December Social Security & SSI Guide: If you depend on Social Security or SSI (Supplemental Security Income), December 2025 is shaping up to be one of the most eventful months in years. With early payments, double checks, and the new 2026 Cost-of-Living Adjustment (COLA), there’s a lot going on that can affect your budget. This guide explains everything clearly — who gets paid when, why some people receive two checks, what COLA means for your benefits, and how to prepare for 2026. Whether you’re a retiree living on Social Security, a disabled worker receiving SSDI, or someone helping family manage benefits, this article breaks it all down in plain English.

Table of Contents

December Social Security & SSI Guide

December 2025 is more than just another payment month — it’s a turning point. With two SSI checks, holiday payment shifts, and a 2.8% COLA, it’s the perfect time to get organized, plan your spending, and start the new year strong. Mark your deposit dates, log into your SSA account, and don’t be caught off guard by the early payment. A little planning now can make January feel a lot less stressful — and a lot more financially secure.

| Topic | Key Details (2025–2026) |

|---|---|

| Social Security Payment Dates (SS/SSDI) | Dec 3 (pre-1997 recipients), Dec 10 (birthdays 1–10), Dec 17 (birthdays 11–20), Dec 24 (birthdays 21–31) |

| SSI Payment Dates | Dec 1 (December benefits) and Dec 31 (January 2026 benefits — early deposit) |

| Double Payment Month? | Yes — SSI recipients get two deposits in December (Dec 1 & Dec 31) |

| 2026 COLA Increase | +2.8% adjustment effective Jan 2026 |

| Average Benefit Increase | About $56 more/month for retirees |

| New 2026 SSI Federal Rate | $994 for individuals, $1,491 for couples |

Why December 2025 Is a “Double Check” Month?

If you get SSI, you’ll notice two payments this month — one on December 1 and another on December 31. But before you start thinking the government is feeling generous, here’s the truth: the second payment isn’t a bonus. It’s your January 2026 SSI benefit arriving early, since January 1 is a federal holiday.

That means December 2025 is a budgeting month that requires a little extra planning. Because when that Dec 31 payment hits your account, it has to stretch through January — even though it technically arrived in December.

Many recipients make the mistake of spending that second check during the holidays, then come up short by mid-January. The smart move? Treat the Dec 31 payment as January income, not December cash.

Who Qualifies for December Social Security & SSI?

The Social Security Administration runs several benefit programs — and it’s important to understand the difference.

Social Security (Retirement, SSDI, and Survivors)

Funded through payroll taxes, Social Security is an earned benefit. You qualify based on your work history and contributions.

- Retirement Benefits: Based on your lifetime earnings. Most people start at age 62 or later.

- SSDI (Disability): For workers who became disabled before retirement age.

- Survivor Benefits: For spouses, children, or dependents of deceased workers.

SSI (Supplemental Security Income)

SSI is a needs-based program — not tied to work history. It helps seniors (65+), blind, or disabled individuals who have low income and few assets. It’s funded by general tax revenue, not Social Security taxes.

December Social Security & SSI Payment Schedule

Here’s the official schedule:

- Dec 3, 2025: For those who began receiving benefits before May 1997 or who also get SSI.

- Dec 10, 2025: If your birthday falls between the 1st–10th.

- Dec 17, 2025: If your birthday falls between the 11th–20th.

- Dec 24, 2025: If your birthday falls between the 21st–31st.

If you receive both Social Security and SSI, you’ll get three deposits this month: Dec 1 (SSI), your Social Security date, and Dec 31 (January SSI).

Payments are almost always deposited on Wednesdays, but if you get paper checks (rare these days), allow 3–5 business days for delivery.

Understanding the 2026 COLA (Cost-of-Living Adjustment)

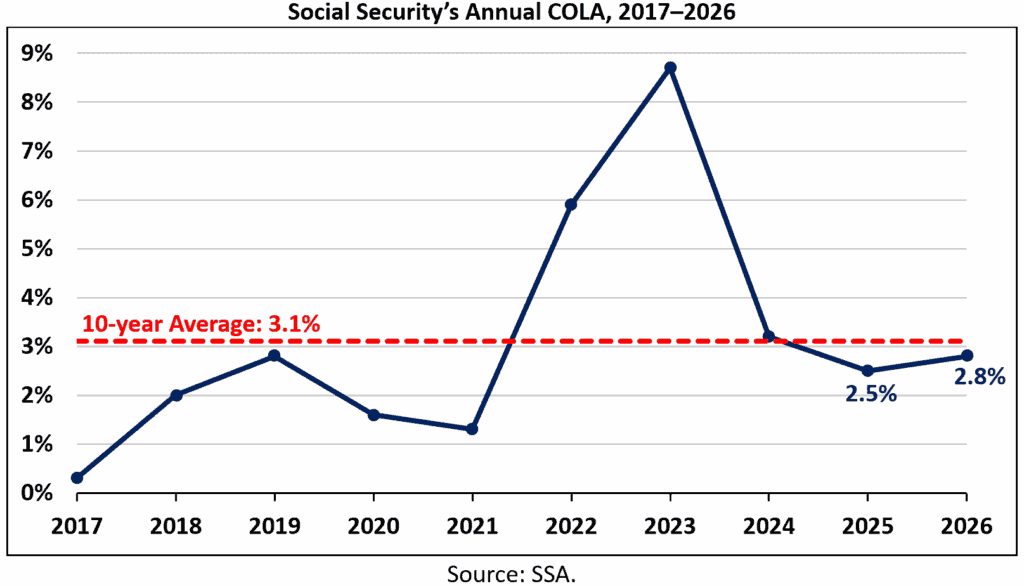

Every fall, the SSA announces the COLA, designed to keep benefits aligned with inflation. It’s based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), tracked by the U.S. Bureau of Labor Statistics.

For 2026, the COLA is 2.8% — reflecting moderate inflation and economic stabilization following several high-inflation years.

Example:

- Your 2025 monthly benefit: $2,000

- COLA: +2.8%

- New 2026 benefit: $2,056 per month

That’s about $672 more per year.

The new rate starts with January 2026 payments, or the Dec 31, 2025 SSI deposit for SSI recipients.

What the COLA Means in Real Life?

The 2.8% increase might sound small, but for many older Americans, it makes a real difference. The average monthly retirement benefit will rise from about $1,907 to $1,963, while SSI for an individual goes up from $967 to $994.

That extra $25–60 a month can help cover food, prescriptions, or higher utility bills — all of which continue to rise despite slower inflation.

If you get both Social Security and Medicare, note that Medicare Part B premiums could also adjust upward. In some years, the premium increase eats into the COLA, so always check your Medicare & You Handbook for updates.

How COLA Is Calculated?

The SSA uses a three-month average of the CPI-W index from July through September of the current year, comparing it to the same period from the previous year. If there’s an increase, that percentage becomes the COLA.

For 2026, inflation during that period was modest but steady — mostly driven by housing and healthcare costs. That’s why the adjustment came in at 2.8%, following 2025’s 3.2% increase.

How You’ll Receive December Social Security & SSI?

Nearly everyone now receives payments electronically, either by direct deposit or via the Direct Express® debit card.

- Direct deposits typically arrive early on the morning of your scheduled date.

- Direct Express card deposits usually appear overnight but can vary slightly by time zone.

- Paper checks are discouraged and may arrive several days late, especially around holidays.

Tax Implications of the COLA Increase

If your income rises because of the COLA, your taxable Social Security income could change. The IRS taxes up to 85% of your benefits, depending on your total income.

Thresholds for 2025:

- Individuals: $25,000

- Married couples: $32,000

If your COLA pushes you above those amounts, you may owe slightly more federal tax.

Planning Ahead: Smart Money Tips for December

- Budget for January early.

Treat your Dec 31 SSI deposit as January income. Separate it mentally — or even put it in a savings account until January 1. - Review your benefits online.

Create or log in to your my Social Security account to see your updated benefit letter for 2026. - Set aside part of your COLA increase.

Even $25 monthly adds up over a year. Consider using it for emergency savings or medical expenses. - Watch out for scams.

The SSA never asks for your Social Security number, bank info, or payment over the phone. - Double-check your bank info.

Any error in routing or account numbers can delay your payment for weeks.

Example: Linda from Tulsa

Linda, a 68-year-old retiree in Oklahoma, receives both Social Security and SSI. She’ll get three deposits in December:

- Dec 1 (SSI)

- Dec 17 (Social Security)

- Dec 31 (January SSI)

Her new COLA boost gives her an extra $47 per month on Social Security and $27 on SSI. She plans to use that to offset higher utility bills and save $20 monthly in a small emergency fund.

By keeping a simple calendar and tracking deposits in her SSA account, Linda avoids confusion and starts 2026 financially prepared.

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?

Historic Social Security Boost Coming to These 5 States in 2026; Are You on the List?

Retiring in 2026? Here’s the New Safe Withdrawal Rate Experts Are Warning You to Follow