Five Social Security Changes: If you’re on Social Security — or planning to claim it soon — 2026 is bringing changes you need to know about. From benefit increases to tax and income limit adjustments, these updates could directly impact how much you receive each month. Understanding these five major Social Security changes in 2026 is more than just “good to know” — it’s essential for smart retirement planning. Whether you’re already retired, nearing retirement, or still working but paying into the system, these changes will shape your financial picture. This guide will break down the updates in plain English, give you real-life examples, expert tips, and action steps — all backed by official sources and up-to-date data to help you make informed decisions.

Table of Contents

Five Social Security Changes

Social Security isn’t static — it evolves each year based on inflation, policy, and economic trends. In 2026, five significant changes are coming that may boost your benefit, increase your deductions, or shift how much you owe in taxes. Whether you’re a retiree, a worker planning ahead, or managing a loved one’s finances, staying informed is key. Use these updates to plan smarter, avoid surprises, and maximize the income you’ve earned over a lifetime of work.

| Change | Details | Who It Affects |

|---|---|---|

| COLA Increase | 2.8% Cost-of-Living Adjustment | All benefit recipients |

| Medicare Part B Premiums | Increased premiums deducted from checks | Retirees on Medicare |

| Earnings Limit Raised | $24,480/year before benefits are withheld | Early retirees still working |

| Taxable Wage Base | Up to $184,500 subject to payroll tax | High-income workers |

| Work Credit Value | $1,890 = 1 credit (need 4/yr) | All working Americans |

Cost-of-Living Adjustment (COLA): Benefits Increase by 2.8%

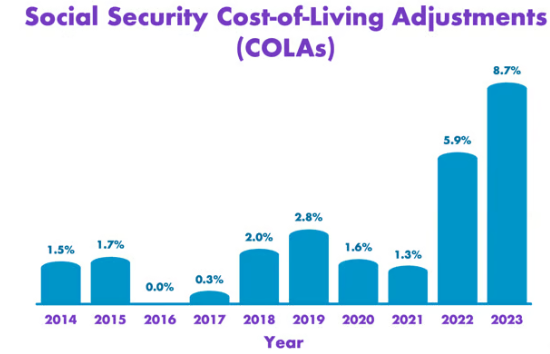

The first big headline? Social Security checks are getting a 2.8% bump in 2026. This annual Cost-of-Living Adjustment (COLA) is designed to help beneficiaries keep up with inflation.

The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — basically, the government’s measurement of inflation. If prices go up, so should your benefits.

For most retirees:

- Average monthly benefit (2025): $2,000

- 2026 COLA (2.8%) = $56 more/month

- New benefit: $2,056/month

That’s an extra $672/year — not huge, but it helps offset rising costs of essentials like food, housing, and health care.

If you’re receiving SSDI (Social Security Disability Insurance) or SSI (Supplemental Security Income), this increase applies to you too.

Important note: You don’t have to do anything to receive the COLA. It’s automatic and will show up in your January 2026 payment.

Medicare Part B Premiums Are Rising

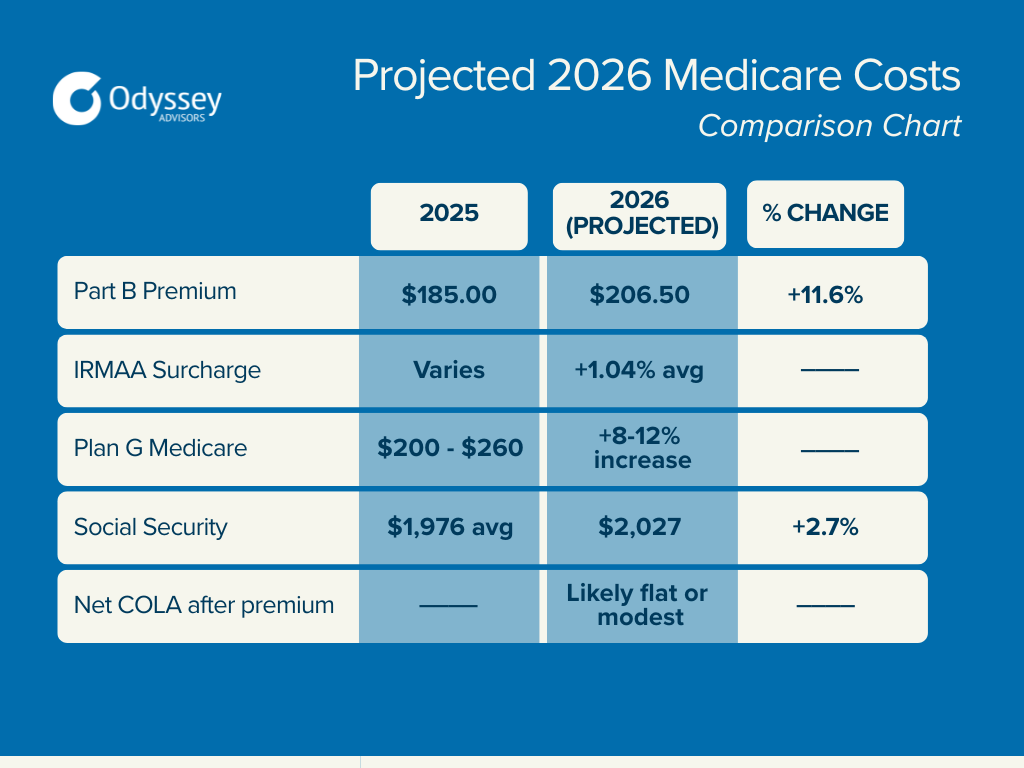

Even though your Social Security check is going up, your net take-home pay might not rise much — because Medicare Part B premiums are also increasing.

Most retirees have Part B premiums deducted directly from their Social Security checks. In 2026, the standard Part B premium is expected to increase to $188.10/month, up from $174.70 in 2025.

That’s a $13.40 monthly increase, which could eat into about 24% of your COLA bump if you’re receiving average benefits.

If you’re a higher-income earner, you may face additional charges through IRMAA (Income-Related Monthly Adjustment Amount). Here’s a quick reference:

- Single filers earning over $103,000

- Married couples earning over $206,000

They’ll pay significantly more — sometimes double the base premium — depending on their income bracket.

Pro Tip: You can appeal your IRMAA if your income dropped due to retirement, divorce, or other life events.

Higher Earnings Limits for Early Retirees

If you’re receiving early retirement benefits (before your Full Retirement Age, or FRA) and still working, there’s a cap on how much you can earn before Social Security temporarily withholds some of your benefits.

In 2026, that limit goes up to:

- $24,480 per year for those under FRA

- $65,160 in the year you reach FRA

If you go over these amounts:

- SSA withholds $1 for every $2 over the limit if you’re under FRA

- SSA withholds $1 for every $3 over the limit in the year you reach FRA

Example:

Let’s say Tom, 63, is drawing early benefits and earning $30,000/year.

- He’s $5,520 over the $24,480 limit

- SSA will withhold $2,760 from his annual benefit

Once Tom reaches full retirement age, these rules go away entirely. He can work and earn as much as he wants without penalty, and previously withheld amounts may be added back into future checks.

Social Security Payroll Tax Expands to More Income

For those still working, especially high earners, there’s another shift to note: the maximum amount of income subject to Social Security payroll taxes is increasing.

- 2025 wage cap: $176,100

- 2026 wage cap: $184,500

This means income up to $184,500 will be taxed at 6.2%, split between employer and employee. Any earnings above that are not taxed for Social Security purposes — although Medicare taxes still apply on all wages.

Why this matters:

- High earners will pay more into the system

- This could eventually translate to slightly higher benefits for them down the road, since benefits are calculated using the highest 35 years of earnings

Planning Tip: If you’re self-employed, remember you pay the full 12.4% Social Security tax on these earnings.

Higher Work Credit Value: $1,890 = One Credit

To qualify for Social Security benefits like retirement, disability, and survivor benefits, you must earn “work credits.”

In 2026:

- $1,890 in wages = 1 credit

- You can earn up to 4 credits per year

- That means you’ll need $7,560 in wages in 2026 to earn the full 4 credits

You generally need 40 credits (10 years of work) to qualify for full retirement benefits.

This change mostly affects:

- Part-time workers

- Gig economy workers

- Young people starting their careers

Even if you don’t earn much, you can still earn credits — as long as your total income meets the minimum threshold.

BONUS: Senior Tax Deduction Could Lower Taxable Income

Though not directly tied to Social Security payments, a new senior-specific federal tax deduction may begin in 2026 to reduce or eliminate income tax on Social Security benefits for middle- and lower-income retirees.

If passed and finalized:

- It could raise the base income threshold for taxing Social Security

- Many retirees who currently pay tax on up to 85% of their benefits might owe far less — or nothing

Real-World Scenarios: Who’s Affected and How

| Profile | Situation | Impact |

|---|---|---|

| Retiree, Age 68 | Receives $1,900/month + Medicare | Sees a ~$43 net increase after COLA and Part B |

| Early Retiree, Age 62 | Receives benefits + works part-time ($28K) | Exceeds limit; $1,760 withheld from benefits |

| High Earner | Makes $200K/year, still working | Pays more payroll tax on extra $8,400 |

| Freelancer, Age 35 | Self-employed gig worker | Needs to earn $7,560 in 2026 to get 4 credits |

What You Should Do Now – Actionable Checklist

1. Log into MySSA Account:

Track your earnings, projected benefits, and check your COLA updates.

2. Review Medicare Costs:

If you’re on Medicare, check for updated Part B and Part D premiums.

3. Talk to a Financial Planner:

An expert can help you adjust for income tax changes or strategize when to claim benefits.

4. Use SSA Calculators:

Estimate your benefits, see how working affects your check, and plan your retirement date.

5. Stay Informed on Tax Law Changes:

Follow IRS updates or subscribe to SSA email notifications.

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules

Social Security $1,850 Monthly Check – How the 2026 Update Changes This Benefit Amount

Social Security Increases by State 2026 – The Five States Seeing the Largest Benefit Gains