IRS February 2026: As we roll into February 2026, many Americans are seeing headlines, social media posts, and even TikToks claiming the IRS is sending $2,000 direct deposits. Understandably, folks are eager for financial relief — and when that kind of number pops up, it raises eyebrows and hope. But let’s set the record straight, from someone who’s been around the tax block more than a few times: There is no official, universal $2,000 stimulus payment authorized by the IRS or federal government this month. However, many taxpayers and benefit recipients may still see $2,000 land in their bank accounts — and it’s not a scam, either. It just takes some context to understand. This detailed guide will help you sort fact from fiction, explain why some people are getting $2,000 deposits, outline who qualifies, share possible payment dates, and provide clear next steps so you’re not left wondering.

Table of Contents

IRS February 2026

While there’s no new $2,000 stimulus payment, many Americans will indeed see IRS deposits around that amount in February 2026. But those funds are your money — coming back as part of refunds, refundable tax credits, or monthly benefits. To stay ahead:

- File early

- Use direct deposit

- Double-check your info

- Track your status via IRS.gov

And please — don’t rely on TikTok or clickbait headlines. Trust the pros and know that with the right prep, $2,000 could very well be headed your way — for all the right reasons.

| Topic | Details |

|---|---|

| Is a $2,000 stimulus confirmed? | No. There is no new stimulus from Congress or the IRS. |

| Why might you receive $2,000? | Early tax refunds, refundable credits (EITC, ACTC), Social Security or state payments. |

| Typical deposit window | 2–3 weeks after filing electronically with direct deposit. |

| Are benefits taxed? | Some, like Social Security, may be taxable depending on income. |

| Where to check refund status | IRS Refund Tool |

Understanding the Buzz: Why People Think There’s a $2,000 IRS Payment

Let’s start with the obvious: $2,000 is a round, headline-grabbing number. It’s also the average refund that many U.S. taxpayers receive during filing season. According to the IRS 2025 Tax Season Statistics, the average refund in early filings ranged from $1,950 to $2,205 — depending on income bracket, credits, and deductions.

This has led many to confuse routine refunds or credits with a new stimulus. Adding to the mix are misleading social media posts, rumors about “Biden Bucks,” and outdated references to pandemic-era relief programs.

So no — the IRS isn’t mailing out $2,000 stimulus checks to everyone this month. But yes — millions are legitimately receiving $2,000+ refunds or deposits.

IRS February 2026: What Could That $2,000 Actually Be?

Here are the most common reasons you might see a direct deposit around that size:

1. Federal Income Tax Refunds

If you file your taxes early — and you’ve had enough withheld from your paycheck — you could receive a refund. The average refund is often in the $1,500–$3,000 range, depending on:

- Income level

- Withholding amounts

- Credits and deductions

If you’re owed money back, and you choose direct deposit, the IRS usually issues it within 21 days of receiving your e-filed return.

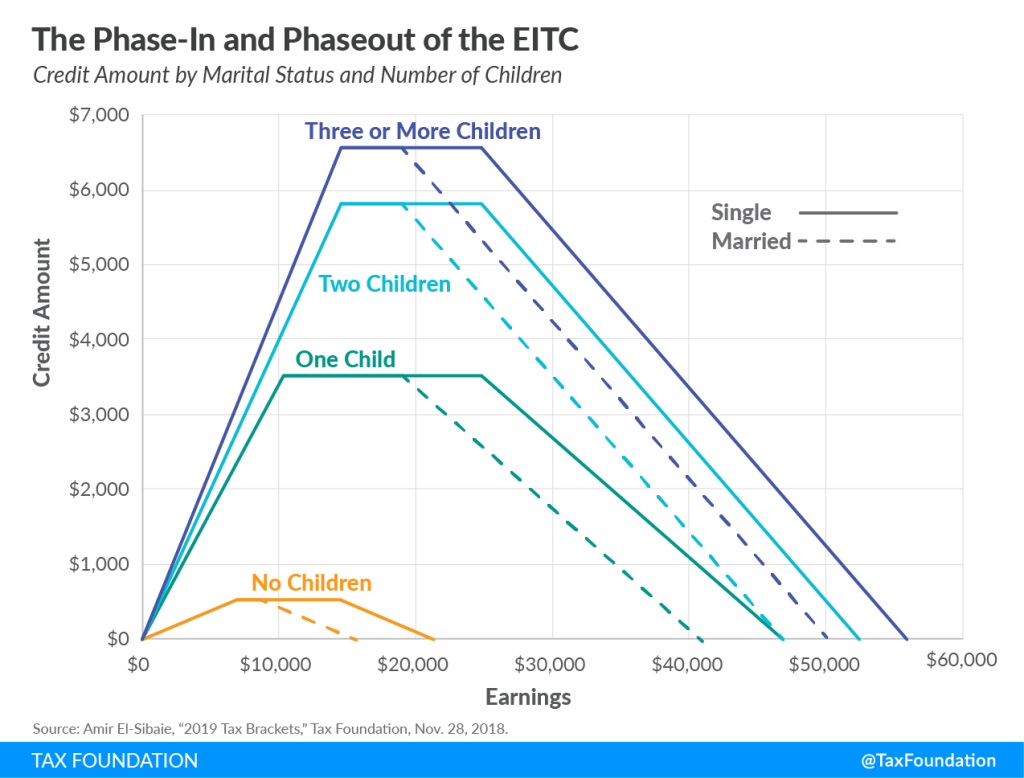

2. Earned Income Tax Credit (EITC)

The EITC is a refundable tax credit that helps low-to-moderate-income earners, especially those with children.

In 2026:

- Families with 3 or more kids could receive up to $7,430

- Those without children can still qualify for up to $632

- Average EITC claim: $2,043

Because this is refundable, it can come back to you as a payment — not just a tax reduction.

3. Child Tax Credit (CTC) and Additional Child Tax Credit (ACTC)

If your income is below certain thresholds, you may qualify for up to:

- $2,000 per child under 17

- $1,600 of that refundable via the ACTC

Combined with EITC, these credits can push your refund amount over $2,000 — or even much more.

4. Social Security / SSI / SSDI Payments

If you receive monthly Social Security, SSI, or SSDI benefits, you may get:

- $1,800 to $2,200 per month (depending on your earnings record)

- Couples can receive more than $3,000/month

In February 2026, regular deposits will continue according to your standard benefit schedule — and some people confuse these with IRS refunds.

5. State Tax Rebates and Refunds

Several states — including California, Maine, New Mexico, and Colorado — have previously issued their own “relief rebates” or automatic refunds based on surplus tax revenue or inflation assistance.

Each state has its own eligibility requirements and timelines. To check if your state has announced anything, visit your:

- State Department of Revenue website

- Or try NASACT’s State Tax Guide

Estimated IRS Refund Deposit Schedule (2026)

Here’s a typical IRS timeline for e-filers who choose direct deposit:

| Date Filed | Expected Deposit |

|---|---|

| Jan 29 – Feb 2 | Feb 19 – Feb 23 |

| Feb 3 – Feb 9 | Feb 26 – March 1 |

| EITC/ACTC Claimants | Feb 27 – March 8 (IRS holds refunds longer) |

Important note: The PATH Act requires the IRS to hold EITC and ACTC refunds until after February 15, even if the return was filed earlier.

How to Check the Status of Your IRS February 2026 Refund?

The IRS offers a free “Where’s My Refund?” tool that updates within 24 hours after your return is received.

Here’s what you’ll need:

- SSN or ITIN

- Filing status (single, married filing jointly, etc.)

- Exact refund amount

Expert Tips to Maximize Your Refund

- File Early: Early filers often get their refunds faster and avoid the crunch in March and April.

- Use Direct Deposit: It’s faster and safer than a paper check.

- Review Credits: Double-check your eligibility for EITC, CTC, education credits, and energy efficiency credits.

- Keep Records Handy: W-2s, 1099s, health insurance forms (1095-A), and dependent info all matter.

- Use Free File or Trusted Software: The IRS Free File Program offers tax prep for those under $79,000 in income.

Common Mistakes That Delay IRS Payments

Even a small mistake can hold up your refund for weeks. Watch out for:

- Incorrect bank info

- Mismatched names/SSNs

- Forgetting to sign the return

- Claiming dependents incorrectly

- Not verifying income with matching W-2/1099 forms

Need help? The IRS Volunteer Income Tax Assistance (VITA) program offers free tax prep help for:

- Low/moderate income individuals

- Seniors

- People with disabilities

What About Stimulus Checks or Future Relief Programs?

Let’s be honest — folks still remember the Economic Impact Payments (EIPs) during the COVID-19 pandemic. Those were unique — and approved by Congress under emergency legislation. Unless Congress passes a new relief bill, there won’t be any new stimulus checks in 2026.

That said, tax law changes do happen, and sometimes mid-year.

IRS Tax Filing Season 2026 – Key Deadlines and When Refunds Are Expected

IRS Refund 2026 – Simple Steps to Track Your Tax Refund Online and Avoid Delays

IRS Confirms Tax Filing Start Date for 2026: Bigger Refunds Could Be Coming