Medicare Advantage Changes: If you’re enrolled in a Medicare Advantage plan — or helping someone who is — there’s a big shift coming down the pipeline in 2026. The Centers for Medicare & Medicaid Services (CMS) is rolling out new rules that could take away some of the extra benefits you may have gotten used to, especially if you’re dealing with chronic conditions or low mobility. This article gives you a clear, detailed breakdown of the Medicare Advantage 2026 changes, explains what’s no longer covered, and walks you through what to do next. Whether you’re a retiree, caregiver, insurance broker, or just someone trying to figure it all out, we’ve got your back.

Table of Contents

Medicare Advantage Changes

The Medicare Advantage changes for 2026 are a major reset, especially for people who rely on the plan’s non-traditional benefits. CMS’s new focus on “health-first” rules is meant to keep care effective, efficient, and fair. Still, if your current plan includes now-banned benefits, the time to prepare is now. Don’t wait until Open Enrollment hits. Learn what your plan will change, explore your options, and make informed choices to protect your health and wallet. Stay alert, stay informed, and don’t hesitate to reach out for help — you’ve got resources, and you don’t have to face this change alone.

| Category | Details |

|---|---|

| Effective Date | January 1, 2026 |

| Primary Change | Limits on Medicare Advantage supplemental benefits |

| No Longer Covered | Cannabis, cosmetic procedures, funeral costs, life insurance, unhealthy food, and more |

| CMS Rule Origin | Federal Register |

| Who It Affects | Over 30 million Medicare Advantage enrollees |

| Main Goal | Refocus Medicare Advantage on health outcomes |

| Action Timeline | Open Enrollment: October 15 to December 7, 2025 |

What’s Medicare Advantage Changes 2026 — and Why It Matters

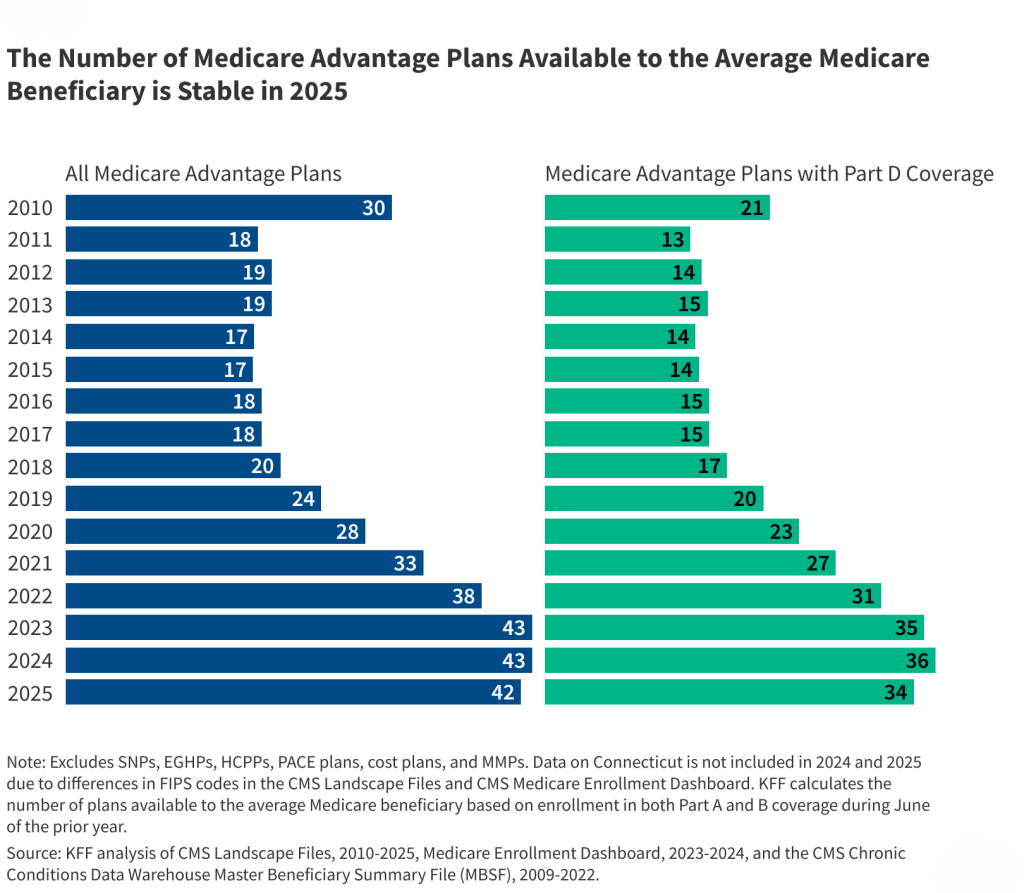

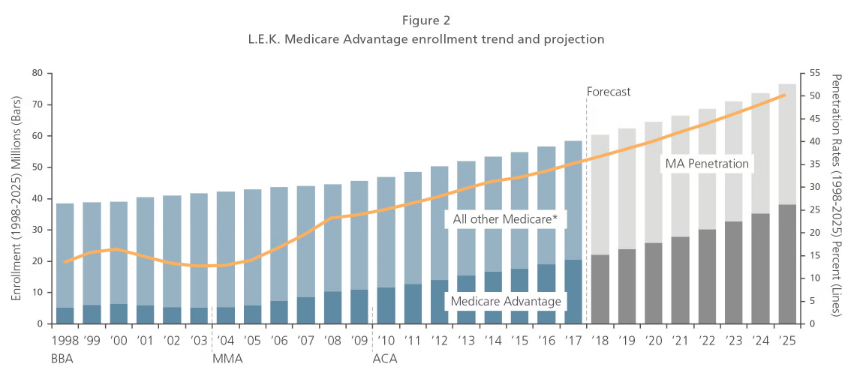

Over the past few years, Medicare Advantage (Part C) plans have grown rapidly. In fact, according to the Kaiser Family Foundation, enrollment surpassed 30.8 million people in 2023 — that’s more than half of all people on Medicare.

Why so popular? Because these private insurance plans often offered more than Original Medicare — stuff like gym memberships, dental care, meal deliveries, and other “extras.”

Some plans even pushed the envelope further, using a 2018 policy shift (called SSBCI, or Special Supplemental Benefits for the Chronically Ill) to provide even non-medical perks, such as air purifiers, pest control, or nutritional support.

But starting in 2026, CMS is saying: “Hold up.”

They’ve issued a new rule that puts clear limits on what can be covered, trimming back some of the non-healthcare-related extras that were allowed under SSBCI. Their aim is to refocus Medicare Advantage on actual healthcare, rather than non-essential lifestyle benefits.

What Will No Longer Be Covered in Medicare Advantage Plans?

Let’s dive into what exactly will be cut.

According to the official CMS rule, the following benefits will be prohibited under Medicare Advantage plans starting in 2026:

Services and Items No Longer Allowed

- Cannabis or CBD Products – Even in states where it’s legal, Medicare won’t allow coverage due to federal law.

- Alcohol – Not considered a health-promoting benefit.

- Cosmetic Procedures – Botox, facelifts, and other aesthetic treatments are excluded unless reconstructive after surgery.

- Unhealthy Food or Fast Food – Processed snacks or high-fat meals not meeting nutritional standards won’t be reimbursable.

- Funeral and Burial Services – Expenses like cremation or burial plots are no longer permitted.

- Life Insurance Policies – You can’t get life insurance coverage bundled into your health plan anymore.

- Tobacco Products – Cigarettes, cigars, or other tobacco forms are now strictly off-limits.

- Hospital Indemnity Policies – Duplicate insurance or cash reimbursements are being phased out.

These items were previously offered in niche plans or pilot programs, but CMS now says they don’t meet the “primarily health-related” standard required for Medicare funding.

Real-Life Example: How It Affects You

Let’s say you’re a 74-year-old with COPD and diabetes. Your current Medicare Advantage plan offers:

- Grocery delivery (including pre-packaged meals)

- Air filters for indoor air quality

- CBD pain patches

- A hospital indemnity policy that pays $250 if you’re admitted

In 2026, some of those — like the CBD patches and the indemnity coverage — will be automatically removed. Others, like meals, may stay only if they’re medically prescribed by your care team.

If these benefits are essential to your daily life, it’s time to start exploring alternative sources of support — which we’ll get to shortly.

Why Is CMS Making These Medicare Advantage Changes?

According to CMS, the goal is to:

- Improve accountability in MA plan spending

- Reduce unnecessary or inappropriate perks

- Ensure all benefits have a direct, measurable health benefit

- Protect taxpayer dollars

The agency is also trying to avoid confusion. Right now, one plan might offer funeral cost coverage, while another doesn’t — leading to uneven experiences across the country.

This change helps bring consistency to what enrollees can expect.

Who Is Most Affected by Medicare Advantage Changes?

These cuts will affect millions of seniors, especially those in these groups:

- Low-income seniors who relied on non-medical support like food, air filters, or pest control

- Rural residents who used transportation and home-based care services

- Chronically ill patients who benefitted from wider SSBCI benefits

- Caregivers who depended on supplemental support services like respite care or help with errands

For people who thought their plan’s extras would stick around forever, these cuts may come as a shock.

The History Behind These Benefits

Understanding the backstory helps explain the change:

- 2018: The Bipartisan Budget Act authorized MA plans to offer non-healthcare services if they were related to chronic illness management.

- 2019–2023: Plans experimented with benefits like food, housing support, and wellness programs.

- 2023: CMS reviewed spending and raised concerns about abuse, overspending, and unclear benefit outcomes.

- 2026: CMS finalizes a rule to standardize what counts as a “health-related” benefit and bans benefits that fail the test.

In short, the pendulum swung wide, and now it’s swinging back.

What You Should Do Next

Don’t wait until 2026 hits. Here’s what you should do today to prepare:

1. Check Your Annual Notice of Change (ANOC)

In September or October 2025, your MA plan will send you a document outlining what’s changing for 2026.

Look for:

- Removed benefits

- Premium changes

- Adjustments to out-of-pocket costs

If you’re unsure how to read it, ask a local SHIP counselor (see below).

2. Compare Medicare Advantage Plans

Use the official Medicare Plan Finder tool to:

- Enter your ZIP code

- Compare plans side-by-side

- Filter based on medical needs and costs

This is especially important during Open Enrollment (October 15 – December 7).

3. Consider Switching to Original Medicare + Medigap

If you’re losing essential benefits and need more flexibility, Original Medicare + Medigap may be worth looking into. Just know:

- Medigap helps pay out-of-pocket costs

- You may need a Part D plan for prescriptions

- Underwriting rules vary by state if you switch outside certain windows

4. Ask About Medicaid or Local Programs

If you’re low-income, Medicaid may help cover services no longer offered by MA. Community programs or nonprofits can also fill gaps — think food banks, elder assistance programs, or utility aid.

What Experts Are Saying?

Industry analysts and healthcare economists have mixed reactions.

Some, like Dr. Sarah Williams, a Medicare consultant, say:

“This move helps ensure Medicare Advantage funds are being used for true healthcare, not marketing gimmicks.”

Others argue it reduces innovation and hurts the most vulnerable. Several insurer advocacy groups have asked CMS to allow more flexibility on a case-by-case basis, but the final rule stands.

Will There Be More Changes After 2026?

Most likely, yes.

CMS is closely monitoring Medicare Advantage growth, and some experts believe further rule updates will follow, especially around:

- Prior authorization abuse

- Mental health access

- Standardization of dental/vision coverage

For now, the 2026 cuts are just the beginning of what may be a long-term shift toward value-based healthcare under Medicare Advantage.

Medicare Open Enrollment 2026-27: What’s New, Deadlines and Plan Updates

Medicare Update 2026: Some Prescription Drug Costs Expected to Drop by Half

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules