$1,390 Direct Deposit Relief Payment: Is the IRS really sending out a $1,390 direct deposit check in February 2026? It’s the talk of the internet — but let’s pause, breathe, and walk through what’s actually going on. You might’ve seen flashy headlines, TikToks, or shared posts claiming that the IRS has confirmed a $1,390 relief payment for millions of Americans. But before you start planning how to spend it, you should know the truth: no such payment has been officially confirmed by the IRS, the U.S. Department of the Treasury, or any new federal law.

In this deep-dive guide, you’ll learn:

- What’s fact vs fiction about the $1,390 relief payment

- What real federal and state-level relief exists in 2026

- How to claim legit IRS credits and refunds

- How to protect yourself from scams

- And what to expect this tax season

Let’s dive in.

Table of Contents

$1,390 Direct Deposit Relief Payment

It’s tempting to believe that a $1,390 check is headed your way, especially when money’s tight. But as of now, no such IRS payment exists. The smart move? Focus on real tax credits, stay alert to scams, and file early to get your refund faster. The tools are there. The credits are real. But the headlines? Not always.

| Topic | Details |

|---|---|

| Rumored Payment | $1,390 direct deposit in February 2026 |

| Official Confirmation | None from IRS or U.S. Treasury |

| Scam Alerts | Multiple phishing campaigns detected |

| Legit IRS Programs | EITC, Child Tax Credit, Recovery Rebate |

| Past Stimulus Checks | Last issued in 2021 (American Rescue Plan) |

| IRS Official Source | IRS Newsroom |

| Filing Deadline | April 15, 2026 |

| Keywords | IRS relief payment 2026, $1390 direct deposit, February stimulus check |

Where Did the $1,390 Direct Deposit Relief Payment Rumour Come From?

Sometime in late 2025, a string of social media posts began spreading like wildfire claiming that the IRS would issue $1,390 stimulus checks via direct deposit starting February 2026.

These posts often came with:

- Edited screenshots of fake news articles

- IRS logos or government-style language

- Promises of “automatic eligibility” or “urgent deadline”

But according to the IRS Newsroom, there’s been no press release, announcement, or statement confirming this payment.

What the Experts Say?

“Relief payments don’t just fall out of the sky. They require a full legislative process — and Congress hasn’t passed any new law authorizing this,”

says Janet Holtzblatt, senior fellow at the Tax Policy Center.

What’s Actually Real: A Look at Past Stimulus Checks

Here’s a table to remind everyone how real federal relief checks happened during the COVID-19 pandemic:

| Year | Amount | Relief Package | Notes |

|---|---|---|---|

| 2020 | $1,200 | CARES Act | Income-based; first major round |

| 2021 | $600 | Appropriations Act | Issued during winter lockdowns |

| 2021 | $1,400 | American Rescue Plan | Largest one-time payment |

| 2022+ | None | No federal checks issued post-2021 |

Any new relief check would need to go through both chambers of Congress, receive presidential approval, and be announced on official sites.

So, What Can You Actually Claim in 2026?

Even if there’s no fresh federal check coming, the IRS has several valuable tax credits that put money back in your pocket — if you file properly.

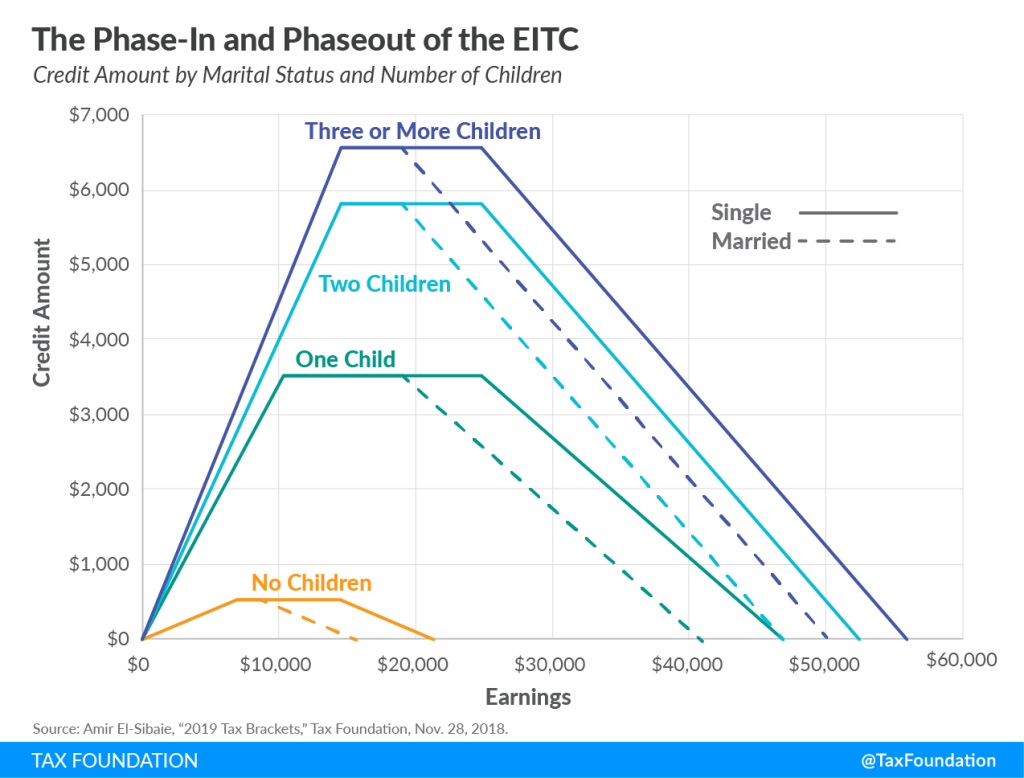

1. Earned Income Tax Credit (EITC)

- Max Value in 2026: Up to $7,430

- For low-to-moderate income earners

- Based on income, filing status, and number of dependents

2. Child Tax Credit (CTC)

- Up to $2,000 per qualifying child

- Partial refund may apply depending on your income

- You must file IRS Form 1040 or 1040-SR

3. Recovery Rebate Credit

- If you missed any COVID-19 stimulus payment (2020–2021), you can claim it as a tax credit

- Fill out Line 30 on Form 1040

4. Education Credits

- American Opportunity Credit (worth up to $2,500)

- Lifetime Learning Credit (up to $2,000)

State-Level Payments in 2026 — Still a Possibility

Some states are continuing local relief programs, even though the federal pipeline has gone dry.

States known to run cash-back or rebate programs as recently as 2024–2025:

- California – Middle Class Tax Refund

- Colorado – TABOR refund program

- New Mexico – Low-income tax rebates

- Illinois – Grocery tax and property relief

If your state has a 2026 budget surplus or special tax law, you might qualify for:

- Gas rebates

- Utility assistance

- Rent relief checks

- Property tax refunds

How to Avoid $1,390 Direct Deposit Relief Payment Scam Traps in 2026?

The IRS says phishing and scam attempts are rising, especially around fake relief checks.

Common Scam Red Flags:

- Unsolicited texts or emails about “urgent stimulus eligibility”

- Fake portals asking for your Social Security number

- Promises of “fast deposit” if you act now

- Emails claiming to be from “IRS Payment Department”

2026 IRS Tax Calendar

| Date | Event |

|---|---|

| Jan 29, 2026 | Filing season opens |

| April 15, 2026 | Tax Day (filing deadline) |

| Oct 15, 2026 | Extension deadline |

| Daily | Use Where’s My Refund to track refund status |

How to Check for Real IRS Payments?

Here’s how to check if you have a payment or credit waiting for you:

- Go to irs.gov

- Use the Where’s My Refund Tool

- You’ll need SSN, filing status, and refund amount

- Create or log in to your IRS Online Account

https://www.irs.gov/payments/your-online-account - Check for:

- Tax transcripts

- Credit notices

- Balance due or pending refunds

Need human help? Call the IRS at 1-800-829-1040 — but avoid Mondays and peak hours.

Real People, Real Experiences

“Last year, I almost fell for a fake email about a $900 IRS refund. Glad I called my local tax prep center before clicking,”

— Maria L., Albuquerque, NM

“I’m a single dad and the EITC saved me over $6,000. You gotta file even if you don’t owe. That check changed my year.”

— Thomas R., Tulsa, OK

Where to Get Free Tax Help?

Filing taxes doesn’t have to cost a dime. If your income is under $60,000 or you’re 60+:

VITA (Volunteer Income Tax Assistance)

- IRS-trained volunteers prepare your return

- Available at libraries, community centers

AARP Tax-Aide

- Free for seniors, no membership required

IRS Confirms $2,000 Direct Deposit for February 2026 – New Payment Dates and Eligibility Guide

SSDI February 2026 — Expected Deposit Dates and Payment Schedule Explained

IRS Refund 2026 Tracker – Simple Steps to Check Where Your Money Is