Medicare Changes 2027: Medicare Changes 2027 are shaping up to be some of the most important updates in years for seniors, healthcare professionals, insurers, and policymakers. With the Centers for Medicare & Medicaid Services (CMS) releasing its 2027 Advance Notice and Proposed Rule, a series of changes could have significant effects on how much insurance plans are paid, how risk is evaluated, what benefits are offered — and ultimately, how much Americans pay out of pocket. Whether you’re a Medicare enrollee trying to budget ahead, or a professional helping others navigate coverage, this guide will break down everything you need to know — from the specifics of the four CMS proposals to the larger implications for the Medicare system.

Table of Contents

Medicare Changes 2027

The Medicare Changes for 2027 represent a bold step toward sustainability, fairness, and modernization of the Medicare Advantage and Part D systems. From a mere 0.09% increase in payments to rigorous changes in risk scoring and plan quality metrics, CMS is sending a clear signal: it’s time to balance innovation with integrity. For beneficiaries, this means staying alert — even small regulatory changes can impact what your plan covers and what it costs. For professionals, it’s time to update your playbook and prepare for a transformed landscape in 2027.

| Area | What’s Proposed for 2027 | Estimated Impact |

|---|---|---|

| Medicare Advantage & Part D Payments | 0.09% net increase | ~$700M total increase |

| Risk Adjustment Model | Exclude diagnoses from chart reviews without linked service | Reduced payment to some insurers |

| Prescription Drug Policy (Part D) | Clarified cost-sharing and updated technical regs | Better rule alignment with current law |

| Star Ratings Overhaul | Update to quality metrics for bonuses | May change competition among plans |

| Part D Out-of-Pocket Cap | Increases to ~$2,400 in 2027 | Indexed to inflation |

Understanding the Context: What Is the CMS Advance Notice?

Each year, CMS releases what’s called the Advance Notice — a proposed set of changes for the coming year that covers:

- Payment formulas for Medicare Advantage (Part C) and Part D

- Risk adjustment methodologies

- Technical clarifications for regulatory alignment

- Quality rating updates

These changes determine how private Medicare plans are compensated — and since over 50% of Medicare enrollees are now in Medicare Advantage plans, even small tweaks can ripple across the country.

Medicare Changes 2027 Advantage & Part D Payment Rates — Just a 0.09% Increase?

Let’s start with the headline figure: CMS projects a net average increase of just 0.09% in payments to Medicare Advantage and Part D plans in 2027. That’s far less than the industry expected.

Insurers and analysts had been anticipating 4% to 6% increases, based on rising medical costs and inflation. Instead, this near-flat increase has spooked the market. Stocks for major health insurance providers like Humana, CVS, and UnitedHealth dipped sharply after CMS released the notice.

What this means for you:

While a flat rate sounds like good news for federal spending, it could mean:

- Fewer or smaller extra benefits (like dental, vision, fitness) in Advantage plans

- Premium increases to offset tighter margins

- Potential plan consolidation or exit from less-profitable regions

For professionals: This shift may impact how brokers guide client choices, as well as how actuaries and plan designers model financial risk.

Risk Adjustment Model Overhaul — Goodbye, Chart Review-Only Diagnoses

Risk adjustment is how CMS adjusts payments to reflect the relative health of enrollees. Sicker beneficiaries mean higher payments. But over the years, some plans have used chart reviews alone to document additional diagnoses and boost their risk scores.

CMS is cracking down on that in 2027 by proposing that only diagnoses linked to actual healthcare encounters (e.g., office visits, treatments) will be counted. Chart reviews, without service claims, will be excluded from risk scoring.

Why CMS is doing this:

- To prevent “gaming” the system for more payments

- To align with more transparent and consistent coding practices

- To promote care-based documentation instead of purely administrative entries

Impact for insurers: Some could see significant reductions in payment if they rely heavily on chart review-only codes. CMS estimates that this could save billions in overpayments.

For patients: This might lead to more emphasis on actual doctor visits, which could improve preventive care documentation but may also prompt insurers to increase encounter-based outreach.

Medicare Changes 2027: Updates to Part D

Part D prescription drug coverage has undergone major reforms recently — especially under the Inflation Reduction Act (IRA), which is phasing in:

- $2,000 out-of-pocket cap by 2025

- Drug price negotiation powers for Medicare

- Inflation rebates on price hikes

CMS’s 2027 proposal updates regulations to reflect this reality, including:

- Clarifying cost-sharing language

- Removing outdated references (e.g., old catastrophic phase rules)

- Simplifying plan design requirements

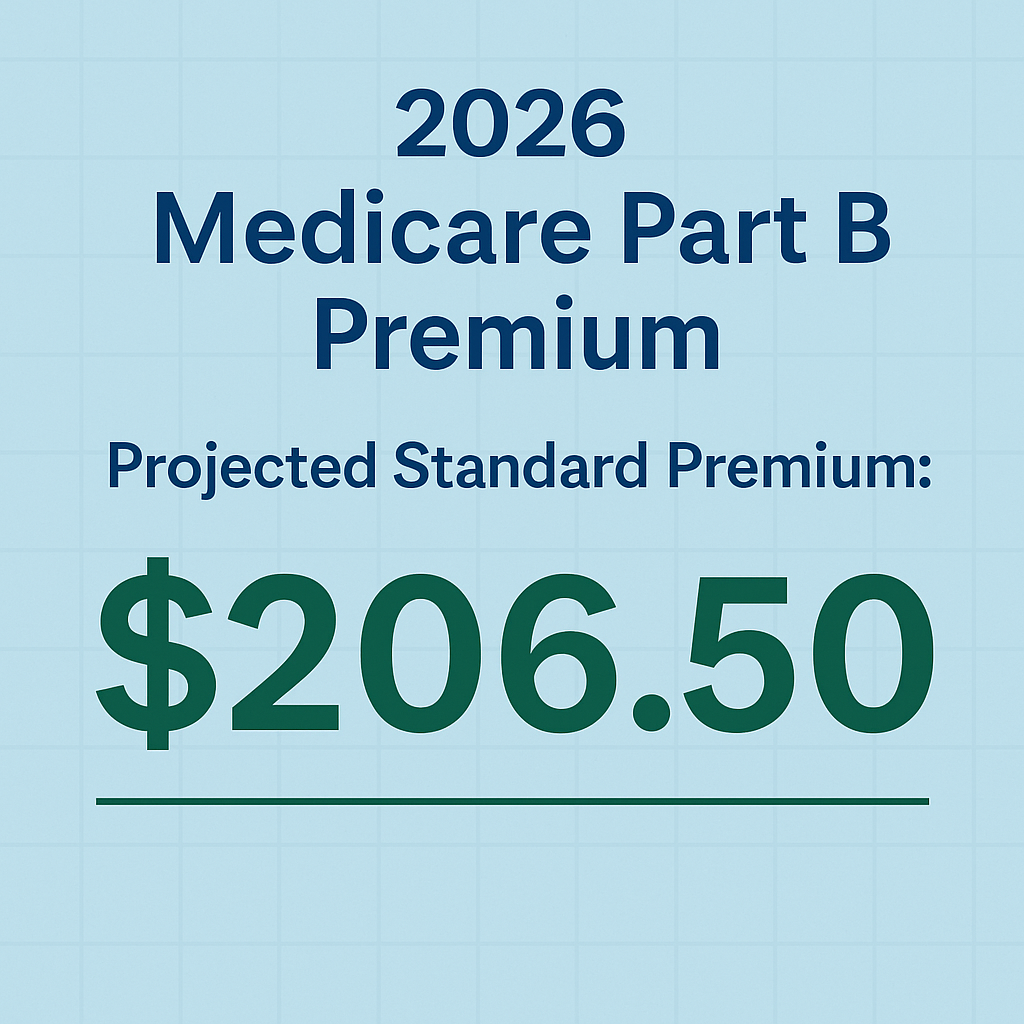

Notable addition: The annual out-of-pocket cap for Part D will rise to about $2,400 in 2027, indexed for inflation, following its $2,000 setting in 2025 and ~$2,100 in 2026.

Why this matters:

Simplified rules make it easier for patients to understand their benefits — and help plans design offerings that are both compliant and user-friendly.

Quality Ratings (Star Ratings) — Updates That Could Shake Up Plan Rankings

Medicare uses Star Ratings (1–5 stars) to rank Medicare Advantage and Part D plans. These ratings influence bonus payments, enrollee satisfaction, and plan visibility on Medicare Plan Finder tools.

CMS is proposing to update quality measurement criteria, which could include:

- More weight on health outcomes versus administrative process measures

- Adjustments to address social risk factors

- Phasing out outdated or less relevant indicators

For professionals, this may mean shifting performance improvement strategies to meet new targets. For enrollees, a plan’s star rating may change even if nothing seems different — because how CMS scores them will evolve.

Real-World Scenarios to Make Sense of the Medicare Changes 2027

Scenario 1: Maria, 72, enrolled in a 5-star MA plan in California

Maria enjoys rich dental benefits and zero premiums. But if her insurer’s revenue falls due to lower risk scores or flat payments, her plan might reduce benefits or start charging premiums.

Scenario 2: Ron, 65, just started on Medicare Part D

He takes two expensive brand-name prescriptions. Knowing his out-of-pocket max is capped at $2,400 in 2027, Ron can plan ahead and avoid financial shock from high drug costs.

Scenario 3: Lisa, insurance broker in Florida

Lisa needs to adjust how she advises clients, especially in low-star counties, and stay on top of plan changes driven by new payment benchmarks and risk adjustment.

Additional Policy Context: Why These Changes Matter Now

1. Medicare enrollment is at a tipping point.

Over 31 million Americans are enrolled in Medicare Advantage — more than half of all Medicare beneficiaries. What CMS decides today defines access and affordability for half the senior population.

2. Federal spending pressure is growing.

Medicare is a major driver of long-term federal spending. These payment policy changes are part of CMS’s effort to bend the cost curve without reducing care quality.

3. Market competition is intensifying.

As major insurers expand MA plans into new areas and acquire healthcare providers (think UnitedHealth’s Optum or CVS’s Aetna), CMS is trying to level the playing field by limiting risk score inflation and pushing quality-based reimbursement.

Medicare Advantage Changes 2026 – These Benefits and Items Will No Longer Be Covered

It’s Official: Medicare Will Cover Telehealth Through January 2026 Amid Federal Shutdown Fallout

Medicare Open Enrollment 2026-27: What’s New, Deadlines and Plan Updates

Practical Advice for Beneficiaries and Professionals

For beneficiaries:

- Review your plan every year, even if you’re happy with it.

- Pay attention to Star Ratings and coverage updates.

- Watch your mail during the Annual Enrollment Period (Oct 15–Dec 7).

For insurance professionals:

- Prepare for risk model shifts — audit coding and provider documentation now.

- Stay ahead of Star Rating recalibration — adjust performance improvement plans.

- Educate clients early about changes to cost-sharing and benefit design.