First 2026 Check in Just Days: If you’re wondering which retirees will get their first 2026 Social Security check in just days, you’re not alone. Millions of Americans, especially retirees living on fixed incomes, rely on timely Social Security payments to cover housing, healthcare, groceries, and other essentials. But 2026 starts off a little differently due to the federal holiday on January 1st, leading to some early payments for certain groups. So if you’re trying to figure out whether your check is coming now or later, or if you’re even eligible yet, this guide has you covered — in plain English.

Table of Contents

First 2026 Check in Just Days

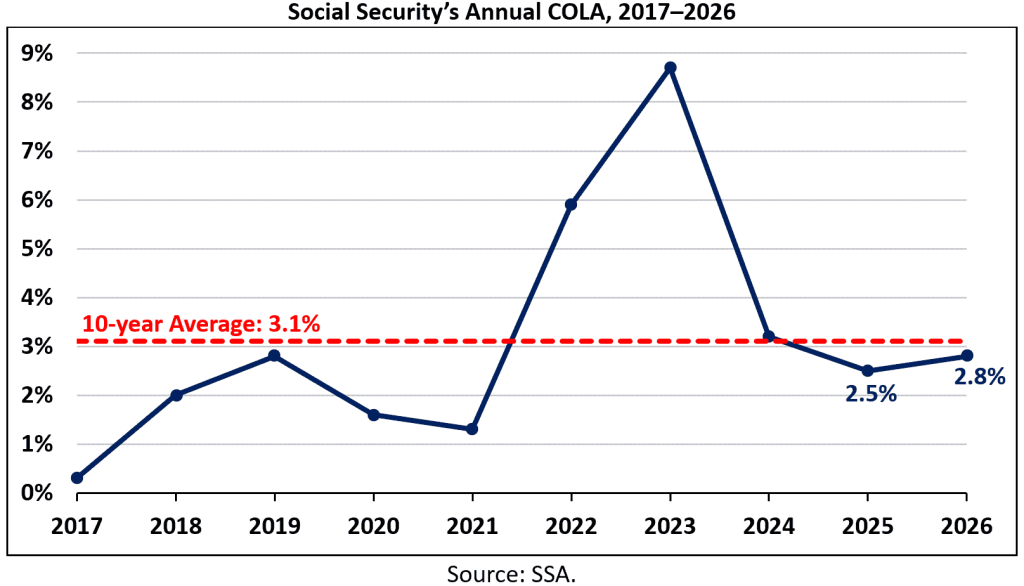

In 2026, Social Security is once again a lifeline for millions of retirees. Thanks to a 2.8% COLA increase, many will see slightly larger checks. And while some groups already got their first 2026 payment, most retirees will be paid between January 14 and January 28, depending on their birthdate. Understanding when your check arrives, what you’re entitled to, and how to prepare for taxes, scams, or changes is crucial to getting the most from your hard-earned benefits.

| Topic | Details |

|---|---|

| First SSI Payment | December 31, 2025 |

| First Retirement Payment | January 14, 2026 (for birthdays 1–10) |

| COLA Increase | 2.8% for 2026 |

| Earnings Limit (Under FRA) | $24,480 in 2026 |

| SSI Max Monthly Benefit | $994 individual / $1,491 couple |

| Credits to Qualify | 40 credits (approx. 10 years of work) |

Who Gets the First 2026 Check in Just Days?

Here’s the bottom line: not everyone gets their check at the same time. Your birth date, benefit type, and payment history all factor into the Social Security Administration (SSA) schedule.

Here’s how it works in 2026:

1. SSI Recipients: Early Bird Gets the Check

Supplemental Security Income (SSI) beneficiaries — often low-income seniors, blind, or disabled individuals — already received their January 2026 check on December 31, 2025. Why? Because January 1st is a federal holiday, and when that happens, payments are bumped to the business day before.

If you’re an SSI-only recipient, your first 2026 check has already hit your account.

2. Longtime Social Security Beneficiaries

People who began receiving benefits before May 1997 (that’s a lot of older retirees) follow a legacy payment schedule. These folks typically get their Social Security check on the 3rd of every month — unless the 3rd falls on a weekend or holiday.

In January 2026, the 3rd is a Saturday, so their payments were moved up to Friday, January 2, 2026.

3. All Other Retirees: Payment Based on Birthday

For most other Social Security recipients — including those who started receiving benefits after May 1997 — payments are based on your birth date:

- Born 1st–10th: Wednesday, January 14, 2026

- Born 11th–20th: Wednesday, January 21, 2026

- Born 21st–31st: Wednesday, January 28, 2026

This staggered schedule helps SSA avoid overwhelming bank processing systems and mail delays.

How Much Will Your Check Be? (COLA Included)

Thanks to inflation, Social Security and SSI benefits are getting a 2.8% bump in 2026 through the annual Cost-of-Living Adjustment (COLA). This is meant to ensure your benefits keep up with the rising cost of everyday goods.

What That Looks Like:

- Average Retirement Benefit (2025): $1,907

- 2026 Benefit (with 2.8% increase): ~$1,960/month

- SSI Max Monthly Benefit (2026): $994 for individuals, $1,491 for couples

That’s not a life-changing increase, but it helps offset the effects of inflation, especially for people living paycheck-to-paycheck.

Eligibility: How to Know If You Qualify for First 2026 Check in Just Days

Even if you haven’t started receiving Social Security yet, you may be wondering whether 2026 is your year. Here’s what you need to know to become eligible for benefits:

1. You Must Have Enough Work Credits

To qualify for Social Security retirement benefits, you generally need 40 credits, which usually means about 10 years of work where you paid into the system through payroll taxes.

In 2026, you earn one credit for every $1,890 you make — and you can earn up to 4 credits per year.

2. You Must Reach Minimum Age

- You can start collecting early retirement benefits at age 62, but your checks will be reduced.

- To receive full retirement benefits, you must reach your Full Retirement Age (FRA):

- Born 1960 or later? Your FRA is 67

- Waiting until FRA avoids reductions and gives you full monthly benefits.

3. You Must Apply for Benefits

Social Security doesn’t automatically start just because you’re eligible. You must file an application through ssa.gov, or by calling SSA or visiting your local field office.

Working While Receiving Social Security? Here’s the 2026 Limit

If you’re under your Full Retirement Age and still working, your earnings might temporarily reduce your monthly benefit.

In 2026, if you’re under FRA:

- You can earn up to $24,480 without affecting your benefits.

- If you exceed that, SSA deducts $1 for every $2 earned over the limit.

The good news? Once you hit full retirement age, there’s no earnings cap, and SSA recalculates your benefit to give you credit for any withheld payments.

Direct Deposit vs Paper Checks

SSA strongly encourages — and in most cases, requires — that you receive benefits via direct deposit. It’s:

- Faster

- More secure

- Protected from theft or delays

If you don’t have a bank account, you can use a Direct Express debit card. Either way, paper checks are no longer the default, and opting in is difficult.

Watch for Scams — They’re Getting Smarter

Every year, Social Security scams cost Americans millions. Scammers pretend to be SSA employees, email fake letters, or call and demand personal info.

What to know:

- SSA will never call and threaten arrest or legal action.

- SSA won’t ask for payment via gift card, wire transfer, or crypto.

- Report scams at ssa.gov/scam.

Stay sharp and cautious — especially if you help older family members with their finances.

Extra Tips for Retirees in 2026

To get the most out of your Social Security benefits, consider these best practices:

1. Create a “my Social Security” Account

This online portal at ssa.gov/myaccount lets you:

- Check your benefit amount

- Verify payment dates

- Update direct deposit info

- Estimate future benefits

2. Consider Tax Implications

Your Social Security benefits can be taxable if:

- You file individually and your total income exceeds $25,000

- You file jointly and your income exceeds $32,000

Be sure to speak with a tax advisor to see how COLA and other income sources affect your taxes.

3. Build a Budget Around SSA Payment Dates

Knowing when your payment lands each month helps avoid overdrafts, missed bills, and food insecurity. Use calendars, reminders, or budgeting apps to track income vs expenses.

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

Social Security Benefits January 2026: How Much Will Your Payments Increase?