January Social Security Payment Timeline: When the First 2026 Checks Will Be Deposited is a crucial topic for millions of Americans who rely on Social Security benefits — including retirees, people with disabilities, survivors, and caregivers managing finances for loved ones. This article explains exactly when payments will arrive in January 2026, why the dates are the way they are, and how you can plan around them to avoid late fees, bounced checks, or budgeting stress. We’ll walk through payment dates, types of benefits, tax and Medicare implications, budgeting tips, and even frequently asked questions that come up every year. I’m writing this in a friendly, clear way so a 10‑year‑old can follow along, but it’s packed with practical detail for financial professionals, planners, and caregivers too. You’ll get facts, sources from official websites, and examples you can use today.

Table of Contents

January Social Security Payment Timeline

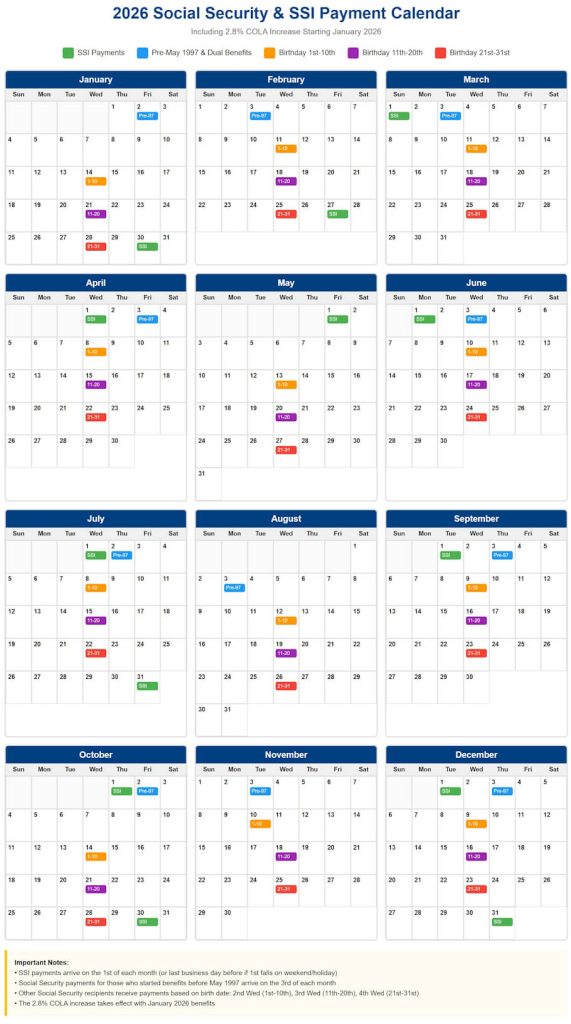

Understanding the January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited isn’t just about knowing dates — it’s about planning your life around your income. In January 2026:

- SSI payments arrive early on December 31, 2025 because of New Year’s Day.

- Retirement and SSDI benefits are deposited on January 14, 21, or 28 depending on your birthdate.

- A 2.8% COLA increase boosts benefits — but higher Medicare premiums and taxes can affect how much of that boost you actually keep.

The more you understand this system — including payment timing, deductions, and tax implications — the more confidently you can budget, reduce stress, and stay financially secure. Always check the official SSA schedule and use tools like my Social Security to stay updated.

| Topic | Details |

|---|---|

| First 2026 Social Security Payment | January 2, 2026 for specific cases |

| SSI January 2026 Payment | December 31, 2025 (due to New Year’s Day) |

| Birthdate‑Based Retirement/SSDI Payment Dates | January 14, 21 & 28, 2026 |

| 2026 Cost‑of‑Living Adjustment (COLA) | 2.8% increase in benefits |

| Average Monthly Retiree Benefit (2026) | About $2,070 per month |

| SSI Maximum Monthly Payment (2026) | Up to $994 individual, $1,491 couple |

| Official SSA Reference | https://www.ssa.gov/pubs/EN-05-10031-2026.pdf |

What Everyone Needs to Know: Payment Types and Why Dates Change

The Social Security Administration runs several programs, and each one has its own rules:

- Social Security Retirement Benefits — based on your work history and earnings record. This is what most people think of when they say “Social Security.”

- SSDI (Social Security Disability Insurance) — benefits for people who have worked but now qualify due to disability.

- SSI (Supplemental Security Income) — a needs‑based program for people with limited income and resources, including older adults and people with disabilities. SSI is not the same as retirement or SSDI, though some people receive both.

SSA sets payment dates based on birthdate cycles for most benefits. SSI normally pays on the first of the month, but federal holidays can shift dates — and that matters in January 2026 because New Year’s Day falls right at the beginning of the month.

January Social Security Payment Timeline: Detailed Breakdown

SSI Payments for January 2026

For people on SSI, January’s payment will arrive on December 31, 2025, because January 1, 2026 is a federal holiday (New Year’s Day). The Social Security Administration moves payments up when the scheduled date is a weekend or holiday.

This means SSI recipients may see two deposits in December 2025 — one for December and one for January. That’s normal and intentional — not a mistake. The early deposit ensures beneficiaries have access to funds before banks and government offices close.

Official SSI payment guidelines from the SSA explain that payments due on holidays or weekends are deposited on the preceding business day.

For many older adults on tight budgets, this early deposit can be a helpful boost during the holiday season.

Retirement and SSDI Payments: Birthdate Schedules

Most Social Security retirement and SSDI benefits follow a predictable pattern based on your date of birth:

| Birthdate | Deposit Date in January 2026 |

|---|---|

| 1st – 10th | January 14, 2026 |

| 11th – 20th | January 21, 2026 |

| 21st – 31st | January 28, 2026 |

These are the three Wednesdays in the month for standard benefit deposits. SSA uses this approach so direct deposit systems and bank partners know when to push money through.

In some special cases — like individuals who started receiving benefits before May 1997 — the SSA may issue an earlier payment (for example, as early as January 2, 2026). That’s an exception to the rule, not the norm.

Why Does SSA Tie Dates to Birthdates?

This birthdate system helps the SSA spread out the processing workload and helps banks manage cash flow. Instead of everyone getting a check on the exact same day, payments are staggered across the month.

This system also helps beneficiaries plan — once you know your birthdate group, you know your payment date every month unless a holiday bumps it.

What’s New in 2026: Social Security Cost‑of‑Living Adjustment (COLA)

Every year, Social Security and SSI benefits are adjusted for inflation with what’s called a Cost‑of‑Living Adjustment (COLA). For 2026, the COLA is 2.8%, a figure based on changes in the Consumer Price Index (CPI) over a 12‑month period.

This means your monthly benefit amount increases by 2.8% compared with 2025. According to SSA estimates:

- The average retired worker benefit will increase by more than $50 per month.

- SSI maximum benefit amounts increase to $994 for individuals and $1,491 for couples.

These changes go into effect starting with the first payment in January 2026, including the early December 2025 SSI deposit.

Understanding COLA is especially important when inflation rises because it helps preserve your purchasing power. However, cost increases in areas like healthcare can offset some of the benefit boost — which we’ll cover next.

Medicare Premiums, Taxes, and “Net” Benefit Planning

Getting a COLA bump feels great, but it’s important to understand how much money you actually keep each month. Two big deductions often affect Social Security income:

Medicare Part B / Part D Premiums

Most people who receive Social Security also pay Medicare Part B premiums, which the SSA automatically deducts from your benefit unless you pay them another way.

In 2026, Medicare Part B premiums are expected to be higher than in 2025 (part of annual adjustments based on healthcare cost trends). Premiums are set by the Centers for Medicare & Medicaid Services (CMS).

Because these premiums come out before you see the deposit, they can reduce your net income significantly — in some cases offsetting most of your benefit increase.

Taxes on Social Security Benefits

Federal taxes may apply to your Social Security benefits depending on your total income (including pensions, wages, investment income, and more). Up to 85% of Social Security income can be taxable if your combined income crosses certain thresholds.

This means two people with the same gross benefit may take home very different amounts after taxes and premiums.

Practical Planning Tips You Can Use for January Social Security Payment Timeline

Knowing dates is only part of the puzzle. Here are practical strategies beneficiaries and caregivers use to stay ahead:

Set Up Direct Deposit

Direct deposit ensures your money lands in your bank account on the morning of the payment date — no waiting for the mail.

Track Your Birthdate Group

Mark your calendar — once you know your group’s deposit dates, you can align bill payments, automatic withdrawals, and expenses accordingly.

Use Your SSA Online Account

Visit https://www.ssa.gov/myaccount to view your benefit amount, payment history, and secure messages from the SSA. This avoids relying on paper mail, which can be slow or lost.

Budget for Medicare Premiums

Since Medicare Part B/D premiums are deducted before you see your benefit, include them in your monthly budget.

Review Your Tax Situation Annually

Because changes in income can affect how much of your benefits are taxable, consider a yearly tax check‑in with a professional, especially if you’ve had changes like selling property or starting a part‑time job.

Examples You Can Relate To

Scenario 1: Mary’s First Payment in 2026

Mary is 67, collects Social Security retirement benefits, and her birthday is January 8. According to the SSA schedule, her check for January 2026 arrives on January 14 through direct deposit.

She also qualifies for Medicare, and her Part B premium is deducted automatically. Because her Medicare isn’t costly, she budgets well — but she knows that if premiums go up next year, she’ll have less take‑home benefit.

Scenario 2: John on SSI

John, age 62 with a disability, receives SSI. In late December 2025, he notices two deposits in his account — one for December SSI and one early January payment on December 31, 2025. This gives him extra cushion during the holidays.

He also gets a COLA bump, which helps pay for rising grocery and rent costs.

Social Security $1,850 Monthly Check – How the 2026 Update Changes This Benefit Amount

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules