February SSI Payments: For millions of Americans who depend on Supplemental Security Income (SSI), the start of 2026 brought an important shift in timing — February’s payment is arriving early, landing in bank accounts on Friday, January 30, 2026. If you noticed the deposit and wondered whether it was a mistake or bonus, you’re not alone. Rest assured: it’s neither. It’s simply how the Social Security Administration (SSA) operates when payment dates collide with weekends or holidays. This smart adjustment ensures timely access to critical funds, especially for vulnerable populations like the elderly, disabled, and low-income families.

In this in-depth guide, we’ll walk you through everything you need to know about the early SSI payment for February 2026 — why it’s happening, how it works, and what it means for your budgeting. Whether you’re a retiree in rural Arizona or a caregiver in Detroit, this info is built to serve everyone — clearly and confidently.

Table of Contents

February SSI Payments

The early SSI payment for February 2026 is a planned, helpful shift that ensures no American misses their benefit due to a weekend calendar conflict. For recipients living on fixed incomes, this predictability matters — not just for peace of mind, but for stability, survival, and dignity. As always, plan ahead, know your rights, and lean into the community resources that help make ends meet.

| Topic | Details |

|---|---|

| Why Early Payments? | February 1, 2026 falls on a Saturday — checks sent Jan 30 instead |

| Next Early Payment? | March 2026 check sent Feb 27 (since March 1 is a Sunday) |

| Recipients Affected | 7.4+ million SSI beneficiaries, including seniors, disabled adults, children |

| 2026 COLA Update | 2.8% cost-of-living adjustment included in checks |

| Max SSI Benefit (2026) | $943/month (individuals), $1,415/month (couples) |

| Official Source | Social Security Administration |

What Is Supplemental Security Income (SSI)?

SSI, or Supplemental Security Income, is a federal financial assistance program administered by the Social Security Administration but funded by general tax revenues, not Social Security taxes.

It provides monthly cash payments to people with limited income and resources who are:

- Age 65 or older

- Blind or disabled (at any age)

- U.S. citizens or certain lawfully present non-citizens

These benefits are used for essentials — food, shelter, clothing, transportation, and medical co-pays.

In 2025, over 7.4 million people received SSI nationwide, including 1 million children with disabilities and nearly 2 million elderly adults who rely on these funds for survival.

Why February SSI Payments Are Early?

The SSA follows a consistent rule: if the 1st of the month — when SSI benefits are typically issued — lands on a weekend or federal holiday, payments are delivered on the previous business day.

In 2026, February 1st falls on a Saturday. That means your February SSI payment will arrive on Friday, January 30th. This early deposit ensures that recipients still have access to funds without delay.

This is not a one-time exception — it happens regularly throughout the year and has occurred in previous years too.

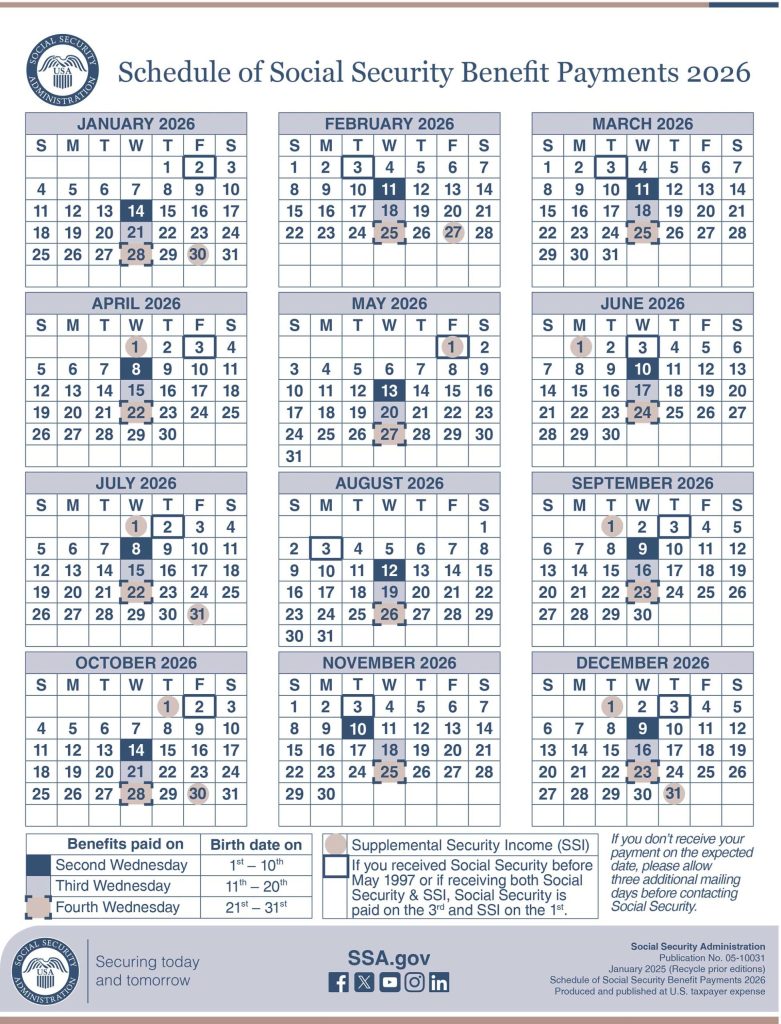

Detailed 2026 SSI Payment Calendar

| Month | Regular Payment Date | Actual Payment Date | Reason |

|---|---|---|---|

| January | Jan 1 | Dec 31, 2025 | New Year’s Day (holiday) |

| February | Feb 1 | Jan 30, 2026 | Falls on Saturday |

| March | Mar 1 | Feb 27, 2026 | Falls on Sunday |

| April | Apr 1 | Apr 1, 2026 | On-time |

| May | May 1 | May 1, 2026 | On-time |

What’s in Your 2026 SSI Payment?

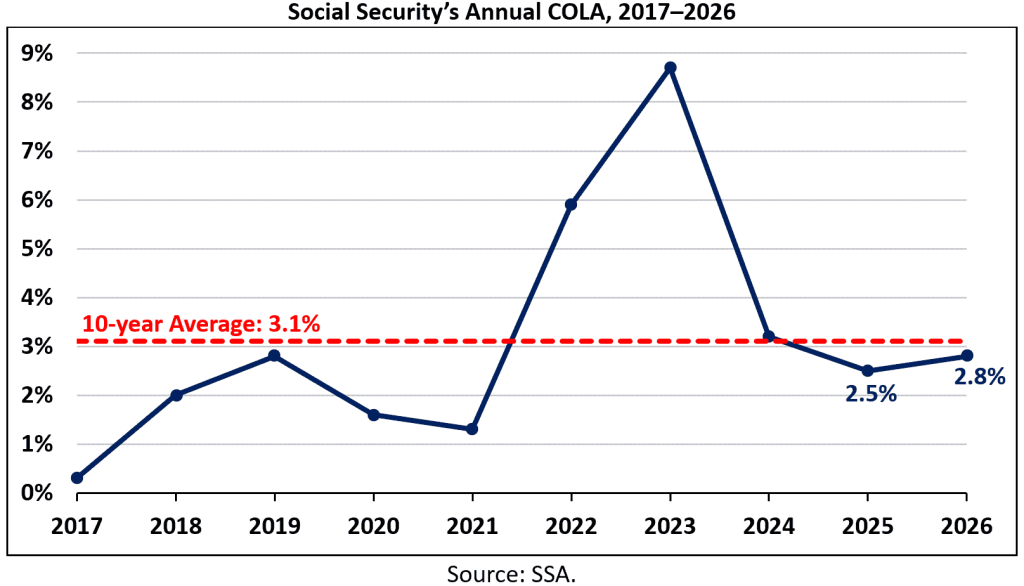

Thanks to the Cost-of-Living Adjustment (COLA), 2026 brings a 2.8% increase in SSI benefits. This adjustment is made to ensure that payments keep pace with inflation and rising living costs.

Here’s how the 2026 numbers break down:

| Recipient Type | Monthly Maximum (2026) |

|---|---|

| Individual | $943 |

| Married Couple | $1,415 |

| Essential Person | $472 |

The increase is based on the Consumer Price Index for Urban Wage Earners (CPI-W) from the U.S. Bureau of Labor Statistics.

Budgeting Advice: Treat Early Payments as Time-Shifts

Early payments don’t mean more money — just an earlier arrival of the same monthly amount.

Practical Budgeting Tips:

- Label the check correctly: Don’t mentally mark the January 30 deposit as “January income.” It’s your February benefit.

- Stretch it strategically: Spread out essential expenses to last the full month.

- Track future early dates: March’s check will also come early — on February 27 — creating a longer wait for April’s.

Some recipients use budgeting apps like Mint or GoodBudget to forecast spending around early payment cycles.

Real-Life Examples of February SSI Payments

- George, 69, from New Mexico, uses SSI to pay his utilities and prescriptions. “When the check hits early, I’m glad — but I know I gotta make it last.”

- Lisa, a single mother in Tulsa caring for her disabled daughter, says she prints out the SSA payment calendar and highlights early dates so she doesn’t overspend.

Step-by-Step: How to Track and Manage Your SSI Payments

Step 1: Create a free my Social Security account at ssa.gov/myaccount

Step 2: Use direct deposit or the Direct Express® Debit Card to receive your payments.

Step 3: Turn on text/email alerts from your bank to notify you when funds are received.

Step 4: Review your annual SSA statement and update your contact or financial info as needed.

Economic Context: Why Timing Matters More Than Ever

In 2026, with rising housing costs, medical expenses, and continued inflation, every day matters for families living on fixed incomes. A report by the Center on Budget and Policy Priorities notes that SSI lifts 3.3 million people out of poverty, especially elderly people of color, rural residents, and children with disabilities.

That means a delay — even by a few days — could have consequences like:

- Missed rent or mortgage payments

- Late utility bills

- Skipped meals or medication

That’s why SSA’s decision to advance payment dates isn’t just policy — it’s a lifeline.

Voices from the Community

“I’ve been on SSI for six years. The early check lets me buy groceries before the weekend rush, when prices go up.” — Raymond B., veteran, Mississippi

“We use my son’s SSI for therapy and transportation. Getting it early helps us avoid borrowing money.” — Amira C., caregiver, Pennsylvania

These are real Americans, managing tight budgets with resilience and grace.

Policy Background: The Law Behind the Date Shift

The legal basis for this early issuance comes from Title XVI of the Social Security Act, which authorizes the Commissioner of Social Security to modify payment schedules to avoid delivery issues. The SSA follows the Electronic Funds Transfer Act, which mandates timely electronic payments and supports early disbursement when holidays or weekends fall on key dates.

From a governance perspective, this is considered a “best practice” for public benefit administration.

SSI February 2026 Payment Schedule – Exact Dates and When Your Check Will Arrive

SNAP Payment Chart 2026: See How Much Your Household Could Get Based on Family Size

IRS New Tax Benefit 2026 – What Was Announced and What It Actually Means