Anthem $12.8M Settlement: If you or a loved one had health insurance through Anthem and got denied coverage for residential mental health or substance abuse treatment, this might be your lucky break — or at least a small win for justice. Anthem Insurance has agreed to pay $12.875 million to settle claims that it improperly denied coverage for behavioral health services. That’s nearly 13 million bucks up for grabs — and if you meet the criteria, you could get a slice. The clock is ticking though. You must file your claim by January 20, 2026. Whether you’re a parent, a young adult who sought help, or a health professional trying to understand the implications for your patients, this guide has got you covered — broken down in plain English with zero legal fluff.

Table of Contents

Anthem $12.8M Settlement

The Anthem $12.8 million class action settlement is a rare opportunity to not only get back money you shouldn’t have had to spend, but also to hold a major insurer accountable for its treatment of mental health care. If Anthem denied you or a family member coverage for residential behavioral health treatment between 2017 and 2025, and you paid for it out-of-pocket, you likely qualify. This isn’t just a refund — it’s a statement. A statement that mental health matters, and that when companies break the rules, people will stand up and fight back. So don’t let that deadline sneak up on you. File your claim by January 20, 2026, and make sure your voice — and your pocket — get heard.

| Key Info | Details |

|---|---|

| Settlement Amount | $12.875 million |

| Company Involved | Anthem Inc. |

| Issue | Denial of coverage for residential treatment related to mental health/substance use (in violation of proper care guidelines) |

| Eligible Time Frame | April 29, 2017 – April 30, 2025 |

| Deadline to File a Claim | January 20, 2026 |

| Payout Amount (Est.) | At least $100 minimum, or a portion based on what you spent |

| Official Settlement Website | https://www.anthembhreclassaction.com/ |

| Fairness Hearing Date | January 26, 2026 |

What Sparked the Anthem $12.8M Settlement?

Here’s the deal: Anthem was hit with a class action lawsuit that claimed the insurance company used outdated and overly strict criteria when evaluating requests for residential mental health or substance abuse treatment.

According to the lawsuit, Anthem’s guidelines failed to align with widely accepted medical standards, resulting in unfair denials of coverage for services like:

- Inpatient rehab for addiction

- Residential mental health facilities

- Long-term behavioral therapy programs

That’s a big deal — because when insurance refuses to pay, people either go into debt or forgo the care they need.

The lawsuit accused Anthem of violating federal parity laws, specifically the Mental Health Parity and Addiction Equity Act (MHPAEA), which requires insurance plans to treat mental health and substance use the same as physical health.

Anthem didn’t admit guilt, but to avoid further litigation, they agreed to a $12.875 million settlement — and thousands of former policyholders could benefit.

Why Anthem $12.8M Settlement Matters (Beyond the Money)

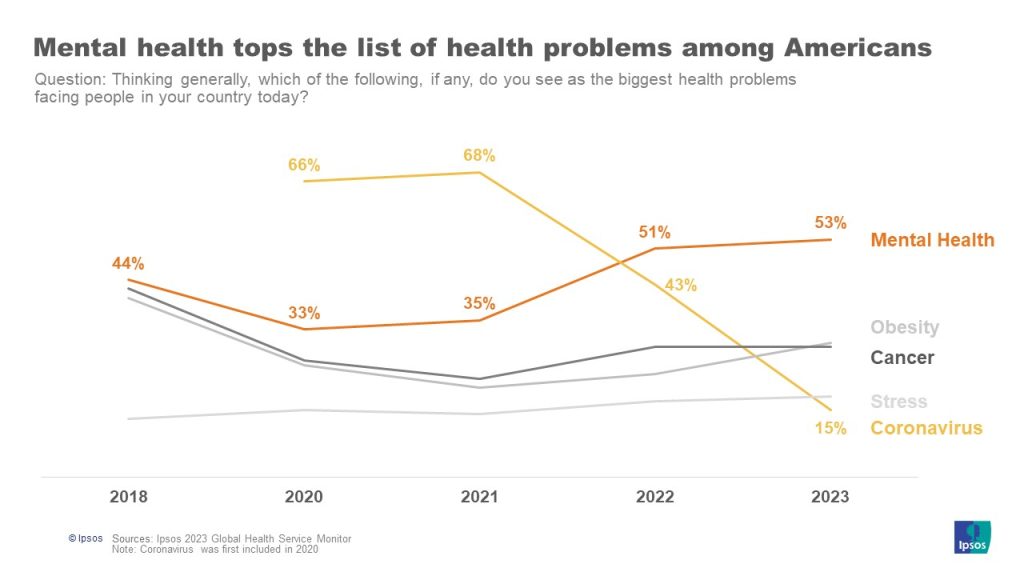

Mental health care is not a luxury — it’s a necessity. But the way insurance companies have treated behavioral health over the years has often been riddled with delays, denials, and discrimination.

By settling this case, Anthem is being held accountable for its past practices. It also sends a message to other insurance companies: follow proper care standards, or face the consequences.

This lawsuit stems from the broader Wit v. United Behavioral Health ruling, where the court found UBH guilty of prioritizing cost-saving over proper medical care. That case became the backbone for similar class actions, including this one against Anthem.

It also reflects a growing trend of legal wins for mental health parity — giving consumers more power to demand fair treatment.

Who Is Eligible?

To claim your share of the settlement, you must meet these three conditions:

- You were covered by Anthem health insurance between April 29, 2017, and April 30, 2025.

- Anthem denied your claim for residential treatment related to mental health or substance use during that time.

- You or your family paid out-of-pocket for that treatment after the denial.

That’s it.

Even if you’re not sure you qualify, you should still file a claim. The settlement administrator will verify your eligibility. Worst case? You get denied. Best case? You get a check.

Real-Life Example: Emily’s Story

Emily, a 32-year-old marketing manager from Minnesota, had Anthem insurance through her job. In 2021, she sought help for her depression and anxiety after losing a close friend. Her psychiatrist recommended a 30-day residential treatment program, but Anthem denied the claim, calling it “not medically necessary.”

Emily went anyway, taking out a $12,000 personal loan to cover the cost.

Now, with this settlement, she’s eligible to recover a portion of that expense — maybe even more than half.

Her story is far too common — and that’s why this lawsuit matters.

How Much Can You Get?

Let’s break it down.

- Everyone who qualifies and files a valid claim will get at least $100 — no matter how much they spent.

- If you have receipts, letters, or proof showing how much you paid after a denial, you could receive a larger share of the pool.

The total amount depends on:

- How many people file

- How much everyone paid

- How complete your documentation is

So if fewer people apply, or if you submitted strong evidence, you could be looking at several hundred or even a few thousand dollars.

Step-by-Step: How to File Your Anthem $12.8M Settlement Claim

1. Visit the Official Website

Go to https://www.anthembhreclassaction.com/

There, you’ll find:

- The official Claim Form

- Frequently Asked Questions

- Details about eligibility

- Legal documents

2. Collect Your Documentation

You’ll need to provide:

- The denial letter from Anthem (or an explanation of benefits)

- Receipts, invoices, or billing statements showing what you paid

- Dates of service and provider information

Even if you don’t have everything, file anyway — partial documentation may still qualify.

3. Fill Out the Claim Form

You can file:

- Online (the fastest and easiest)

- By mail (download the form and send it to the address provided)

Make sure the claim is submitted or postmarked by January 20, 2026. No extensions.

What Happens Next?

Once all claims are reviewed and the Fairness Hearing is held on January 26, 2026, the court will decide whether to approve the settlement.

If all goes well, payments will be issued in mid to late 2026 — either as a check or direct deposit, depending on what you select during filing.

Be patient. Class action settlements take time. But if you’ve ever felt powerless against a big insurance company, this is a moment to reclaim what’s yours.

Expert Perspective

“We’ve seen decades of insurance companies treating mental health as a secondary issue. This lawsuit is part of a turning point — and an opportunity for consumers to finally be heard.”

— Dr. Raquel Santiago, Health Policy Researcher, University of Colorado

Google’s $700M Settlement, Explained: Eligibility, Deadlines, and Payouts

Wells Fargo $33 Million Settlement: How Eligible Customers Can Claim Their Payout

Infosys McCamish Wins Final Approval for $17.5 Million Class Action Settlement – Check Details