Average Social Security Benefits 2026: New Monthly Payment Amounts by Retirement Age is more than just a trending search term — it’s a key topic that can significantly impact your retirement plan, your paycheck in your golden years, or the financial well-being of your loved ones. Whether you’re a 30-something looking ahead or a 65-year-old eyeing the finish line, this guide is your one-stop shop to understanding what the numbers mean for you in 2026. With new benefit increases, changes to wage limits, and rising living costs, it’s crucial to get ahead of the game. We’re breaking it all down — plain English, pro tips, and backed by real numbers — so you can confidently plan your future. You’ll walk away with practical insights, links to official sources, and a clear picture of what to expect in your Social Security checks starting this year.

Table of Contents

Average Social Security Benefits

The Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age reflect the ever-evolving reality of retirement planning in America. While the 2.8% COLA increase is a welcome change, most retirees still face pressure from rising healthcare, taxes, and everyday costs. Understanding your benefit options, claiming strategies, and how to optimize your timing is more important than ever. Whether you’re just starting to plan or already collecting, the best step you can take today is to log into your SSA account, run the numbers, and create a diversified income plan that supports your long-term retirement goals.

| Topic | 2026 Figures / Facts |

|---|---|

| COLA Increase | 2.8% boost |

| Average Retired Worker Benefit | $2,071/month |

| Max Benefit at Full Retirement Age (FRA) | $4,152/month |

| Max Benefit at Age 70 | $5,251/month |

| Earliest Claiming Age | 62 |

| SSI Individual Max | $994/month |

| Wage Base Limit (Taxable Earnings Cap) | $184,500 |

| Earnings Limit Before FRA | $24,480/year |

What’s New in 2026?

If you’ve been keeping an eye on Social Security updates, you probably noticed that benefit payments are increasing for 2026 — thanks to a 2.8% Cost-of-Living Adjustment (COLA).

That means the average retired worker’s monthly benefit climbs from approximately $2,015 to $2,071. This bump is meant to help retirees keep pace with inflation — though critics argue it’s still not enough given the rising costs of healthcare, rent, and essentials like food and transportation.

This annual adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), tracked by the Bureau of Labor Statistics. COLA helps ensure your purchasing power doesn’t shrink over time.

But what does that actually mean for you? Let’s take a closer look.

Average Social Security Benefits by Age (2026)

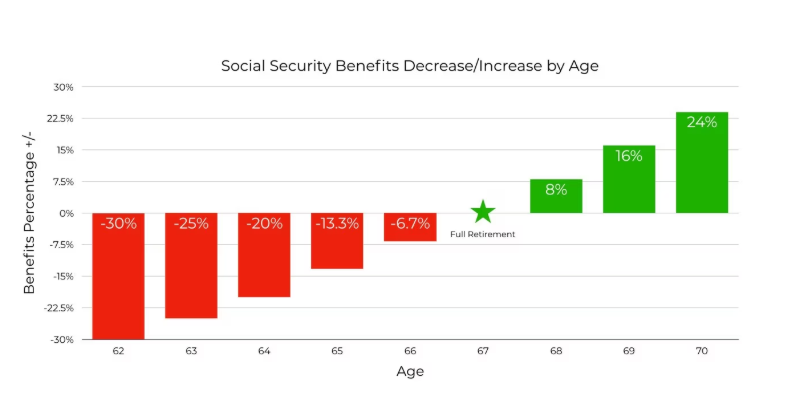

The age at which you start collecting Social Security plays a huge role in how much you receive monthly. The system is designed to reward patience — so claiming early gives you a smaller monthly amount, while delaying boosts your check size.

Here’s how the average benefit numbers stack up after applying the 2026 COLA:

| Claiming Age | Estimated Avg Monthly Benefit (2026) |

|---|---|

| 62 | ~$1,415 |

| 63 | ~$1,431 |

| 64 | ~$1,487 |

| 65 | ~$1,658 |

| 66 | ~$1,859 |

| 67 (Full Retirement Age) | ~$2,017 |

| 68 | ~$2,059 |

| 69 | ~$2,109 |

| 70 | ~$2,248 |

These figures reflect average benefits — not the max — and help everyday Americans estimate what to expect. Waiting until age 70 can increase your check by more than 60% compared to claiming at 62.

Maximum Benefits: What’s the Highest You Can Get?

While the average benefit is a helpful benchmark, some high earners can claim a much larger monthly benefit — if they meet the criteria.

To qualify for maximum Social Security benefits, you’ll need:

- 35 years of earnings at or above the wage cap (in 2026, that’s $184,500/year)

- A delay in claiming benefits until age 70

Here’s what the maximum monthly benefit looks like:

- At Full Retirement Age (67): $4,152/month

- At Age 70: $5,251/month

That’s a potential $63,000/year — but keep in mind, only a small percentage of retirees qualify for this.

How Average Social Security Benefits Are Calculated?

Social Security benefits are calculated using a formula that looks at your 35 highest-earning years, adjusted for inflation. Here’s the simplified version of how it works:

- Earnings History: SSA indexes your annual earnings and finds your 35 highest-paid years.

- AIME (Average Indexed Monthly Earnings): Your top earnings are averaged monthly.

- PIA (Primary Insurance Amount): SSA applies a formula to your AIME to determine your full benefit at Full Retirement Age.

- Adjustments: Benefits are reduced if claimed early or increased if delayed.

Should You Claim Early or Wait?

This is a big question with a very personal answer. Here are some key factors:

Reasons to claim early (62–64):

- You need the money now

- Health concerns reduce life expectancy

- You’re retiring early and don’t want to rely on savings

Reasons to delay (68–70):

- You’re in good health and expect to live longer

- You’re still earning and don’t need the money yet

- You want to maximize survivor benefits for a spouse

As a rule of thumb, if you live past 78–80, delaying benefits tends to pay off in total lifetime value. It’s smart to do a break-even analysis — especially if you’re married and trying to coordinate claiming strategies.

What If You Keep Working After Claiming Benefits?

Working while receiving Social Security? It’s allowed, but there are earnings limits to keep in mind if you’re under full retirement age.

For 2026:

- If you’re under FRA, you can earn up to $24,480 without penalty.

- Earn above that? SSA deducts $1 for every $2 you earn above the limit.

- In the year you reach FRA, the limit is higher and the penalty is lower: $1 for every $3.

After you hit full retirement age, you can earn as much as you want — no penalties, no reductions.

Will Your Social Security Be Taxed?

Yep — Social Security benefits can be taxed at the federal level, and some states tax them too.

Here’s how it works:

- If your combined income (includes 50% of Social Security + other income) exceeds $25,000 (individual) or $32,000 (joint), you’ll owe taxes on up to 85% of your benefits.

States like Florida, Texas, and Nevada don’t tax Social Security — but states like Colorado and Nebraska do. Always check with your tax advisor or state website.

SSI vs. Social Security: What’s the Difference?

Let’s clear up the confusion:

- Social Security (SS): Earned benefits based on your work history and payroll taxes.

- Supplemental Security Income (SSI): Needs-based program for low-income seniors and disabled individuals, regardless of work history.

In 2026:

- SSI individual max: $994/month

- SSI couple max: $1,491/month

SSI is often paired with Medicaid and other support programs, but it’s separate from regular Social Security.

Smart Planning Tips for Average Social Security Benefits 2026 and Beyond

- Check Your Social Security Statement Annually:

Sign up for a “mySSA” account to view your earnings history and estimates. - Diversify Income Streams:

Social Security should be part of your retirement plan — not all of it. Add IRAs, 401(k)s, HSAs, and taxable investments. - Coordinate Spousal Benefits:

Married? Consider survivor benefits and timing strategies — it can dramatically impact long-term income. - Prepare for Medicare Premiums:

These often rise, and they’re usually deducted from your Social Security check. Plan ahead. - Consult a Professional:

A fee-only financial planner can help optimize your claiming strategy, especially if you’re balancing taxes, investments, and legacy goals.

Which States Tax Social Security Benefits? Check the Full Map and What You Might Pay in 2026!

Social Security Check at $1,850 – How Much Your Monthly Payment Could Increase in 2026