December SSA Payouts: The December 2025 Social Security Administration (SSA) payouts are officially confirmed, and millions of Americans can breathe a sigh of relief. This month isn’t just another payday—it’s a “double check” month for many SSI recipients, and starting January 2026, benefit amounts will rise across the board. The reason? A newly announced 2.8% cost-of-living adjustment (COLA) will bump up Social Security and SSI benefits to help offset inflation and higher living costs. That means bigger checks in the new year — a welcome change after several years of fluctuating prices. Whether you’re retired, receiving SSDI, or managing Supplemental Security Income (SSI) for yourself or someone else, it’s crucial to understand how these changes work, what to expect, and how to plan ahead.

Table of Contents

December SSA Payouts

The December 2025 SSA payment schedule and 2026 COLA increase bring encouraging news for millions of Americans. With a 2.8% boost in benefits and clear payout timelines, recipients can look forward to a more stable financial start to the new year. By using December’s double SSI payments wisely and budgeting around the new COLA rates, beneficiaries can strengthen their monthly plans and reduce stress during the transition into 2026. The message from the SSA is clear: while inflation remains a challenge, the system is working to keep pace — ensuring that retirees, the disabled, and low-income Americans can maintain their standard of living with confidence.

| What’s Happening | Details / Numbers | Why It Matters |

|---|---|---|

| 2026 COLA Boost | +2.8% increase for Social Security & SSI. Around $56 more per month for retirees. (SSA.gov) | Keeps benefits aligned with inflation and higher consumer costs. |

| Who’s Affected | ~71 million Americans: retirees, disabled workers, survivors, and SSI recipients. | Roughly 1 in 5 Americans receive SSA benefits. |

| December Payment Dates | Social Security: Dec 3, 10, 17, 24 (based on birthday). SSI: Dec 1 (regular) + Dec 31 (January 2026 benefit). | SSI recipients will see two checks in one month. |

| Taxable Earnings Cap (2026) | Rises from $176,100 → $184,500. | Affects high earners contributing to Social Security taxes. |

| Direct Deposit | Over 99% of benefits via electronic payment. | Faster, safer, and more reliable than paper checks. |

Understanding the December SSA Payouts Schedule

The SSA pays out on a staggered schedule to help distribute processing evenly. The exact date depends on your type of benefit and your birthdate.

For Retirees, SSDI, and Survivor Beneficiaries

If you receive retirement, disability, or survivor benefits, your check will arrive based on the day of the month you were born:

- Before May 1997: Your payment comes early — December 3, 2025.

- Born 1st–10th: You’ll be paid on December 10, 2025.

- Born 11th–20th: Your check arrives December 17, 2025.

- Born 21st–31st: You’ll get it December 24, 2025.

This schedule ensures that no one’s benefits get delayed by bank holidays or end-of-year closures.

For SSI (Supplemental Security Income)

SSI operates on a slightly different timeline.

- December benefit: Paid December 1, 2025.

- January benefit (early): Paid December 31, 2025 since January 1 is a federal holiday.

If you receive both SSI and Social Security, you may see two or even three deposits during December — one for SSI (Dec 1), one for your regular Social Security (based on your birthday), and another SSI payment on Dec 31 for January.

Why January 2026 Checks Are Bigger?

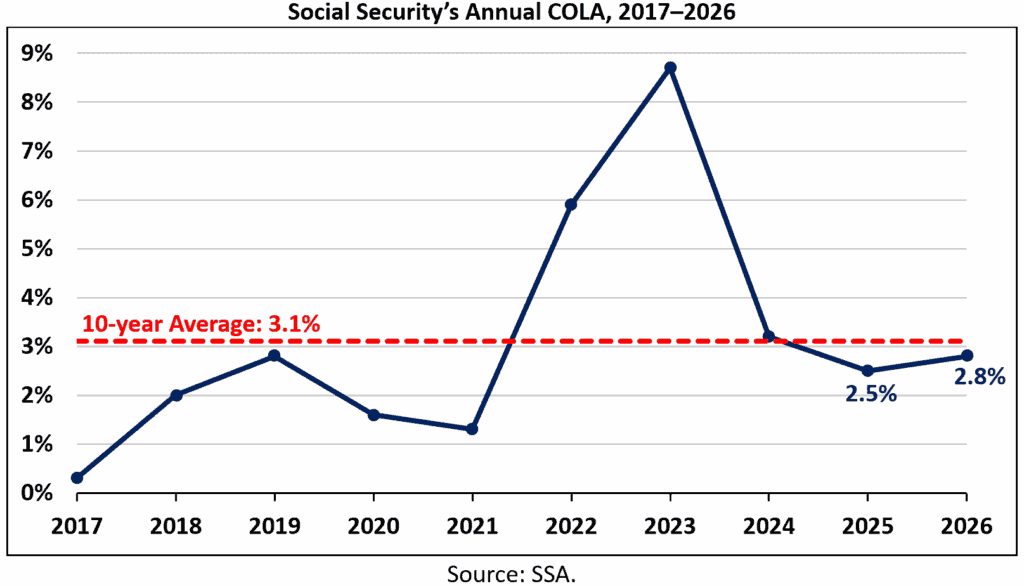

Every fall, the SSA announces a new cost-of-living adjustment (COLA) based on data from the Consumer Price Index for Urban Wage Earners (CPI-W). This index tracks inflation — the cost of goods and services that everyday Americans rely on, like food, gas, and housing.

For 2026, the increase is 2.8% — smaller than the 8.7% spike seen in 2023, but significant enough to make a difference.

For instance:

- If you currently receive $1,800/month, your new benefit will be $1,850.40/month.

- If you get $1,200/month in SSI, expect around $33.60 more per month.

Historical Context

| Year | COLA % | Avg Monthly Increase | Inflation Trend |

|---|---|---|---|

| 2023 | 8.7% | +$146 | Post-pandemic inflation surge |

| 2024 | 3.2% | +$59 | Inflation easing |

| 2025 | 3.4% | +$63 | Moderate growth |

| 2026 | 2.8% | +$56 | Controlled inflation, stable growth |

These adjustments are more than just numbers — they’re lifelines for retirees and disabled Americans trying to keep up with rising costs of healthcare, rent, and groceries.

How COLA Is Calculated?

The Social Security Act requires the SSA to measure the CPI-W each year (July through September). If the average increases year over year, the same percentage is applied to all Social Security and SSI benefits.

This system prevents the purchasing power of benefits from declining during inflationary periods.

Here’s a quick example:

Example: If your 2025 benefit is $2,000 per month, and the COLA is 2.8%, you’ll see an increase of $56 per month — or $672 extra for the year.

That may not sound like much, but for millions of Americans living on fixed incomes, that extra money can cover rising utility bills or a week’s worth of groceries.

Planning for the December SSA Payouts

December can get confusing when you receive multiple deposits. If you’re on SSI, you’ll get two — and if you also get Social Security, you might see three.

To make sure you’re managing this wisely, follow this step-by-step guide:

1. Identify Each Deposit

Use your my Social Security account to verify which payment is for which month. The Dec 31 payment is actually your January benefit.

2. Budget Ahead

Treat the Dec 31 deposit as January’s income. Plan your expenses accordingly so you’re not short once the new year starts.

3. Automate Bill Payments

Set up automatic payments for rent or utilities right after deposits land to avoid overspending during the holidays.

4. Check for Updates

Ensure your bank account info and address are up to date at ssa.gov/myaccount. Payment errors can take weeks to fix.

5. Save the COLA Increase

Even if it’s only $50 a month, setting it aside builds a financial cushion for unexpected costs.

Real-Life Example:

James, a 70-year-old retired construction worker from Texas, receives:

- $1,900 monthly Social Security

- $700 monthly SSI

In December 2025, he’ll get:

- $700 on Dec 1 (December SSI)

- $1,900 on Dec 17 (Social Security)

- $719.60 on Dec 31 (January SSI with 2.8% COLA)

That’s a total of $3,319.60 hitting his account before New Year’s Eve — but he treats the Dec 31 payment as January’s budget to stay on track.

Economic and Policy Outlook

While inflation has cooled since the highs of 2022–2023, the cost of essentials remains elevated. The Bureau of Labor Statistics (BLS) reports modest but persistent increases in housing, medical care, and energy costs through 2025.

Experts predict the 2026 COLA will help offset much of this, but not eliminate financial strain completely — especially for those in high-cost states like California, New York, or Florida.

Meanwhile, Congress continues to debate long-term reforms to preserve the Social Security Trust Fund, which, according to the latest SSA Trustees Report, could face funding challenges by 2034 without legislative adjustments.

For now, however, recipients can rest easy: 2026 benefits are fully funded and secure.

Tax and Earnings Updates for 2026

If you’re still working while collecting benefits, pay attention to new thresholds:

- Taxable earnings limit: $184,500 (up from $176,100).

- Earnings test limit (under full retirement age): $23,520. SSA withholds $1 for every $2 earned above this limit.

- At or above full retirement age: No limit on earnings.

If your income is above $25,000 (single) or $32,000 (married), up to 85% of your benefits may be taxable.

Practical Tips for December SSA Payouts

- Set Up “My Social Security” Account

Review COLA letters, update direct deposit info, and check benefit history online anytime. - Monitor for Scams

SSA never contacts you via text, email, or phone asking for banking details. - Update Dependents and Spouse Information

If your marital status or dependents change, update SSA immediately to ensure your benefit calculations remain accurate. - Consider Medicare Changes

The COLA increase may slightly impact Medicare Part B premiums (which are deducted from most retirees’ checks). SSA will notify you if your premium amount changes.

Expert Insight: Inflation and Retiree Spending

Financial planners across the U.S. suggest that retirees use COLA increases not just to spend more, but to rebalance budgets.

According to AARP analysts, seniors typically spend 70% of their income on essentials like housing, food, and healthcare. Even a 2–3% raise can make a meaningful difference if allocated strategically.

For instance:

- Put $20/month of your COLA toward an emergency fund.

- Use $15/month for inflation-affected groceries.

- Save $10/month for prescription costs.

- Invest $10/month in short-term savings or CDs for liquidity.

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?

December Social Security & SSI Guide: Payment Dates, Double Checks, and Next Year’s COLA

Historic Social Security Boost Coming to These 5 States in 2026; Are You on the List?