Earned Income Tax Credit: The IRS recently confirmed a new tax benefit that could impact approximately 1 million Americans, drawing renewed attention to one of the most powerful tools for working families — the Earned Income Tax Credit (EITC). Whether you’re a single parent, full-time employee, part-time worker, or gig economy hustler, this guide walks you through how this credit can put real money back in your pocket during tax season. The EITC is not new, but every year millions of eligible people don’t claim it. Some don’t know they qualify, while others find taxes too confusing or intimidating. This year, with added IRS benefits and outreach programs, it’s more important than ever to understand what you’re entitled to — and how to claim every dollar you deserve.

Table of Contents

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is one of the most impactful tools in the American tax system — lifting millions out of poverty every year. Whether you’re working two jobs, freelancing, or raising kids on your own, you could qualify for thousands of dollars in refundable credits. With the IRS confirming additional support for specific groups like military members, now’s the perfect time to double down on checking your eligibility and filing your taxes the smart way. Don’t let confusion or myths rob you of your refund.

| Topic | Details |

|---|---|

| New IRS Benefit (Not EITC) | One-time $1,776 non-taxable Warrior Dividend for ~1.45 million active-duty service members. |

| Federal EITC Max Credit | Up to $8,231 (for families with 3 or more children in 2026). |

| Eligibility Factors | Based on earned income, filing status, number of qualifying children. |

| State-Level EITCs | Over 30 states offer their own version of EITC to supplement the federal benefit. |

| Gig/Part-Time Workers Qualify? | Yes, if income and other requirements are met. |

| IRS Tool to Check Eligibility | IRS EITC Assistant |

| Free Filing Support | VITA Program for eligible individuals under $60K annual income. |

What Is the Earned Income Tax Credit (EITC)?

The Earned Income Tax Credit is a refundable credit, which means it can increase your tax refund or reduce the amount of taxes you owe to zero. Unlike standard tax deductions, which lower your taxable income, this credit goes straight into your refund.

Here’s the kicker: if your EITC is more than the taxes you owe, the IRS sends you the difference as a refund.

It’s designed to help:

- Low- and moderate-income working families

- Single workers with or without kids

- Part-time or gig workers

- People making an honest living but struggling to get by

According to the IRS, the average EITC refund is over $2,500, but many families with multiple children receive more than $6,000 each year.

New Tax Benefit: The Warrior Dividend (Not Earned Income Tax Credit)

Amid EITC updates, a new tax-free benefit was confirmed by the IRS — the $1,776 Warrior Dividend. This one-time payment is issued to 1.45 million military service members and is not taxable income.

Here’s what you need to know:

- It will not count as income when determining EITC eligibility.

- It does not need to be reported on tax returns.

- It’s a completely separate benefit from the EITC.

Bottom line: This is great news for the military, but for everyone else, the EITC remains the primary opportunity to maximize your refund.

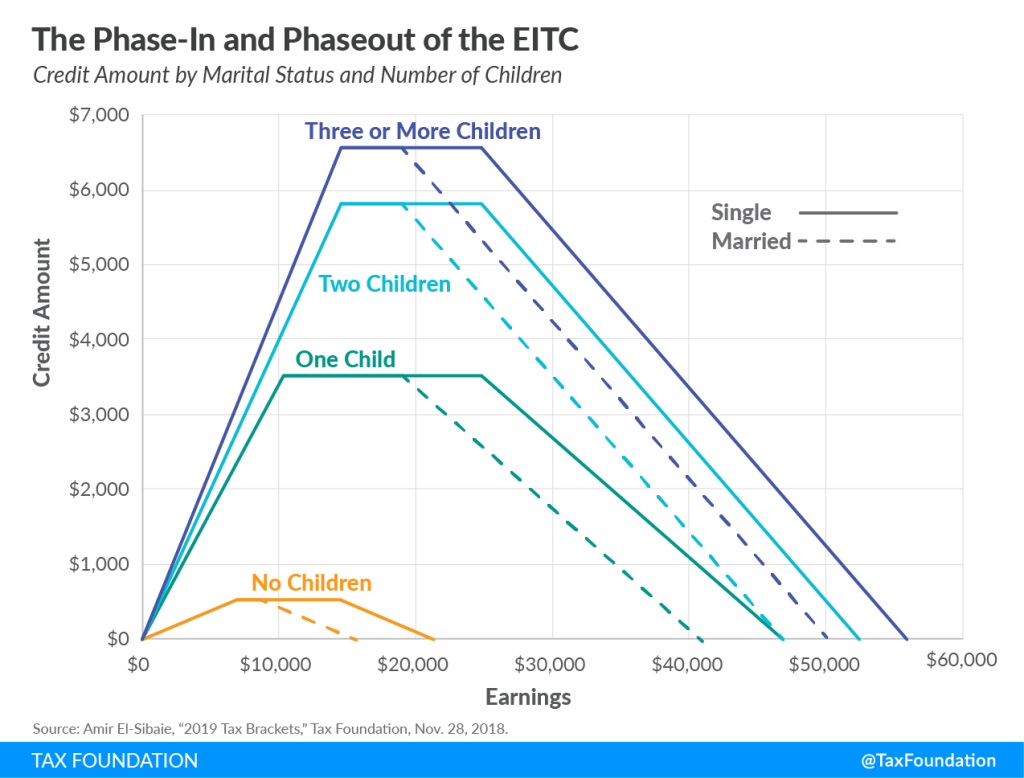

EITC Credit Amounts for 2026

Here’s a breakdown of the maximum federal EITC amounts for the 2026 tax year:

| Filing Status & Children | Max EITC (2026) |

|---|---|

| No children | $560 |

| 1 child | $3,995 |

| 2 children | $6,164 |

| 3 or more children | $8,231 |

Eligibility is determined by:

- Earned income (wages, self-employment, gig income, etc.)

- Filing status (Single, Married Filing Jointly, Head of Household)

- Number of qualifying children (defined by IRS)

How to Qualify for the Earned Income Tax Credit: Step-by-Step

1. Meet the Earned Income Requirements

You must have earned income from a job or self-employment. Investment income (dividends, rental income) cannot exceed $11,000.

2. Stay Within the Income Thresholds

For 2026, your adjusted gross income (AGI) must be under these limits:

- No children: $18,950 (single), $25,100 (married)

- 1 child: $43,500 (single), $49,000 (married)

- 2 children: $50,300 (single), $55,700 (married)

- 3+ children: $56,800 (single), $63,000 (married)

(Source: Projected IRS 2026 limits)

3. Have a Valid Social Security Number

Every person on the return must have an SSN valid for employment.

4. Be a U.S. Citizen or Resident Alien

Nonresident aliens generally don’t qualify.

5. File a Tax Return, Even If You Don’t Owe

You can’t get the EITC unless you file a return. Use Form 1040 and Schedule EIC.

Filing Tips: Avoid These Common Mistakes

Even a small mistake can delay your refund or trigger an audit. Watch out for:

- Listing children who don’t meet IRS qualifying child tests (age, relationship, residency)

- Failing to report gig income

- Incorrect filing status

- Filing too early before all income documents are received

- Math or input errors

Pro Tip: Use IRS-certified programs like Free File or VITA to get free help and avoid common blunders.

EITC for Gig Workers, Freelancers & the Self-Employed

A huge number of eligible gig and part-time workers don’t claim the EITC — often because they:

- Don’t think they qualify

- Don’t realize they need to report cash or app-based income (Uber, Doordash, Etsy, etc.)

Here’s what to know:

- You must report self-employment income even if it was a side hustle.

- Use Schedule C to detail business income and expenses.

- IRS may require proof of income, so keep digital receipts or bank statements.

Don’t skip it — this group often qualifies for $1,500+ refunds they never claim.

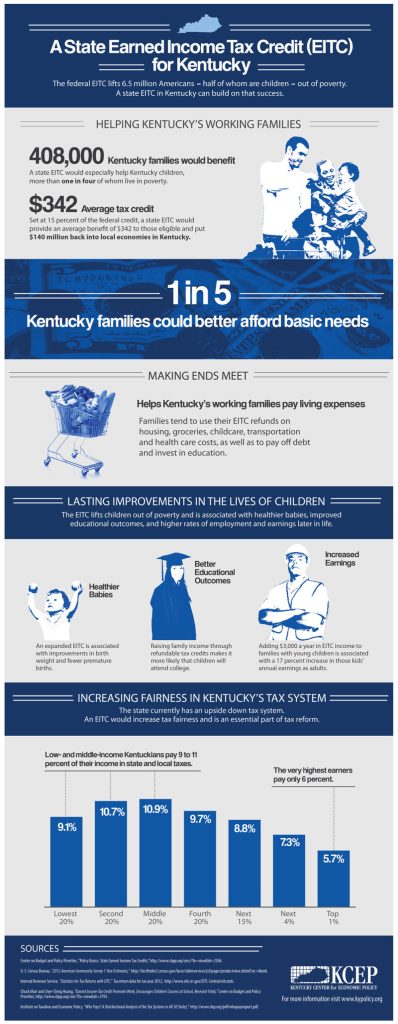

State-Level EITC Programs

In addition to the federal credit, 30+ states and the District of Columbia offer their own EITCs, often as a percentage of the federal amount.

Here’s a quick glance:

- California: Offers CalEITC + Young Child Tax Credit

- New York: State credit = 30% of federal EITC

- Colorado: Expanded EITC to match federal levels

- Minnesota, Oregon, Maryland, and others have robust programs

These stack on top of your federal refund — so don’t miss out.

Case Study: Real Example

Let’s say Tasha, a 32-year-old single mom in Kansas, earns $31,500 from her job and has two young kids.

- She files as Head of Household.

- Her children live with her all year and meet the qualifying child criteria.

- She’s eligible for a $6,000+ EITC refund, plus the Child Tax Credit.

That’s over $9,000 back in her pocket — enough to cover rent, car repairs, groceries, and debt.

Need Free Help? Use IRS VITA Program

The IRS runs the Volunteer Income Tax Assistance (VITA) program, which offers free tax help to:

- People who earn less than $60,000/year

- People with disabilities

- Limited English speakers

VITA volunteers are IRS-certified and trained to handle EITC, Child Tax Credit, and complex returns.

IRS Tax Refund 2026 Schedule: Check Amount & Estimated Dates for Refund Payments

IRS Confirms Tax Filing Start Date for 2026: Bigger Refunds Could Be Coming

IRS Fresh Start Program 2026: Updated Qualifications and Payment Rules Explained