals who cannot work due to personal or family-related health matters. It’s structured similarly to unemployment insurance, but instead of being jobless, you’re simply on approved leave.

This benefit was legislated in 2023 and officially launched in January 2026, positioning Minnesota among the few states in the U.S. to implement such a comprehensive and inclusive paid leave policy.

Who Qualifies for the Minnesota Stimulus Payment 2026?

You must meet three main requirements to be eligible:

- You must work in Minnesota. If at least 50% of your work is performed in Minnesota, you qualify—whether you work remotely, part-time, or full-time.

- You must have earned enough income. The threshold is currently $3,900 over a recent 12-month base period. That’s roughly $75 per week, so most employed individuals will qualify.

- You must have a valid reason for leave. Minnesota has outlined several qualifying conditions:

- Recovering from a serious personal health condition

- Caring for a family member with a major illness or injury

- Bonding with a newborn, adopted, or foster child

- Supporting a family member during military deployment

- Experiencing domestic abuse or other safety-related issues

This isn’t just for traditional 9-to-5 workers. Independent contractors and self-employed individuals can opt into the program by paying into the fund.

How Much Can You Receive?

The maximum you can receive is $1,423 per week, based on Minnesota’s Average Weekly Wage (AWW), which is recalculated annually. The benefit amount depends on your individual income and is designed to be progressive—lower-wage workers receive a higher percentage of their regular earnings.

The Benefit Formula:

- For wages up to 50% of the AWW: you’ll get 90% wage replacement

- For wages above 50% of the AWW: you’ll get 66% wage replacement up to the cap

Example:

If you earn $800 per week:

- First $711.50 (50% of AWW) → 90% = $640.35

- Remaining $88.50 → 66% = $58.41

- Total weekly benefit = ~$698.76

These payments are issued weekly and continue for the duration of your leave, subject to the annual cap.

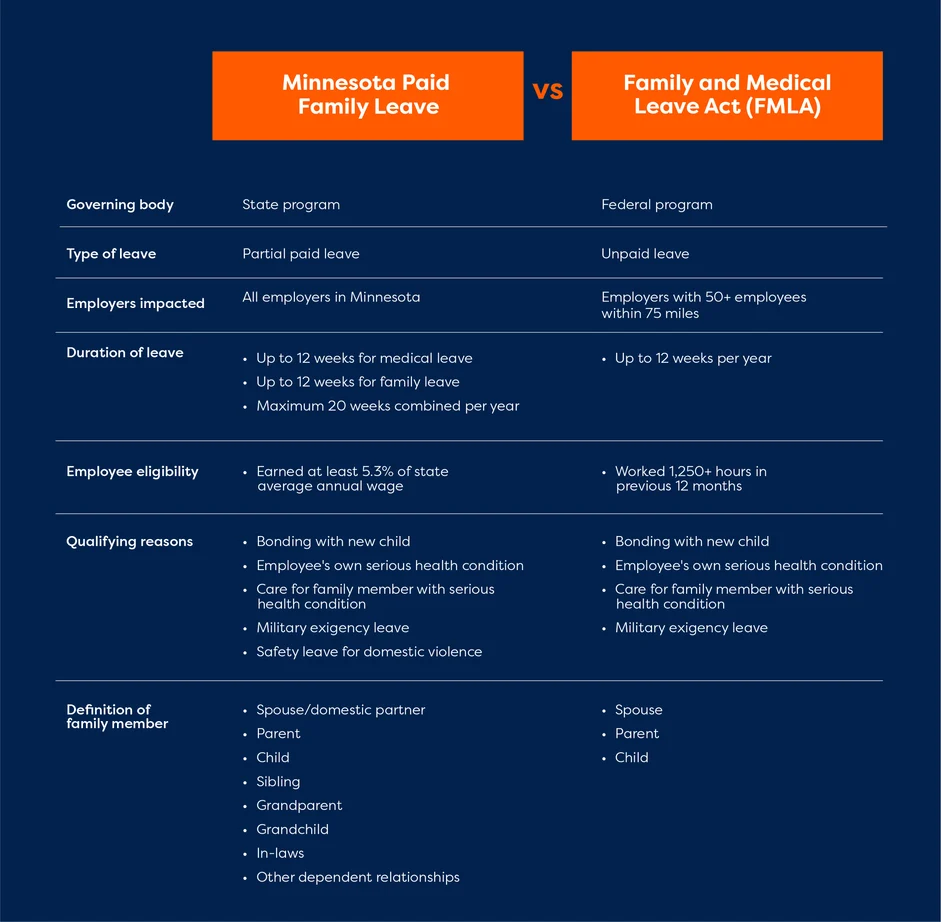

Duration of Leave Allowed

You can receive PFML benefits for:

- Up to 12 weeks of Medical Leave

- Up to 12 weeks of Family Leave

- Maximum of 20 combined weeks per year

This flexibility allows people to handle multiple needs—like recovering from childbirth and later caring for a parent in hospice.

How to Apply for Minnesota Stimulus Payment 2026?

The application process is straightforward, but it does require documentation.

Step-by-Step Guide:

- Gather your documentation:

- Pay stubs, W-2s, or tax records

- Birth certificates, adoption paperwork, or medical certifications

- Proof of employment and work schedule

- Apply through the official portal:

- Visit mn.gov/deed/programs-services/paid-family-medical

- Create an account and complete your profile

- Submit documentation for review.

The state may contact you for further information or verification. - Start receiving payments.

Once approved, benefits are disbursed weekly via direct deposit or check.

Processing times typically take 7 to 14 business days, depending on demand and complexity of your case.

Program Funding: Where’s the Money Coming From?

PFML is not funded by the federal government. Instead, it’s paid for by a Minnesota-wide payroll premium tax, currently set at 0.88% of an employee’s wages.

This tax is typically shared equally between employers and employees (0.44% each), although employers can choose to cover the entire amount.

For someone earning $50,000/year, the annual contribution would be around $220—or about $4.23 per week. That small amount funds your future safety net.

Real-Life Examples: How This Program Helps Minnesotans

Example 1: Emily – A New Mother in St. Paul

Emily welcomed her first child in March 2026. She used 12 weeks of family leave and received $925 per week. That money allowed her to stay home and bond with her baby without worrying about paying rent or groceries.

Example 2: Ben – A Truck Driver from Mankato

Ben had to take medical leave for knee surgery. He received $1,105/week for 9 weeks, which covered nearly 80% of his income while he recovered.

Common Mistakes to Avoid

Applying for PFML is simple, but people still run into common issues:

- Not submitting full documentation (like medical notes or income proof)

- Trying to claim leave for non-qualifying reasons, such as vacation or burnout without diagnosis

- Missing deadlines for appeal or filing updates

- Not reporting other income, which can affect your benefit amount

Avoid delays by reading all guidelines carefully and submitting required materials early.

How Minnesota Compares to Other States?

Minnesota joins a growing list of states with paid leave laws. However, it stands out due to its high weekly cap and flexible program design.

| State | Max Weekly Benefit | Combined Leave Limit | Self-Employed Eligible? |

|---|---|---|---|

| Minnesota | $1,423 | 20 weeks | Yes |

| California | $1,620 | 8 weeks | Yes |

| New York | $1,131 | 12 weeks | Yes |

| Washington | $1,456 | 18 weeks | Yes |

Minnesota’s benefit cap and duration make it one of the most generous programs in the U.S.

Tax Implications and Reporting

PFML benefits are considered taxable income under both federal and Minnesota state law. Recipients will receive a Form 1099-G at the end of the year for tax reporting purposes.

It’s recommended to:

- Set aside a portion of the benefit for taxes

- Consult a CPA if you’re receiving benefits over multiple tax years

Professional Impact: Why It Matters to Employers and HR Teams

Employers are now required to:

- Deduct payroll premiums

- Educate employees about the program

- Maintain job security for eligible workers on leave

Companies can also apply for private plan exemptions if they offer benefits that are equal to or better than the state PFML.

This means HR departments need to update employee handbooks, compliance documentation, and payroll systems.

$1702 Stimulus Payment 2026: Is It Really Confirmed?

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies

Social Security Income $2,071 in 2026 – Why Taxes Could Reduce Most of Your Payment