Final Social Security Payments: The Final Social Security Payments of 2025 are set to arrive with a few key changes that could affect millions of Americans. Whether you’re a retiree, a disability recipient, or a Supplemental Security Income (SSI) beneficiary, December is shaping up to be a month of double—and even triple—payments for some. In this comprehensive guide, we’ll walk through exactly when your payments will arrive, why the schedule is different this year, and how the new Cost-of-Living Adjustment (COLA) for 2026 will boost your monthly checks. We’ll also include practical budgeting tips, address common myths about Social Security, and share official resources you can trust.

Table of Contents

Final Social Security Payments

December 2025 is a month to pay attention. Between the early SSI payment, the 2026 COLA increase, and the usual mid-month deposits, this period can feel financially busy. But with a clear understanding of the schedule, you can plan your expenses smoothly and avoid surprises. Remember: The SSA’s early payment schedule isn’t a bonus—it’s just a reschedule. Use this time to organize your finances, prepare for tax season, and review your benefit details for the year ahead.

| Category | Details |

|---|---|

| SSI Payment – December 2025 | Regular SSI benefits will be issued on December 1, 2025 |

| January 2026 SSI Payment (Early) | Paid December 31, 2025 due to New Year’s holiday |

| Retirement & SSDI (Post-May 1997) | Payment dates based on birthdays:1–10 → Dec 1011–20 → Dec 1721–31 → Dec 24 |

| Retirement & SSDI (Pre-May 1997) | Paid on December 3, 2025 |

| 2026 COLA (Cost-of-Living Adjustment) | 2.8% increase, average boost of $56/month for retirees |

| 2026 SSI Benefit Maximums | Individual: $994/month; Couple: $1,491/month |

Why December 2025 Is Different?

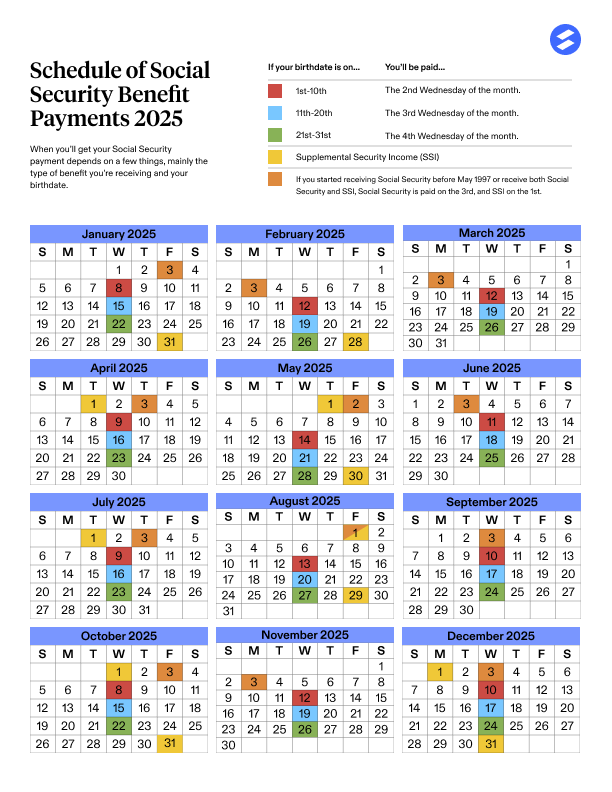

Most years, the Social Security Administration (SSA) follows a predictable payment schedule. Retirement and Disability Insurance (SSDI) benefits are typically issued on a Wednesday, based on the recipient’s birth date. Supplemental Security Income (SSI), however, is generally paid on the first day of each month.

But 2025 ends on a unique note: January 1, 2026, falls on a federal holiday (New Year’s Day). Since the SSA doesn’t issue payments on weekends or holidays, the January SSI payment will be sent one day earlier—on December 31, 2025.

That means many SSI recipients will receive two payments in December—one for December itself, and another early deposit representing January 2026. If you also receive Social Security or SSDI benefits, that’s where the potential third payment can come in.

This isn’t “free money,” though—it’s simply an early payment due to the federal holiday schedule. Still, it can make a big difference for budgeting at the end of the year, especially with holiday expenses in full swing.

Understanding the December Schedule

SSI Recipients

If you receive SSI, your usual payment pattern will slightly shift:

- December 1, 2025: Regular December SSI payment.

- December 31, 2025: Early payment for January 2026.

This schedule ensures you don’t experience a delay due to the New Year’s Day federal holiday. However, note that no payment will arrive in January 2026, since that month’s benefit was paid early.

Retirement, SSDI, and Survivor Benefits

For Social Security retirement, survivor, or disability beneficiaries who began receiving checks after May 1997, the SSA schedules payments based on your date of birth:

- 1st–10th: Wednesday, December 10, 2025

- 11th–20th: Wednesday, December 17, 2025

- 21st–31st: Wednesday, December 24, 2025

If you started getting benefits before May 1997, or if you receive both SSI and Social Security, your payment will arrive on Wednesday, December 3, 2025.

The 2026 COLA: A Modest Boost, But Still Welcome

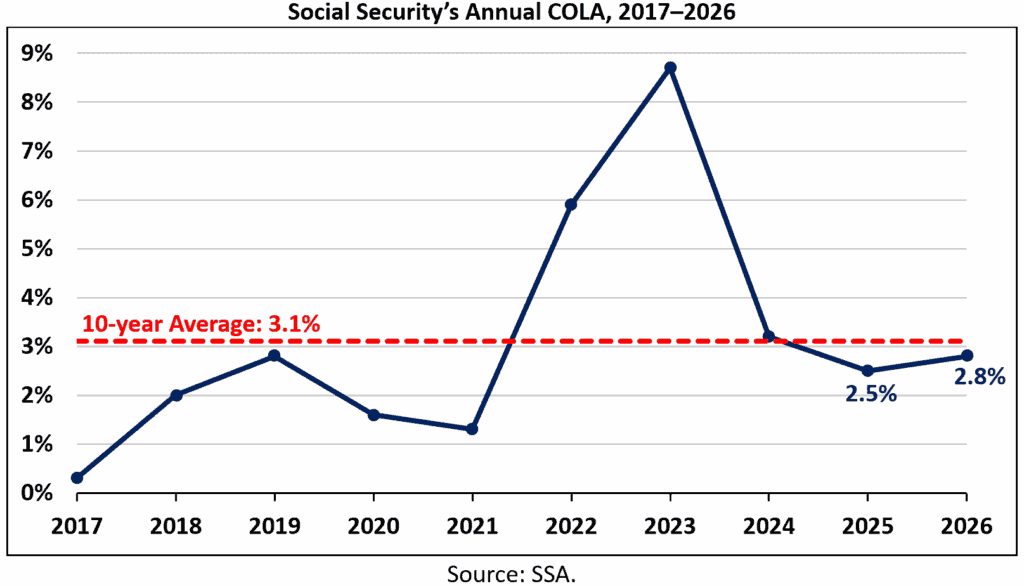

Every year, the SSA adjusts benefit amounts to keep pace with inflation. For 2026, the COLA increase is 2.8%, reflecting the slight rise in consumer prices measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

What does this mean in real dollars?

- The average retired worker will see about a $56 monthly increase, raising the typical benefit to roughly $2,055 per month.

- The maximum SSI payment rises to $994 for individuals and $1,491 for couples.

While that might not sound like much, it helps offset costs for essentials like groceries, utilities, and healthcare—especially with inflation still higher than pre-pandemic averages.

The Logic Behind the Final Social Security Payments

It all comes down to timing. Since the SSA never issues payments on weekends or federal holidays, dates must occasionally move around.

In this case:

- January 1, 2026 (New Year’s Day) is a holiday.

- Therefore, the SSA pushes the January SSI payment to December 31, 2025.

- Other Social Security payments remain unchanged because their scheduled Wednesdays don’t fall on a weekend or holiday.

This early payment system ensures recipients never go without income due to federal closures.

How to Prepare Financially for Final Social Security Payments?

Even though the schedule change is routine, many people mismanage the overlap between December and January payments. To stay organized:

- Mark your calendar. Write down your exact payment dates so you don’t mistake an early deposit for an extra one.

- Budget accordingly. Remember, your December 31 SSI deposit is actually next month’s payment—so plan bills and spending accordingly.

- Avoid over-withdrawing. Treat that early check as January income, not December’s surplus.

- Check your bank or card. If you use the Direct Express debit card, verify deposits through the official app or hotline.

- Watch for your COLA notice. The SSA mails personalized COLA updates each December; you can also check them online through your My Social Security Account.

Common Misconceptions About Social Security

Many Americans misunderstand how Social Security works. Let’s clear up a few myths:

Myth 1: “Social Security is a personal savings plan.”

Not true. It’s a social insurance program, not a savings account. Your payroll taxes fund benefits for current recipients, and future workers will do the same for you.

Myth 2: “Everyone gets the same amount.”

Benefits depend on your lifetime earnings and the age you start claiming. The earlier you start (as young as 62), the smaller your monthly check. Waiting until full retirement age (67 for most) or even age 70 increases your benefit significantly.

Myth 3: “You can’t work while collecting benefits.”

You can—but there are limits. If you’re under full retirement age, the SSA may temporarily withhold part of your check if your earnings exceed certain thresholds. Once you reach full retirement age, your benefit is recalculated and restored.

Myth 4: “Social Security is running out.”

Not exactly. The SSA’s trust fund reserves are projected to cover full benefits until around 2035. After that, payroll tax revenue could still fund roughly 80% of benefits if Congress doesn’t act. So, it’s not vanishing—but reforms will be needed to keep it solvent long-term.

Understanding the 2026 Tax Implications

Social Security benefits may be taxable, depending on your income. If you have additional income from wages, investments, or pensions, up to 85% of your benefits could be subject to federal income tax.

Here’s how the SSA defines “combined income”:

Combined Income = Adjusted Gross Income + Nontaxable Interest + ½ of Social Security Benefits

- Single filers: If combined income is between $25,000–$34,000, up to 50% of benefits may be taxable; above $34,000, up to 85% may be taxable.

- Married couples filing jointly: Between $32,000–$44,000, up to 50% taxable; above $44,000, up to 85%.

While these thresholds haven’t changed in years, the 2026 COLA increase could slightly bump some retirees into higher taxable ranges. That’s worth factoring into your tax planning.

Future Outlook: What to Expect Beyond 2026

The SSA’s 2026 payment structure will continue following the same pattern—payments issued on Wednesdays based on birthdates, SSI on the 1st, and holiday adjustments as needed.

Experts expect modest COLA increases in the following years as inflation stabilizes. But the agency is also modernizing its systems—making direct deposits faster and expanding digital self-service options through the My Social Security portal.

If you haven’t already, setting up your online account can help you:

- View upcoming payments and COLA increases.

- Access benefit verification letters.

- Change banking information securely.

- Track your lifetime earnings and estimated future benefits.

Step-by-Step: What to Do This December

- Review your payment schedule — Use the SSA calendar to confirm dates.

- Verify your direct deposit info — Outdated bank details can delay payments.

- Check for COLA updates — Expect an official notice in your mailbox or online account.

- Budget for early payments — Don’t treat the December 31 deposit as “extra” money.

- Consult a financial advisor or tax preparer if your income mix is complex or near taxable limits.

- Stay alert for scams — The SSA never calls or emails to demand payment or personal info.

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?

New York Social Security Schedule: Exact December 2025 Payment Dates

December 10 Social Security Payments: What Retirees Will Receive and Who Qualifies