IRS Confirms $2,000 Direct Deposit: this headline has been making the rounds like wildfire. People are buzzing, social feeds are lighting up, and folks are asking, “Is the IRS really dropping two grand into our bank accounts?” Let’s clear the air and get real: There is no new federal stimulus or one-size-fits-all payment of $2,000 from the IRS hitting every American in January 2026. What is true is that many Americans are filing their taxes early and receiving refunds — and those refunds might total around $2,000 or more, depending on their personal tax situation.

If you’re wondering whether you qualify, how this works, or how to get your refund faster, this guide has your back. It’s written in clear, down-to-earth language — the kind you’d hear over coffee with a friend who knows taxes like the back of their hand — while also offering the expert insight of a seasoned financial advisor.

Table of Contents

IRS Confirms $2,000 Direct Deposit

The buzz about an “IRS $2,000 Direct Deposit for January 2026” has folks fired up — but here’s the truth: it’s not a new stimulus, it’s your refund. If you paid too much tax, or you qualify for key credits, you might see that amount (or more) in your bank account this season. But it’s based on your unique tax situation — not a blanket payout. The smartest move? File early, double-check your info, use direct deposit, and know what credits apply to you. And if your refund turns out to be $2,000 — well, now you know exactly where it came from and how to make the most of it.

| Topic | Quick Fact |

|---|---|

| Is there a universal $2,000 payment? | No — not an IRS-confirmed stimulus |

| Why some see ~$2,000 | Refunds from overpayments + credits |

| When IRS begins accepting returns | Jan. 26, 2026 is the official start |

| Refund timing estimates | 10–21 days after acceptance |

| Best way to track refund | Where’s My Refund? |

| Key refundable credits | EITC & Child Tax Credit |

What’s Behind the “IRS Confirms $2,000 Direct Deposit” Claims?

The term “$2,000 direct deposit” has been misinterpreted by some as a fresh round of stimulus payments. In reality, it refers to tax refunds that are being issued as part of the normal 2026 IRS filing season.

Many taxpayers — especially families with kids or workers with modest incomes — are eligible for refundable tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC). When you combine these credits with any income tax overpayments, it’s easy to see refund totals reach or exceed $2,000.

Here’s the kicker: this is your money, not a government handout. You earned it through the work you did in 2025. The IRS is just refunding the difference or crediting you based on laws already in place.

The IRS Tax Season Timeline: What to Know

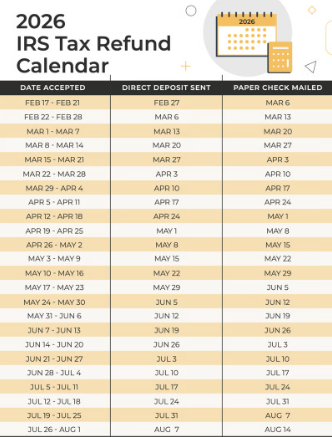

The IRS typically begins processing tax returns in late January — and for the 2025 tax year, January 26, 2026 is the official start date. That means if you file electronically and opt for direct deposit, you could see your refund in your bank account as early as the first or second week of February.

But hold on — not everyone gets paid out that fast. Here’s what affects the speed of your refund:

- Whether you filed electronically (e-filing is way faster than paper).

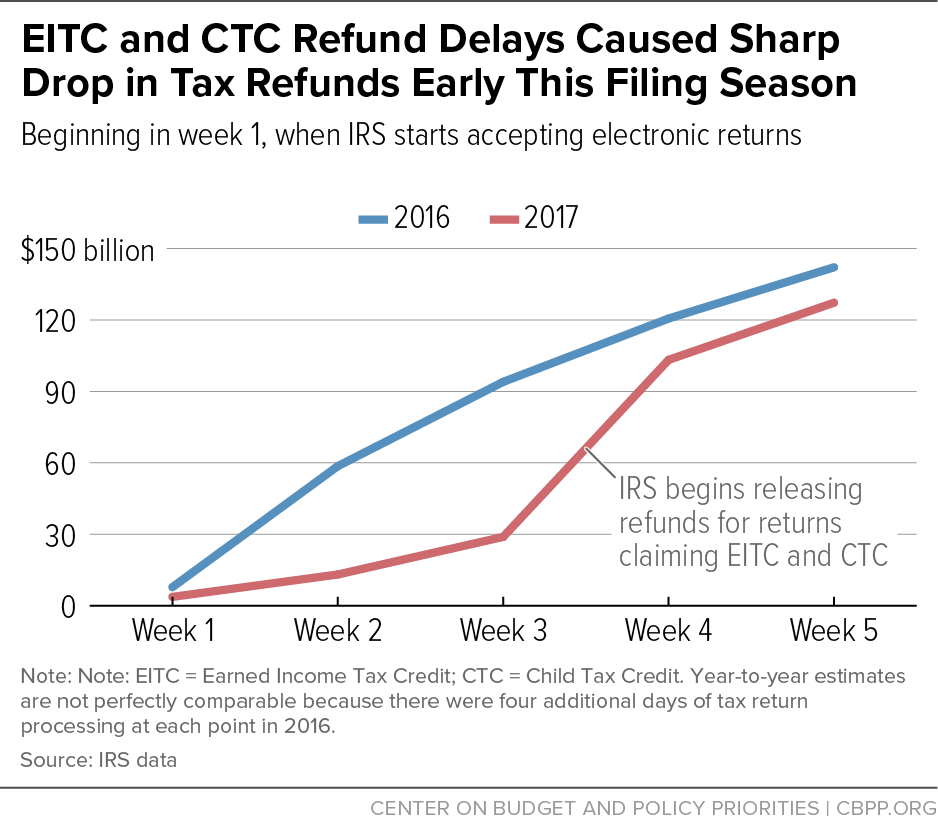

- If you claimed certain credits (EITC and CTC returns are held a bit longer).

- Whether your return needs further review or verification.

- Whether you selected direct deposit or a paper check.

To avoid delays, the IRS recommends e-filing and double-checking your return for accuracy before submitting.

Who Might Receive an IRS Confirms $2,000 Direct Deposit?

Let’s talk real numbers.

Say you’re a single parent with two kids. You earned around $30,000 in 2025. You qualify for:

- Earned Income Tax Credit: About $5,900

- Child Tax Credit: Up to $4,400 ($2,200 per child)

- Federal taxes withheld from your paychecks: Maybe $2,200

Now, subtract what you owe in taxes (which might be zero or very low because of your income and dependents), and guess what? That refund can easily add up to over $2,000 — and in some cases, even more.

Another example: A married couple with one child, earning around $45,000, may qualify for both EITC and a partial Child Tax Credit. Depending on how much tax they paid throughout the year, their refund could hover near the $2,000 mark.

But remember, the refund amount is not fixed — it’s personal. It depends on your earnings, deductions, credits, and how much tax you already paid.

The Truth About Tax Credits: Refund Boosters

Understanding how refundable tax credits work is key to understanding why these refunds can be so high.

Earned Income Tax Credit (EITC)

This credit helps low- to moderate-income earners — especially those with children. The amount varies based on income and family size, but for 2025 tax returns (filed in 2026), the EITC could be worth:

- Up to $7,000 for families with three or more qualifying kids.

- Around $4,000 for two kids.

- Even individuals with no children can qualify for a small amount.

Child Tax Credit (CTC)

The CTC remains a powerful refund booster. If you qualify, it can provide up to:

- $2,200 per qualifying child

- A portion of this may be refundable (meaning you get it even if you owe no taxes)

If you missed out on claiming these in past years, the IRS allows amended returns for up to three years. That’s free money just sitting there.

Refund Timing: When Will I Get My Money?

Most people want to know one thing: “When will I get my refund?”

Here’s a breakdown:

- File electronically + choose direct deposit: 10 to 21 days is the norm.

- Claiming EITC or CTC: Add a few days — refunds for these start going out in mid-February due to anti-fraud laws.

- Filed by mail: Expect delays. Paper returns can take 6–8 weeks (or more) to process.

If you file on January 26 and everything checks out, you could have your refund — yes, maybe even that magical $2,000 — by the second week of February.

Avoiding Delays: Top Mistakes to Watch For

Tax professionals say the biggest refund delays come from the smallest mistakes. Here’s what to double-check:

- Social Security numbers – for you, spouse, and kids. One typo can stall everything.

- Bank account info – wrong routing number = no direct deposit.

- Name mismatches – make sure they match your SSA records.

- Unreported income – forgot that freelance gig? The IRS won’t.

- Missing signatures – if you file by paper, sign everything!

Even better? Use IRS Free File or a trusted tax software. Many catch these issues before you hit “Submit.”

How to Track Your $2,000 Direct Deposit Status?

The best way to keep tabs on your refund is the “Where’s My Refund?” tool on the IRS website. It updates once every 24 hours, usually overnight.

You’ll need:

- Your Social Security number

- Your filing status (single, head of household, married, etc.)

- Exact refund amount

It’ll tell you if your return has been:

- Received

- Approved

- Sent (with an estimated deposit date)

How to Maximize Your Refund in 2026

Want to bump up your refund (or reduce what you owe)? Here are tips from seasoned tax advisors:

- Claim every credit you qualify for – EITC, CTC, Saver’s Credit, American Opportunity Credit for students.

- Contribute to retirement accounts – IRA contributions can reduce taxable income.

- Track deductions – Like student loan interest, job-related expenses, or HSA contributions.

- File early – Not only do you get paid sooner, but you reduce identity theft risks.

Red Flags for Tax Scams in 2026

When tax season kicks off, so do the scams. Here’s how to stay safe:

- IRS will never call, text, or email you to ask for payment or personal info.

- Don’t trust third-party “check claimers” offering to get your refund faster for a fee.

- Watch for fake IRS websites or fake refund emails.

If it sounds too good to be true — like a “guaranteed $2,000 check” for everyone — it probably is.

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

January 2026 Stimulus Payment Update – IRS Direct Deposits and Tariff Dividend Facts

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies