Federal Tax Refund Tracking: Federal Tax Refund Tracking is a must-know skill for anyone who files taxes in the U.S. — whether you’re 18 and filing for the first time or 58 and managing a household. Once you hit submit on that return, the waiting game begins, and the big question becomes: Where’s my refund? This guide is gonna walk you through the entire process of tracking your IRS refund, using the official tools, avoiding common pitfalls, and understanding every step. We’ll keep it real simple, like explaining it to your younger cousin, while making it useful enough for tax professionals and accountants. We’re breaking it down step by step, so you know where your money is, why it might be delayed, and what to do if something goes wrong. Let’s roll.

Table of Contents

Federal Tax Refund Tracking

Federal Tax Refund Tracking isn’t complicated when you know the ropes. Use the official IRS tools, have your information ready, and be patient — especially during busy tax season. To recap:

- Use Where’s My Refund on irs.gov

- Track refunds once per day only

- Understand refund statuses and timelines

- Protect your identity when checking status

- Know what to do if your refund is delayed or incorrect

Tax season doesn’t have to be stressful. With this guide, you’re not just waiting around — you’re in control, tracking your refund the smart way.

| Topic | Details & Stats |

|---|---|

| Official IRS Tracker | “Where’s My Refund?” — https://www.irs.gov/refunds |

| Mobile Access | IRS2Go App (iOS & Android) |

| Typical Refund Time | Around 21 days (e-file + direct deposit) |

| Refund Updates | Once per day, typically overnight |

| What You Need | SSN/ITIN, filing status, exact refund amount |

| Amended Return Tracker | Use “Where’s My Amended Return” |

| Paper Returns | Show status ~4 weeks after filing |

| IRS Refund Hotline | 1-800-829-1954 |

What Is Federal Tax Refund Tracking?

After you file your tax return with the IRS, you’re either owed money, owe money, or break even. If you’re owed money — your tax refund — you want to know when it’ll land in your bank account.

Federal Tax Refund Tracking means using IRS tools to monitor the status of that refund. It’s like tracking a package — except the package is your money.

The IRS makes it easier than ever to check your refund status — but only if you know where to look and how to use the tools correctly.

The Federal Tax Refund Process: A Step-by-Step Timeline

Understanding the IRS’s internal process helps you know where you stand and what to expect.

Step 1: File Your Tax Return

You file your federal taxes using IRS Form 1040. Most people do this electronically — either with tax software or through a tax pro. You can still file by paper, but it’s slower (like, really slow).

E-file + direct deposit is the fastest combo to get your refund — most are processed within 21 days, according to the IRS.

Step 2: IRS Acknowledges Receipt

Within 24–48 hours of e-filing, the IRS usually acknowledges that it received your return. This is when you’ll see the status “Return Received” if you check the tracking tool.

Paper returns may take up to four weeks before you even see this status appear.

Step 3: Processing and Review

The IRS runs your return through automated systems. If it doesn’t see any red flags or math errors, and identity checks pass, your status will change to “Refund Approved.”

Step 4: Refund Sent

Once approved, the IRS releases your money. This shows as “Refund Sent” in the tracker. It can take:

- 1–5 business days for direct deposit to show up in your bank

- 1–3 weeks for a mailed check, depending on USPS delivery

Federal Tax Refund Tracking: Trusted Tools

1. IRS “Where’s My Refund?” Online Tool

This is the official source. Don’t trust random websites — go straight to the IRS

Enter:

- Your SSN or ITIN

- Filing status (e.g., Single, Head of Household)

- Exact whole-dollar refund amount

It will show one of three statuses:

- Return Received

- Refund Approved

- Refund Sent

Important: The IRS updates the system once per day (usually overnight). Checking it more often won’t get you new info.

2. IRS2Go App

If you’re always on your phone, download the IRS2Go app. It gives you the same refund status as the website, but with a mobile-friendly layout. Search “IRS2Go” in your app store.

3. IRS Refund Hotline

Call 1-800-829-1954 if you don’t have internet access or need voice confirmation. The automated system will ask for the same info as the website.

What You Need for Federal Tax Refund Tracking

Don’t show up empty-handed. Here’s what to have ready:

- Your Social Security Number or ITIN

- Your filing status (Single, Married Filing Jointly, etc.)

- The exact refund amount you’re expecting

If you mistype even one number, the tracker won’t work.

Common Reasons for Refund Delays

Sometimes, your refund takes longer than 21 days. Here’s why:

1. Filing Errors

Math mistakes, incorrect bank info, or a wrong SSN will cause delays. The IRS has to flag and manually review these.

2. Identity Verification

If your return triggers fraud filters — like mismatched W-2s or addresses — the IRS might ask for identity verification before processing your refund.

3. Tax Credits

Claims involving the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) are subject to stricter review. By law, refunds involving these credits can’t be released before mid-February.

4. Paper Returns

Paper takes longer. It’s scanned manually, and during peak season, backlogs happen. Expect 4–8 weeks minimum.

What To Do If You See No Update After 21 Days?

If you e-filed and chose direct deposit, but your refund status hasn’t changed after 21 days, here’s what to do:

- Check your email or mailbox: The IRS may have sent a letter asking for more info.

- Call the IRS: 1-800-829-1040 (different from the refund line, this connects to a human).

- Double-check your bank info: Make sure you didn’t enter the wrong account number.

If you mailed a paper return and it’s been 6+ weeks, it’s okay to call the IRS to ask for an update.

Federal Refund vs. State Refund: What’s the Difference?

Your federal refund comes from the IRS, based on your federal income tax return (Form 1040).

Your state refund — if you get one — is handled by your state’s department of revenue. The process and tools for tracking state refunds vary widely.

To track your state refund, search:

[Your State] + Tax Refund Tracker

Example: “California tax refund tracker”

State refund timelines can range from a few days to a few months.

What Happens After You Get Your Refund?

So your refund hits your account — now what?

Here are smart moves to make:

- Pay down high-interest debt (credit cards, payday loans)

- Build your emergency fund

- Invest in a Roth IRA or 401(k)

- Set aside savings for next year’s taxes (especially if self-employed)

If you got a large refund, consider adjusting your W-4 form so less tax is withheld during the year. That means more money in your paycheck each month.

Refund Not What You Expected? Here’s What to Do

If your refund is lower than expected, or the IRS took part or all of it, you may see a notice explaining why.

Common reasons include:

- Past-due federal student loans

- Unpaid child support

- Back taxes

- State income tax debts

The IRS Offset Program can reduce your refund to cover these debts. You’ll receive a letter (often a Notice CP49) explaining what happened.

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

January 2026 Stimulus Payment Update – IRS Direct Deposits and Tariff Dividend Facts

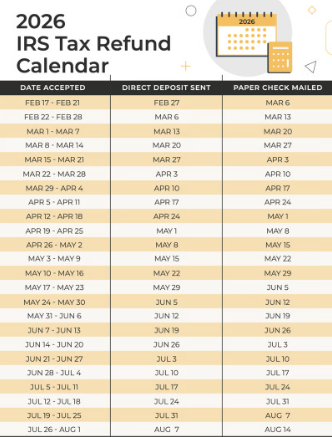

IRS Tax Refund 2026 Schedule: Check Amount & Estimated Dates for Refund Payments