February Social Security Payments Could Be Affected: The big question floating around Washington — and kitchen tables across America — is this: “Will February Social Security payments be affected by the government shutdown?” Let’s cut to the chase — Nope, your checks are safe. That’s right. Even though the U.S. government entered a partial shutdown on January 31, 2026, your hard-earned Social Security benefits are still rolling out like clockwork. The politics may be messy, but the payments are solid. Now, if you’ve got your coffee in hand, let’s dig into the “why,” “how,” and “what you should know” — with real talk, real facts, and zero fluff.

Table of Contents

February Social Security Payments Could Be Affected

In a nutshell, your February Social Security payments are 100% safe. The funding comes from dedicated sources, not from Congress’s annual budget. But be aware: if you’re trying to get a new card, apply for benefits, or need help from SSA — brace for delays. Shutdowns may rattle things in D.C., but your benefits are protected by structure and law. So take a deep breath, stay informed, and use this time to get your online account and financial documents in order.

| Topic | Key Information |

|---|---|

| Shutdown Date | January 31, 2026 |

| Are Payments Affected? | No, Social Security payments continue |

| Programs Covered | Retirement, SSDI, SSI |

| Reason They Continue | Mandatory spending & trust fund-based |

| Early SSI Payment? | Yes, January 30 if due Feb 1 (weekend) |

| Services Affected | Admin services like verification, new applications |

| Official Website | ssa.gov |

What’s the Deal With the Shutdown?

Let’s set the scene. Congress couldn’t pass a full budget to fund all federal agencies before the January 31 deadline. That means we’re in a partial government shutdown, where many non-essential services are paused, and thousands of federal workers face furloughs.

Shutdowns like this aren’t new. We’ve seen this rodeo before — and if history teaches us anything, it’s that while things slow down, critical services like Social Security still keep moving.

This is thanks to how the program is structured: Social Security doesn’t rely on yearly appropriations from Congress. Instead, it runs on payroll taxes and dedicated trust funds — and that makes all the difference.

A Look Back: What Happened in Previous Shutdowns?

To understand the current scenario better, let’s rewind the tape on a few of the most recent and major shutdowns:

2018–2019 Government Shutdown (35 days)

- Longest shutdown in U.S. history.

- Social Security checks still went out as scheduled.

- SSA field offices remained open but offered only limited services.

2013 Government Shutdown (16 days)

- Again, payments continued.

- Some Social Security personnel were furloughed, resulting in slower processing of disability claims and benefit verifications.

1995–1996 Shutdown (21 days)

- Social Security checks were issued on time.

- But customer service response times took a major hit.

What this tells us is that even during major funding lapses, benefit payments continued uninterrupted.

Why February Social Security Payments Could Be Affected?

Here’s where things get important. Social Security is mandatory spending. This means:

- The program is funded outside the annual Congressional appropriations process.

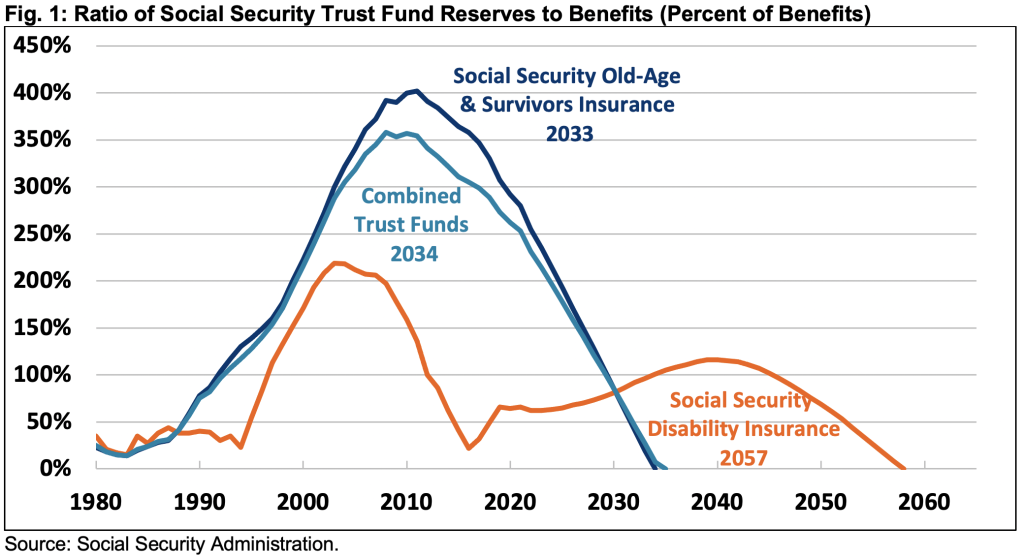

- It’s paid for by FICA payroll taxes and managed through two trust funds: the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) funds.

- The Social Security Administration (SSA) has procedures in place — known as a contingency plan — that ensure critical operations continue even if most federal workers are furloughed.

As long as the SSA has sufficient reserves in those trust funds (which it does), benefits keep flowing, shutdown or not.

Here’s an Example:

Imagine you prepaid your electric bill for the year, but the power company has a billing system issue. You still get electricity because the money’s already there. That’s how Social Security works during a shutdown — it’s already funded, separate from political brawls.

Will My February Social Security Payments Be Delayed?

No. If you receive:

- Retirement benefits

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

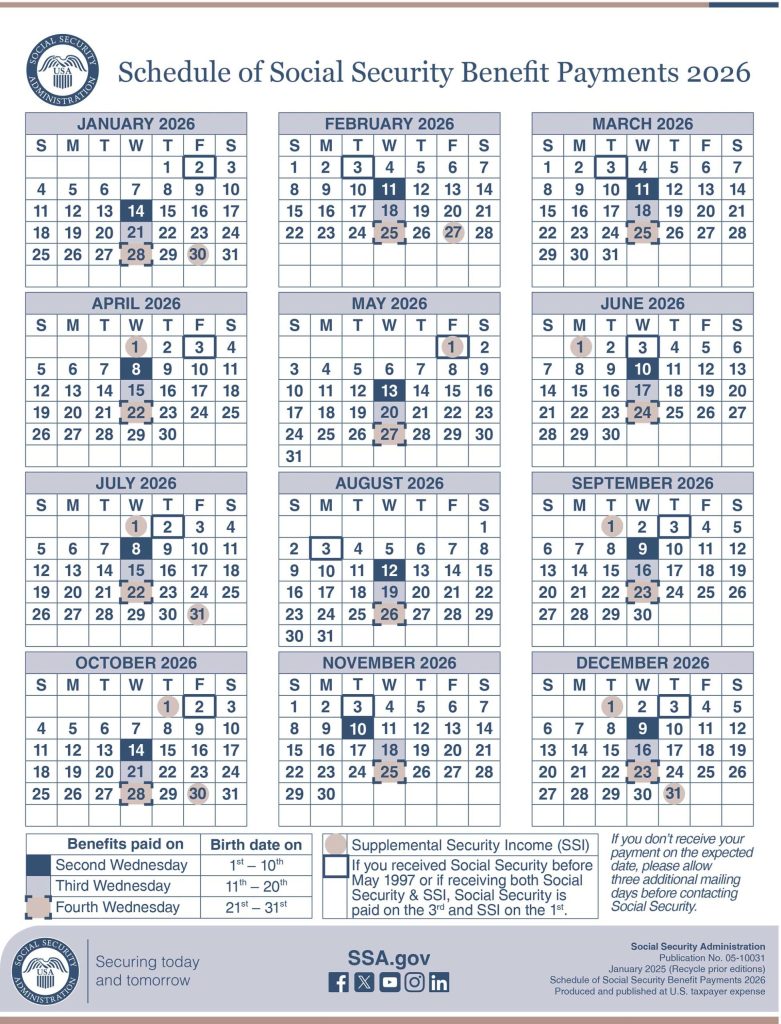

Your February 2026 payment will arrive on its usual schedule. If you’re signed up for direct deposit, it will land in your account automatically, as always.

Early SSI Payments

Because February 1, 2026 falls on a Sunday, SSI payments will be issued on January 30, 2026 — this is standard procedure, not a glitch. The SSA always processes SSI payments on the prior business day if the first of the month is a weekend or holiday.

What Could Be Affected by the Shutdown?

Although your check will arrive, the shutdown isn’t completely painless. The SSA’s discretionary operations can be impacted.

Here’s what may slow down:

- New Social Security number (SSN) applications

- Benefit verifications for loans, housing, or Medicaid

- Appeals and hearings for SSDI

- Phone and in-person customer service

- Requests for replacement cards

- Processing of benefit changes (like address or bank account updates)

According to AARP, over 6,000 SSA employees could be furloughed if the shutdown drags on. This means longer processing times and reduced assistance — especially for folks filing new claims or appealing existing ones.

Who’s Most Affected?

While all Social Security recipients will continue receiving payments, some groups should pay special attention:

- New applicants awaiting benefit approval

- Disabled individuals needing hearings or appeals

- Seniors relying on SSA staff for document support

- Caregivers managing multiple benefits

- Veterans receiving both SSA and VA benefits

If you fall into any of those categories, expect delays and lean more on online tools during this time.

Financial Planning During a Shutdown: What You Can Do

Whether you’re retired, disabled, or living on fixed income — a government shutdown is a reminder to be proactive with your finances.

Here’s a mini guide:

1. Enroll in Direct Deposit

This ensures zero delay from postal disruptions or processing hiccups. Sign up via GoDirect.gov or by calling your bank or SSA.

2. Create a “My Social Security” Account

With ssa.gov/myaccount, you can:

- Track your benefit status

- Request replacement documents

- Change direct deposit info

- Estimate future benefits

3. Build an Emergency Budget

Use a free budget tool like Consumer.gov’s budgeting worksheet to prepare for unexpected delays in administrative services.

4. Contact Community Resources

Local Area Agencies on Aging, food banks, or faith-based groups often have programs for seniors or disabled folks in times of crisis.

Expert and Government Voices

“The good news is that benefits will be paid. The bad news is you may not get through to a human at SSA if you need help,” — Bill Sweeney, AARP

“SSA’s contingency plan allows it to keep paying checks. But long-term delays in funding could cripple non-critical support,” — Rachel Snyderman, Bipartisan Policy Center

“People deserve consistency — especially seniors and people with disabilities. Political gridlock shouldn’t affect their peace of mind,” — Senator Elizabeth Warren

Key Statistics That Matter

- 71 million Americans receive Social Security benefits monthly.

- $1.4 trillion in benefits were paid in 2023.

- Social Security is expected to remain solvent until 2035 even without reforms.

- 22 million people are lifted above the poverty line thanks to Social Security, according to CBPP.

Social Security February 2026 Schedule – All Official Payment Dates in One Place

Social Security $994 Payment for February 2026 – Check Payment Dates and Who Qualifies

Social Security COLA Increase – Why Thousands of Retirees Will See Higher Payments Starting Tomorrow