Capital One $425M Settlement: The Capital One $425M Settlement 2026 is turning heads across the U.S. banking and legal communities — and for good reason. If you held a Capital One 360 Savings account between September 18, 2019 and June 16, 2025, you’re likely part of a class action settlement that could put cash in your hands — without needing to lift a finger. This $425 million agreement centers around allegations that Capital One failed to adjust savings interest rates for long-time customers, while offering far better rates to new customers through a different product. It’s a case that’s shaken the consumer banking world and raised big questions about fairness, disclosure, and trust in financial products. Whether you’re a regular saver, a financial professional, or just someone curious about how class action lawsuits work, this guide has everything you need to know — broken down in plain English with expert-level insights.

Table of Contents

Capital One $425M Settlement

The Capital One $425M Settlement 2026 is a landmark case for everyday savers and financial transparency. By addressing both past harm and future practices, it offers a model for consumer protection that’s clear, actionable, and fair. With automatic payments, no claims to file, and a better interest future for current customers, it sets a precedent — one that says banks can’t quietly leave loyal customers behind.

| Topic | Details |

|---|---|

| Settlement Amount | $425 million total |

| Final Approval Hearing | April 20, 2026 |

| Class Period | Sept 18, 2019 – June 16, 2025 |

| Eligibility | Customers with Capital One 360 Savings accounts during the class period |

| Payment Type | Automatic — no claims necessary |

| Minimum Payment | $5+ for mailed checks; smaller amounts via electronic delivery |

| Future Benefit | 360 Savings rates matched to 360 Performance Savings for 2 years |

| Official Site | capitalone360savingsaccountlitigation.com |

What Was the Issue? Understanding the Lawsuit

To understand the settlement, you need to know the difference between Capital One’s 360 Savings and its newer 360 Performance Savings accounts.

Here’s what happened:

- For years, 360 Savings was advertised as a high-yield product.

- Then in 2019, Capital One launched the 360 Performance Savings account — with significantly better interest rates.

- But many customers with the original 360 Savings account were never told about the new option, and their rates stayed much lower.

At one point, customers in the newer product earned up to 14 times more interest than those in the legacy product — despite the accounts having nearly identical structures and marketing. Capital One did not migrate legacy customers automatically, nor did they clearly notify them that better options existed. The lawsuit alleges this was misleading and unfair.

Legal Background: How We Got Here

This isn’t the first time a bank’s interest rate practices have drawn fire. But what’s notable is how much pushback this case received before reaching the current settlement:

- The class action, In re: Capital One 360 Savings Account Interest Rate Litigation, was filed in the U.S. District Court for the Eastern District of Virginia.

- A previous settlement proposal was rejected by the court in 2025, after 18 state attorneys general called it “insufficient and inadequate.”

- Critics said the earlier deal did too little for those who had closed their accounts and didn’t provide lasting value to current customers.

- In January 2026, a revised settlement totaling $425 million with future interest rate protections was granted preliminary approval.

Attorneys general from states including New York, California, and Illinois praised the improved terms, noting it restored fairness and delivered real economic value.

Who Is Eligible for the Capital One $425M Settlement?

You may be part of the class if:

- You held a Capital One 360 Savings account between September 18, 2019 and June 16, 2025.

- You are either a current or former account holder (you didn’t need to keep the account open the whole time).

- You held the account individually or jointly.

Not eligible:

- People who only held the 360 Performance Savings account.

- Customers outside the defined class period.

How Much Will You Receive?

This isn’t a one-size-fits-all payout. Instead, settlement payments will vary based on:

- How long you held the 360 Savings account during the class period.

- Your average daily balance.

- The interest rate difference between what you earned and what you could have earned with the 360 Performance Savings account.

Example:

If you had $10,000 in your 360 Savings account from 2020 to 2023, and the rate difference averaged 0.60%, you may receive several hundred dollars. Customers with lower balances or shorter timeframes may get smaller checks.

Bonus Payout:

If you closed your account before October 2, 2025, your payment could include an extra 15%, since you’re not eligible for the future interest benefit.

Capital One $425M Settlement Method – No Claim Needed

One of the most appealing features of this settlement is its simplicity. Most eligible customers will:

- Receive payments automatically — no need to file a claim.

- Payments over $5 will be sent by mailed check if you haven’t opted for electronic payment.

- Payments under $5 will only be sent if you choose electronic delivery.

Why Interest Rate Matching Matters?

In addition to cash payments, Capital One agreed to a forward-looking fix: for two full years after final approval, the 360 Savings interest rate will match the 360 Performance Savings rate.

This ensures current customers aren’t shortchanged in the future. Based on current market trends, this could mean hundreds in extra interest for long-time savers.

This element adds a projected value of up to $125 million to the overall deal, making it one of the most comprehensive class action settlements in banking history.

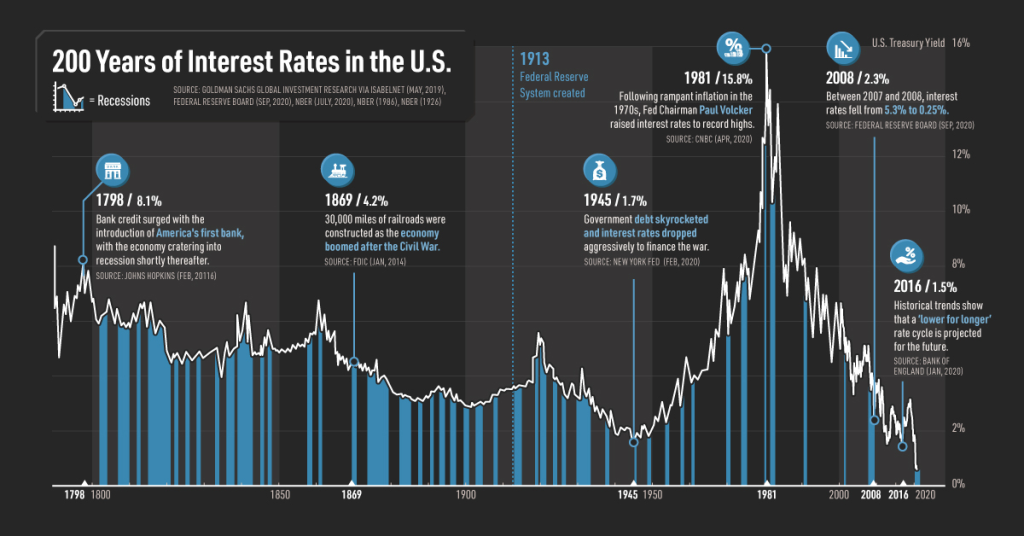

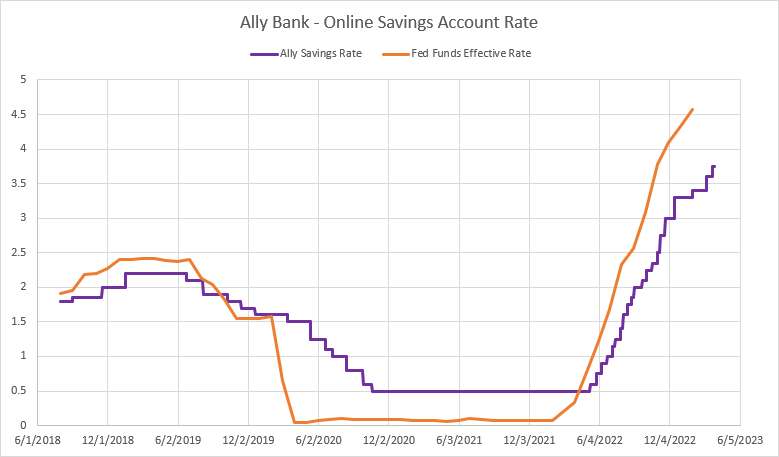

Historical Context – U.S. Savings Rates

Let’s not forget — this issue happened during a period of rising interest rates:

- In 2020, the U.S. Federal Reserve kept rates near 0% due to COVID-19.

- By 2022-2023, rates surged above 5%, creating major differences in bank savings products.

- During this time, many financial institutions began offering high-yield savings accounts exceeding 4.00% APY.

However, Capital One’s legacy 360 Savings account sometimes paid as little as 0.30% APY, while its newer account paid over 4.25% — a glaring discrepancy that triggered public and legal scrutiny.

How This Compares to Other Settlements?

This isn’t the first major banking class action — but it’s one of the largest by payout volume. Here’s how it stacks up:

| Case | Company | Amount | Issue |

|---|---|---|---|

| Capital One 360 | Capital One | $425 million | Interest rate discrepancy |

| Wells Fargo Fake Accounts | Wells Fargo | $575 million | Unauthorized accounts |

| Bank of America Junk Fees | Bank of America | $250 million | Hidden overdraft fees |

What makes the Capital One case unique is the blend of past compensation + future benefit, plus the automatic payments system that removes barriers for affected users.

Consumer Response

Feedback from consumers has been generally positive — especially among those who were unaware of the rate differences until the lawsuit gained attention.

Online forums like Reddit’s r/personalfinance and BankingClassActions.com saw spikes in user engagement when the revised settlement was announced. Some savers said they had “no idea [they] were earning so little” until prompted to switch by a notification or by legal news coverage.

The Capital One case has also prompted greater awareness around reviewing account terms annually, checking for new product launches, and comparing APYs regularly.

Wells Fargo $33 Million Settlement: How Eligible Customers Can Claim Their Payout

Infosys McCamish Wins Final Approval for $17.5 Million Class Action Settlement – Check Details

$30 Million Google-YouTube Kids Settlement Eligibility, Claim & Deadline