Federal SNAP Cuts: Why South Dakota Faces an Extra $5.5 Million Cost in FY 2027 isn’t just another line in a government spreadsheet. It’s a powerful example of how policy changes made in Washington ripple all the way down to the local grocery store, the food pantry, and the kitchen tables of hardworking families in South Dakota.

What seems like a simple shift in funding—changing who pays to run the Supplemental Nutrition Assistance Program (SNAP)—will soon have real financial consequences for South Dakota. Beginning in fiscal year (FY) 2027, the state is expected to pick up an extra $5.5 million in costs just to keep the same food assistance system functioning. In this article, we break down what SNAP is, what changed at the federal level, how South Dakota got hit, what this means for the rest of the country, and what you can expect as a resident, policymaker, or concerned citizen.

Table of Contents

Federal SNAP Cuts

Federal SNAP Cuts – Why South Dakota Faces an Extra $5.5 Million Cost in FY 2027 tells a deeper story about how major policy changes don’t just stay in Washington—they land hard in state capitals and small-town communities. For South Dakota, the shift to 75% state funding of SNAP administration means an immediate $5.5 million hit to the state budget, with even more potentially looming in the years ahead. The decisions made now—in Pierre and across the country—will shape how well we care for our most vulnerable neighbors, and how responsibly we manage our public dollars.

| Topic | Snapshot |

|---|---|

| Program Name | Supplemental Nutrition Assistance Program (SNAP) |

| Federal Share of Admin Costs (before FY 2027) | 50% |

| Federal Share of Admin Costs (starting FY 2027) | 25% (State pays 75%) |

| South Dakota’s Extra Cost in FY 2027 | $5.5 million |

| State Benefit Cost Sharing (Starting FY 2028) | 5–15% based on payment error rates |

| Program Impact | Increased strain on state budget and administrative systems |

| Households Receiving SNAP in SD | ~75,000 |

| Official USDA SNAP Site | https://www.fns.usda.gov/snap |

What Is SNAP and Why Does It Matter?

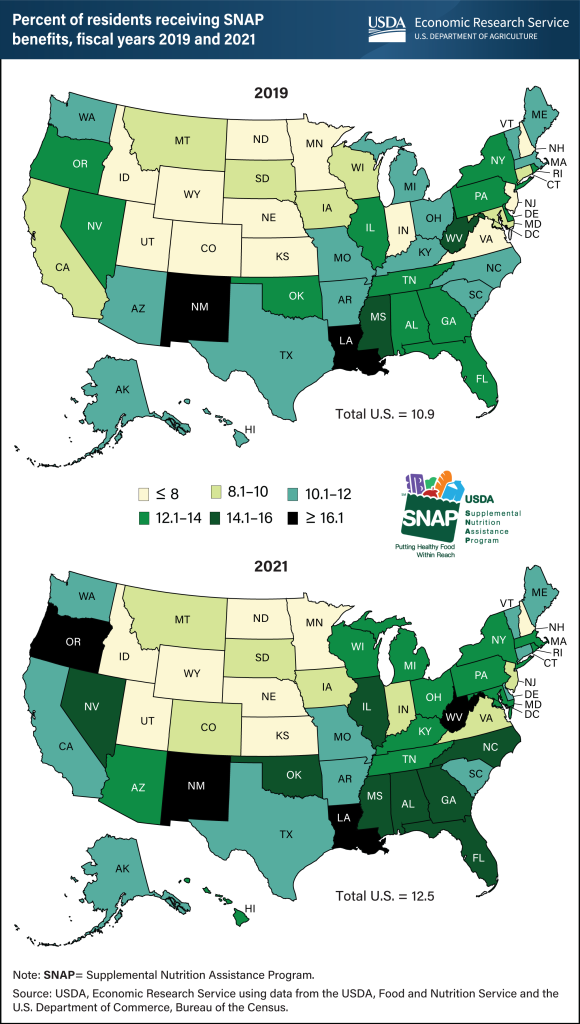

SNAP, formerly known as food stamps, is the largest federal nutrition assistance program in the United States. It helps eligible low-income individuals and families buy groceries. The program serves over 40 million Americans annually, including more than 75,000 in South Dakota.

SNAP is designed to keep families out of food insecurity. And it works. Studies show SNAP reduces poverty, improves health outcomes, and supports economic activity—especially in rural communities where grocery stores and small-town retailers depend on SNAP dollars.

But here’s the kicker: while SNAP benefits (the dollars people spend at the store) are paid for entirely by the federal government, the cost of running the program is shared between the feds and the states.

Until now, that cost-sharing was 50-50: the federal government paid half of the administrative costs, and the states paid the other half.

That’s all about to change.

The Policy Shift That’s Costing South Dakota

In 2025, Congress passed a sweeping federal spending package—the One Big Beautiful Bill Act—that made significant changes to how SNAP is funded and managed.

Among the most consequential changes:

- Beginning FY 2027, the federal share of SNAP administrative costs drops from 50% to 25%.

- This means states will be required to cover 75% of the administrative costs on their own.

- South Dakota, like every other state, must either find that money or scale back its services.

In short, a big portion of the bill for running the food assistance program—staff, systems, office operations—is now coming out of the state budget instead of the federal treasury.

According to internal estimates from South Dakota’s Department of Social Services, this will increase the state’s annual SNAP-related costs by approximately $5.5 million in FY 2027 alone.

This isn’t about wasteful spending or administrative bloat. It’s about essential functions: processing applications, ensuring accurate payments, preventing fraud, maintaining eligibility systems, and providing customer service.

And if states can’t cover those costs? People may face longer wait times, errors in eligibility decisions, and reduced access to help when they need it most.

Why South Dakota Is Especially Affected by Federal SNAP Cuts?

South Dakota may not have the largest SNAP population, but the relative size of its state budget means that even modest shifts in federal cost-sharing can hit hard.

$5.5 million might not sound like much in Washington, D.C.—but for a state with limited revenue sources and one of the leanest state governments in the country, that’s a significant amount of money.

Plus, rural states like South Dakota tend to face higher administrative costs per SNAP participant. That’s because:

- Offices are more spread out.

- Travel distances for outreach and casework are longer.

- Broadband and infrastructure limitations make digital administration more difficult.

So while the total number of SNAP participants may be lower than in urban states, the cost to serve each one is often higher. South Dakota will have to absorb that cost at a time when many agencies are already under-resourced.

What’s Coming in FY 2028: Benefit Cost Sharing

While FY 2027 brings a clear $5.5 million administrative burden, FY 2028 could bring an even bigger challenge.

Starting that year, states may be required to contribute a portion of the actual SNAP benefit payments—something they’ve never had to do before.

This new cost-sharing model is tied to performance:

- States with low payment error rates (under 6%) are exempt.

- States with higher error rates must pay between 5% and 15% of total benefit costs.

Payment errors include both overpayments and underpayments—not just fraud. And while South Dakota currently boasts one of the lowest error rates in the nation, it’s not guaranteed that will last.

These errors often stem from:

- Complicated eligibility rules.

- Inadequate staffing or training.

- Technology failures.

Even a slight uptick in error rates could trigger millions in new costs for the state starting in 2028.

The Bigger Picture: A National Trend of Cost Shifting

The SNAP changes aren’t just about South Dakota. This is part of a broader trend in federal policymaking: shifting responsibilities and costs from the federal government to the states.

Other programs facing similar transitions include Medicaid, housing assistance, and public health funding. The idea is often to encourage efficiency or give states more “skin in the game.” But critics argue it’s just a way to reduce federal spending by pushing the problem downstream.

For SNAP, the danger is that states will cut corners to save money. That might mean:

- Delayed application processing.

- Reduced staffing for program outreach.

- Less investment in fraud prevention and customer service.

And for families relying on the program, it could mean longer waits, more bureaucratic headaches, and less trust in the system.

What Federal SNAP Cuts Means for Families and Communities?

For the average South Dakotan, this policy change may not seem immediately visible—but it could impact families in subtle but serious ways.

Let’s break it down:

- Longer wait times: If staff are cut or overwhelmed due to budget strain, people may wait longer to receive benefits.

- Increased errors: Overworked caseworkers or outdated technology can lead to mistaken denials or benefit miscalculations.

- Reduced access in rural areas: Offices could be consolidated, and outreach reduced—especially in the most remote corners of the state.

- Community ripple effects: Every SNAP dollar spent generates $1.50–$1.80 in economic activity. Less efficient administration could mean fewer dollars reaching local grocery stores, food markets, and farmers.

In a state where agriculture and small-town retail are foundational, even a minor disruption in SNAP can have real consequences for economic vitality.

Budgeting and Policy Options for South Dakota

Facing a $5.5 million increase in costs, South Dakota’s policymakers have a few options:

- Redirect funds from other programs. But that could mean cutting elsewhere—possibly in education, infrastructure, or public safety.

- Raise new revenue. South Dakota doesn’t have a state income tax, so revenue sources are limited. Increasing sales tax or fees could be on the table.

- Invest in error-reduction systems. Ensuring that SNAP payment accuracy stays below the 6% threshold could protect the state from even larger costs in FY 2028.

- Join national advocacy efforts. Several states are lobbying Congress to delay the cost-sharing changes or to increase federal investment in state capacity.

Any of these steps will require difficult trade-offs—and leadership that understands both the numbers and the human stories behind them.

$2,503 Stimulus Check Confirmed for January 2026 – Check Eligibility & Payment Date

SNAP Purchase Rules 2026 – These Items May Be Removed From EBT Cards If Your State Joins the Ban