Average Social Security Benefit for Retirees: The Average Social Security Benefit for Retirees in 2026 is on the rise, offering a financial cushion for millions of retired Americans. As of January 2026, retired workers will see a modest boost in their monthly payments — and while the increase isn’t life-changing for everyone, it’s a critical component of many Americans’ retirement income. Thanks to a 2.8% Cost-of-Living Adjustment (COLA), the average Social Security retirement benefit is expected to be about $2,071 per month in 2026. This adjustment ensures that retirees’ purchasing power isn’t wiped out by inflation — a critical factor when you’re on a fixed income. In this article, we’ll walk through what this means in plain English. We’ll also give you real-world scenarios, important calculations, and strategies to make your benefits work harder for you.

Table of Contents

Average Social Security Benefit for Retirees

The average Social Security benefit for retirees in 2026 is $2,071 per month, marking a modest but welcome increase from the previous year. For millions of Americans, this payment forms the foundation of retirement. But how far it goes depends on when you claim, your health costs, your location, and your financial strategy. Understanding how Social Security works — from earnings records and Medicare deductions to taxes and inflation — puts you in control. It’s not just about getting a check; it’s about making the most of the retirement you’ve earned.

| Topic | 2026 Info & Stats |

|---|---|

| Average Monthly Benefit (Retired Worker) | About $2,071/month – ~$56 more than 2025 |

| Cost‑of‑Living Adjustment (COLA) | 2.8% increase |

| Average Married Couple Benefit | ~$3,208/month |

| Possible Max Benefit | Up to ~$5,251/month (delayed filing) |

| SSI Federal Max (2026) | $994 (individual), $1,491 (couple) |

| Medicare Part B Monthly Premium | $202.90 (deducted from benefits) |

| Payment Dates | Based on birth date in January |

Why Average Social Security Benefit for Retirees Matters?

For over 66 million Americans, Social Security isn’t just a benefit — it’s a lifeline. According to the SSA, for nearly half of retirees, Social Security makes up 50% or more of their total retirement income.

Whether you’re a blue-collar worker in Ohio, a retired schoolteacher in Georgia, or a self-employed contractor in Texas, these benefits form the backbone of financial stability after age 62. That’s why any change, even a 2.8% increase, is newsworthy.

How Social Security Payments Are Calculated?

Social Security isn’t a one-size-fits-all system. The amount you receive is based on:

1. Your Earnings Record

Social Security calculates your benefit based on your highest-earning 35 years. If you worked fewer than 35 years, the SSA fills in the blanks with zeros — which brings your average down.

If you earned more in later years (as many people do), working even a few extra years can replace low-earning years and boost your benefit.

2. Your Full Retirement Age (FRA)

FRA is the age at which you can collect 100% of your earned benefit. For most people born in 1960 or later, FRA is 67 years old. If you claim earlier, your benefit is reduced. If you wait, your benefit grows.

- Claim at 62: Up to 30% reduction

- Claim at 67: Full benefit

- Claim at 70: Up to 24-30% increase

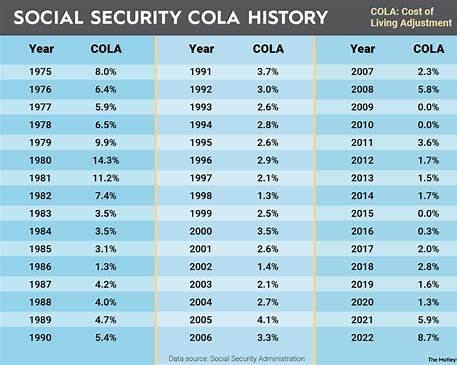

3. The COLA (Cost-of-Living Adjustment)

Every October, the SSA calculates the COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). It’s meant to protect retirees from losing buying power as the price of essentials increases.

Real-World Examples of Average Social Security Benefit for Retirees

Example 1: The Average Retiree

- Monthly benefit: $2,071

- Annual benefit: $24,850

- After Medicare Part B: ~$1,868/month net

Example 2: Dual-Earner Married Couple

- Combined benefit: ~$3,208/month

- Annual household benefit: ~$38,500

- Likely subject to partial federal tax depending on other income

Example 3: High Earner Waiting Until 70

- Max benefit: ~$5,251/month

- Lifetime value: Could exceed $1.5 million in benefits depending on longevity

These numbers show how waiting or working longer can impact your check — but also how costs like Medicare eat into the final number.

The Medicare Factor: How It Affects Net Benefit

Most retirees are automatically enrolled in Medicare Part A and B at age 65. However, Part B premiums are taken directly out of your Social Security check, reducing your take-home amount.

- 2026 Medicare Part B Premium: $202.90/month

- Net benefit for average retiree: ~$1,868/month

Add prescription drug coverage (Part D), supplemental plans, or out-of-pocket expenses, and the total cost could be $300+ per month. Retirees should budget accordingly.

Taxes on Social Security

Yes, your Social Security benefits can be taxed. If your “combined income” (half your benefits + all other income) exceeds certain limits, a portion of your benefits may be taxable.

- Single: If combined income > $25,000

- Married Filing Jointly: If combined income > $32,000

As inflation pushes more income up, more retirees are being taxed on Social Security — a growing concern.

Geographic and Demographic Differences

Not all retirees experience Social Security the same way. Where you live, your race, gender, and income level can influence your total benefits and cost of living.

- Hawaii, Connecticut, and New Jersey often see higher benefits due to higher lifetime wages.

- Mississippi, Arkansas, and West Virginia often have lower benefits and higher rates of poverty among retirees.

- Women often receive less due to interrupted work histories or lower average lifetime earnings.

Understanding these nuances helps tailor retirement planning based on your individual context.

Spousal and Survivor Benefits Explained

Many retirees don’t realize they may qualify for spousal or survivor benefits:

- Spousal Benefits: Up to 50% of a spouse’s benefit (if the spouse has a higher benefit)

- Survivor Benefits: Up to 100% of a deceased spouse’s benefit

These benefits have different rules but can be a major support for non-working or lower-income spouses.

SSI vs. Social Security: Know the Difference

Social Security (SSDI or Retirement) is earned by working and paying into the system.

Supplemental Security Income (SSI) is need-based — often for people who are elderly, blind, or disabled with little income. It has stricter limits but provides essential support.

- 2026 Federal SSI Limit: $994 (individual), $1,491 (couple)

- Some states add extra payments on top

Historical Context: How Benefits Have Tracked with Inflation

Over the last 20 years, COLA has ranged from 0% (in deflation years) to over 8% (as in 2023). While 2026’s 2.8% isn’t extreme, it’s relatively normal — and reflects moderate inflation trends returning post-pandemic.

In real terms, that’s good news — it means the economy is stabilizing, but your check still gets a bump.

Is Social Security Going Broke?

You may have heard rumors about Social Security “running out of money.” Here’s the truth:

- The Social Security Trust Fund is projected to be depleted by 2034.

- After that, payroll taxes will still cover about 77% of scheduled benefits.

- That doesn’t mean it’ll vanish — but some benefits may be reduced unless Congress acts.

Most experts believe reforms (like raising the payroll tax cap or adjusting FRA) will come before cuts.

Smart Strategies to Maximize Average Social Security Benefit for Retirees

Here’s how to make the most of your Social Security in 2026 and beyond:

- Delay if Possible – Even waiting one year can raise your benefit by 8%.

- Work a Little Longer – Replace low-earning years in your 35-year average.

- Avoid Penalties – Don’t claim before age 65 without understanding Medicare rules.

- Coordinate with Your Spouse – Timing both of your claims can yield thousands more.

- Watch for Scams – Only use .gov sites and never give info over the phone to unsolicited callers.

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Social Security Check at $1,850 – How Much Your Monthly Payment Could Increase in 2026

Social Security Benefits January 2026: How Much Will Your Payments Increase?