January 2026 IRS Relief Deposits: Are the January 2026 IRS relief deposits, tariff dividend, and stimulus payment real — or just another round of internet rumors? If you’ve been scrolling through TikTok, YouTube, or Facebook lately, you’ve probably seen some big claims: $2,000 direct deposits from the IRS, surprise relief payments, or a “tariff dividend” being issued to all Americans this month. But before you start checking your bank account or clicking on suspicious links, let’s break down the facts, separate truth from fiction, and get crystal clear on what’s really happening in January 2026 — straight from the perspective of a tax professional who’s seen it all.

Table of Contents

January 2026 IRS Relief Deposits

Despite what you might have seen online or heard from friends, there are no IRS stimulus checks or $2,000 “tariff dividends” being deposited in January 2026. The only money the IRS is sending right now comes from normal tax refunds — based on the taxes you paid and credits you’re eligible for. Relief payments from the government require legislation, approval, and execution — and none of that has happened for 2026. Stay informed. Stay safe.

| Topic | Status (As of Jan 2026) | Key Fact / Stat |

|---|---|---|

| IRS stimulus payment in 2026 | No approved payment | Last EIP was March 2021 |

| $2,000 “Tariff Dividend” | Only a proposal | Floated by former President Trump |

| IRS refunds in Jan 2026 | Yes, for early filers | Refunds issued 2–3 weeks after filing |

| Direct deposit scams | On the rise | Fake websites and phishing texts |

Why January 2026 IRS Relief Deposits Is Trending in January 2026?

It’s January — and that means two things in America: tax season is here, and online rumors are flying.

TikTok, Instagram Reels, and YouTube Shorts are flooded with headlines like:

- “$2,000 stimulus check dropping January 10”

- “IRS direct deposits this month — check your account!”

- “President Trump’s dividend payment is here!”

But here’s the cold, hard truth: None of these viral claims are backed by any official government source.

They’ve caught fire mostly because of financial stress, misinformation, and a deep desire for economic relief after years of inflation and stagnant wages.

So let’s set the record straight, piece by piece.

IRS Tax Refunds vs. Stimulus Checks — Know the Difference

Before we talk about what’s not happening, let’s be clear on what is.

A tax refund is what you get when you’ve overpaid taxes throughout the year. This happens when too much is withheld from your paycheck or when you qualify for refundable tax credits, such as:

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- American Opportunity Credit (for students)

Refunds are based on your own income, your taxes paid, and any credits you’re eligible for.

A stimulus check, on the other hand, is a one-time payment made to the public — regardless of taxes owed — to stimulate the economy during a crisis.

Those require Congressional action. You can’t just “get one” because the economy’s rough.

As of January 2026, no such legislation has passed.

The $2,000 Tariff Dividend Proposal — Explained

So where did this idea come from?

During a campaign speech in late 2025, former President Donald Trump proposed a new plan:

“Every American household should get a $2,000 ‘Tariff Dividend’ — paid for by foreign countries through tariffs. It’s your money, not theirs.”

— Donald Trump, Iowa campaign rally, Nov. 2025

The plan suggested using revenue from import tariffs (especially on Chinese goods) to fund payments to U.S. citizens.

Sounds great, right? But there are some serious problems:

- No legislative action has taken place.

- Tariff revenue is unpredictable and might not be sufficient to cover $2,000 for over 130 million U.S. households.

- The U.S. Constitution requires that spending originate in Congress — not through executive order.

So for now, the “Tariff Dividend” remains a talking point, not a payment program.

Real-Life Confusion: Why It Happens

Let’s say you filed early this tax season. You had some dependents, claimed the EITC, and boom — you got $2,145 as a refund on January 20.

That’s real money, and it hits your bank with the description “IRS TREAS 310 TAX REF.”

It’s easy to confuse that with a stimulus check — especially when influencers online say “watch for this code.”

But that refund is your money, not a government bonus.

Many people confuse normal refunds with relief deposits due to:

- Similar timing

- Similar deposit descriptions

- Social media misinformation

- Financial stress

This is how scams and rumors thrive.

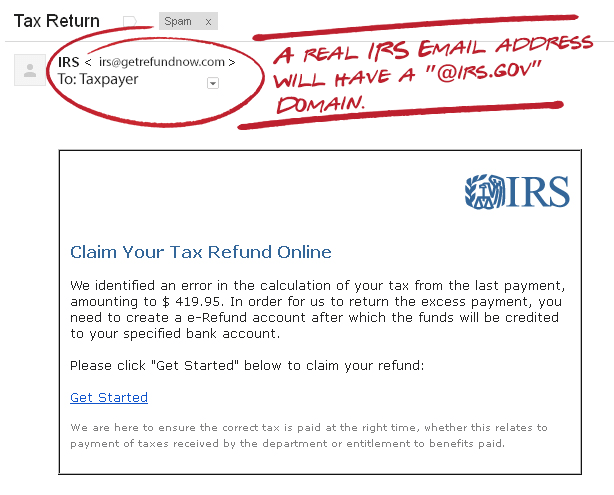

January 2026 IRS Relief Deposits: Scams, Phishing, and Fake Relief Claims

Here’s a nasty truth: scammers use the promise of free money to steal yours.

In January 2026, the IRS and FTC report a surge in:

- Fake websites with IRS branding offering “relief portals”

- Phishing texts saying “Claim your $2,000 deposit now”

- Social media posts leading to ad-farm scam blogs

Red flags include:

- Requests for your full Social Security Number

- Asking for your bank info to “verify your identity”

- Urging you to act before a “deadline”

Don’t fall for it. The IRS never contacts taxpayers by email, text, or social media to request information.

If it seems too good to be true — it is.

What’s Really Happening This Tax Season?

Here’s what’s legit:

- The IRS officially began accepting returns in late January 2026.

- Taxpayers who e-file and select direct deposit will likely get refunds within 14–21 days.

- Early filers with simple returns — especially those who qualify for the EITC or CTC — may already be seeing refunds hit their accounts.

This is not “free money” — it’s your money being returned.

Historical Background: How Previous Stimulus Payments Worked

Let’s rewind a bit and remember what real stimulus checks looked like:

- March 2020: CARES Act — $1,200 per adult

- December 2020: Consolidated Appropriations Act — $600

- March 2021: American Rescue Plan — $1,400

Each of those was passed by Congress, signed by the President, and administered by the IRS. They had clear eligibility rules, tax implications, and timelines.

That’s not the case with 2026.

How to Prepare Financially for January 2026 IRS Relief Deposits (Even Without Stimulus)

If you were counting on a stimulus or dividend and now feel disappointed, here’s what you can do:

- File taxes early — the sooner you file, the sooner you can use your refund to catch up or build savings.

- Claim all eligible credits — many taxpayers miss out on the EITC or Child & Dependent Care Credit.

- Create a “relief fund” — even $25 a week adds up to $1,300+ by next tax season.

- Avoid refund loans — those “get your money today” advances often carry hidden fees and interest.

January 2026 Stimulus Payment Update – IRS Direct Deposits and Tariff Dividend Facts

Tariff Dividend Payments January 2026 – Reality Check on New Federal Payment Claims

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules