Canada Scraps Mandatory Retirement at 65: Canada scraps mandatory retirement at 65 — that’s the line popping up across news feeds, office chats, and financial newsletters from coast to coast. It’s sparked plenty of questions: Does this mean you’re now forced to work longer? Can you still retire at 65? What does it mean for CPP and OAS? Here’s the real story: Canadians now have more choice than ever when it comes to when and how they retire. But contrary to what some headlines suggest, no law is forcing anyone to keep working beyond 65. Instead, the government has reaffirmed and formalized a long-standing shift — giving Canadians the freedom to choose their retirement age, with financial flexibility through the Canada Pension Plan (CPP) and Old Age Security (OAS).

Table of Contents

Canada Scraps Mandatory Retirement at 65

This shift away from mandatory retirement at 65 doesn’t just change laws — it changes mindsets. Retirement is no longer tied to a date on a calendar. It’s a financial, personal, and strategic decision based on your goals, income, health, and lifestyle. With flexible rules around CPP and OAS, Canadians have the tools to build a retirement that works for them — not just because they turned 65. Whether you’re in your 30s planning ahead, or in your 60s making decisions today, take the time to understand your options. Work with professionals. Do the math. And above all, take control of your retirement journey.

| Topic | Key Info |

|---|---|

| Mandatory Retirement at 65 | No longer the default. Canadians now have full flexibility to retire earlier or later without legal restrictions. |

| CPP (Canada Pension Plan) | Can be taken anytime from age 60 to 70. Early claim = lower payout. Delayed claim = larger payout. |

| OAS (Old Age Security) | Standard start age is 65, but can be deferred until 70 for higher monthly payments. |

| Average CPP (2025) | ~$848/month at age 65. Max possible: ~$1,433/month (depending on full contribution history). |

| OAS (2025) | ~$727/month (age 65–74). Higher rates for those 75+. Income-tested clawback may apply at ~$93,000+. |

| Flexibility Impact | Delaying benefits can increase lifetime income. Great for long-term financial security. |

| Official Resources | CPP: https://www.canada.ca/en/services/benefits/publicpensions/cpp.htmlOAS: https://www.canada.ca/en/services/benefits/publicpensions/old-age-security.html |

What Does “Scrapping Mandatory Retirement” Really Mean?

Let’s clear up a common misconception. There’s no federal law in Canada that ever required people to retire at 65. That number has been more of a cultural milestone than a legal cutoff.

What’s new is that the government has strengthened employment rights, reinforced provincial rules, and formally ended age-based retirement policies in most sectors. Employers can no longer force someone out just because they’ve turned 65 — unless the job involves specific physical or safety-related criteria (like firefighting or air traffic control).

In other words, you can now work as long as you want — or retire as early as you need — without penalties beyond those built into pension systems.

How CPP Works in 2025/26?

The Canada Pension Plan (CPP) is funded by payroll contributions from employees and employers throughout your working life. You earn pension credits based on how much you earn annually (up to a maximum limit), and those credits translate into retirement income later.

Key CPP Details:

- Standard start age: 65

- Earliest start age: 60 (reduced benefits)

- Latest start age: 70 (increased benefits)

- After 70: No advantage to delaying; benefits max out

- Average monthly benefit (2025): ~$848

- Maximum benefit (2025): ~$1,433 if you’ve made max contributions for 39+ years

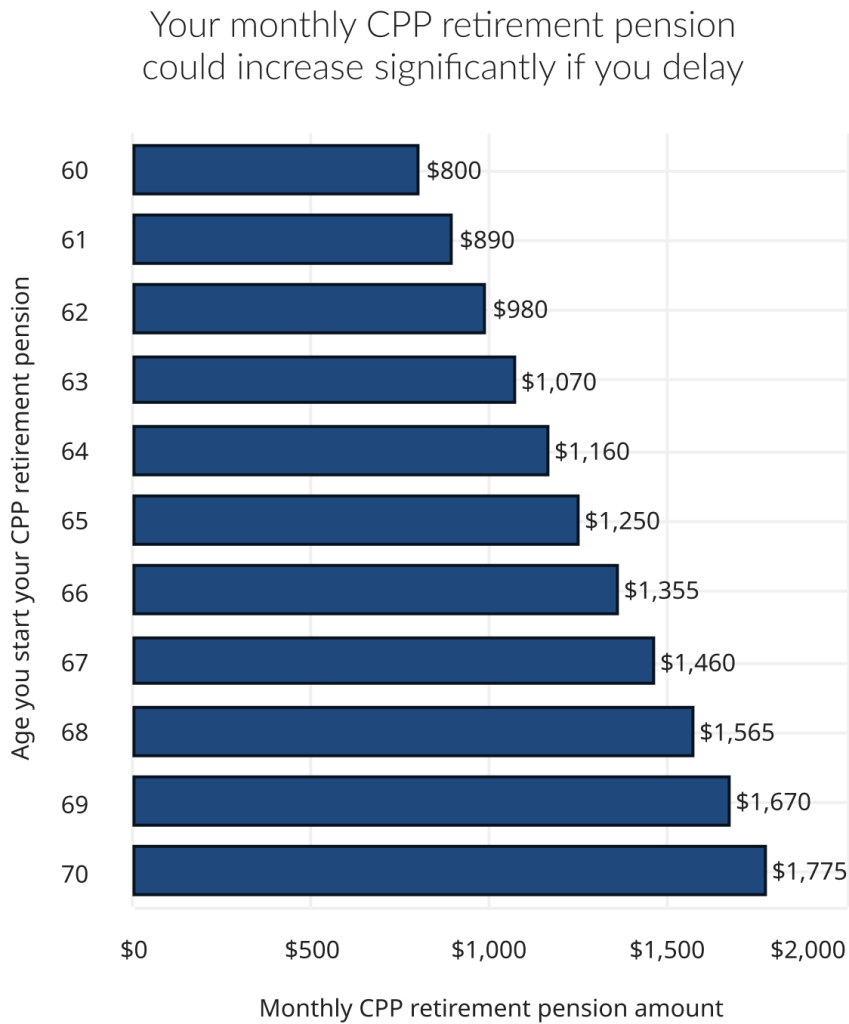

Early vs. Late CPP Claiming:

- Start at 60: You receive up to 36% less than if you waited until 65.

- Start at 70: You could get up to 42% more than the 65 amount.

- Contribute after 65: You continue to accrue Post-Retirement Benefits (PRB), even while collecting CPP.

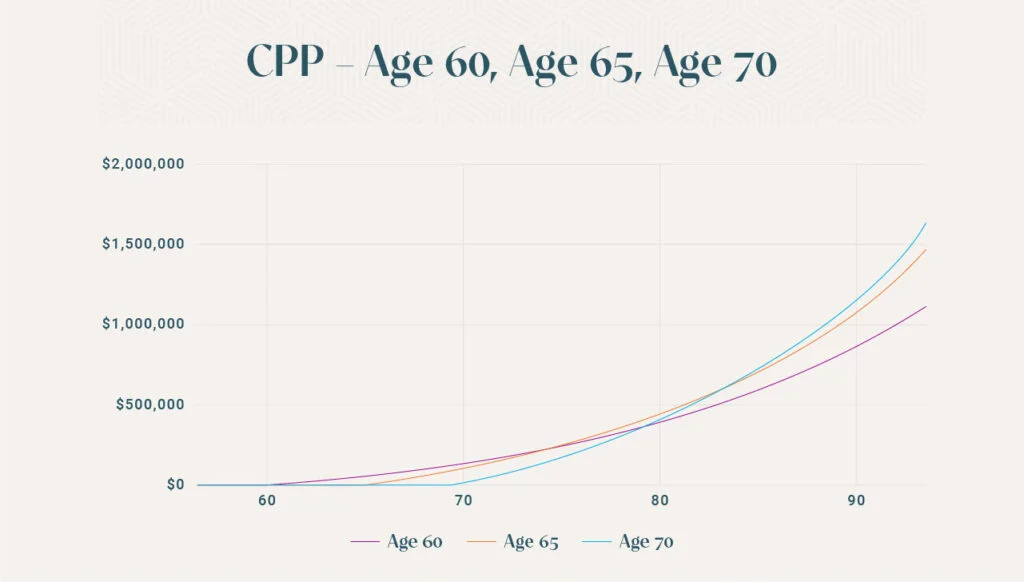

Who Benefits from Delaying?

- Those in good health who expect to live into their 80s or beyond.

- People still working full- or part-time and don’t immediately need CPP income.

- Those focused on minimizing taxes in early retirement.

How OAS Works in 2025/26?

Old Age Security (OAS) is different from CPP. It’s funded by general tax revenue and based on residency, not employment or payroll deductions.

Key OAS Facts:

- Standard start age: 65

- Maximum benefit (2025): ~$727/month (age 65–74); higher for those 75+

- Defer to age 70: Gain ~0.6% per month, or ~36% increase by deferring to 70

- Clawback (Recovery Tax): Begins at ~$93,000 in net income; full phase-out by ~$151,000+

Residency Requirements:

- You must have lived in Canada for at least 10 years (since age 18) to qualify.

- Full pension requires 40 years of residency.

Why Delaying Retirement Could Pay Off?

While many Canadians are used to thinking of 65 as “retirement age,” the truth is, retiring later often makes better financial sense. Here’s why:

1. You Get Paid More — For Life

Delaying both CPP and OAS increases your monthly income for the rest of your life. If you live into your 80s or 90s, this adds up.

2. Avoid Clawbacks and Higher Taxes

Strategic timing of benefits helps minimize taxes. For high-income retirees, delaying OAS could prevent the clawback entirely.

3. Bridge Early Retirement with Other Savings

Some folks retire at 62 or 63 using RRSPs or personal savings, and defer government benefits until 67–70. That way, they avoid reduced CPP and OAS, while still enjoying early retirement.

Step-by-Step Guide to Retirement Planning in 2025

Step 1: Know Your Numbers

- Log into My Service Canada Account

- View your CPP Statement of Contributions

- Estimate OAS eligibility

- Tally other income (RRSPs, pensions, investments)

Step 2: Assess Your Goals

- Do you want to stop working completely, or phase out?

- Would part-time work or consulting be an option?

- Do you want to retire early and travel, or delay for financial comfort?

Step 3: Run the Scenarios

Model out different scenarios:

- Retire at 60, claim CPP immediately

- Retire at 65, claim both CPP and OAS

- Retire at 63, claim RRSP income, delay CPP/OAS to 70

Compare the lifetime income and tax impact of each option.

Step 4: Factor in Health & Longevity

If you have a family history of long life and expect to live into your 90s, delaying benefits is often a winning bet. On the flip side, if your health is poor or your life expectancy is shorter, early access to benefits may make more sense.

Step 5: Talk to a Professional

Work with a certified financial planner to analyze your CPP, OAS, and private savings together. A personalized plan can save thousands over your lifetime.

Real-World Examples

Case Study #1: Early Retiree

Diane, age 60, just sold her small business and wants to travel for 5 years before settling down. She claims CPP immediately to supplement her savings but plans to delay OAS until 70.

Result: She sacrifices some CPP income but builds her OAS to over $900/month by age 70, locking in better cash flow for life.

Case Study #2: Late Career Worker

Mohammed, age 67, loves his consulting job and doesn’t need income from CPP or OAS yet. He delays both to age 70.

Result: He gets maximum benefits and uses RRSP withdrawals to stay below OAS clawback thresholds.

CRA $680 Canada Payment in December 2025: Check Eligibility, Payment Date

Canada Grocery Rebate December 2025: Check Eligibility, Amount & Payment Date

Canada Housing Benefit 2026: Exact Payment Dates, Eligibility, and Payment Date