If the IRS Sends You This Letter, Don’t Panic: Let’s be honest — getting a letter from the Internal Revenue Service (IRS) can send your stress levels through the roof. Nobody enjoys mail from the tax folks. But before you assume the worst, take a deep breath. If the IRS sends you a letter, don’t panic — but don’t ignore it either. Contrary to popular belief, these letters are often routine notices. The IRS might just need a little clarification, want to inform you of a change, or ask you to verify some information. Most issues can be resolved quickly if you take a calm, informed approach. The key is understanding why the letter arrived and how to handle it properly. According to the IRS, millions of taxpayers receive notices every year, and most are not audits or penalties. The IRS simply communicates about your account, refund, payment, or missing information.

Table of Contents

If the IRS Sends You This Letter, Don’t Panic

Receiving a letter from the IRS isn’t the end of the world. It’s a normal part of the tax process. Most letters are simple requests or clarifications that can be resolved in minutes. The secret is to stay calm, read carefully, and respond on time. Remember: the IRS values cooperation more than confrontation. Handle it with patience, organization, and respect — and you’ll avoid bigger headaches later. If in doubt, speak with a qualified tax professional. The sooner you act, the easier it is to keep your finances — and your peace of mind — on track.

| Topic | Details & Sources |

|---|---|

| Main Message | Don’t panic. Read the letter carefully and respond by the deadline if required. |

| Common Reasons | Refund adjustments, missing documents, identity verification, balance due. |

| Top Notice Types | CP2000, CP14, 5071C, CP3219A, CP12 |

| Response Timeframe | Usually 30 to 90 days, depending on the letter. |

| Scam Warning | IRS never initiates contact by email, text, or social media. |

| Official Resources | IRS Notice Lookup Tool |

Why the IRS Sends You This Letter?

An IRS letter doesn’t always mean something bad. Here’s what it could mean:

- A correction or adjustment: The IRS found a small math or clerical error on your tax return.

- Missing or mismatched info: The information from your employer or bank doesn’t match your return.

- Identity verification: The IRS needs to confirm that you, not a scammer, filed the return.

- Balance due or overpayment: They’re notifying you of a refund adjustment or tax balance.

- General updates: Sometimes it’s just about confirming an address or a change in tax law.

For example, the CP2000 Notice is among the most common. It means the income reported on your tax return doesn’t match data from your employer or bank. The IRS isn’t accusing you of fraud — it’s giving you a chance to review and respond.

In contrast, a 5071C Letter means the IRS wants to verify your identity before releasing your refund. That’s part of its ongoing effort to stop tax fraud.

In other words, an IRS letter is often just a prompt to clarify something — not a punishment.

Step-by-Step Guide: What To Do When the IRS Sends You This Letter

Handling an IRS letter is simple when you know the process. Follow these six steps to avoid stress and stay compliant.

Step 1: Open and Read It Carefully

Many taxpayers make the mistake of tossing IRS mail aside, assuming it’s bad news. But not opening it only delays your ability to fix anything.

Inside, you’ll find exactly what the letter is about — including the notice number, such as CP14 or CP2000, and clear instructions. That number is the key to understanding the issue. You can look it up directly on the IRS website.

Take note of any deadlines. Many notices give you 30 days to respond, while others may provide 60 or 90. Missing the date can lead to penalties or loss of appeal rights.

Step 2: Understand the Issue

Ask yourself:

- Is it about your refund, tax balance, or identity?

- Does it request documents, payment, or confirmation?

- Is there a proposed adjustment?

If the letter says “No action required,” you’re in the clear. If it includes a balance or a request for more info, plan your response immediately.

Example: If the IRS says your 1099 income was higher than reported, compare your return with your records. Maybe your employer issued a corrected form, or you forgot a freelance gig. Either way, you’ll know what to fix.

Step 3: Follow the Instructions

The IRS doesn’t expect you to guess. Every letter has instructions. Some might ask for a mailed response; others allow online resolution through your IRS account.

If they ask for documentation, send copies only, never originals. Always include the letter’s notice number and your taxpayer ID on every page you send.

And if the IRS says you owe money, don’t delay payment. Even if you can’t afford the full amount, the IRS offers flexible payment options through the Installment Agreement Program.

Step 4: Don’t Ignore It

Ignoring an IRS letter is like ignoring a leaky pipe — it only gets worse. Failure to respond can lead to:

- Added interest and penalties

- Tax liens or levies

- Loss of appeal rights

- Collection action

For instance, the CP14 Notice gives you 21 days to pay before penalties begin. Responding quickly can save you hundreds of dollars.

Step 5: Respond If You Disagree

If you believe the IRS made a mistake, don’t stay silent. You can challenge the notice.

Write a clear explanation of your disagreement, include relevant documents (such as W-2s or receipts), and mail it to the address listed on the notice. Keep copies of everything you send.

For larger or complex issues, consider hiring a Certified Public Accountant (CPA), Enrolled Agent, or tax attorney. They can communicate with the IRS on your behalf.

Step 6: Keep Good Records

Every letter or response should go into your permanent tax file. The IRS recommends keeping tax records for at least three years, but keeping them for seven is even safer — especially if you’ve ever claimed deductions or business expenses.

Scan copies and store them securely in a digital folder. If the IRS ever contacts you again, you’ll have everything ready.

Examples of Common IRS Notices

| Letter Type | What It Means | Recommended Action |

|---|---|---|

| CP2000 | Income mismatch (IRS data vs. your return). | Review, agree/disagree, and respond in 30 days. |

| CP14 | Balance due after filing your tax return. | Pay balance or request payment plan. |

| CP12 | IRS corrected a math error and adjusted your refund. | No action needed unless you disagree. |

| CP3219A (90-Day Letter) | Proposed changes to your return. | Respond or petition Tax Court within 90 days. |

| 5071C | Identity verification notice. | Verify your ID online or by phone. |

What Not To Do If the IRS Sends You This Letter?

- Don’t ignore the letter. The IRS won’t forget.

- Don’t call random numbers online. Only contact the number listed on your notice.

- Don’t pay via gift cards or wire transfers. The IRS never asks for those methods.

- Don’t fall for fake “urgent” calls. The IRS never initiates contact by phone or email.

The only legitimate way the IRS reaches you first is through the U.S. Postal Service.

What To Do If You Can’t Pay?

If you owe taxes but can’t pay the full amount, don’t panic. You have several options:

- Short-term payment plan: Pay the balance within 180 days.

- Long-term installment agreement: Pay monthly over time.

- Offer in Compromise: Negotiate to pay less if you qualify.

- Currently Not Collectible (CNC): Temporary delay due to financial hardship.

IRS Communication Facts and Statistics

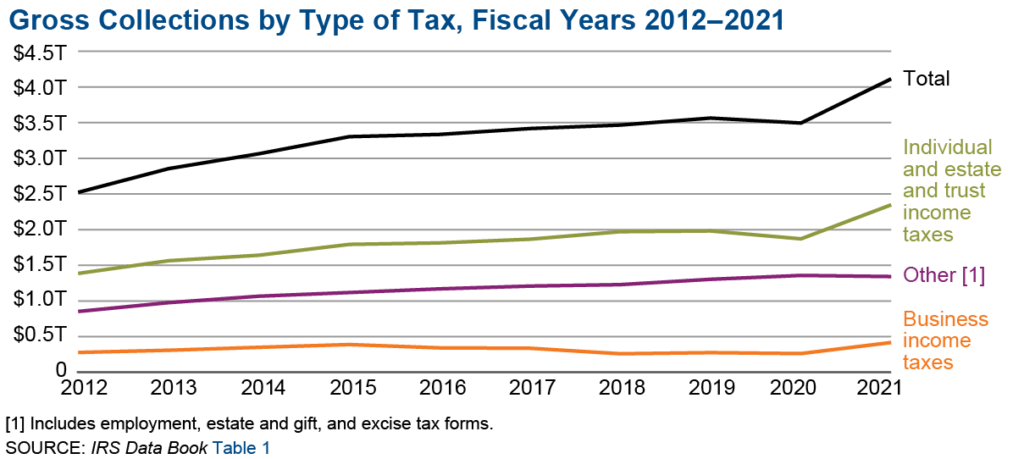

According to the IRS Data Book 2023, more than 75 million notices and letters were sent to taxpayers that year. Of those:

- Less than 1% led to audits.

- Around 25% were automatically resolved when taxpayers responded correctly.

- The IRS handled nearly 15 million identity verification cases due to rising fraud attempts.

This proves that communication is key. Responding promptly often resolves issues without penalties or further action.

Expert Tips from Tax Professionals

- Double-check everything. Compare the IRS’s numbers to your return and documents.

- Respond in writing. Phone calls are fine for clarification, but written records protect you.

- Use certified mail. Always keep proof that you responded on time.

- Seek help early. A tax professional can often resolve notices in days instead of weeks.

- Use IRS Online Tools. Log in to your IRS Account to see balances, letters, and payment options in one place.

CPA and tax consultant Jane K. notes:

“The IRS isn’t your enemy — they’re just following up. Problems usually happen when people freeze or delay.”

$500 a Month, No Strings Attached; Are You Eligible for America’s First Guaranteed Income Program?

SNAP Benefits Are Changing—And If You Live in These 6 States, You’ll Feel It First