December 2025 Social Security Timeline: December 2025 Social Security Timeline is a topic many Americans care about as the year ends and a new one begins. Whether you are a Supplemental Security Income (SSI) beneficiary, a Social Security retirement recipient, a financial planner, or someone helping a family member understand their benefits, it’s important to know what happens with payment dates, benefit amounts, and the Cost‑of‑Living Adjustment (COLA) going into 2026. In this article, we explain everything from why SSI payments can look like they arrive twice in one month, to how COLA works, and how you should plan your household budgeting around these dates.

We’ll break down technical rules in a way a 10‑year‑old could follow while also giving valuable insight for professionals, caregivers, and anyone who needs trusted guidance on Social Security. After the next paragraph, you’ll find a clear table summarizing the key data, dates, and links to official resources so you can verify and explore further on your own.

Table of Contents

December 2025 Social Security Timeline

December 2025’s Social Security timeline matters because it illustrates how careful planning can make government benefit payments work for you. Two SSI payments in one month may look generous at first glance, but understanding that one is simply an early January payment helps you budget realistically. The 2026 COLA increase of 2.8% boosts monthly income for SSI and Social Security recipients, but it’s equally important to account for Medicare premiums, taxes, and personal cash‑flow planning. By using the official SSA payment calendars and logging into your online account to verify dates and amounts, you’ll be equipped to manage your benefits with confidence. Understanding how Social Security rules interact with your financial life helps you plan bills, health care costs, savings, and everyday expenses — making this timeline not just a calendar of dates, but a roadmap to smarter financial planning.

| Item | Details |

|---|---|

| Standard SSI Payment (2025) | Up to $967 for an individual |

| 2026 SSI Payment | $994 individual / $1,491 couple |

| 2026 COLA Increase | 2.8% boost for Social Security & SSI |

| SSI December Payment Dates | December 1 and December 31, 2025 |

| Social Security Retirement/SSDI Payments | Scheduled by birth date in December |

| Official SSA Information | Social Security Administration |

Understanding SSI and the $967 Figure for 2025

Supplemental Security Income, commonly known as SSI, is a need‑based benefit program administered by the Social Security Administration (SSA). People who are aged 65 or older, blind, or disabled with limited income and resources may qualify for SSI. SSI is different from Social Security retirement in that it is based on financial need rather than work history.

For the year 2025, the maximum federal SSI payment amounts were:

- $967 per month for an individual, and

- $1,450 per month for an eligible couple.

These figures are published and updated annually by the SSA. Some states also add an additional amount, known as a state supplement, which varies depending on local rules.

These benefits help cover basic needs like food, housing, and clothing. For many recipients, SSI is a critical part of monthly income.

Why December 2025 Has Two SSI Payment Dates?

One reason people pay special attention to December is because, in some years, SSI payments can appear twice in one calendar month. That happened in December 2025.

Here’s why.

SSA’s normal rule for SSI is that payments are issued on the first of each month. However, if the first falls on a weekend or a federal holiday, the payment is made on the preceding business day. In 2025, the first of January — the usual SSI payment date for January — landed on a federal holiday (New Year’s Day). Because of that, the SSA moved the payment forward to the prior business day — December 31, 2025.

So for many SSI recipients:

- The December 2025 SSI benefit was paid on December 1, 2025.

- The January 2026 SSI benefit was paid early — on December 31, 2025.

This created what looks like two SSI payments in December. But it’s important to know that this is not “extra money” — it’s simply the January benefit arriving early. As a result, there will be no SSI payment in January 2026 because it has already been paid on December 31.

Understanding this is critical for people who rely on SSI to budget their monthly bills. Planning ahead for this timing shift helps avoid surprises.

December 2025 Social Security Timeline

Social Security retirement and Social Security Disability Insurance (SSDI) payments follow a different scheduling pattern compared to SSI.

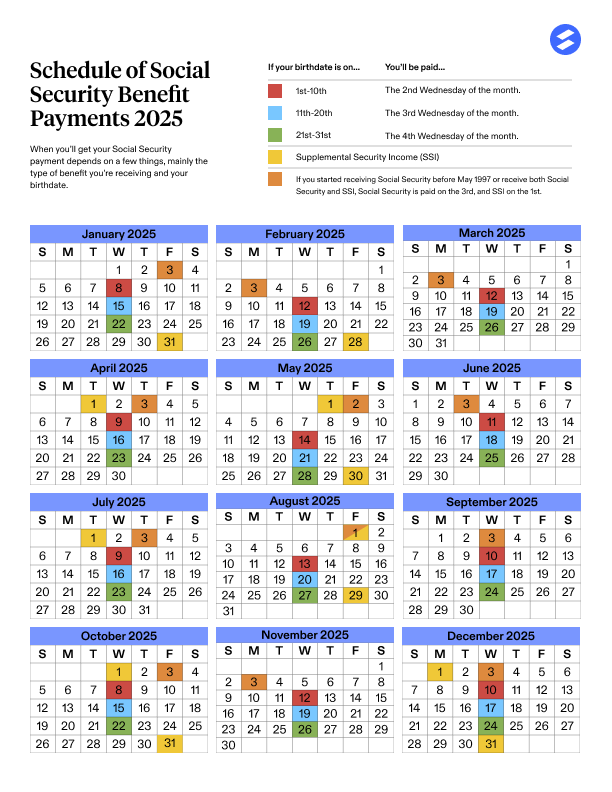

Instead of paying all recipients on one date, the SSA issues retirement and SSDI payments on Wednesdays based on a recipient’s birth date:

- If your birthday falls between the 1st and 10th, you receive your payment on the second Wednesday of the month.

- If your birthday falls between the 11th and 20th, you receive your payment on the third Wednesday.

- If your birthday falls between the 21st and 31st, you receive your payment on the fourth Wednesday.

In December 2025, this resulted in typical payment dates on:

- December 3,

- December 10,

- December 17, and

- December 24.

These dates can vary slightly each year depending on how the calendar falls, but the birth date rule is consistent.

It’s also worth noting that if someone began receiving benefits before May 1997, or if they receive both SSI and retirement/SSDI, different scheduling rules may apply. In those cases, the SSA sometimes pays those individuals on the first Wednesday of the month.

What the 2026 COLA (Cost‑of‑Living Adjustment) Means?

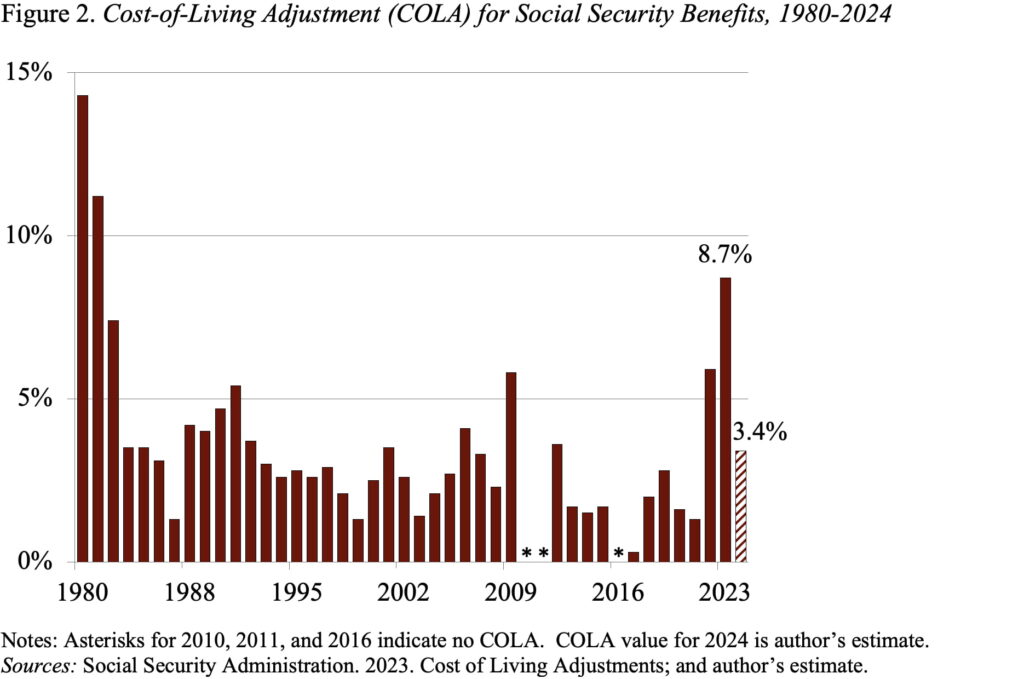

Each year, the Social Security Administration applies a Cost‑of‑Living Adjustment (COLA) to benefits. COLA is designed to help benefits keep pace with inflation — particularly increases in the cost of goods and services that seniors and disabled Americans tend to spend their money on.

The 2026 COLA was announced at 2.8%.

This 2.8% increase applies to:

- SSI benefits, and

- Social Security retirement and SSDI benefits.

For SSI, this meant the new maximum benefit amounts beginning with the January 2026 payment (initially paid on December 31, 2025):

- $994 per month for an individual, and

- $1,491 per month for a couple.

For Social Security retirement and SSDI, the average monthly benefit is also increased by the same percentage. According to SSA figures, the 2026 COLA rise translates into a noticeable increase compared to 2025. While individual benefit amounts vary, the overall effect is that people receiving benefits will have more monthly income to offset rising costs.

While the COLA percentage may seem modest, many recipients and financial advisers consider it an important adjustment that helps maintain purchasing power over time.

Practical Money Planning: How to Handle Two Payments in One Month

When you’re counting dollars and planning bills, having two benefit deposits in one month can feel like a windfall. But because the January payment is simply arriving early, the smart approach is to plan ahead.

Here are practical strategies that many financial professionals recommend:

1. Budget for January Now

Since you receive the January SSI on December 31, consider earmarking a portion of it for January expenses. This prevents a cash shortfall when the next payment arrives in February.

2. Track Your Bank Deposit Dates

Sign up for direct deposit if you haven’t already, and confirm your bank account information in your SSA online account. This helps avoid delays or misdirected payments.

3. Create a Cash‑Flow Calendar

Mark all Social Security and SSI payment dates on a calendar. When you visually see the dates, it’s easier to plan rent, utilities, and other recurring bills.

4. Watch for Medicare Premiums

If you are enrolled in Medicare Part B or Part D, those premiums are usually deducted from your Social Security benefit each month. Premium adjustments sometimes rise at the same time as COLA, which may reduce the net increase in your monthly funds.

Many financial planners suggest calculating your net benefit after premium deductions, rather than focusing solely on the gross amount.

How COLA Affects Healthcare and Living Costs?

While the COLA increase boosts monthly benefits, recipients should know that not all living expenses rise at the same rate. In particular, healthcare costs — including Medicare premiums, prescription drugs, and medical services — often increase more rapidly than general inflation.

Medicare Part B premiums are typically set each year based on projections of healthcare costs. If the Part B premium increases significantly, it can absorb much of your COLA increase. For example, a COLA of 2.8% may add several dollars to your monthly benefit, but if Medicare Part B premiums go up by a larger percentage, your net disposable income could stay the same or even decrease.

That’s why financial planners recommend reviewing both your Social Security benefit amount and your healthcare premium costs together.

Extra Considerations: Taxes and Other Income

Another practical factor is taxation. Social Security benefits can be subject to federal income tax if your combined income (which includes adjusted gross income, tax‑exempt interest, and half of your Social Security benefits) exceeds certain thresholds.

For example:

- If you file as an individual and your combined income is above $25,000, up to 50% of your Social Security benefits may be taxable.

- If your combined income exceeds $34,000, as much as 85% of your benefits could be subject to tax.

These thresholds apply to federal taxes. Some states also tax Social Security benefits, though many do not.

Understanding your tax situation can help you plan more effectively for year‑end and future payments.

Future Payment Timing and Common Adjustments

While December 2025 has this unique two‑payment scenario, other months in other years can also have adjustments due to weekends and holidays. The key takeaway is that Social Security and SSI payments follow clear rules based on:

- Calendar dates,

- Federal holidays,

- Weekends,

- And your birth date (for retirement/SSDI).

People who plan ahead — either personally or with the help of a financial professional — tend to manage bills and budgeting more confidently.

New York Social Security Schedule: Exact December 2025 Payment Dates

Final Social Security Payments of 2025: Check Updated December Dates and Benefit Amounts

New Social Security payment arrives on December 24, 2025: Check eligibility and requirements