IRS Fresh Start Program 2026: If you’re behind on your taxes, dealing with mounting debt, or facing scary letters from the IRS, you’re not alone. Millions of Americans owe back taxes. But here’s the good news: the IRS Fresh Start Program is still going strong in 2026 and has evolved to give everyday people a better shot at catching up — without losing sleep, wages, or their home. This article is your go-to guide for understanding what the program is, how it works in 2026, who qualifies, and how to apply. We’ll break it all down into plain language, with helpful examples, insider tips, and official resources.

Table of Contents

IRS Fresh Start Program 2026

The IRS Fresh Start Program 2026 remains one of the most valuable tools for U.S. taxpayers facing the burden of tax debt. Whether you’re an employee who forgot to withhold enough, a freelancer who didn’t save for quarterly taxes, or a business owner affected by a tough year, you have real options. From installment plans to Offers in Compromise, to simply pressing pause through CNC status, the key is to act — not hide. Get your filings in order, understand your options, and use the free tools available through the IRS. You don’t need a lawyer to start, but you do need a plan. And that’s what Fresh Start is all about.

| Topic | Details & Stats |

|---|---|

| Official IRS Resource | irs.gov/payments/get-help-with-tax-debt |

| Installment Agreements | Monthly payments up to 72 months |

| Offer in Compromise | Settle tax debt for less than full amount |

| OIC Application Fee | $205 (waived for eligible low-income filers) |

| Lien Filing Threshold | Generally over $10,000 owed |

| Penalty Relief | First-Time Abatement & Reasonable Cause |

| Online Tools | IRS OIC Pre-Qualifier, IRS Online Account |

| Primary Requirement | All tax filings must be up-to-date |

What Is the IRS Fresh Start Program 2026?

The IRS Fresh Start Program was first launched in 2011 to help struggling taxpayers resolve their tax debt without facing harsh collection tactics like liens, levies, or wage garnishments. In 2026, this initiative is still active — now strengthened by digital tools, updated income thresholds, and simplified qualification processes.

Despite what some companies might tell you, Fresh Start isn’t a one-time “get out of taxes free” card. Instead, it includes a series of flexible tax relief tools for qualifying individuals and small businesses:

- Installment Agreements (monthly payment plans)

- Offer in Compromise (OIC) (settle for less than what you owe)

- Currently Not Collectible (CNC) status

- Penalty abatement options

- Relaxed lien filing thresholds

Each one targets a specific type of financial hardship. The idea is simple: if you’re making a good-faith effort to comply, the IRS is more likely to work with you — not against you.

Why the Fresh Start Program Matters in 2026?

The IRS isn’t known for its warmth, but this program is their way of recognizing the reality most Americans face. Life happens — job loss, medical bills, inflation, or pandemic-related setbacks have made it harder for folks to pay everything upfront.

In 2026, economic uncertainty, higher interest rates, and wage stagnation are putting pressure on individuals and small businesses alike. Falling behind on your taxes isn’t a crime — it’s a financial misstep that can be corrected with the right approach. That’s where this program shines.

And the IRS knows chasing debt that can’t be collected is a waste of time and money — so they’re offering these relief programs as a way to help taxpayers get back on track, not punish them.

Who Qualifies for the IRS Fresh Start Program 2026?

Eligibility for any Fresh Start relief hinges on three key things:

1. You’re behind on your taxes or can’t pay in full.

You must owe a tax debt and genuinely be unable to pay it off in one lump sum without causing financial hardship. This includes individuals, gig workers, freelancers, and small business owners.

2. You’ve filed all required returns.

Before the IRS approves any payment relief, your filing history must be current. If you’re missing returns, file them first — even if you can’t afford to pay what you owe.

3. You’re not in an open bankruptcy case.

If you’re in bankruptcy, you’ll have to resolve your IRS debts through the bankruptcy process, not through the Fresh Start Program.

Step-by-Step Guide to IRS Fresh Start Options

Let’s explore the four major components of the Fresh Start Program, and how they’re used.

1. Installment Agreements (Monthly Payments)

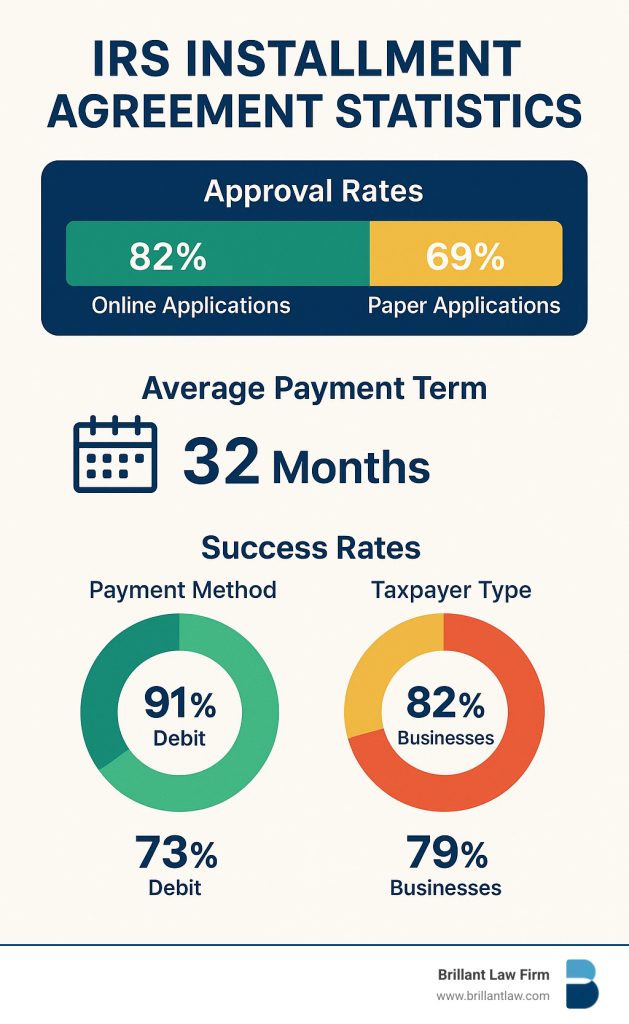

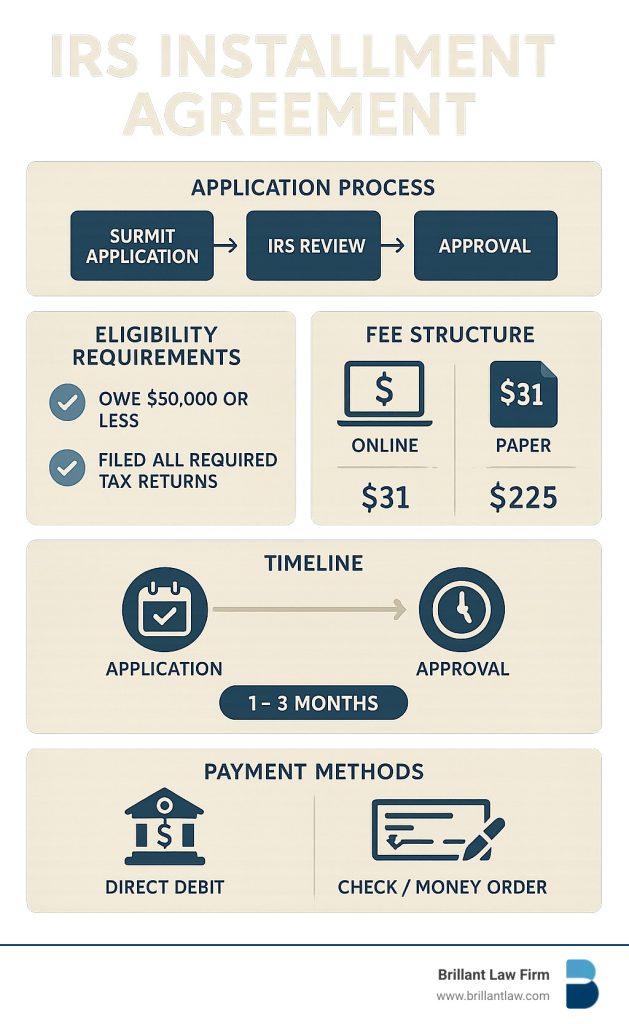

This is the most common tool for taxpayers with IRS debt. Here’s how it works:

- If you owe $50,000 or less, you may qualify for a streamlined payment plan without having to submit a full financial statement.

- You can stretch your payments across 72 months (6 years).

- Payments are based on your income and expenses. The IRS wants to ensure that you can make monthly payments without going broke.

- You can apply online using the Online Payment Agreement Tool.

If you owe more than $50,000, you can still apply — but you’ll likely need to submit Form 433-F, which details your assets, income, and debts.

Example:

Mike, a self-employed consultant, owes $24,000 in taxes from 2023. He applied online and was approved for a 72-month plan at $350/month — no lien, no harassment, and no court dates.

2. Offer in Compromise (OIC)

This powerful relief option lets you settle your IRS debt for less than the full amount owed, but it comes with strict criteria. You’ll need to prove:

- You can’t afford to pay the full debt, even over time.

- You have limited equity in assets (like your home or car).

- You’ve filed all required returns and aren’t in bankruptcy.

The process includes:

- Form 656 (Offer)

- Form 433-A (OIC) or 433-B (for businesses)

- $205 application fee (unless waived)

- An initial payment (usually 20% of the offer or first month of the proposed plan)

Example:

Sarah, a graphic designer, owed $41,000 after years of IRS debt snowballing. She submitted an OIC for $6,400 based on her income and modest assets. The IRS accepted the deal after reviewing her documentation, and the rest was forgiven.

3. Penalty Relief and Abatement

The IRS charges failure-to-pay, failure-to-file, and accuracy-related penalties, which can easily add up to 25%+ of your tax bill. Under Fresh Start:

- First-Time Abatement (FTA) is available if you’ve filed and paid on time for the last three years and have no penalties on file.

- Reasonable Cause Relief is available if you had events beyond your control (medical emergency, natural disaster, etc.).

To request penalty relief, call the IRS or submit a written request explaining your situation.

4. Currently Not Collectible (CNC) Status

If you can’t afford to make any payments right now, and paying would prevent you from covering basic living expenses, you can request CNC status. This doesn’t erase your tax debt — but it halts IRS collection activity temporarily.

You’ll need to provide full financial documentation using Form 433-F or 433-A, showing that your income and expenses leave no disposable income.

Heads up: Interest still accrues, and the IRS will review your situation every 1–2 years.

Pros and Cons of the IRS Fresh Start Program 2026

Benefits:

- Stops or reduces wage garnishments, liens, and levies.

- Provides structured payment plans or settlements.

- Helps avoid bankruptcy.

- Reduces stress and gives you financial breathing room.

Downsides:

- Interest continues to accrue until the balance is paid.

- Offers in Compromise are not guaranteed and take time.

- Lying or hiding income/assets can result in rejection or penalties.

Common Mistakes to Avoid

- Waiting too long to act — Delays increase penalties and reduce options.

- Using sketchy tax relief companies — Many make big promises but charge high upfront fees and deliver little.

- Failing to file returns — This instantly disqualifies you from any Fresh Start option.

- Missing payments after entering a plan — Falling behind again can cancel your relief.

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

IRS Tax Refund 2026 Schedule: Check Amount & Estimated Dates for Refund Payments

January 2026 Stimulus Payment Update – IRS Direct Deposits and Tariff Dividend Facts