Income Tax Changes: Every year, Uncle Sam tweaks how much of your paycheck he’s entitled to. And Income Tax Changes in 2026 bring a mix of inflation adjustments, legislative updates, and policy rollouts that directly affect your take-home pay. Whether you’re a 9-to-5’er, self-employed, or managing payroll for a small business, understanding these shifts is crucial to planning your budget — and avoiding any tax-time surprises. In this comprehensive guide, we break it down like a backyard BBQ — approachable, friendly, but packed with expert-level insights you can take to the bank (literally). We’ll walk through new tax brackets, deductions, credits, tips for maximizing your paycheck, and what the IRS is now expecting from YOU come 2026.

Table of Contents

Income Tax Changes

Income Tax Changes in 2026 won’t blindside you — if you’re paying attention. The inflation-adjusted brackets, new deductions, and expanded credits aim to keep take-home pay stable or even better than before, especially for working families and mid-income earners. But understanding how these updates apply to your specific situation is key. Smart taxpayers plan ahead, update their withholdings, and work every break they’ve got.

| Topic | What’s New / Changed | Why It Matters |

|---|---|---|

| Federal Tax Brackets | Still seven brackets (10–37%), but income thresholds increase for inflation | Prevents you from paying higher taxes just due to inflation |

| Standard Deduction | Increased: $16,100 (Single), $32,200 (Married) | Reduces taxable income for those not itemizing |

| New Provisions Under the One Big Beautiful Bill Act (OBBBA) | Tax breaks for tips, car loan interest, expanded SALT deduction | Supports working class and middle-income families |

| Child Tax Credit | Enhanced: up to $2,200 per child under age 17 | Reduces tax liability for families |

| Earned Income Tax Credit (EITC) | Slight bump in max credit: up to $7,200 | Helps low-income workers keep more of their paycheck |

| Estate Tax Exemption | Increased to $15 million | Larger estates avoid federal tax |

| Refund Process Updates | Direct deposit preferred; paper refunds phased out | Speeds up refund delivery |

How Federal Income Tax Works in 2026?

The U.S. income tax system is progressive. That means you’re taxed in chunks. Your first slice of income is taxed at the lowest rate, and only income above certain thresholds is taxed at higher rates.

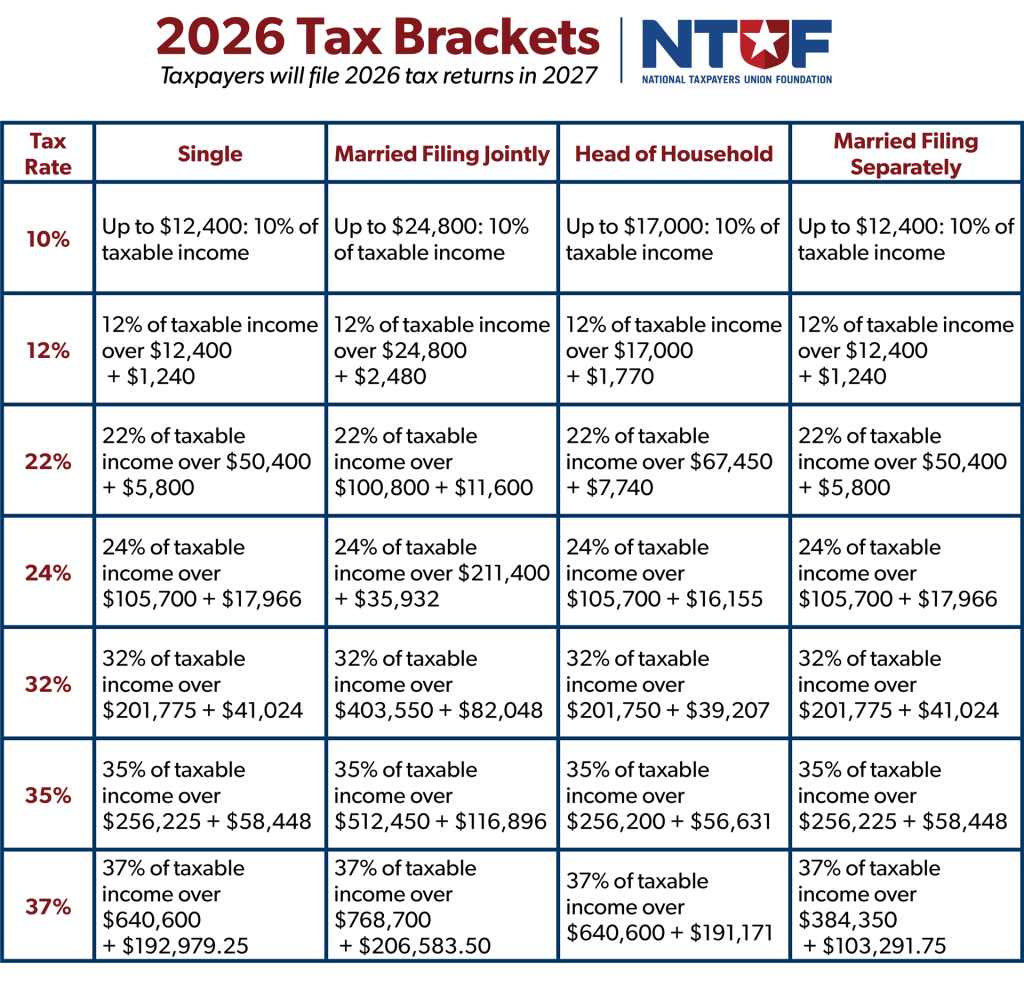

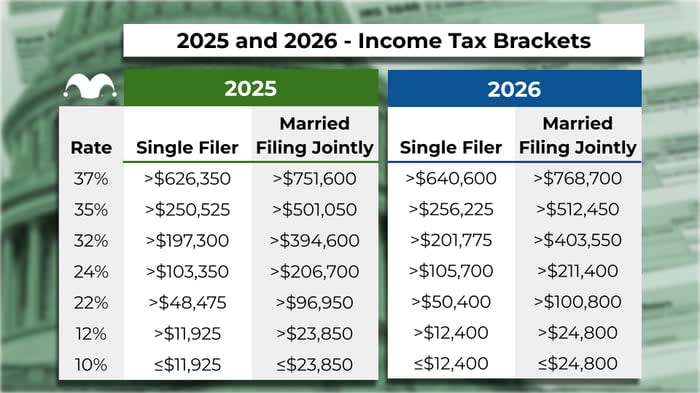

2026 Tax Brackets (Adjusted for Inflation)

| Filing Status | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

|---|---|---|---|---|---|---|---|

| Single | Up to $12,400 | $12,401–$50,400 | $50,401–$105,700 | $105,701–$201,775 | $201,776–$256,225 | $256,226–$640,600 | $640,601+ |

| Married Filing Jointly | Up to $24,800 | $24,801–$100,800 | $100,801–$211,400 | $211,401–$403,550 | $403,551–$512,450 | $512,451–$768,700 | $768,701+ |

These brackets are not new. They were introduced under the Tax Cuts and Jobs Act of 2017 and are now indexed for inflation as part of the IRS annual tax code maintenance.

So why do these thresholds matter?

Let’s say your salary went up 5% in 2025 due to inflation. If the brackets didn’t adjust, you’d move into a higher tax bracket, even though your buying power stayed flat. That’s called “bracket creep” — and adjusting the thresholds helps prevent it.

Standard Deduction and What It Means for You?

The standard deduction is the portion of income the IRS lets you keep tax-free — no receipts, no itemizing required.

Standard Deduction Amounts in 2026

- Single or Married Filing Separately: $16,100

- Married Filing Jointly: $32,200

- Head of Household: $24,150

Compared to 2025, that’s about a 4.6% increase, aligned with general inflation levels. For the majority of Americans (about 90%) who take the standard deduction, this means less taxable income and a lower tax bill.

New and Expanded Income Tax Changes: The One Big Beautiful Bill Act

Signed into law in 2025, the One Big Beautiful Bill Act (OBBBA) overhauled various tax provisions. 2026 is the first full year many of those changes take effect.

Here’s a closer look:

1. Tip Income Deduction

Tipped workers — think restaurant servers, barbers, and hotel staff — can now deduct up to $25,000 of reported tips from taxable income. This provision is aimed at easing the burden on workers whose paychecks depend on customer generosity.

2. Overtime Pay Credit

Workers clocking more than 45 hours/week may qualify for an “Overtime Earned Credit” — a refundable tax credit equal to 10% of overtime pay earned beyond the standard 40-hour week. Must meet AGI limits ($85,000 for individuals, $170,000 for couples).

3. Car Loan Interest Deduction

For the first time in years, interest on car loans used for commuting purposes can be deducted (capped at $1,200 per year). Must be able to show primary vehicle use is for getting to and from work.

4. Enhanced Child Tax Credit

- Increased to $2,200 per child under 17 (up from $2,000)

- Fully refundable for families earning under $50,000 (MFJ)

- Partial phase-out begins at $200,000 (Single) and $400,000 (MFJ)

This means many middle-class and lower-income families will see larger refunds in 2027 when filing their 2026 taxes.

5. Expanded SALT Deduction Cap

The cap on deducting state and local taxes (SALT) has been raised from $10,000 to $40,000. This primarily helps homeowners and professionals in high-tax states like California, New York, and New Jersey.

Real-Life Examples of Income Tax Changes

Let’s look at how the 2026 rules affect different types of taxpayers:

Example 1: Single Professional, $75,000 Annual Income

- Standard deduction: $16,100

- Taxable income: $58,900

- Effective federal tax rate: ~13.8%

- Tax due: ~$8,100

This taxpayer may also qualify for student loan interest deductions or other credits, further reducing the total owed.

Example 2: Married Couple, $130,000 Joint Income, 2 Kids

- Standard deduction: $32,200

- Taxable income: $97,800

- Child Tax Credit: $4,400 (2 kids)

- Effective tax rate after credits: ~9.5%

This household could end up paying just under $12,000 in federal taxes for the year, down from ~$13,000 in 2025 — a decent increase in take-home pay.

Other Notable 2026 Income Tax Changes

Health Savings Accounts (HSAs)

- Contribution limit for individuals: $4,200

- Contribution limit for families: $8,400

- Catch-up for those over 55: $1,000

Using an HSA not only helps you save on medical expenses but also reduces your taxable income.

401(k) and IRA Contribution Limits

- 401(k) max contribution: $23,000

- IRA limit: $7,500

- Catch-up contributions (50+): +$7,500 (401k), +$1,000 (IRA)

These increases are crucial for those aiming to lower their tax bill and boost retirement savings.

Estate Tax Exclusion

- 2026 exemption: $15 million per individual

- That’s up from $13.6M in 2025

- Useful for high-net-worth families planning generational wealth transfers

How to Maximize Your Take-Home Pay in 2026?

Here’s a game plan for tax-savvy earners:

- Adjust Withholdings via IRS Form W-4 – Update your allowances to avoid overpaying or underpaying taxes.

- Use Pre-Tax Benefits – HSAs, FSAs, and 401(k)s can shield thousands in income from taxation.

- Explore Every Credit – From education (Lifetime Learning Credit) to green energy (EV credit), they reduce your tax dollar-for-dollar.

- Stay Organized for Deductions – Keep receipts for vehicle interest, work gear, and eligible home expenses.

- File Electronically + Use Direct Deposit – IRS is moving away from paper checks; direct deposit gets you refunds faster.

IRS Tax Filing Season 2026 – Key Deadlines and When Refunds Are Expected

$2,000 Stimulus Check February 2026 – Are Payments Really Coming or Just Rumours?

Filing Form 1040 in 2026? Smart Ways to Prepare Early for Your 2025 Tax Return