Up to $100,000 in Settlement Claims: When life throws curveballs — from a bag of bad dog food to a company leaking your personal data — you’d be surprised how often you could be owed real money. But here’s the kicker: most people don’t even know they qualify. Right now, several class action settlements are offering Americans payouts ranging from $20 to $100,000, and many of these claims have deadlines before or around February. If you’ve been affected by a defective product, data breach, or company wrongdoing, it’s worth checking if you can file a claim — and in most cases, you don’t need a lawyer or even a receipt.

Table of Contents

Up to $100,000 in Settlement Claims

The clock’s ticking — and these class action settlements offer a real chance to get compensated for things that never should’ve happened. Whether your dog got sick, your data was exposed, or you simply bought something defective, you could be owed serious money — no strings attached. By taking 10 minutes today to check your eligibility and file your claim, you could get back what’s rightfully yours — from $20 to $100,000. Don’t wait until it’s too late.

| Topic | Details |

|---|---|

| Maximum Payout | Up to $100,000 (Mid America Pet Food Settlement with full documentation) |

| Other Major Settlements | Purpose Financial (~$5,100), Blood Centers (~$2,500) |

| Types of Claims | Pet food contamination, data breaches, identity theft, emotional distress |

| Deadlines | As early as February 5, 2026 |

| Eligibility | U.S. residents affected by specific product use or incidents |

| Where to File | Official settlement websites (listed below) |

| Is Proof Required? | No, but documentation leads to higher payouts |

| Trusted Info Sources | TopClassActions.com, ClassAction.org |

| Tax Implications | Varies by settlement type — see IRS guidance |

What Is a Class Action Settlement?

A class action lawsuit happens when a group of people sues a company or organization for the same wrongdoing — usually something like selling a dangerous product, mishandling private data, or charging unfair fees.

Once a case settles, the court allows anyone who qualifies to file a claim for compensation. It’s one of the most powerful tools for consumer justice — and yet, millions of eligible Americans never file a claim.

Let’s fix that.

Mid America Pet Food Settlement — Up to $100,000 in Settlement Claims

What happened:

Mid America Pet Food, which manufactures brands like Victor, Wayne Feeds, and Eagle Mountain, had multiple products recalled due to Salmonella contamination. Many pets across the U.S. suffered illness, and tragically, some died.

Who qualifies:

You may be eligible if:

- You bought one of the recalled pet food products

- Your pet became sick or passed away

- You have vet bills, medical records, or even just proof of purchase

Payouts:

- Up to $100,000 for documented losses (including vet bills, cremation, medications, etc.)

- Flat payouts (undocumented) available for less severe or unverified claims

Deadline:

February 5, 2026

Purpose Financial Data Breach Settlement — $5,100+

What happened:

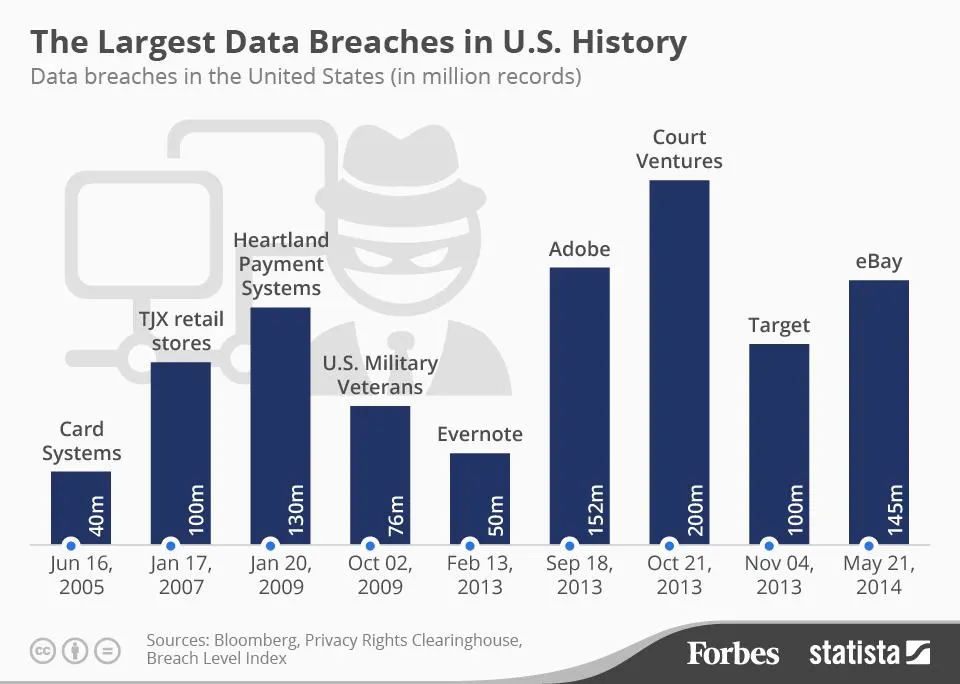

In 2023, Purpose Financial, parent company of Advance America and Cash Advance, suffered a major data breach, exposing customer names, Social Security numbers, bank info, and other sensitive data.

Who qualifies:

You’re likely eligible if:

- You were notified of the breach in 2023

- You used any related service (Advance America, Purpose Financial, etc.)

- You experienced identity theft, fraud, or paid for credit monitoring

Payouts:

- Up to $5,100 for documented expenses

- Flat payouts for anyone who files (approx. $50–$100)

- Extra compensation for California residents under CCPA law

Deadline:

Expected February 2026 (watch official site for updates)

NY Blood Center & Memorial Blood Centers Settlement — Up to $2,500

What happened:

A cyberattack exposed confidential donor and patient data at the New York Blood Center and Memorial Blood Centers, sparking legal action.

Who qualifies:

- Anyone who received a notification letter or email

- Those whose PII (personally identifiable information) was leaked

Payouts:

- Up to $2,500 for documented expenses (identity theft, monitoring)

- $20–$50 flat payments for all other claimants

Deadline:

February 11, 2026

How to File for Up to $100,000 in Settlement Claims: A Step-by-Step Guide

Filing might sound legal or complex — but it’s as simple as ordering something online. Here’s the breakdown:

Step 1: Identify Your Eligibility

- Did you get an email or letter about a class action?

- Did you buy a listed product or use a service like Advance America?

- Did your pet become sick after eating a recalled food brand?

Step 2: Gather Documentation (If You Can)

- Receipts, vet bills, bank statements, fraud alerts

- Emails confirming product purchases or breach notices

Step 3: Visit the Official Settlement Website

Avoid scams. Only use court-approved sites listed at:

- TopClassActions.com

- ClassAction.org

Step 4: Fill Out the Claim Form

- Be accurate and thorough

- Upload supporting documents if you have them

Step 5: Submit Before the Deadline

Late claims won’t be accepted — mark your calendar!

Real-Life Examples to Help You Understand

Tasha (TX) fed her dog Victor’s High Energy formula in 2023. Her dog fell ill, and vet treatment cost over $1,200. With documentation, she filed for reimbursement and is expecting a high payout.

Reggie (CA) had his SSN leaked from the Purpose Financial breach. He paid $300 for credit monitoring and got hit with a fraud alert. He filed a documented claim and qualifies for over $5,000.

Maya (NY) was notified her blood donation data was exposed. She didn’t suffer losses but still submitted a claim and expects a flat $20–$50 payout.

Why You Shouldn’t Ignore These Settlements?

It’s not just about free money — it’s about holding corporations accountable. These lawsuits often lead to:

- Better industry regulation

- Improved safety standards

- Corporate behavior changes

Even filing for $20 helps show that consumers are watching and taking action.

Are Settlements Taxable?

Short answer: It depends.

According to the IRS:

- Reimbursement for losses (out-of-pocket) is NOT usually taxable

- Emotional distress or punitive damages often ARE taxable

- Interest earned on delayed payments? Definitely taxable

Best advice: Keep track of your settlement payouts and ask a tax pro during filing season — especially if you received a large check.

How to Protect Yourself From Settlement Scams?

The rise in online claims means scammers are lurking. Here’s how to stay safe:

Do:

- Only use official sites or trusted aggregators like TopClassActions

- Look for .gov or .org where possible

- Check if a court docket exists

Don’t:

- Pay anyone to “file for you”

- Click random Facebook ads offering settlement money

- Give out your full Social Security Number unless it’s a verified court document

Class Action Settlements 2026 – The Biggest Payouts This Year and What They Mean for Consumers

Robinhood Class Action Settlement Reaches $2 Million: Who’s Eligible and How to File a Claim

Michael Kors Class Action Settlement – Check If You Qualify for Store Credit