January 2026 $4,873 Direct Payment: If you’ve been hearing whispers about a $4,873 direct payment hitting bank accounts in January 2026, you’re not alone. Headlines and social media posts make it sound like Uncle Sam is dropping big checks for everyone, but the truth is a bit more nuanced. Let’s break this down clearly: what’s real, who can actually get money, and exactly when payments will appear in your account. We’ll cover official government updates, Social Security adjustments, and eligibility rules, all in plain English. You’ll understand it whether you’re a retiree, professional, or just curious, and by the end, you’ll know exactly what to expect and how to make sure you don’t miss a cent.

Table of Contents

January 2026 $4,873 Direct Payment

There is no universal $4,873 payment for Americans in January 2026. The reality: Social Security and SSI beneficiaries receive monthly benefits, adjusted for inflation (2.8% COLA). Deposit dates are Jan 2, 14, 21, or 28, depending on birth date and program type. Understanding your eligibility and ensures you don’t miss payments. Always avoid clickbait, and plan your monthly budget around confirmed payment dates.

| Topic | Detail |

|---|---|

| $4,873 direct payment | Not a universal federal payment |

| Actual benefit increase | Social Security benefits rise ~2.8% from 2025 to 2026 |

| Average Social Security benefit (2026) | ~$2,071 per month |

| Maximum possible benefit (age 70) | Around $5,251 with 2026 COLA |

| Payment dates (Retirement/SSDI) | Jan 14, 21, 28 depending on birthday |

| SSI payment date | Dec 31, 2025 (for Jan 2026) |

Introduction — Understanding the January 2026 $4,873 Direct Payment Rumor

Let’s start with the obvious question: is the $4,873 payment real?

Short answer: No. There is no new federal program or universal stimulus check sending every American $4,873 in January 2026. Rumors about this number come from confusion with Social Security benefits, particularly maximum monthly payments for high-income retirees who delayed claiming benefits until age 70.

Understanding this distinction is crucial. Millions of Americans are getting real, verified Social Security benefits, and some high earners could see payments in that ballpark due to retroactive benefits, cost-of-living adjustments, and combined payments, but this does not apply to the general population.

Actual January 2026 Payments

1. Social Security Benefits Continue Strong

The Social Security Administration (SSA) issues regular monthly payments for:

- Retirement benefits

- Disability (SSDI) benefits

- Survivor benefits

- Spousal benefits

These payments are vital for millions of Americans, especially retirees who rely on them for essential expenses like rent, groceries, and medical costs.

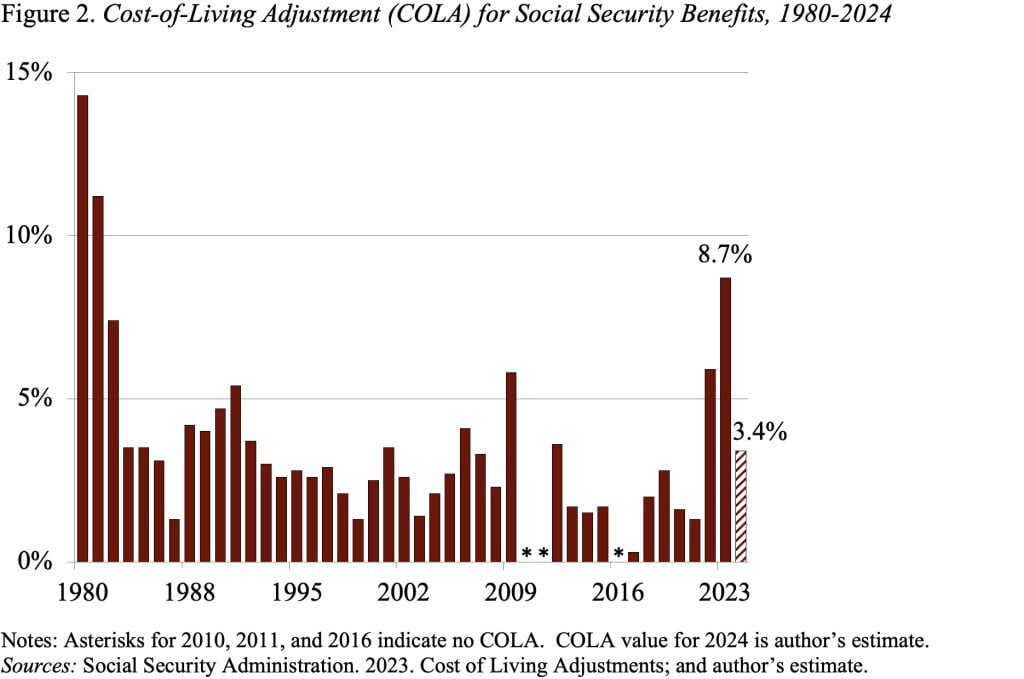

In 2026, Social Security payments increase slightly due to the 2.8% Cost-of-Living Adjustment (COLA), which helps benefits keep up with inflation.

2. The 2.8% COLA Explained

The SSA calculates COLA based on the Consumer Price Index (CPI-W), which measures inflation for urban wage earners. The 2026 COLA is 2.8%, meaning:

- If you received $2,015 in December 2025, you’ll get about $2,071 in January 2026.

- Couples sharing benefits could see $3,290+, depending on their history.

This ensures retirees and fixed-income individuals aren’t losing purchasing power.

3. Maximum Benefits — Why $4,873 Gets Mentioned

The $4,873 figure is misleading if you think it’s universal. In reality:

- It represents the maximum potential Social Security payment for retirees around age 70 with high lifetime earnings.

- Only a small fraction of beneficiaries ever hit this number.

- Factors include earnings history, delayed claiming, and past contributions.

Average retirees receive far less — around $2,071 in 2026. So unless you qualify for maximum benefits, don’t expect a $4,800 check.

Deposit Dates for January 2026

The SSA uses birthday-based deposit schedules to manage millions of payments efficiently:

Retirement & SSDI Payments

- Born 1st–10th: Wednesday, Jan 14, 2026

- Born 11th–20th: Wednesday, Jan 21, 2026

- Born 21st–31st: Wednesday, Jan 28, 2026

For long-term beneficiaries who started payments before May 1997, deposits may have been Jan 2, 2026.

SSI Payments

SSI payments, which assist low-income and disabled individuals, are usually sent on the first of the month. Since Jan 1, 2026 was a federal holiday, deposits were sent Dec 31, 2025.

Why Knowing Dates Matters?

Knowing the deposit schedule lets beneficiaries plan bills, rent, and other monthly obligations. Direct deposit ensures you get funds first thing in the morning on your scheduled date.

Eligibility for January 2026 $4,873 Direct Payment

1. Current Beneficiaries

Anyone already receiving Social Security or SSI benefits before January 2026 is automatically eligible.

2. New Beneficiaries

Those approved for benefits in 2026 will have first payments scheduled according to SSA rules, not the standard January schedule.

3. No Extra Applications Needed

You don’t need to reapply every year — SSA payments automatically adjust for COLA and eligibility.

How to Avoid Payment Issues?

1. Use Direct Deposit

Direct deposit is faster, safer, and more reliable than paper checks. Banks usually post SSA funds first thing on deposit day.

2. Keep Info Updated

Ensure your bank details, mailing address, and contact info are current in SSA records.

3. Track Payments Online

Use the my Social Security portal to:

- Check your next payment date

- Review benefit amounts

- Update direct deposit info

4. Be Patient if Funds Don’t Show

Payments may post up to three business days later if banks or holidays cause delays.

Practical Examples

Let’s make this tangible:

- Example 1: Maria, 68, delayed claiming Social Security until 70. She may see a higher-than-average payment in January 2026 — potentially approaching $4,800 due to delayed benefits and COLA.

- Example 2: Jamal, 65, started receiving retirement benefits last year. His average payment is around $2,071 — he should not expect $4,873, but his payment reflects the 2.8% COLA.

- Example 3: Carla, on SSI, receives $914 monthly. Her January 2026 deposit came on Dec 31, 2025, ensuring no gap due to the holiday.

Texas Social Security Schedule – Check January 2026 Payment Dates and Eligibility Criteria

Retirees Could Save $450 in 2026 Thanks to Trump Tax Cuts; Check Eligibility

Social Security Benefit Boost 2026 – 3 Simple Moves That Can Increase Your Monthly Check

Understanding Historical Context

Social Security has been protecting Americans since 1935, providing monthly income to retirees, disabled individuals, and survivors. The COLA mechanism, introduced in 1975, ensures benefits keep pace with inflation. Over decades:

- Average benefits have grown steadily

- Maximum benefits vary based on earnings and age of claim

- Payments remain a lifeline for retirees

Understanding this history makes it clear why the $4,873 figure appears in some discussions — it’s tied to maximum earned benefits, not new stimulus programs.