AT&T Settlement Update: If your personal info was caught up in one or both of the major AT&T data breaches in 2024, and you took action by filing a claim, then you’re probably watching the calendar, wondering: “When will I actually get my check?” The answer is: soon—but not just yet. The class action settlement, valued at $177 million, is designed to compensate affected individuals with up to $7,500, depending on what breach(s) they were involved in and what documentation they submitted. The timeline has reached a crucial point, with the final court hearing completed in January 2026. We’ll walk you through everything — in plain talk — so you know exactly what to expect, what to do next, and how to protect yourself going forward. Whether you’re a busy parent or a professional looking for real answers, this guide covers it all.

Table of Contents

AT&T Settlement Update

The AT&T data breach settlement is one of the largest of its kind — and it’s reaching the finish line. If you’re one of the millions who filed a claim, know this: help is on the way, and your payout could land in 2026, assuming all goes smoothly. Just keep your information handy, stay updated, and protect your digital life. Money is great — but peace of mind is better.

| Topic | Details |

|---|---|

| Settlement Fund Value | $177 million total for affected claimants |

| Final Approval Hearing Held | January 15, 2026 in Texas federal court |

| Maximum Individual Payout | Up to $7,500 depending on breaches claimed & documentation |

| Claim Filing Deadline (Online/Mail) | Dec. 18, 2025 (online closed; late mail possible) |

| Expected Distribution Window | Likely Spring to Summer 2026 if judicial approval confirmed |

| Official Settlement Website | https://www.telecomdatasettlement.com/ |

| Kroll Contact | (833) 890‑4930 for updates/forms |

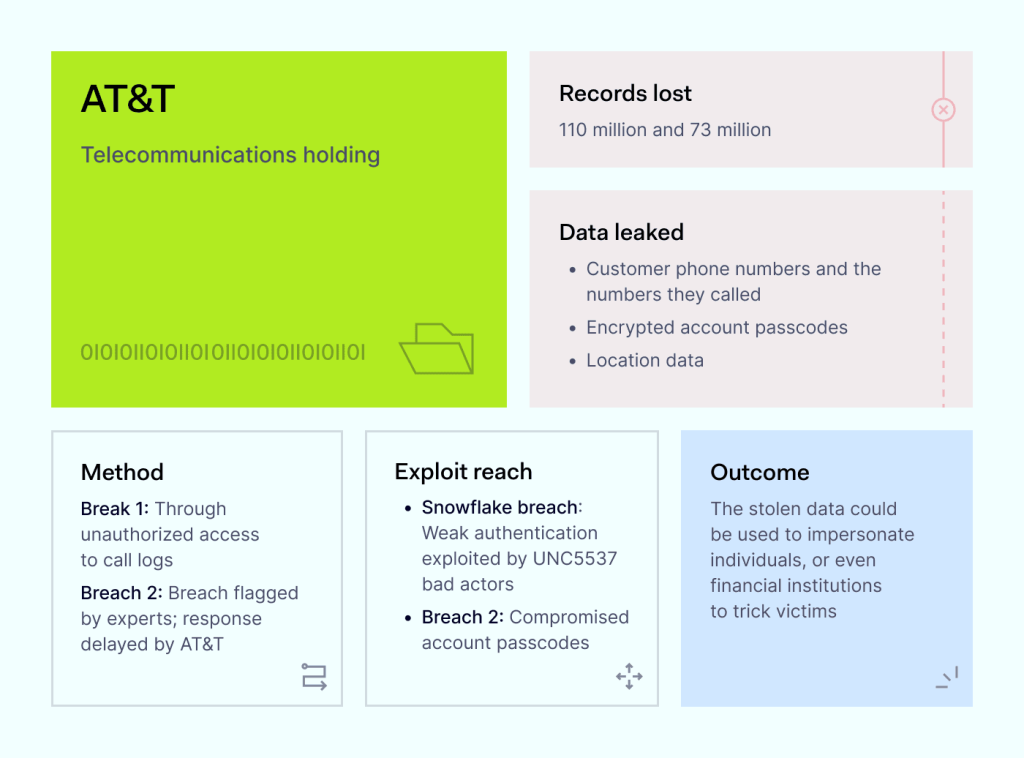

Understanding the Background — What Really Happened?

In 2024, AT&T confirmed two major security incidents that compromised sensitive customer data. These weren’t just small technical glitches. These were serious breaches that potentially exposed names, Social Security numbers, phone records, and more. Millions of people were affected.

Here’s a quick breakdown:

- March 2024 breach: A massive data set surfaced online that included the personal information of over 70 million former and current AT&T customers. This leak included Social Security numbers, dates of birth, and contact details.

- July 2024 breach: Attackers accessed metadata from calls and texts, along with subscriber IDs and other technical information stored on a third-party platform. This one affected even more users, especially those currently active with AT&T services.

Understandably, people were concerned. Lawsuits were filed across the country, and eventually, they were bundled into one big class action. Rather than fight it out in court for years, AT&T agreed to settle — without admitting fault — by paying $177 million into a compensation fund.

What Is a Class Action Settlement?

If this is your first rodeo with a big lawsuit like this, here’s the deal:

A class action means that many people with similar complaints are grouped together in one case. Instead of everyone suing separately, a few representatives handle the case on behalf of all.

Once a company agrees to settle, everyone who fits the description — called a Settlement Class Member — is automatically included unless they opt out. If you’re part of that group and submit a claim, you get your share of the money.

But that also means you give up your right to sue AT&T separately for these same issues in the future. It’s a tradeoff: you get a piece of the pie now, but you can’t go back for another slice later.

Who Qualifies for an AT&T Settlement Update?

You might be eligible if:

- You were an AT&T customer at the time of the breaches (March or July 2024).

- Your data was part of either incident.

- You submitted a claim by the December 18, 2025 deadline — or possibly via mail shortly after.

There are two categories:

- Documented Losses — If you had receipts or proof that you paid for credit monitoring, identity theft protection, or experienced financial fraud as a result of the breaches, you could get up to $5,000 for the March breach and $2,500 for the July breach.

- Tiered Payments — If you didn’t have documentation, you may still be eligible for a fixed amount depending on your exposure and how many people filed. The more people file, the smaller these “no proof” payments may be.

Where Things Stand Now?

The final approval hearing took place on January 15, 2026. This is where the judge reviewed the settlement, addressed any objections, and determined whether the terms were fair, reasonable, and adequate.

Now, the court is in the process of issuing a final order. Once that order is signed and entered into the docket, the payment process can begin. That process includes:

- Verifying claims

- Resolving any appeals (if filed)

- Issuing checks or direct deposits

If everything moves forward without major delays, payments could begin as early as late spring or early summer 2026.

Why AT&T Settlement Update Takes This Long?

If you’re wondering why you can’t just get your check right now, you’re not alone. But there’s a good reason behind the slow timeline:

- Legal checks and balances: Courts need to protect all parties, especially when millions are involved.

- Fraud prevention: Claims need to be validated to prevent scammers from cashing in.

- Appeals: If someone objects to the deal and appeals, that can stall everything.

In most big cases, there’s a lag of 90 to 150 days between the final hearing and the first checks being issued. So while it might feel slow, this is standard operating procedure.

Can I Still File a Claim?

Not online — that ship has sailed.

But you might still be able to submit a Late Claim Form by mail, depending on court discretion. This is a long shot, and there’s no guarantee it’ll be accepted. If you missed the deadline but were eligible, it’s still worth sending in a late claim — just don’t count on success.

What Should I Be Doing Now?

Here’s a checklist to stay ahead:

- Hold on to confirmation emails or documents from when you filed.

- Watch your mailbox and email for updates from Kroll (the settlement administrator).

- Make sure your bank details haven’t changed if you opted for direct deposit.

- Ignore scam calls/emails claiming to expedite your payment. Only Kroll manages these funds.

- Monitor your credit reports to protect against lingering effects of the breach.

What Happens After You Get Paid?

It’s tempting to think once the money arrives, that’s the end of the road. But it’s not. Your data was compromised — and that could have consequences down the line. Even if you haven’t experienced fraud yet, stolen data often resurfaces years later.

Here’s what we recommend:

- Set up credit monitoring, if you haven’t already.

- Place fraud alerts on your accounts with major credit bureaus.

- Consider a credit freeze — it’s free and adds a big layer of protection.

- Use strong, unique passwords for your online accounts and change them often.

- Enable 2FA (two-factor authentication) wherever you can.

Think of the settlement money as a silver lining — but not a cure-all. The best defense is staying alert.

Google Class Action Settlement – How to Qualify for the $68 Million Voice Assistant Payout

Robinhood Class Action Settlement Reaches $2 Million: Who’s Eligible and How to File a Claim

$147 Payment for Everyone – Cash App Agrees to $12.5M Settlement Over Spam Texts Class Action Claims