IRS Paper Check Phaseout: If you’ve been used to getting a paper check refund in the mail each tax season, 2026 will bring a big change. The IRS is officially ending the automatic issuance of paper refund checks, pushing taxpayers to switch to electronic refund methods such as direct deposit or prepaid cards. This shift is part of a broader federal move to modernize payments, reduce fraud, and streamline the refund process. But here’s the thing: if you don’t act, your refund might be frozen, delayed, or even go unclaimed. Let’s break down what’s changing, what you need to do, and how to make sure you’re set up for success under these new 2026 IRS refund rules.

Table of Contents

IRS Paper Check Phaseout

The IRS paper check refund phaseout in 2026 marks a major shift in how taxes get refunded in America. It’s all about speed, security, and modernization. But don’t wait until the last minute to prepare. Add your direct deposit info now, create your online IRS account, and help others do the same. By going digital, you’ll not only avoid headaches—you’ll get your money faster and safer than ever before.

| Topic | Details |

|---|---|

| Effective Year | 2026 tax season (for 2025 returns) |

| Refund Change | Paper checks are no longer automatic |

| Action Required | Include direct deposit info in tax return |

| IRS Notice Issued If Missing | CP53E letter |

| Delay Risk | 6–8+ weeks without banking info |

| Still Allowed | Mailing paper checks to IRS (for payments) |

| Exceptions | Religious, disabilities, no banking/internet access |

| Official Source | IRS.gov |

Why IRS Paper Check Phaseout?

Let’s start with the “why” behind this big change.

The Biden administration’s Executive Order 14247, signed in 2022, calls for all federal agencies to transition to faster, secure, and modern digital payments.

The IRS is following suit. According to IRS data, in 2023:

- Over 108 million refunds were sent via direct deposit.

- Roughly 6.5 million taxpayers still received paper refund checks.

- Direct deposits are delivered in 10 to 21 days, while paper checks can take up to 8 weeks.

In short, switching to electronic refunds:

- Saves taxpayer money

- Cuts back on fraud and lost checks

- Makes refunds faster and more accurate

It’s a win for the IRS—and for you—if you’re prepared.

The New Refund Process for 2026: What’s Changing?

Starting with the 2026 filing season (for 2025 tax returns), the IRS will no longer automatically mail refund checks to taxpayers who don’t provide banking info.

Here’s how it’ll work:

- If you file your return with correct direct deposit info, your refund will be sent electronically—just like before.

- If you file without banking info, your refund is held.

- The IRS will mail you a CP53E notice, asking you to update your direct deposit details through your IRS Online Account.

If you don’t respond, your refund will eventually be mailed—but only after a lengthy delay, often 6–8 weeks or longer.

Year-By-Year IRS Paper Check Phaseout Timeline

| Year | What Happens |

|---|---|

| 2024 | IRS launches awareness campaign and updates systems |

| 2025 | Last year for automatic paper refunds |

| 2026 | Electronic refund requirement begins |

| 2027 | Full enforcement; fewer exceptions allowed |

This staggered timeline gives people time to adjust, but the key deadline is January 2026—that’s when the new system kicks in.

How to Add Your Direct Deposit Info?

Here’s what to do when filing your return:

- Line 21b (Form 1040): Enter your bank routing number

- Line 21c: Enter your bank account number

- Line 21d: Choose “Checking” or “Savings”

Want to use a digital wallet or prepaid card instead? Many platforms like PayPal, Venmo, and Cash App offer account/routing numbers that can be used the same way—just confirm that they accept federal government deposits.

IRS Paper Check Phaseout: What If You Don’t Have a Bank Account?

Millions of Americans are unbanked, meaning they don’t use a traditional bank. That’s totally fine—but you still need to provide a valid electronic deposit method.

Here are your options:

- Open a low-fee checking account at a credit union or online bank

- Get a prepaid debit card that accepts IRS refunds

- Use a digital wallet that provides direct deposit capability

What Happens If You Ignore the CP53E Notice?

Let’s say you file your taxes but forget to include bank info. Here’s how it plays out:

- IRS holds your refund

- They mail a CP53E notice

- You log in and update your info

- Refund is processed and paid

BUT if you ignore that notice:

- The refund is not processed

- You wait weeks or even months

- You might have to refile or contact the IRS manually

That’s a headache no one needs.

IRS Online Account – Your Digital Refund Hub

To stay in control of your tax money, create an IRS Online Account.

Here’s how:

- Go to IRS.gov

- Click “Sign In to Your Account”

- Create a secure login using ID.me

- Upload your photo ID and complete identity verification

- Add or change your banking info, check refund status, and respond to notices like CP53E

This account also lets you view your past filings, balances due, and letters received—essential tools for tax season.

Are There Any Exceptions?

Yes—but they’re rare and tightly defined.

The IRS will still issue paper refunds if you qualify under these exceptions:

- Religious objection to electronic banking

- Mental or physical disability that prevents online access

- Living in a remote area without banking or internet

- Deceased taxpayer refunds handled through estates

If you meet these conditions, you’ll need to file supporting documentation or complete Form 8944 (Preparer Hardship Waiver Request).

But remember—just preferring paper isn’t enough anymore.

What About People Living Abroad?

If you’re an American living abroad, this change still affects you.

Here’s what you need to know:

- Refunds can be direct deposited into a U.S.-based bank account

- Some international banks do not accept U.S. government transfers

- Paper refunds may be allowed in limited foreign hardship cases

For Tax Pros and Advisors: What You Need to Do

If you’re a CPA, EA, or tax preparer, here’s your 2026 prep list:

- Educate clients early about refund changes

- Collect bank info upfront during intake

- Prepare for a wave of CP53E notices

- Help elderly or low-income clients set up online accounts or prepaid options

- Track exception requests in your files for audit defense

You may also want to update your firm’s engagement letters or filing checklists to reflect the new requirements.

What About Refund Fraud and Identity Theft?

One of the IRS’s major goals is to cut down on refund fraud.

With paper checks, fraudsters could:

- Steal checks from mailboxes

- Cash or forge endorsements

- File fake returns using stolen identities

By shifting to electronic refunds with secure login systems, the IRS is tightening controls.

In 2022 alone, the IRS reported stopping over $5.7 billion in fraud attempts thanks to digital authentication.

This change protects not just the IRS—but you, too.

IRS Fresh Start Program 2026: Updated Qualifications and Payment Rules Explained

$400 Inflation Refund – Who Gets It & Payment Status

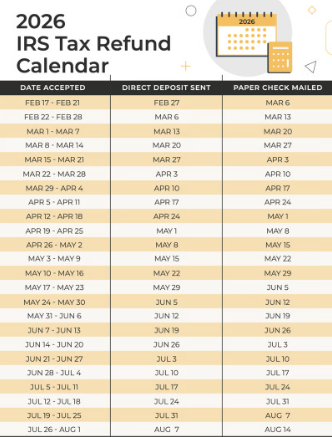

IRS Tax Refund 2026 Schedule: Check Amount & Estimated Dates for Refund Payments