CPP Retirement Payments Set to Rise: CPP retirement payments set to rise in 2026, and if you’re planning ahead for your financial future, this is news you’ll want to understand thoroughly. Whether you’re already collecting benefits, preparing to apply, or just mapping out your long-term retirement strategy, knowing how CPP increases work — and how they affect your monthly payouts — can help you make smarter decisions for yourself and your family. For many Native American and Indigenous families living across Turtle Island, financial stability isn’t just about numbers; it’s about community, responsibility, and honoring our elders. So this guide breaks everything down in a friendly, conversational, easy-to-understand voice while keeping the accuracy, authority, and trustworthiness required for financial reporting. Think of it as a knowledgeable relative explaining the system clearly — but with expert-level detail and data to keep the pros satisfied too.

Table of Contents

CPP Retirement Payments Set to Rise

CPP retirement payments are set to rise in 2026, and while the increase may seem small at first glance, it plays a crucial role in protecting your long-term income against inflation. Whether you’re a retiree, a future retiree, or someone helping guide your community, understanding these changes empowers you to make clearer financial choices. With smart planning, the 2026 adjustment — and future increases — can support a more stable and confident retirement.

| Topic | Details |

|---|---|

| 2026 CPP Increase | Estimated ~2% rise (based on CPI inflation index). |

| Who Gets the Increase? | All CPP retirement, disability, survivor, and children’s benefit recipients. |

| How Rates Are Determined | Based on lifetime contributions, contribution enhancements (2019–2025), and your retirement age. |

| CPP Maximum (2025) | ~$1,433/month at age 65 (most Canadians receive less). |

| 2026 Payment Dates | Jan 28, Feb 25, Mar 27, Apr 28, May 27, Jun 26, Jul 29, Aug 27, Sep 25, Oct 28, Nov 26, Dec 22. |

| New Enhancements in Effect | CPP additional (enhanced) contributions increase payouts for younger workers and future retirees. |

| Official Source | https://www.canada.ca/en/services/benefits/publicpensions/cpp.html |

| Best For | Retirees, financial planners, workers contributing to CPP, HR professionals, Indigenous and rural communities. |

Why Are CPP Retirement Payments Set to Rise in 2026?

Every January, Canada adjusts CPP benefit amounts based on Consumer Price Index (CPI) inflation data. If prices go up — groceries, fuel, utilities, clothing — CPP increases to help retirees keep up. This process is called indexation.

For 2026, analysts are projecting around a 2% increase, which reflects moderate inflation after Canada’s higher inflation wave between 2021–2023.

Indexation Protects Your Long-Term Income

Over a 25-year retirement, even a few percentage points a year can grow into thousands of extra dollars. This is why CPP remains one of the most stable retirement tools in North America.

How CPP Benefit Increases Work (Explained Simply)?

CPP isn’t a flat-rate pension. It’s based on:

1. Your Lifetime Contributions

The more you earned — and the more years you contributed — the higher your pension.

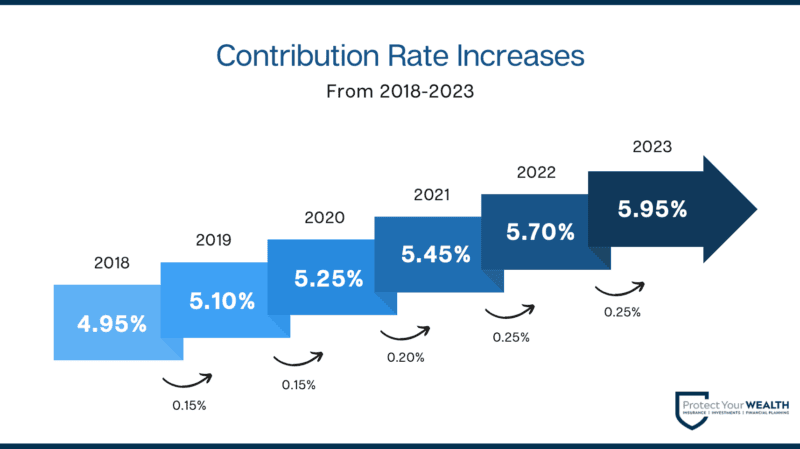

2. CPP Enhancements (2019–2025 Reforms)

Starting in 2019, Canadians began paying enhanced CPP contributions. These increases are phased in through 2025 and will significantly boost pensions for younger & mid-career workers.

This means:

- Workers retiring after 2030 will receive higher benefits.

- Those retiring now receive moderate enhancements depending on their contribution years.

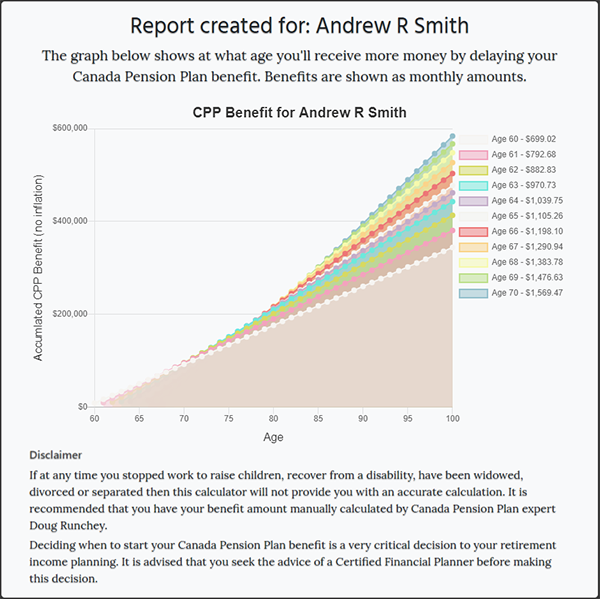

3. Your Age When You Start CPP

- Starting at 60 lowers payments permanently.

- Starting at 70 increases payments by up to 42% or more.

4. Annual Indexation

This is where the 2026 increase comes in — your payment rises automatically based on inflation.

2026 CPP Payment Dates — Official Deposit Schedule

CPP benefits deposit on the same day across Canada, including reserves, rural communities, and northern territories.

2026 Payment Dates

- Jan 28

- Feb 25

- Mar 27

- Apr 28

- May 27

- Jun 26

- Jul 29

- Aug 27

- Sep 25

- Oct 28

- Nov 26

- Dec 22

If you’re using direct deposit (recommended), payments typically arrive early morning. Paper checks can take several extra days — especially in remote areas.

Who Benefits Most from the 2026 CPP Retirement Payments Set to Rise?

1. Seniors Living on Fixed Incomes

Even a modest 2% increase helps offset rising grocery and fuel prices.

2. Indigenous and Rural Communities

Remote communities often face higher living costs, so indexation matters more.

3. Survivors and Disability Benefit Recipients

These groups often rely heavily on monthly government benefits.

4. Canadians Retiring in 2026

If you turn 60, 65, or 70 in 2026, your starting benefit will reflect:

- Contribution enhancements

- Inflation adjustments

- Your retirement timing strategy

How the 2026 Increase Could Affect Your Monthly Benefit?

Let’s walk through some simple examples.

Example 1 — Average CPP Recipient

2025 monthly CPP: $900

2026 increase: 2%

$900 × 1.02 = $918/month

Annual increase: $216

Example 2 — Maximum CPP Recipient

2025 max CPP: ~$1,433/month

Increase: 2%

New amount: ~$1,461/month

Annual increase: ~$336

Example 3 — Disability or Survivor Benefits

These also rise by approx. 2%.

Step-By-Step Guide: How to Check Your CPP Payments or Update Information

Step 1 — Log Into My Service Canada Account

Step 2 — View Your Contribution Record

Check that all employment years are recorded accurately.

Step 3 — Review Your Estimated Retirement Benefit

Use the built-in estimator tool.

Step 4 — Switch to Direct Deposit

This prevents delays, especially in rural areas.

Step 5 — Contact Service Canada if Something Looks Wrong

CPP errors do happen — especially missing contribution years.

Common Mistakes Canadians Make with CPP

Mistake 1 — Taking CPP at 60 Without a Plan

This reduces your pension permanently — sometimes by $300+ monthly.

Mistake 2 — Not Checking Contribution History

Missing years = lower pension.

Mistake 3 — Confusing CPP with OAS

CPP is based on contributions; OAS is based on residency.

Mistake 4 — Forgetting Tax Implications

CPP counts as taxable income.

Tax Considerations for CPP in 2026

CPP increases may raise your taxable income slightly. This matters if:

- You’re receiving OAS

- You’re near the OAS clawback range

- You’re working past age 60

- You’re receiving both CPP and RRSP withdrawals

Tax planning tip:

Consider splitting pension income with a spouse to reduce tax burden.

How Indigenous Communities Can Maximize CPP Access?

Across Native American and First Nations communities, systemic barriers can limit awareness of benefits — especially for:

- Elders

- Disabled community members

- Survivors and caregivers

- Workers with incomplete employment records

Recommended Steps

- Register all employment officially.

- Use My Service Canada Account to confirm contributions.

- Ask band offices or Indigenous friendship centers for CPP workshops.

- Help elders set up direct deposit to avoid lost checks.

Empowerment starts with access — and CPP is one of the most stable financial tools available.

CRA $680 Canada Payment in December 2025: Check Eligibility, Payment Date

Canada Pension Boost Coming in December 2025; Here’s How Much More CPP and OAS You’ll Get

$2400 CRA Payment December 2025; Check Eligibility Rules, Deposit Schedule & Payment Status