IRS Tax Refund 2026 Schedule: As we step into the 2026 tax season, many taxpayers are eager to learn about the IRS tax refund schedule, including when they can expect to receive their refund and how to check their refund status. Whether you’re filing your taxes for the first time or you’re a seasoned pro, understanding how the IRS processes refunds in 2026 can help you plan and avoid any unwanted surprises. This article will provide a comprehensive guide to the IRS tax refund schedule, offering insights on estimated refund dates, how to check your refund status, and tips for avoiding common delays.

Table of Contents

IRS Tax Refund 2026 Schedule

Navigating the IRS tax refund schedule in 2026 doesn’t have to be a mystery. By filing early, using e-filing, and opting for direct deposit, you can get your refund in record time. Make sure to double-check all your information and avoid common errors to prevent unnecessary delays. And remember, if you’re claiming tax credits like the EITC or CTC, your refund may take a little longer to process due to additional verification steps.

| Key Information | Details |

|---|---|

| Filing Start Date | January 26, 2026 |

| Deadline for Filing | April 15, 2026 |

| Average Refund Processing Time | 10-21 days for e-filed returns with direct deposit |

| Refund Delays | Common delays include errors, claims for credits (EITC, CTC), and paper filing. |

| How to Check Refund Status | Use the “Where’s My Refund?” tool on the IRS website or the IRS2Go mobile app. |

| Official IRS Website | irs.gov |

Understanding the IRS Tax Refund 2026 Schedule

When you file your tax return in 2026, you may be wondering when the IRS will process your return and issue your refund. The good news is that the IRS works hard to get your refund back to you as quickly as possible. But understanding the exact timing of when your refund will arrive can sometimes feel like a guessing game.

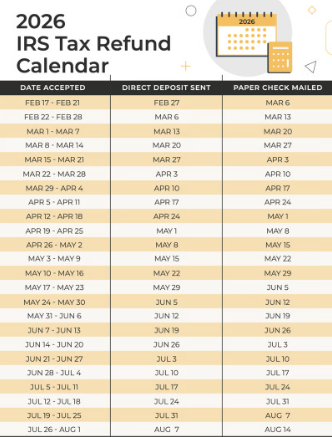

In 2026, the IRS is expected to begin accepting tax returns starting January 26, 2026, which marks the beginning of the filing season for the 2025 tax year. The IRS typically aims to process refunds within a few weeks, but the timing of your refund depends on several factors, including how you file your return, whether you claim certain credits, and if you file electronically or on paper.

Filing Early vs. Filing Late

While the IRS does not guarantee a specific refund date, most taxpayers who file electronically and opt for direct deposit can expect their refunds to arrive in 10 to 21 days. This is a big advantage for those who file early, as refunds are usually issued faster in the first few weeks of the filing season.

On the other hand, paper filers or those who opt for paper checks will see a longer processing time. Refunds for paper filers can take up to 6–8 weeks or longer, depending on the volume of returns the IRS is processing at the time.

How Refunds Are Processed: E-File vs. Paper Filing

One of the best ways to speed up your refund is by filing your taxes electronically (e-filing). The IRS has streamlined this process, and e-filed returns are processed much faster than paper returns. If you opt for direct deposit, your refund will be deposited directly into your bank account within days of the IRS processing your return.

- E-File + Direct Deposit: 10–21 days for refunds

- E-File + Paper Check: 3–4 weeks

- Paper File + Direct Deposit: 4–6 weeks

- Paper File + Paper Check: 6–8 weeks or more

If you file early in the season, you’ll likely receive your refund sooner than if you file closer to the deadline. The IRS also processes returns on a first-come, first-served basis, so getting your return in early gives you a better chance of receiving your refund sooner.

Why Does the IRS Take Time to Process Refunds?

The IRS has to ensure that all returns are accurate, and that means processing each one carefully. For those claiming tax credits like the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC), the IRS may delay refunds until after early March to double-check that these credits are being claimed correctly. This is in line with efforts to prevent fraud and errors.

Additionally, refunds can be delayed if your tax return contains mistakes, such as:

- Incorrect Social Security numbers

- Misspelled names

- Incorrect bank account numbers

- Mismatched tax information

The IRS uses a detailed verification process to avoid fraudulent claims, and this can occasionally cause a delay in processing and issuing refunds.

How to Check Your IRS Tax Refund 2026 Status?

After filing your taxes, it’s natural to want to know when your refund will arrive. Luckily, the IRS offers several easy ways to track your refund status.

- “Where’s My Refund?” Tool: This is an online tool provided by the IRS that lets you check your refund status. It’s updated daily, and all you need is your Social Security Number (SSN), filing status, and exact refund amount.

- IRS2Go Mobile App: If you prefer using your smartphone, you can download the IRS2Go app, which gives you access to the same refund tracking information.

Both tools are reliable and give you a snapshot of your refund status. Keep in mind that the IRS recommends waiting at least 24 hours after e-filing or 4 weeks after mailing your return to check your refund status.

Common Reasons for Refund Delays

Refund delays are not uncommon, but many of them are avoidable. Here are some of the most frequent causes of delayed refunds:

1. Errors on Your Tax Return

As mentioned, errors such as incorrect information on your return can delay the processing time. Double-check all the information you input on your tax forms before submitting, especially:

- Your Social Security Number (SSN) or ITIN

- Bank account information (if you are opting for direct deposit)

- Your filing status

- Amount of refund claimed

2. Claims for Tax Credits

If you are claiming tax credits such as the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), the IRS may take extra time to review your return. According to the IRS, refunds for these credits are usually issued by early March due to the extra verification steps involved.

3. Paper Filing

Filing on paper is significantly slower than e-filing, and as mentioned before, can lead to longer processing times of 6-8 weeks or more. If possible, opt for e-filing and direct deposit to speed up the process.

Social Security January 2026 Payment Dates – Who Gets Paid First and Which Checks Arrive Early

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies