Average Social Security Check: Average Social Security Check 2026 is more than just a number — it’s the pulse of retirement income for over 71 million Americans. Whether you’re retired, about to retire, or just planning for the future, this year’s benefit increase plays a critical role in how far your dollars stretch. The Social Security Administration (SSA) recently announced a 2.8% Cost-of-Living Adjustment (COLA) that will increase monthly benefit payments starting in January 2026. This modest bump affects every Social Security recipient — from retirees to disabled workers to low-income individuals receiving Supplemental Security Income (SSI). In this guide, we’ll break down what these changes mean, how much the average check will be, and what you can do to make the most of your benefits.

Table of Contents

Average Social Security Check

Average Social Security checks in 2026 are set to rise to about $2,071 per month, thanks to a 2.8% COLA designed to help retirees and others keep pace with inflation. While this increase is welcome, rising Medicare premiums, income taxes, and living costs mean many Americans won’t feel much of a boost. To make the most of your benefit, it’s critical to understand the fine print, time your claiming decision wisely, and plan around Medicare and taxes. Whether you’re already retired or preparing for that next chapter, knowing how your benefits work — and what you can do to optimize them — is essential. Stay informed, stay proactive, and use the tools at your disposal.

| Topic | 2026 Figure / Change |

|---|---|

| Average Retired Worker Benefit | ~$2,071/month |

| Annual COLA Increase | 2.8% |

| SSI Federal Max (Individual) | $994/month |

| Medicare Part B Premium 2026 | $202.90/month |

| Maximum Monthly Retirement Benefit | ~$5,251/month |

| Earnings Limit (Under FRA) | $24,480/year |

| When Benefits Start | January 2026 |

| Official SSA Website | — |

Understanding the 2026 Average Social Security Check

The average Social Security retirement benefit in 2026 is projected to be approximately $2,071 per month, up from $2,015 in 2025. While this might not sound like a huge increase, it reflects an important adjustment that helps retirees and other beneficiaries maintain their purchasing power in the face of rising prices.

The 2.8% COLA means that recipients will see a monthly boost of about $56 on average. This increase is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation. When the cost of essentials like food, housing, and transportation goes up, COLA helps ensure Social Security payments rise with them — at least in theory.

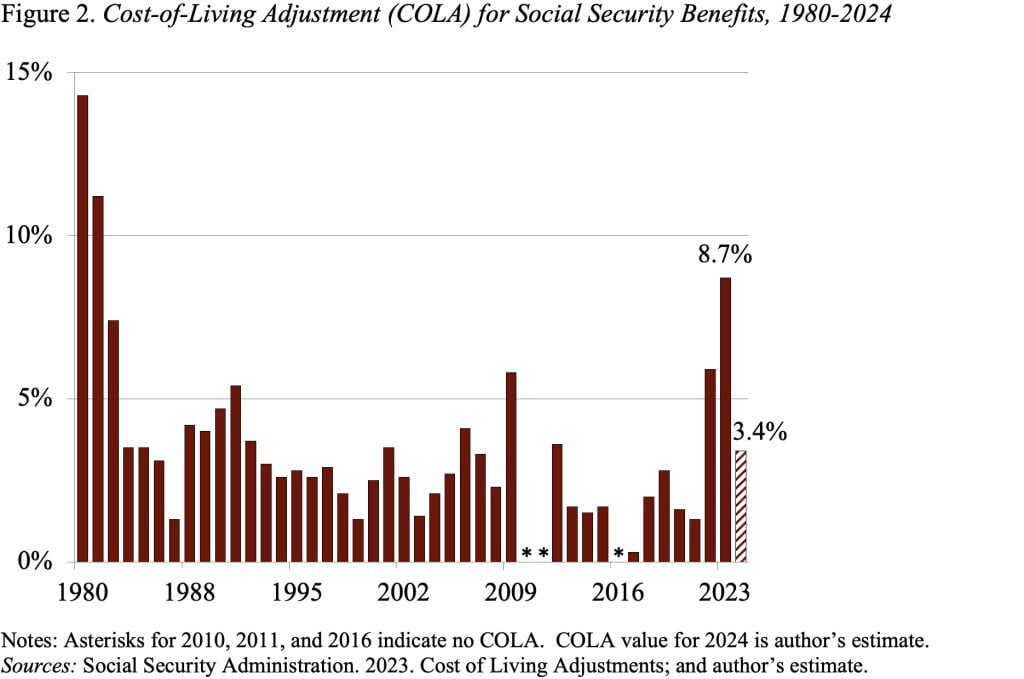

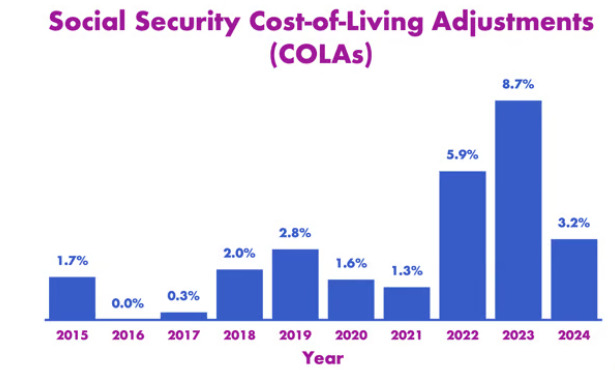

A Look Back: COLA Trends Over Time

To appreciate this year’s increase, let’s put it in context:

- 2023 COLA: 8.7% (one of the largest in over 40 years)

- 2024 COLA: 3.2%

- 2025 COLA: 3.0%

- 2026 COLA: 2.8%

While 2.8% may not seem impressive next to 2023’s historic adjustment, it’s relatively strong in a “normal” inflation year. That said, many retirees feel these increases still don’t reflect the true costs they face, especially in areas like healthcare and housing, which often outpace general inflation.

Breakdown by Beneficiary Type

Here’s how the 2026 COLA affects different Social Security recipients, based on SSA estimates:

| Category | 2025 Average Benefit | 2026 Estimate (2.8% COLA) |

|---|---|---|

| Retired Worker (average) | $2,015 | $2,071 |

| Aged Couple (both receiving) | $3,120 | $3,208 |

| Widowed Individual | $1,867 | $1,919 |

| Disabled Worker | $1,586 | $1,630 |

| SSI (Individual) | $966 | $994 |

| SSI (Couple) | $1,453 | $1,491 |

The figures vary depending on lifetime earnings, work history, retirement age, and whether spousal or survivor benefits apply.

How COLA Works: Step-by-Step

Step 1: Calculate Your Base Benefit

The SSA calculates your monthly benefit using your highest 35 years of indexed earnings. They use a formula that applies bend points (income thresholds) to determine your Primary Insurance Amount (PIA) — the base amount you’re entitled to at Full Retirement Age (FRA).

Step 2: Apply the COLA

Once your base benefit is calculated, the annual COLA is applied. So if your monthly check in 2025 is $1,800, a 2.8% COLA brings it to roughly $1,850.40.

Step 3: Adjust for Medicare (if applicable)

For retirees enrolled in Medicare Part B, the premium is deducted directly from your check. The 2026 premium is set at $202.90, meaning your net benefit may rise less than you expect.

Step 4: Consider Taxes and Earnings Limits

Depending on your income, up to 85% of your Social Security benefit may be taxed. If you’re working and below full retirement age, earning more than $24,480 could temporarily reduce your benefits.

Medicare: The Hidden Factor in Your Paycheck

One often-overlooked impact on your Social Security income is Medicare premiums. In 2026:

- Part B Premium: $202.90/month

- Part B Deductible: $283/year

For many retirees, these premiums are subtracted before they ever see their Social Security money. This year’s $17.90 increase in the Part B premium could offset a good portion of the COLA, depending on your benefit level.

High-income retirees may also pay Income-Related Monthly Adjustment Amounts (IRMAA), which raise the Medicare premium significantly.

SSI & Disability Payments in 2026

For recipients of Supplemental Security Income (SSI), 2026 brings:

- Individuals: Up to $994/month

- Couples: Up to $1,491/month

These changes also go into effect December 31, 2025, due to the payment calendar shifting for holidays. The COLA also applies to Social Security Disability Insurance (SSDI) recipients, who will see similar percentage increases in their monthly benefits.

How and When You Get Average Social Security Check?

Social Security checks follow a schedule based on your birth date:

- 1st–10th of the month: Paid 2nd Wednesday

- 11th–20th: 3rd Wednesday

- 21st–31st: 4th Wednesday

If you receive both Social Security and SSI, you usually receive SSI on the 1st and Social Security on the 3rd of each month. But holidays and weekends can bump payments to earlier dates, so staying informed is key.

Taxes on Average Social Security Check: What to Expect

While Social Security income is tax-free for some, many retirees are surprised to find they owe taxes on a portion of their benefits.

If your combined income (including half your Social Security plus other earnings) exceeds:

- $25,000 (individual) or $32,000 (married) → you may owe federal tax

- Up to 85% of your benefit can be taxed

These thresholds haven’t been adjusted in decades, which means more retirees are paying taxes than ever before.

Some states — like Colorado, Nebraska, and West Virginia — have phased out taxes on Social Security, but others still do.

Will Social Security Still Be There? Trust Fund Concerns

It’s impossible to talk about Social Security without addressing the elephant in the room: long-term funding.

According to the 2025 Trustees Report, the Social Security Trust Fund could be depleted by 2034 unless Congress acts. If that happens, benefits may be cut by up to 20–25% across the board.

That doesn’t mean Social Security is going away. It’s still funded by payroll taxes, and even if the trust fund runs dry, revenue from FICA taxes would cover most benefits.

Still, experts are urging reforms now to protect the program for future generations. Options on the table include:

- Raising the retirement age

- Increasing or removing the payroll tax cap (currently $168,600 in 2025)

- Reducing benefits for higher earners

- Expanding taxes on investment income

Financial Planning Tips for 2026 Average Social Security Check

Here’s how to make the most of your Social Security benefits in 2026:

- Delay if You Can: Claiming at age 70 can increase your benefit by up to 24–32% over claiming at 62.

- Understand Spousal Benefits: Even if you didn’t work, you may be eligible for up to 50% of your spouse’s benefit.

- Review Medicare Options: Shop Medicare Advantage or Medigap plans to offset premium hikes.

- Manage Taxes: Withdraw strategically from IRAs and Roths to minimize taxable income and reduce benefit taxation.

- Create a Budget: Use your COLA increase wisely — put it toward savings, inflation-proof expenses, or healthcare reserves.

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

Social Security Increases by State 2026 – The Five States Seeing the Largest Benefit Gains

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules