$200M SNAP Funding Shift: The $200 million SNAP funding shift is shaking up budgets, raising eyebrows in state legislatures, and sparking big conversations about who pays for food assistance in America. At the center of the storm? A new federal policy that changes the way the Supplemental Nutrition Assistance Program (SNAP) — also known as food stamps — is funded. And if you’re wondering what this means for everyday families, social workers, state budgets, or your tax dollars — you’re in the right place. We’ll break it down like we’re sitting around the kitchen table: plain talk, real examples, and expert-backed facts.

Table of Contents

$200M SNAP Funding Shift

The $200 million SNAP funding shift is more than a budgeting headache — it’s a stress test for state governments, a policy wake-up call, and a potential burden on the people who need help most. As federal policy changes shift costs downstream, states must get smart, fast, and focused. For Alabama — and other vulnerable states — the question is no longer “if” the bill comes due, but how to pay it without letting anyone go hungry. With the right tech, training, and leadership, it’s possible. But the clock’s ticking, and families are watching.

| Topic | Details |

|---|---|

| Keyword Focus | $200 million SNAP funding shift |

| Federal Change | Under the One Big Beautiful Bill (OBBBA), states must pay up to 15% of SNAP benefit costs if they have high error rates |

| Impact State | Alabama expected to owe $200M by FY2028 due to 9% SNAP error rate |

| Beneficiaries Affected | Over 770,000 people in Alabama rely on SNAP monthly |

| Why It Matters | Risk of service delays, stricter eligibility, and budget cuts to other public programs |

| Federal Resources | USDA SNAP Page, Congress.gov Bill Info |

| Budget Planning Need | Lawmakers urge early action to plug the gap before 2028 |

What’s Behind the $200M SNAP Funding Shift?

Let’s start with the basics. SNAP is a federally funded program that helps low-income families buy groceries. Usually, the federal government covers most of the cost — and states handle administration. But in 2025, Congress passed the One Big Beautiful Bill (OBBBA) — and it changed the game.

Now, under OBBBA:

- If a state’s SNAP payment error rate is higher than 6%, they could be required to pay up to 15% of total SNAP benefits provided in their state.

- The error rate refers to incorrect approvals, wrong benefit amounts, or bad calculations in who gets help.

- The effective date for full state cost sharing is Fiscal Year 2028.

This move was framed as a way to boost efficiency and reduce fraud. But states are worried it’s just a way for the federal government to offload responsibility — especially onto poorer states with underfunded public service systems.

Alabama’s $200 Million Wake-Up Call

Alabama has found itself at the center of this story — and it’s a case study in how one small error rate can have big consequences.

What’s Alabama’s Situation?

- Alabama’s SNAP error rate is 9% — above the 6% threshold.

- That triggers a shared-cost clause under OBBBA.

- The result? An expected $177 million in SNAP benefit payments + $39 million in administrative costs — over $200 million per year starting in 2028.

What Are Lawmakers Saying?

During recent state budget hearings, several lawmakers expressed shock and concern. They said the state needs to:

- Reduce its error rate urgently

- Budget ahead of time for the added costs

- Ensure no one loses benefits or faces delays

“We can’t just pretend this isn’t coming. We need a real plan with real numbers,” said one Republican lawmaker from Montgomery. “That’s taxpayer money, and families’ food on the line.”

How Does This Impact Regular Folks?

To put it plainly: this isn’t just a budgeting issue. It’s about access to food, government trust, and system efficiency.

Let’s Meet Jasmine

Jasmine, a single mom in Mobile, works two jobs and receives $300/month in SNAP benefits to help feed her two kids. Her case was wrongly flagged as ineligible due to a data mismatch, and her benefits were cut off for 6 weeks before being restored.

That kind of administrative error:

- Hurts families like Jasmine’s

- Raises the state’s error rate

- Costs the state millions in penalties under OBBBA

So, yes — error rates matter.

Why Are States Struggling With SNAP Accuracy?

Most states aren’t trying to mess this up. But staffing shortages, outdated technology, underfunded agencies, and complex eligibility rules make accurate administration difficult.

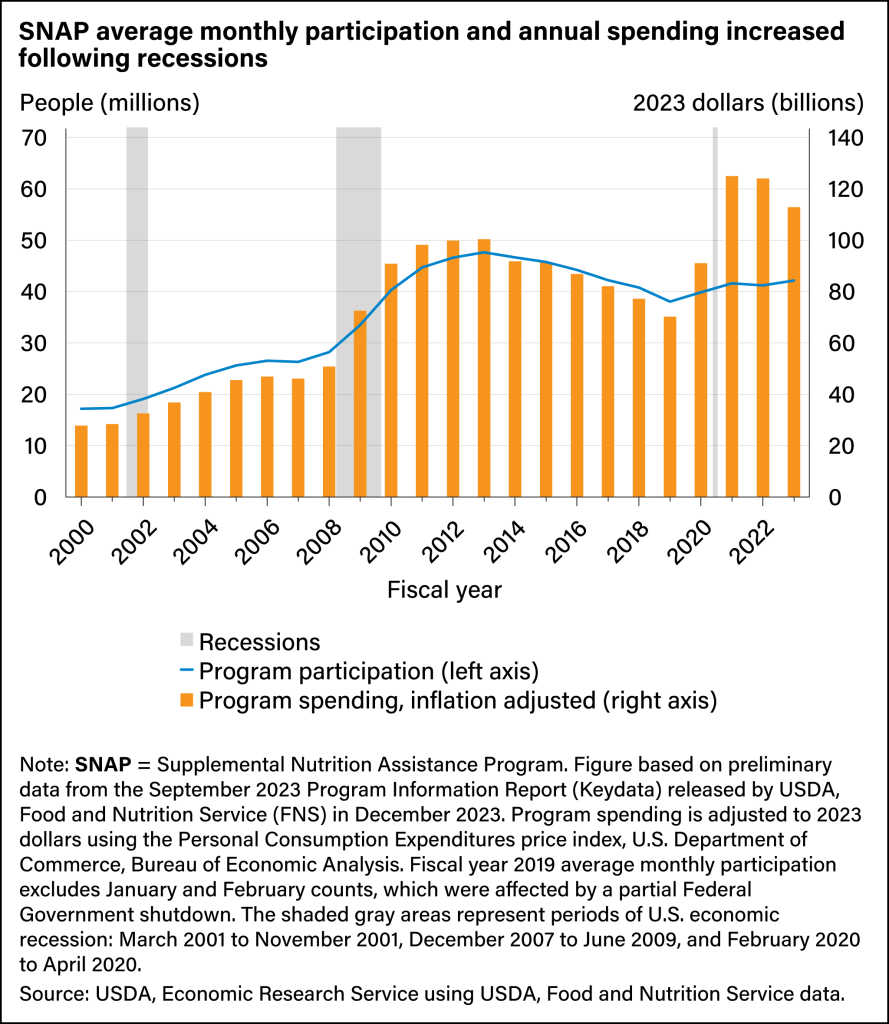

Nationally, SNAP error rates have fluctuated:

- In 2023, the national average was around 6.3%

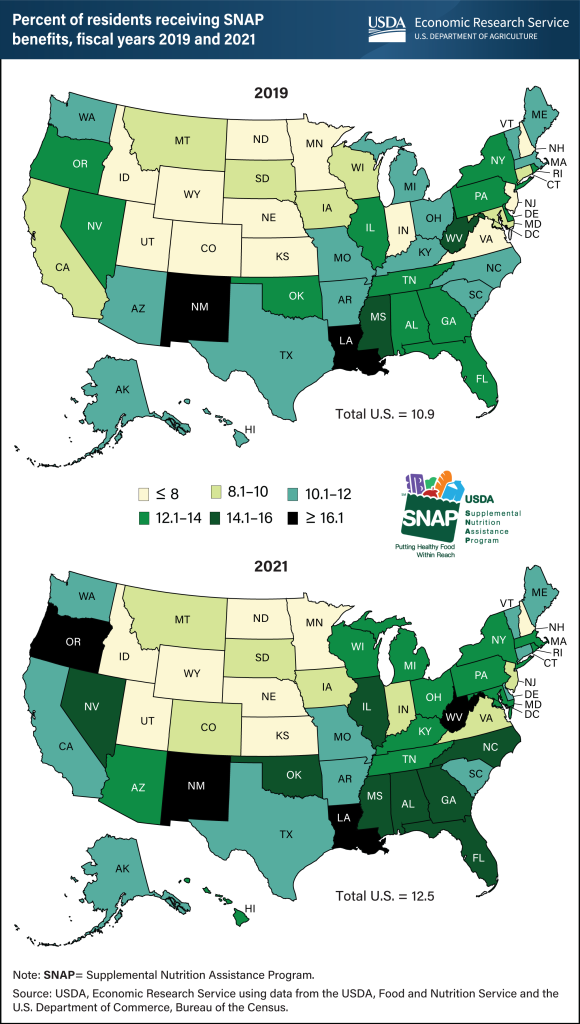

- Several states were flagged for high error rates: Alabama (9%), Mississippi (8.7%), and New York (6.9%)

- These errors include both overpayments and underpayments

These mistakes can:

- Waste taxpayer dollars

- Delay services to eligible families

- Trigger federal cost-sharing penalties

What the Experts Are Saying About $200M SNAP Funding Shift?

Policy experts and analysts are weighing in, too.

Elaine Waxman, a senior fellow at the Urban Institute, explained:

“This policy might improve accountability, but it risks pushing poor states further into deficit. If they don’t invest in admin improvements now, they’ll pay later — literally.”

Meanwhile, the Center on Budget and Policy Priorities has warned that cost shifts like this could discourage states from maintaining broad SNAP access, leading to increased food insecurity.

A Step-by-Step Guide to What’s Happening

Step 1: Federal Reform Passed (OBBBA, 2025)

Congress introduces a bill linking state payment accuracy to SNAP funding responsibilities.

Step 2: States Evaluated by Error Rates

Every state is assessed based on how well they process SNAP claims. If error rates exceed 6%, they face cost-sharing penalties.

Step 3: Alabama Flagged for 9% Error

This places Alabama in the 15% cost-share bracket under OBBBA.

Step 4: Lawmakers Raise Red Flags

State leaders demand clarity on how Alabama will cover the $200M shortfall by 2028.

Step 5: Action Still Pending

No finalized plan has been released by Alabama’s budget office as of February 2026.

What Can States Like Alabama Do?

Here are six actionable strategies states can adopt to prepare:

- Modernize SNAP IT Systems

Many state systems still run on 1990s-era software. Upgrading platforms can reduce input errors and speed up verification. - Hire and Train Caseworkers

SNAP eligibility can be complicated. States need well-trained staff and better oversight to process cases accurately. - Audit and Clean Data Regularly

Proactive auditing helps catch red flags before they become federal violations. - Public-Private Partnerships

States can collaborate with non-profits and tech firms to build more resilient systems. - Federal Waivers and Flexibility

Requesting waivers for certain populations or error categories can help mitigate penalties. - Reserve Funding Early

Budget line-items should be created now to soften the blow in 2028.

Will This Affect Other States Too?

Absolutely. While Alabama is the example today, any state with:

- High poverty rates

- Understaffed SNAP offices

- Complex caseloads

…could end up in the same boat. States like Mississippi, Louisiana, Kentucky, and even some in the Northeast are on watch lists due to elevated error rates.

And if multiple states can’t close their budget gaps in time, we could see:

- Cuts to SNAP eligibility

- Delays in monthly disbursements

- Longer wait times for new applications

That’s a national ripple effect worth watching.

SNAP Benefits 2026 Update – New Rules and Orders That Could Change Eligibility

SNAP Benefits February 2026 – Full Payment Schedule and Key Changes You Should Know

SNAP Changes in 2026 – New Payment Amounts & Rules Explained