January 2026 Social Security Checks: Social Security checks for January 2026 are coming soon, and many Americans are wondering whether they will see a bigger payment in their bank accounts. With inflation still on people’s minds, the Cost-of-Living Adjustment (COLA) is once again playing a significant role in these benefit checks. In this article, we’ll break down exactly what you can expect from your January 2026 payment, including the changes in payment amounts and what you should know about the 2026 COLA increase. Whether you’re a retiree, someone with a disability, or a family member of a beneficiary, we’ll cover the essentials to keep you informed and prepared.

Table of Contents

January 2026 Social Security Checks

With January 2026 Social Security checks approaching, beneficiaries can expect a modest increase in payments thanks to the 2.8% COLA. While the increase helps to keep pace with rising costs, Medicare premiums may offset some of the boost. Whether you’re a retiree, disabled, or a loved one of a beneficiary, it’s important to understand when you’ll get your payment and how the changes might affect your budget.

| Key Data | Details |

|---|---|

| COLA Increase for 2026 | 2.8% |

| Average Retirement Payment | $2,071/month after COLA |

| Effective Payment Dates | January 14-31, 2026 |

| SSI Payment Dates | Early payments on Dec. 31, 2025 or Jan. 2, 2026 |

| Monthly Medicare Premium for 2026 | $202.90 |

| Social Security Administration Website | www.ssa.gov |

What’s Happening With January 2026 Social Security Checks?

As we roll into January 2026, Social Security recipients are anticipating their first checks of the year. This time, many will receive larger payments due to the annual COLA increase. The Cost-of-Living Adjustment is applied to Social Security benefits each year to help beneficiaries keep up with inflation and the rising cost of goods and services.

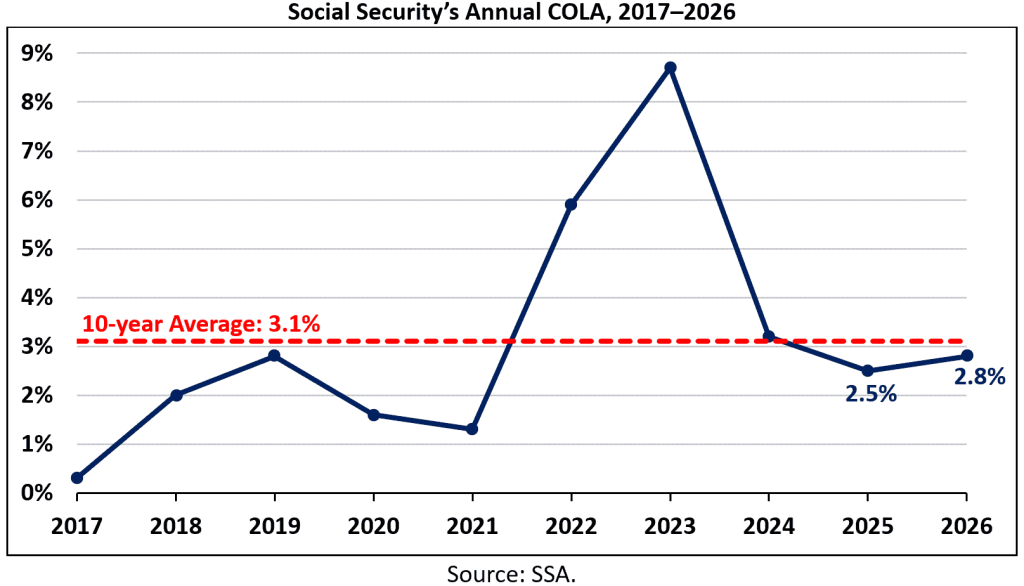

In 2026, the COLA increase is 2.8%, which means beneficiaries will see a modest boost in their payments. For example, the average monthly benefit for a retired worker will increase from about $2,015 to $2,071. While this increase may not feel like a huge jump, it’s a significant amount when you look at the overall impact over the year.

Understanding the COLA Impact

The COLA increase is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks inflation and the changing cost of living in the U.S. When inflation goes up, the government adjusts Social Security payments to help beneficiaries maintain their purchasing power. This 2.8% increase for 2026 is a result of inflation over the past year, but it’s worth noting that Medicare premiums may offset some of the increase in your net payment.

Will You Get a Bigger Payment?

Yes, you’ll likely see a bigger payment, but the amount can vary depending on your individual circumstances. Social Security checks are distributed based on your birthdate, and there’s also the factor of whether or not you are on Supplemental Security Income (SSI).

For example, here’s how things break down for most retirees:

- COLA Increase: Your monthly payment will increase by 2.8%. If you were receiving $2,015 a month in 2025, your 2026 payment would rise to $2,071.

- Medicare Deductions: While the COLA increase helps offset rising costs, the Medicare Part B premium for 2026 will rise to $202.90/month. If you are on Medicare, this amount will be deducted from your Social Security payment.

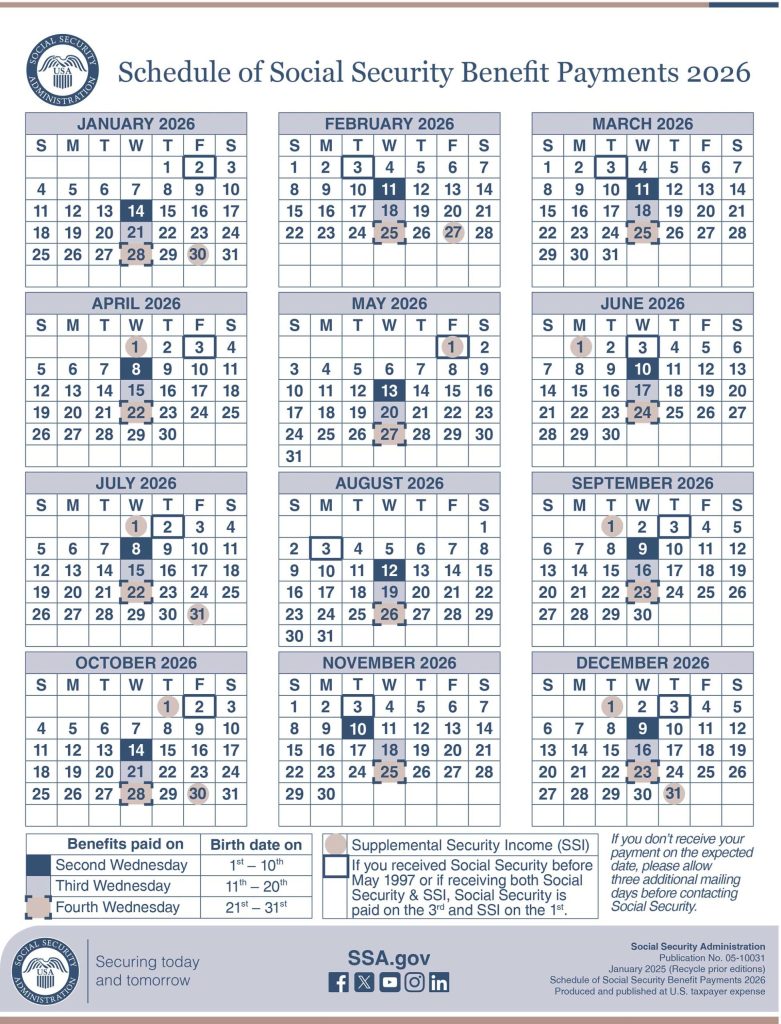

For people who get Supplemental Security Income (SSI), the first 2026 payment may come earlier, typically around Dec. 31, 2025, or Jan. 2, 2026, to ensure beneficiaries get the new year’s payment early. If you’re unsure when you’ll receive your payment, Social Security Administration (SSA) provides a payment schedule on its website, which you can use to check your dates.

When Will You Receive Your January 2026 Social Security Checks?

Payments are issued on a set schedule, but the exact date depends on your birthday. Social Security payments are sent out in the following manner:

- If your birthday falls between the 1st and 10th: Payments will be sent on the 2nd Wednesday of each month.

- If your birthday falls between the 11th and 20th: Payments are sent on the 3rd Wednesday of the month.

- If your birthday falls between the 21st and 31st: Payments are issued on the 4th Wednesday of each month.

January 2026 payments will follow this same schedule. So, if your birthday is early in the month, you will likely see your first 2026 Social Security check on January 14, with others following later in the month based on your birthday.

Early SSI Payments

For those receiving SSI payments, things work a little differently. You could receive your January 2026 SSI check as early as December 31, 2025 or January 2, 2026, depending on the specifics of your account.

Key Things to Keep in Mind About January 2026 Social Security Checks

Before you get excited about your larger check, there are some important factors to consider that could impact your net payment:

- Higher Medicare Premiums: While your gross Social Security payment may increase, Medicare premiums have also risen. For 2026, expect the standard Part B premium to be $202.90 per month. This premium covers outpatient services like doctor visits, durable medical equipment, and certain preventive services.This means that if your monthly benefit increased by $56 due to the COLA, you might see a portion of that offset by the Medicare premium increase. It’s important to account for these adjustments when budgeting.

- Tax Withholding: Some Social Security beneficiaries may choose to have federal taxes withheld from their payments. If this applies to you, be sure to review your tax withholding status and adjust as necessary.

- SSI and Disability Recipients: If you receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), your COLA increase will be similar, but your total payment might be lower due to other adjustments, like your disability status or specific living arrangements.

Social Security Payments January 14 – Will You Get a Check? Check Eligibility Criteria

Social Security January 2026 Payment Dates – Who Gets Paid First and Which Checks Arrive Early

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules