Paper Tax Refund Checks: If you’re used to getting a check in the mail from Uncle Sam every spring, you might want to check your mailbox a little less this year. That paper refund check could be a thing of the past — for good. Starting with the 2026 tax season, the IRS (Internal Revenue Service) is making direct deposit and digital payments the new default, effectively ending paper refund checks for most Americans. This move comes under Executive Order 14247, which orders the federal government to modernize how it sends and receives money. The change took effect after September 30, 2025, and while it makes refund payments safer and faster overall, it could delay refunds for folks who aren’t ready — especially those without bank accounts or with outdated info on file. Let’s break it down: what this means, who it affects, how to avoid delays, and how to make sure your refund doesn’t get caught in the slow lane.

Table of Contents

Paper Tax Refund Checks

The paper check era is officially over. The IRS is now fully digital when it comes to refund delivery. If you don’t want your refund delayed by weeks or even months, your best move is to file electronically, enter your bank info accurately, and stay alert for any follow-ups from the IRS. This shift is meant to help — not hurt — taxpayers. But only if you’re prepared.

| Topic | Details |

|---|---|

| Policy Change | Paper refund checks are being phased out under Executive Order 14247 |

| Effective Date | Applies to most refunds issued after September 30, 2025 |

| Delivery Method | Direct deposit is now the primary method |

| Impacted Groups | People without banking info, unbanked, underbanked, or overseas |

| Refund Delay Risk | Delays of 6+ weeks possible without valid electronic info |

| Stats | ~93% of refunds already go through direct deposit (IRS) |

| IRS Resources | www.irs.gov/modernpayments |

Why the IRS Is Ditching Paper Tax Refund Checks?

From Pony Express to Digital Express

For decades, the IRS printed and mailed millions of refund checks to taxpayers across the U.S. It was slow, manual, and expensive. But in the digital age, the paper check has become a liability. Checks get lost in the mail, stolen, forged, or simply delayed due to weather or mailing errors.

In March 2025, the federal government signed Executive Order 14247, titled Modernizing Payments to and from America’s Bank Account, requiring agencies like the IRS to reduce paper-based payments in favor of secure, efficient electronic delivery.

In short, they said: Let’s get with the times.

Why Some Paper Tax Refund Checks May Take Longer?

Here’s where the rubber meets the road: while digital delivery is faster for most, it’s slower for people who don’t follow the new rules.

1. No Bank Info? Expect a Pause

If you don’t include valid bank routing and account numbers when filing, your refund won’t be sent until you update it. The IRS now pauses refunds, sends out notices (like CP53E), and waits up to 30 days for you to respond. If you don’t? You might eventually get a paper check — but not before weeks of delay.

2. Wrong Account Numbers

A single mistyped number means the deposit fails. If your refund bounces back, the IRS flags it for review and will contact you — but you’ll go to the back of the processing line.

3. Paper Returns = Slower Reviews

People who mail in their tax returns often experience longer wait times, regardless of delivery method. In 2023, the IRS warned that paper returns could take up to 6–8 weeks to process.

4. Returns Triggering Verification

If your return involves special tax credits (like the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC)), or if you report significantly different income than last year, your return may be flagged for manual review. That review — even if everything checks out — adds to the wait.

IRS Refund Stats & Payment Trends

According to the IRS:

- Over 93% of refunds were delivered via direct deposit in 2025

- Only 7% were paper-based — and that number is now shrinking rapidly

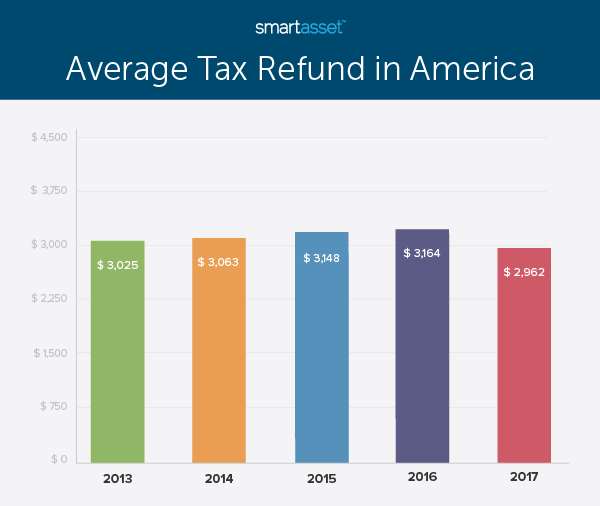

- The IRS issues over 160 million refunds each year, averaging around $3,200 each

A Brief History of Refund Delivery

Back in the 1980s and early 90s, waiting 10 weeks for a refund check was just part of tax season. But by 2004, the IRS had begun pushing e-filing and direct deposit, saving billions in processing costs. Now in 2026, the full phase-out of paper checks brings us to the final step in that evolution.

It’s worth noting: paper checks were once seen as more trustworthy, especially by older generations. But with fraud, theft, and postal issues on the rise, digital delivery is now considered more secure and trackable.

IRS Technology Modernization Efforts

The move to direct deposit is part of the IRS’s broader IT modernization strategy. Over the past five years, the agency has:

- Rolled out the IRS Online Account Portal for faster taxpayer communication

- Launched the IRS Direct File pilot in select states

- Upgraded fraud detection systems to reduce identity theft refund fraud

- Expanded payment options to include digital wallets and mobile banking apps

The goal? Get refunds processed faster, reduce manual bottlenecks, and eliminate paper wherever possible.

What About the Unbanked and Underbanked?

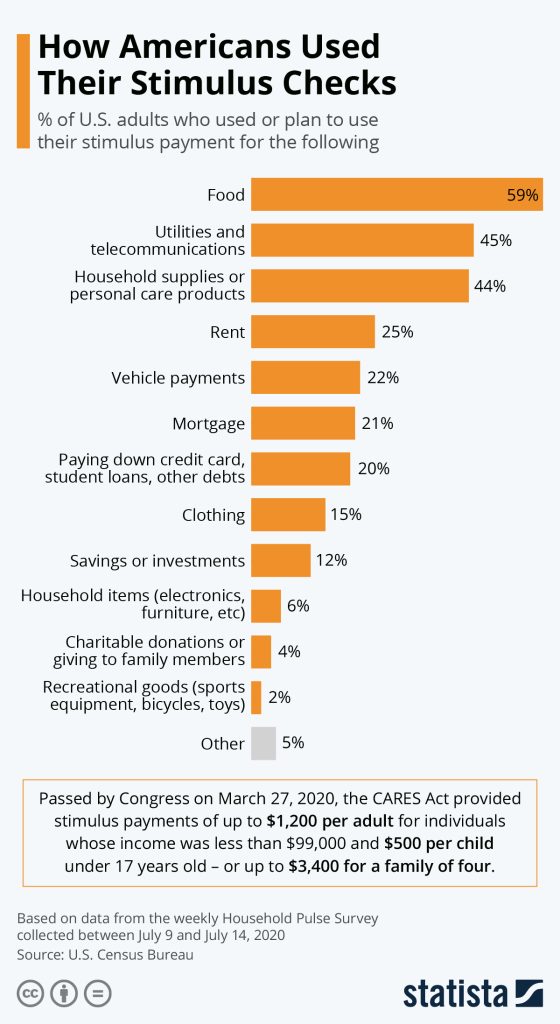

According to the Federal Deposit Insurance Corporation (FDIC), over 5 million U.S. households remain unbanked, and millions more are underbanked, relying on check-cashing services, prepaid debit cards, or money apps.

If that’s you, don’t panic — you still have options:

- Use a prepaid debit card that accepts IRS direct deposits

- Open a low-cost checking account at a credit union or community bank

- Link your IRS refund to mobile banking apps like Cash App, Chime, or Venmo (if they support direct deposit)

Tip: Make sure the account is in your name and matches your tax return to avoid rejection.

Red Flags That Could Trigger Paper Tax Refund Checks Review

Even if your refund is set to direct deposit, some returns get flagged. Common red flags include:

- Income that doesn’t match reported W-2s or 1099s

- Claiming dependents not listed on prior returns

- Big swings in reported business income or deductions

- Filing with multiple addresses or new bank accounts

- Using suspicious preparers or tax software with fraud history

Want to stay off the radar? Be consistent, be honest, and be early.

What Tax Professionals Are Advising in 2026?

CPAs, Enrolled Agents, and tax software providers like TurboTax and H&R Block all agree: Direct deposit is the way to go. They’re urging clients to:

- Double-check bank info

- File electronically

- Use two-factor authentication with the IRS online portal

- Watch for IRS letters in the mail and respond immediately

- Avoid rushing through filing just to get a bigger refund — mistakes delay payment

Common Myths — Busted

Myth: The IRS won’t send a refund if I don’t have a bank.

False. They will — but it will take a LOT longer, and only in special cases.

Myth: Direct deposit refunds get audited more often.

Nope. Refund reviews are based on return content, not refund method.

Myth: I can use someone else’s bank account to get my refund.

Not recommended. Mismatched names and accounts often get rejected.

Step-by-Step: How to Set Up Direct Deposit with the IRS

- File your return electronically.

Use IRS Free File, commercial software, or a tax pro. - Locate your routing and account numbers.

Double-check with your bank or app provider. - Enter the numbers correctly.

Include both routing and account numbers on your return. - Confirm your refund status online.

Use the Where’s My Refund tool. - Watch for letters or emails.

If anything goes wrong, the IRS will notify you.

IRS February 2026 — Who May Receive a $2,000 Direct Deposit and Possible Payment Dates

IRS Refund 2026 Tracker – Simple Steps to Check Where Your Money Is

IRS Tax Filing Season 2026 – Key Deadlines and When Refunds Are Expected