Federal Employees Are Getting a Pay Raise: It’s official — federal employees are getting a pay raise in 2026, and while it’s not the biggest increase in recent memory, it’s a solid step forward. Starting with the first full pay period of January 2026, most General Schedule (GS) employees will receive a 1% across-the-board increase to their base pay. Certain federal law enforcement professionals may see even larger increases — up to 3.8% — through special salary rate authorities.

This article will break everything down for you in simple, friendly, yet professional terms. Whether you’re a seasoned fed, a new hire navigating your first GS step, or a policy wonk tracking government pay reform — this guide is designed for everyone, from ten-year-olds curious about how adults get paid, to senior analysts planning their retirement years. Let’s dive into what this raise means, how it works, and how it fits into the bigger picture of federal pay, inflation, budgeting, and career planning.

Table of Contents

Federal Employees Are Getting a Pay Raise

The 2026 federal pay raise is now a done deal — a 1% increase for most, with a few groups seeing more. While not a windfall, it’s a building block in the long-term financial lives of over 2 million public servants. Whether you’re preparing for retirement, trying to stretch your paycheck, or just starting out in federal service, understanding how these changes fit into your pay, benefits, and opportunities is essential. In the end, smart planning, upskilling, and strategic career moves often outweigh the base percentage of a pay raise. So, take this raise as a cue to refresh your goals and make 2026 a year of financial and professional growth.

| Key Point | Details |

|---|---|

| Effective Date | First full pay period in January 2026 |

| Base Pay Raise | 1% across-the-board for most GS employees |

| Locality Pay Change | No increase; 2025 levels remain in effect |

| Law Enforcement Pay | Up to 3.8% increase for selected positions under special rate authority |

| Military Pay Raise | Set at 3.8% under separate statute (Congress.gov) |

| COLA for Retirees | Estimated 2.8% for CSRS and partial FERS COLA, based on CPI-W |

| Source | Office of Personnel Management (OPM), Executive Order, Annual Budget Guidance |

Understanding Federal Employees Are Getting a Pay Raise: What’s Behind the Numbers

Every year, federal pay adjustments are driven by legal frameworks and policy decisions. The Federal Employees Pay Comparability Act of 1990 (FEPCA) originally mandated adjustments based on private-sector wage comparisons. However, the president is allowed to propose an alternative pay plan if national economic concerns or budget priorities require a deviation — and that’s exactly what happened this year.

In late 2025, President Trump issued an executive order establishing a 1% across-the-board base pay raise for most federal employees in 2026. No adjustments were made to locality pay, meaning employees in high-cost areas like San Francisco or New York will not see additional increases due to geographic cost-of-living.

This executive decision followed historical patterns seen in prior administrations where the full FEPCA formula was not implemented — largely due to cost.

What the Raise Looks Like in Real Dollars?

To understand what this raise means practically, let’s look at examples across different GS levels. These are estimates and may vary based on locality and step increases:

| GS Level | 2025 Salary | 2026 Salary (1% Raise) | Annual Increase | Biweekly Gain |

|---|---|---|---|---|

| GS-5 Step 1 | $32,570 | $32,895 | $325 | ~$12.50 |

| GS-9 Step 1 | $49,028 | $49,518 | $490 | ~$18.85 |

| GS-12 Step 5 | $79,363 | $80,157 | $794 | ~$30.54 |

| GS-14 Step 10 | $132,122 | $133,443 | $1,321 | ~$50.81 |

While these may look modest, remember — federal raises are compounded over time. Your Thrift Savings Plan (TSP) contributions, retirement annuity, and Social Security benefits are often tied to your salary history.

Locality Pay: Why It’s Staying Flat This Year

Locality pay is designed to help federal salaries remain competitive with private-sector wages in various geographic regions. It’s a percentage-based adjustment on top of base GS pay, and it can range from around 16% (for the Rest of U.S.) up to 40%+ in places like San Francisco.

In 2026, locality pay will not increase, which means paychecks in high-cost regions won’t keep pace with regional inflation rates. That can create wage stagnation in some cities. OPM normally recommends updates to locality pay after reviewing Bureau of Labor Statistics (BLS) wage data, but those recommendations were not implemented in this cycle.

This stagnation has led to growing pressure from employee unions and professional associations such as the National Treasury Employees Union (NTEU) and AFGE, calling for Congress to step in with supplemental pay authority.

Law Enforcement and Special Pay Rates: Who Qualifies for More

One bright spot in this year’s compensation structure is the targeted increases for federal law enforcement personnel and those in hard-to-fill roles.

Using its special salary rate authority, OPM can approve pay boosts of up to 3.8% or more for certain job classifications, including:

- Border Patrol agents

- Correctional officers under the Federal Bureau of Prisons

- FBI and DEA field agents

- Federal Air Marshals

- Secret Service special agents

These higher adjustments are justified by recruitment/retention challenges and heightened risk profiles.

Retirement Implications: More Than Just Take-Home Pay

Raises like this do more than boost your next paycheck — they influence long-term retirement outcomes under both FERS (Federal Employees Retirement System) and CSRS (Civil Service Retirement System).

Here’s how:

- High-3 average salary: Your pension is calculated using the average of your highest 3 consecutive years of salary. Every raise counts toward boosting that average.

- TSP matching: Even a 1% increase in base salary means more dollars contributed (and matched).

- COLA differences: While active employees get structured raises, retirees rely on Cost-of-Living Adjustments (COLAs). In 2026, retirees under CSRS are projected to receive 2.8%, while FERS retirees will likely get 2.5%, as FERS COLA is reduced when inflation is between 2–3%.

Long-Term Pay Trends: Are Feds Falling Behind?

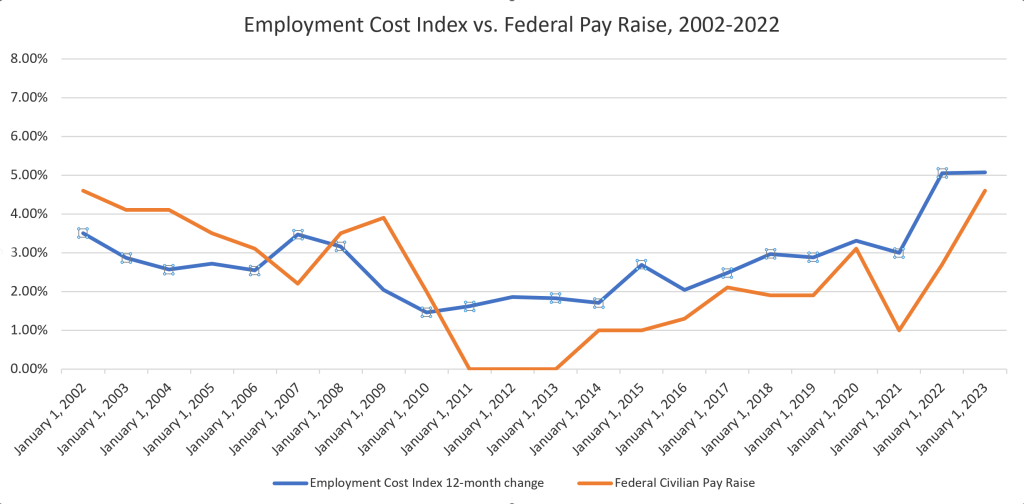

A consistent theme over the past decade has been a widening pay gap between federal and private-sector workers. According to the Federal Salary Council, this gap was over 22% in 2024 before locality and benefits were factored in. Even with annual raises, base pay often fails to keep up with private-sector increases, inflation, or labor demand shifts.

This has raised questions about:

- Federal recruitment competitiveness

- Workforce morale

- Retention in STEM, cybersecurity, and high-skill roles

Many federal HR leaders argue that pay reform is urgently needed to modernize how we compensate civil servants and reflect a 21st-century labor market.

Planning Tips: How to Maximize Federal Employees Are Getting a Pay Raise

You may not be able to control the raise itself, but here’s what you can do:

- Update TSP Contributions: A 1% raise might be a great time to increase your TSP by 1%, especially if you’re under age 50. Consider Roth vs. Traditional.

- Check for Step Increases: Many federal employees qualify for automatic step increases every 1–3 years. Those bumps can be worth thousands, and timing matters.

- Review Withholdings: Use the IRS paycheck calculator to ensure you’re not over- or under-withholding as your income rises.

- Adjust Budgeting Tools: Sync the raise with your household budget and consider adjusting allocations toward savings, debt payoff, or HSA contributions.

- Explore Training and Upgrades: More pay often means more responsibility. Consider whether 2026 is the year to earn a promotion or apply for a detail assignment.

Federal vs. Private Student Loans in 2026; Which One Should You Pick?

Visa and Mastercard Agree to $167.5 Million Settlement Over ATM Fee Charges – Check Details

2026 COLA Benefit Plans: Check Updated Cost-of-Living Adjustments Rules