Class Action Settlements: Class Action Settlements marked one of the most important years in modern consumer protection history. From tech giants and national banks to grocery suppliers and healthcare systems, corporations paid tens of billions of dollars to resolve claims that affected everyday Americans. These cases weren’t just about courtroom wins — they reshaped how companies treat customers, handle data, price products, and communicate honestly. If you’ve ever paid a hidden fee, struggled to cancel a subscription, worried about your personal data, or wondered whether big corporations are ever held accountable, this guide is for you. Written in plain American English, this article explains what happened in 2026, why it matters, and how you can protect yourself and possibly recover money you didn’t even know you were owed.

Table of Contents

Class Action Settlements

Class Action Settlements 2026 proved that collective action still works in modern America. These cases returned billions to consumers, forced transparency, and reshaped industries that touch our daily lives. Whether you’re a consumer, professional, or business owner, understanding these settlements helps you protect your money, your data, and your rights. Staying informed isn’t just smart — it’s how you make sure fairness doesn’t stop at the courthouse door.

| Settlement | Approximate Amount | Industry | Who Benefited |

|---|---|---|---|

| Amazon Prime FTC Settlement | ~$2.5 billion | E‑commerce / Subscriptions | Amazon Prime members |

| Google Play Antitrust Settlement | ~$700 million | Technology | Android app purchasers |

| Capital One Consumer Settlement | ~$425 million | Banking | Savings account holders |

| AT&T Data Breach Settlement | ~$177 million | Telecommunications | Affected customers |

| Kaiser Permanente Tracking Settlement | ~$46 million | Healthcare | Patients & portal users |

| Wells Fargo Billing Settlement | ~$33 million | Banking | Consumers with recurring charges |

Understanding Class Action Settlements in Simple Terms

A class action settlement happens when a large group of people who experienced the same harm come together to resolve a lawsuit against a company. Instead of one person fighting a billion‑dollar corporation alone, the law allows people to join forces. This makes justice more realistic, affordable, and fair.

In most cases, companies do not admit wrongdoing. Instead, they agree to pay money, change their practices, or both. The settlement must be approved by a judge to ensure it is fair to the public.

For consumers, this system matters because many harms are small on an individual level — a few dollars here, a monthly charge there — but massive when added up across millions of people.

Why 2026 Became a Record‑Breaking Year?

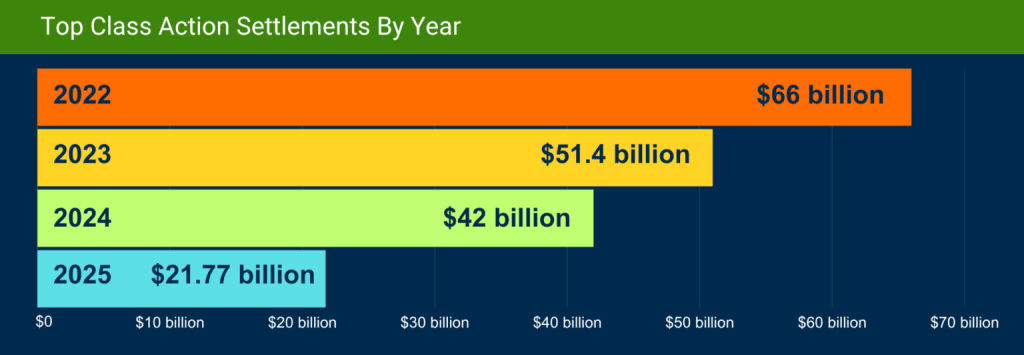

According to multiple legal and financial analyses, more than 1,700 class action cases were resolved in 2026, with total settlements approaching $79 billion. That figure nearly doubled the previous year and reflects a broader shift in enforcement priorities.

Several factors drove this surge:

- Aggressive regulatory enforcement

Federal and state agencies increased scrutiny of deceptive practices, especially in subscriptions, financial products, and data privacy. - Technology‑driven harm

The rise of AI, digital tracking, and automated billing created new legal gray areas that courts are now addressing. - Consumer awareness

Americans are more informed than ever. Social media, watchdog journalism, and public databases have made it easier to identify patterns of harm. - Judicial willingness to certify classes

Courts increasingly recognized that widespread digital practices affect consumers in similar ways, making class actions more appropriate.

Deep Dive: The Biggest Class Action Settlements of 2026

Amazon Prime FTC Settlement – ~$2.5 Billion

The Amazon Prime case became the most talked‑about settlement of the year. Regulators alleged that Amazon enrolled customers into Prime without clear consent and made cancellation intentionally difficult through multi‑step processes known internally as “dark patterns.”

The settlement included:

- $1.5 billion in consumer refunds

- $1 billion in civil penalties

- Mandatory changes to enrollment and cancellation processes

Why this matters: Subscription traps are everywhere — from streaming services to fitness apps. This case sent a strong message that companies must be clear, honest, and fair.

Google Play Antitrust Settlement – ~$700 Million

Google faced claims that its Play Store practices limited competition and inflated prices for consumers. Attorneys general argued that Google restricted alternative payment systems and charged excessive fees.

Consumers who purchased apps or digital content during the affected period became eligible for compensation.

Why this matters: This settlement may influence how app stores operate worldwide, potentially lowering costs and increasing consumer choice.

Capital One Consumer Settlement – ~$425 Million

Capital One agreed to a major settlement involving savings accounts that allegedly paid lower interest rates than consumers were led to expect.

Affected customers may receive cash payments depending on:

- Account balance

- Length of time the account was held

- Specific product type

Why this matters: Transparency in financial products is critical. Even small interest differences can cost consumers millions over time.

AT&T Data Breach Settlement – ~$177 Million

Two major data breaches exposed sensitive customer information, including Social Security numbers and account data. Plaintiffs alleged inadequate security measures and delayed disclosure.

The settlement includes:

- Cash payments

- Credit monitoring services

- Identity theft protection

Why this matters: Data breaches aren’t just inconvenient — they can affect credit, employment, and financial security for years.

Kaiser Permanente Tracking Settlement – ~$46 Million

This case involved allegations that Kaiser shared sensitive patient portal data with third‑party tech companies without proper consent.

Why this matters: Healthcare data is among the most sensitive information a person has. This case reinforced that patient privacy extends beyond hospitals into digital systems.

Wells Fargo Billing Settlement – ~$33 Million

Wells Fargo faced claims related to recurring charges tied to misleading free‑trial promotions processed through bank systems.

Why this matters: Banks play a critical role in consumer protection. This case emphasized their responsibility to monitor billing practices tied to customer accounts.

Types of Class Action Settlements Consumers Should Know

Understanding the category of a settlement helps you identify whether you might be eligible.

Consumer Protection Settlements

Involve deceptive advertising, hidden fees, or unfair business practices.

Data Privacy & Security Settlements

Cover breaches, unauthorized tracking, or misuse of personal information.

Financial & Banking Settlements

Focus on interest rates, fees, overdraft practices, and account disclosures.

Antitrust & Price‑Fixing Settlements

Address inflated prices due to lack of competition.

Employment & Labor Settlements

Involve unpaid wages, misclassification, or missed breaks.

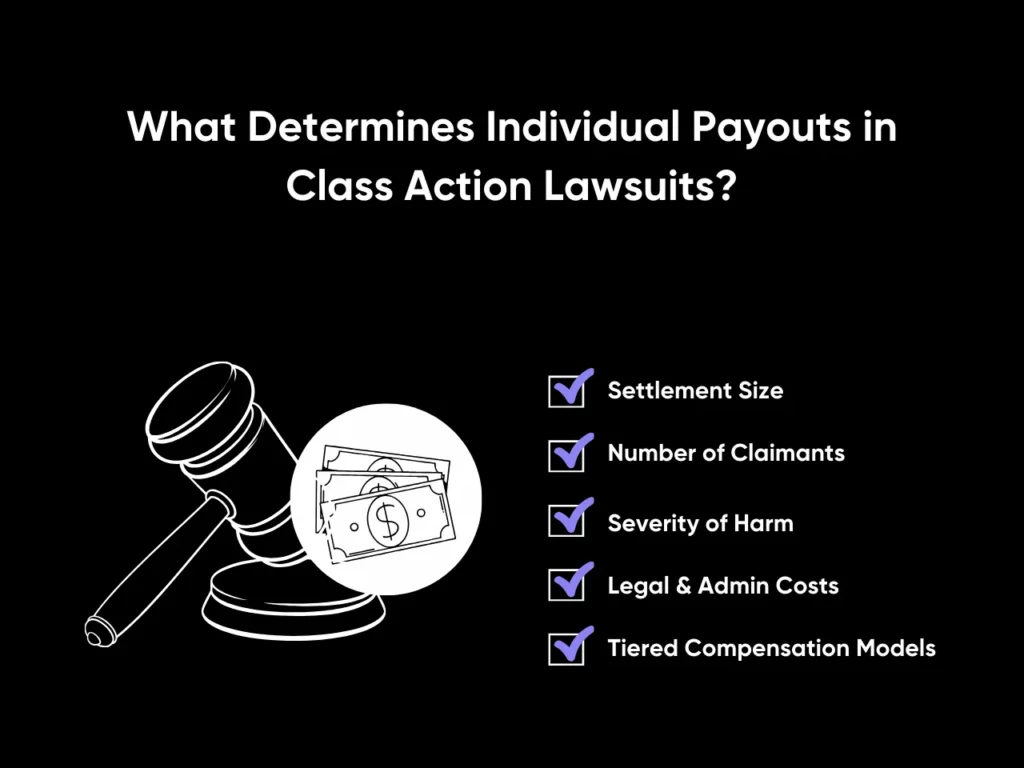

How Class Action Money Is Divided?

Many people are surprised when payouts seem small. Here’s why:

- Settlement funds are divided among millions of people

- Legal fees and administrative costs are deducted

- Some funds are reserved for future claims

- Individual payouts depend on usage, loss, or participation length

Even so, these settlements often change corporate behavior — which is just as valuable as cash.

How to Check If You Are Owed Money?

Follow these steps carefully:

- Search reputable settlement databases such as TopClassActions or Consumer Action

- Check emails and physical mail for official notices

- Visit the settlement administrator’s website

- Submit your claim before the deadline

- Save confirmation and track your payment

Never pay to file a claim. Legitimate settlements are free to join.

Avoiding Class Action Settlement Scams

Scammers target people who don’t know how settlements work. Protect yourself by:

- Verifying the settlement name online

- Avoiding links from unsolicited messages

- Confirming the administrator’s name

- Never sharing banking info unless on an official site

If it feels rushed or threatening, it’s likely fake.

What These Settlements Mean Going Forward?

The long‑term impact of Class Action Settlements 2026 goes beyond refunds:

- Companies are redesigning subscription flows

- Data privacy standards are tightening

- Financial disclosures are becoming clearer

- Courts are setting precedents for AI and digital conduct

For professionals, this year provides valuable insight into compliance, risk management, and consumer trust.

Infosys McCamish Wins Final Approval for $17.5 Million Class Action Settlement – Check Details

Google’s $700M Settlement, Explained: Eligibility, Deadlines, and Payouts

$2,500 Cash App Settlement in 2026; Check If You’re Eligible and When You’ll Get Paid