December SSI and Social Security Deposits: If you receive Social Security or Supplemental Security Income (SSI), December 2025 might feel like a small windfall. Thanks to holiday scheduling quirks and the new 2026 cost-of-living adjustment (COLA), millions of Americans will see two or even three payments this month — plus slightly higher benefits heading into the new year. This article breaks down everything in plain English: when you’ll get paid, why some deposits arrive early, how much more you’ll earn next year, and how to make the most of it. Whether you’re a retiree, disabled worker, or someone helping a loved one manage benefits, this guide will help you stay informed and confident.

Table of Contents

December SSI and Social Security Deposits

December 2025 is one of those months when timing really matters. Between early deposits, COLA adjustments, and the holiday season, it’s easy to lose track — but knowing what to expect helps you stay in control. If you receive SSI, expect two payments: December 1 and December 31. If you also get Social Security, you’ll likely see three deposits. Starting with that last check in December, your 2026 benefits rise by 2.8%, helping offset rising costs for groceries, rent, and healthcare. Bottom line: know your schedule, watch your deposits, and plan ahead. SSA’s payment shifts aren’t random — they’re designed to ensure you get your money safely and on time.

| Topic | Details |

|---|---|

| SSI December 2025 Payment | December 1, 2025 |

| January 2026 SSI (paid early) | December 31, 2025 |

| Social Security (pre-1997) | December 3, 2025 |

| Birthdays 1–10 | December 10, 2025 |

| Birthdays 11–20 | December 17, 2025 |

| Birthdays 21–31 | December 24, 2025 |

| 2026 COLA Increase | 2.8% |

| Average Retiree Increase | About $56 per month |

Why December SSI and Social Security Deposits Is a Big Deal for Recipients?

Every December, the Social Security Administration (SSA) shifts its payment calendar to work around federal holidays. For 2025, January 1, 2026 lands on a federal holiday, so SSI recipients will get their January payment early — on December 31, 2025.

That means if you’re on SSI, you’ll get:

- Your regular December 1 payment, and

- An early January 2026 payment on December 31.

Two payments, one month. It’s not a bonus, but it sure helps during the holiday crunch when bills and gift shopping pile up.

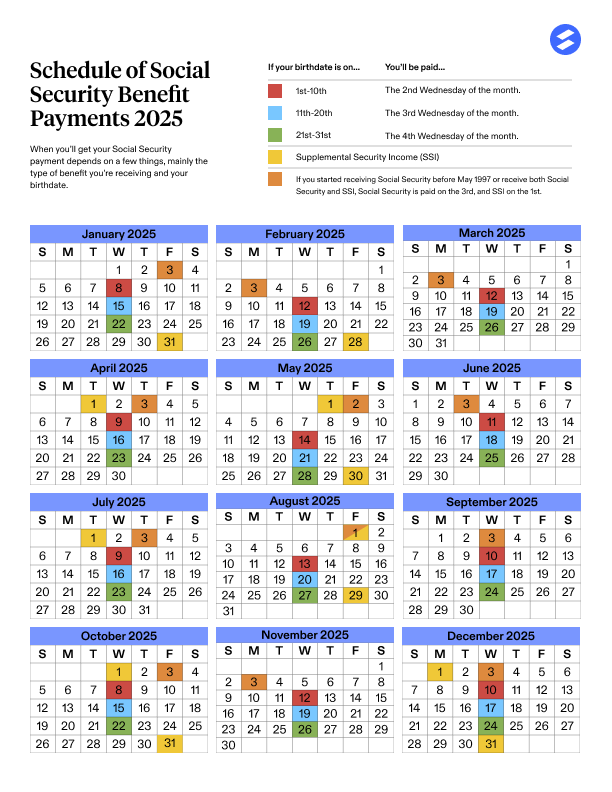

Social Security Payment Schedule for December 2025

If you receive Social Security retirement, disability (SSDI), or survivor benefits, your payment date depends on your birth date or when you first started benefits.

- If you began receiving benefits before May 1997: Paid on Wednesday, December 3, 2025.

- Born between the 1st–10th: Paid Wednesday, December 10.

- Born between the 11th–20th: Paid Wednesday, December 17.

- Born between the 21st–31st: Paid Wednesday, December 24.

That means some people will see their Social Security payment mid-month and their early SSI check at the end of the month — potentially three deposits in December.

How Many Payments You Might Receive in December?

Let’s clarify the possible combinations:

- SSI only: Two payments — December 1 and December 31.

- Social Security only: One payment on your usual Wednesday.

- Both SSI and Social Security: Three payments (Dec 1, your mid-December Social Security date, and Dec 31).

This schedule sometimes confuses people who think the December 31 check is an extra or “bonus” payment. It’s not. It’s your January payment paid early because the SSA can’t process deposits on federal holidays.

The 2026 COLA: How Much Your Benefits Will Increase

Here’s the part everyone’s been waiting for — the 2.8% Cost-of-Living Adjustment (COLA) for 2026.

Each year, SSA adjusts benefits based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks inflation for basic goods and services. The 2026 increase reflects modest inflation but still gives retirees, disabled workers, and SSI recipients a little extra breathing room.

According to SSA’s official announcement:

- The average retired worker will see about $56 more per month.

- Disabled workers will see an average increase of $47 per month.

- SSI individuals will see about $43 more.

That means a single SSI recipient receiving $943 in 2025 will start getting around $969 per month starting with the December 31, 2025 deposit — the first check that includes the 2026 increase.

Who Qualifies for December SSI and Social Security Deposits?

It’s easy to confuse the two programs, but they serve different purposes:

- Social Security (Retirement and SSDI): You qualify by working and paying Social Security taxes. These benefits are based on your earnings record.

- SSI (Supplemental Security Income): This is a needs-based program for low-income seniors, disabled adults, and children. You don’t need a work history, but you must meet strict income and resource limits.

Both programs are administered by SSA, but they’re funded differently — Social Security through payroll taxes, and SSI through general federal tax revenues.

How to Check or Track Your December SSI and Social Security Deposits Schedule?

The easiest way to stay on top of your deposits is to go digital.

- Create or log in to your my Social Security account at ssa.gov/myaccount. You’ll see your exact payment history, next scheduled deposit, and COLA update notice.

- Use Direct Express. If you get benefits via Direct Express debit card, download the Direct Express app or call the number on your card to check deposits.

- Ask your bank for deposit alerts. Many banks send text or email notifications when funds arrive.

- If your payment is late: Wait three business days, then call SSA at 1-800-772-1213 or contact your local SSA office.

How to Prepare Financially for 2026?

The COLA increase is helpful, but inflation continues to raise costs for groceries, rent, and healthcare. Here’s how to make the most of your new benefits:

- Update your budget. Factor in your increased income and rising expenses. A few extra dollars a month can make a difference if planned carefully.

- Check your Medicare premiums. These often change in January and may offset part of your COLA raise.

- Adjust your tax planning. Social Security becomes taxable once your total income exceeds certain limits.

- Build a cushion. Consider setting aside part of the extra COLA money for emergencies, car repairs, or medical expenses.

- Track inflation. The 2.8% increase helps now, but keeping an eye on prices helps you advocate for yourself in the long run.

Common Mistakes to Avoid

- Treating the Dec 31 payment as a bonus. It’s not extra — it covers January. Spend carefully so you’re not short in early 2026.

- Ignoring COLA notices. SSA mails letters showing your new benefit amount; keep them for tax and budget purposes.

- Falling for scams. The SSA will never call, text, or email you asking for personal info or payment.

- Failing to update your information. Moved recently or changed banks? Log into your SSA account to prevent missed or delayed payments.

Real-World Example

Let’s say Maria, a 67-year-old retired teacher from Ohio, receives both Social Security and SSI. Her 2025 benefits are $1,650 (Social Security) and $943 (SSI).

Here’s her December schedule:

- Dec 1: $943 SSI (December benefit)

- Dec 17: $1,650 Social Security

- Dec 31: ~$969 SSI (January 2026 payment with COLA increase)

Maria will see three deposits totaling $3,562 in December — but only two actually count for December. Her next SSI payment after that will be on February 1, 2026.

New York Social Security Schedule: Exact December 2025 Payment Dates

December Social Security & SSI Guide: Payment Dates, Double Checks, and Next Year’s COLA