Average Social Security Payment in Every State: If you’re planning for retirement — whether it’s five years out or five months away — there’s one thing you need to know for sure: your Social Security check will be a major part of your monthly income. And in 2025, the average Social Security benefit for retired workers is sitting right around $2,009.50 a month, but that amount can vary a lot depending on which state you live in. In this guide, we break down how Social Security works, how benefits vary across states, what impacts your check, and most importantly — how to make the most out of your Social Security. This isn’t just theory — we’re talking real money, real impact, and real strategies you can use to retire smarter.

Table of Contents

Average Social Security Payment in Every State

The average Social Security payment in 2025 may hover around $2,009.50/month, but what really matters is how much of that you’ll actually receive — and how far it will stretch in your state. Planning early, delaying your claim, coordinating spousal benefits, and supplementing with retirement savings are all smart ways to boost your retirement income. Whether you’re in Connecticut pulling $2,200 or in Mississippi living on less than $1,900, your choices today shape your comfort tomorrow. Start now. Check your earnings record. Map out your options. And get retirement-ready — because you deserve more than just to get by.

| Topic | Key Data & Stats |

|---|---|

| Average national benefit (2025) | ~$2,009.50/month for retired workers (SSA) |

| Highest average benefits | Connecticut ($2,196), New Jersey ($2,190), New Hampshire ($2,184) |

| Lowest average benefits | Mississippi ($1,814), Louisiana ($1,818), Arkansas ($1,852) |

| Maximum monthly benefit (2025) | $4,873/month (for high earners who claim at age 70) |

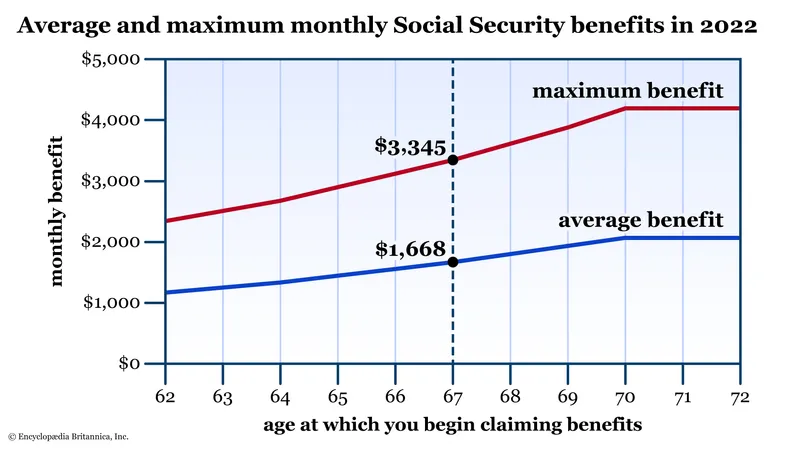

| Full Retirement Age (FRA) | 66–67 depending on birth year (SSA-defined) |

| Early Retirement Claim Age | 62 (with ~30% reduced benefit) |

| Age for Maximum Benefit | 70 (with ~24–30% higher monthly checks compared to FRA) |

| 2025 Cost-of-Living Adjustment (COLA) | 3.2% increase |

| Benefit taxable thresholds | Single: $25,000+ |

| Official website for Social Security benefits | https://www.ssa.gov |

Why Average Social Security Payment in Every State Matters More Than Ever?

Social Security is the largest source of retirement income for most Americans. As of 2025:

- Over 56 million retirees rely on Social Security every month.

- The average benefit for retired workers is approximately $2,009.50/month.

- For 40% of seniors, Social Security makes up more than 90% of their income.

But here’s the kicker: while the federal government calculates your benefit based on your earnings, the cost of living where you retire can make a huge difference in how far that money goes.

What Is Social Security and How Does It Work?

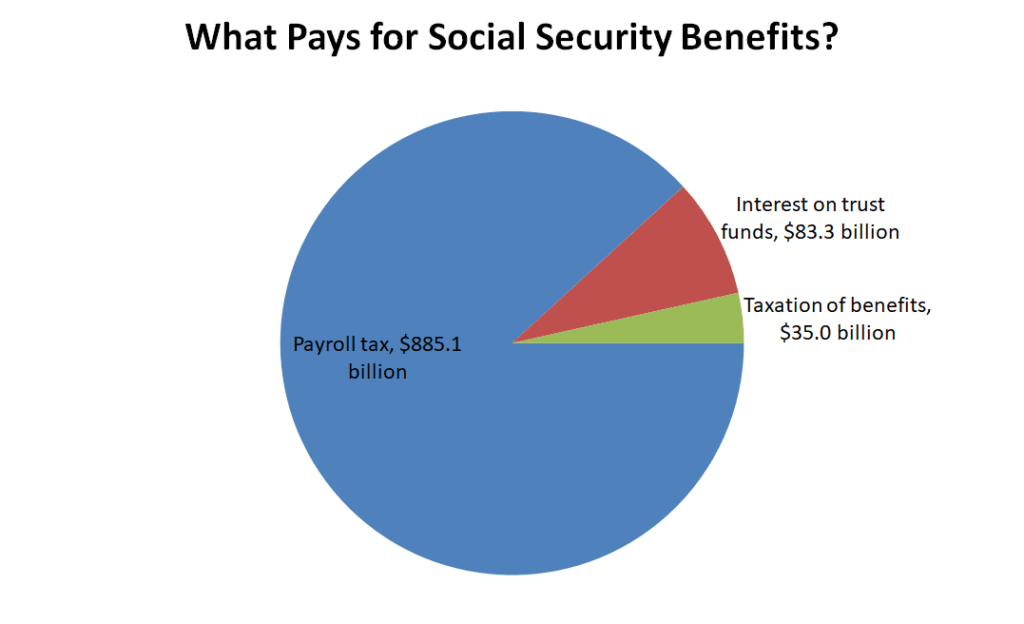

Social Security is a government-backed retirement benefit system that pays monthly checks to eligible retirees. It’s funded through payroll taxes — that 6.2% that comes out of your paycheck (plus your employer’s share).

How much you get depends on:

- Your 35 highest-earning years

- Your age when you start collecting

- Whether you’re eligible for spousal/survivor benefits

You can start collecting at age 62, but that comes with a permanent reduction in your benefit. Wait until full retirement age (66–67 depending on birth year), and you get the full amount. Delay until age 70, and you can max it out — potentially reaching over $4,800 per month if you were a high earner.

Average Social Security Payment in Every State (2025)

Here’s a closer look at how average checks stack up across the U.S., based on 2025 data from the SSA and analysis from Kiplinger:

| State | Avg Benefit (2025) |

|---|---|

| Connecticut | $2,196 |

| New Jersey | $2,190 |

| New Hampshire | $2,184 |

| Delaware | $2,171 |

| Maryland | $2,140 |

| Washington | $2,099 |

| Massachusetts | $2,084 |

| Virginia | $2,064 |

| Arizona | $2,020 |

| California | $1,935 |

| Florida | $1,961 |

| Mississippi | $1,814 |

| Louisiana | $1,818 |

| Arkansas | $1,852 |

Important: Social Security benefits are not adjusted based on location. So why the differences? Because people in higher-wage states tend to earn more over their careers, boosting their eventual benefits.

Factors That Impact Your Social Security Check

1. Your Lifetime Earnings

Your Social Security benefit is calculated using your top 35 earning years. If you worked part-time, took time off, or had gaps in your work history, your average may be lower.

Example:

- 35 years earning $80,000/year → higher benefit

- 20 years earning $60,000 + 15 years at $0 → significantly lower benefit

2. Your Age at Claiming

You can claim Social Security anytime between 62 and 70. But the earlier you claim, the smaller your check.

| Claiming Age | Effect on Monthly Benefit |

|---|---|

| 62 | ~30% reduction |

| 66-67 (FRA) | Full benefit |

| 70 | ~24-30% increase |

3. Spousal and Survivor Benefits

If you’re married, divorced, or widowed, you might be eligible for:

- Up to 50% of your spouse’s benefit

- 100% survivor benefits if your spouse passed

This is a huge planning tool for couples — especially if one spouse didn’t work as much.

4. Cost-of-Living Adjustments (COLA)

Each year, Social Security gets adjusted for inflation. In 2025, the COLA was 3.2%, and expectations for 2026 are around 2.8% depending on inflation data.

What Else You Need to Know?

Social Security Is Taxable

Yes, you might have to pay taxes on your Social Security benefits, depending on your income.

- If you file single and make over $25,000/year, or married filing jointly over $32,000/year, up to 85% of your benefits can be taxed.

You Still Need Retirement Savings

Most financial experts agree — Social Security should only replace about 30–40% of your pre-retirement income. That means you still need other savings like:

- 401(k) or 403(b)

- Traditional or Roth IRA

- Pensions or annuities

Rule of thumb: Aim to replace 70–80% of your working income in retirement.

Retirement Age Keeps Creeping Up

If you were born in 1960 or later, your full retirement age is 67. There’s talk in Congress about raising it even further — up to 69 or 70 — to keep the program solvent.

Practical Tips to Maximize Your Benefit

- Work at least 35 years to avoid zeros in your benefit calculation.

- Delay claiming until at least full retirement age — or age 70 if possible.

- Coordinate benefits as a couple to maximize household income.

- Use SSA calculators to model scenarios: https://www.ssa.gov/benefits/retirement/estimator.html

- Consider Roth conversions before you claim to reduce future taxes on benefits.

Social Security and the Future: Should You Be Worried?

Yes and no.

Yes, Social Security is still going to be there.

No, it probably won’t pay 100% of benefits forever.

The Social Security Trust Fund is expected to be depleted by 2034, at which point it could only pay about 77% of scheduled benefits unless Congress steps in.

Possible fixes include:

- Raising the full retirement age

- Increasing payroll taxes

- Cutting benefits for high earners

Four Ways to Boost Income in Retirement Without Reducing Social Security Payments

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Ranking the 15 Least Friendly Cities for Retirement — Check Which Surprised the List