Filing Form 1040 in 2026: If you’re filing Form 1040 in 2026, you’re getting ready to handle your 2025 federal income tax return. While it may seem far away, trust me — getting a head start can make the process less stressful, potentially more profitable, and a whole lot smoother. Tax season doesn’t have to feel like a sprint. It can feel like a well-paced walk in the park if you prepare ahead.

Whether you’re a W-2 wage earner, self-employed, running a side hustle, or retired and drawing Social Security, early tax planning puts you in the driver’s seat. This article will guide you step-by-step to prepare for tax season long before the IRS even opens its doors. We’re breaking everything down into simple, real-talk steps that even a 10-year-old could understand, but with enough meat for tax professionals to chew on. Get ready to learn, plan, and take control of your taxes.

Table of Contents

Filing Form 1040 in 2026

Preparing for filing Form 1040 in 2026 doesn’t need to be overwhelming. With a little early effort, the right tools, and smart year-end strategies, you’ll cut through the confusion and get back what’s yours — faster and with less hassle. Tax prep is a year-round mindset, not just a springtime scramble. The more organized you are now, the better your results will be when the IRS starts accepting returns.

| Topic | Details |

|---|---|

| Tax Year | 2025 |

| Filing Window Opens | Estimated Late January 2026 |

| Tax Day Deadline | April 15, 2026 |

| Extension Deadline | October 15, 2026 (with Form 4868) |

| Standard Deduction | $14,800 (Single), $29,600 (Married Filing Jointly) — Estimate |

| Best Filing Method | E-file with Direct Deposit |

| IRS Official Website | https://www.irs.gov |

Why Early Tax Prep Matters (and Pays Off)?

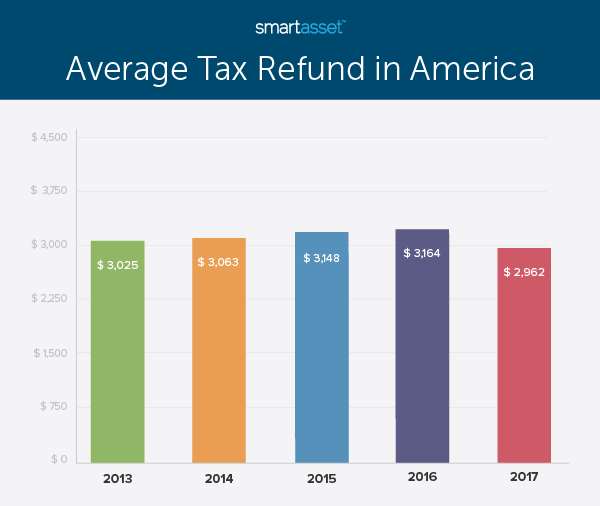

The IRS says that over 160 million individuals file a tax return each year — and about 75% receive a refund. According to the IRS Data Book, the average refund in recent years has been between $2,700 and $3,000. That’s no pocket change.

But here’s the kicker: errors, missing forms, forgotten income, and late filings cause delays, audits, or hefty penalties. The earlier you start organizing, the more likely you are to catch and correct problems before they become expensive.

And for those who owe money? Early prep gives you more time to plan your payment or set up a payment plan without the mad rush in April.

2025 Federal Income Tax Brackets (Estimated)

While the IRS hasn’t finalized the 2025 numbers yet, the inflation-adjusted brackets are expected to look similar to this:

| Filing Status | 10% Bracket | 12% | 22% | 24%+ |

|---|---|---|---|---|

| Single | Up to $11,600 | $11,601–$47,150 | $47,151–$100,525 | $100,526+ |

| Married Filing Jointly | Up to $23,200 | $23,201–$94,300 | $94,301–$201,050 | $201,051+ |

These numbers matter because they affect how much of your income is taxed — which can guide decisions like contributions to 401(k)s, IRAs, or Health Savings Accounts.

Step-by-Step Guide: How to Prepare for Filing Form 1040 in 2026

Step 1: Create Your 2025 Tax Folder

Don’t wait until January 2026 to scramble for receipts. Get ahead by setting up a physical or digital folder with these categories:

- Income documents: W-2s, 1099s (including 1099-NEC, 1099-MISC, 1099-INT, 1099-DIV, and 1099-K)

- Health-related: 1095-A (Marketplace coverage), HSA records, premium payments

- Education: Form 1098-T for tuition payments

- Mortgage: 1098 showing interest paid

- Charitable donations: Receipts and acknowledgment letters

- Business expenses (if self-employed): Receipts, mileage logs, home office records

Keeping these organized throughout 2025 will make 2026 tax filing a breeze.

Step 2: Use the IRS Online Account

The IRS has beefed up its online tools. You can:

- View your adjusted gross income (AGI) from past years

- Download transcripts

- Check on refund status

- Make and manage payment plans

- Request your IP PIN for identity protection

Setting up your account now is smart — authentication can take time, and you’ll want full access by the time you file.

Step 3: Estimate What You’ll Owe (Or Get Back)

The Tax Withholding Estimator at irs.gov helps you project what you’ll owe or get refunded, based on your current paycheck.

This tool is crucial if:

- You have multiple jobs

- You are married but file separately

- You work freelance, gig, or contract jobs

- You had a major life change — marriage, baby, home purchase

Many people overpay all year long — essentially giving the IRS an interest-free loan — just to get a big refund. A better move? Adjust your withholdings so your paycheck reflects the correct amount, and invest the difference.

Step 4: Make Strategic Year-End Tax Moves

Before December 31, 2025, you can make money-saving decisions that directly affect your tax bill:

- Max out 401(k)/403(b) contributions — tax-deferred savings

- Contribute to an HSA or FSA

- Harvest investment losses to offset gains

- Make charitable donations

- Buy eligible business equipment or supplies (if self-employed)

If you’re self-employed, consider prepaying certain deductible expenses or opening a Solo 401(k) or SEP IRA to reduce taxable income.

Step 5: Choose the Right Filing Method

There’s more than one way to file, and choosing the right method can save you both time and stress.

| Method | Best For | Refund Time |

|---|---|---|

| E-file with tax software | Simple to moderate returns | 14–21 days |

| Tax pro / CPA | Complex returns, multiple incomes, business owners | 14–30 days |

| IRS Free File | AGI under $79,000 | 21 days |

| Paper mail | Minimal returns, not time-sensitive | 6–12 weeks |

E-filed returns with direct deposit are consistently the fastest. If you’re due a refund, don’t wait for a paper check.

Common Mistakes to Avoid

Even the smartest folks make tax mistakes that cost them time and money. Here’s what to avoid:

- Not reporting freelance/gig income from platforms like Venmo, PayPal, or Upwork (Form 1099-K is now more commonly issued)

- Wrong bank info for direct deposit

- Claiming ineligible dependents

- Forgetting IRA/HSA contributions

- Not filing at all if you owe

The IRS uses matching systems. If they have a 1099 form and you don’t report that income — even if it’s a few hundred bucks — they will flag it.

Real-Life Case Study: From Panic to Peace

In 2023, one of my clients — a first-time freelancer — didn’t realize he needed to make quarterly estimated tax payments. When April 2024 came, he owed $6,400 in federal taxes and got hit with a $450 penalty.

Fast-forward to the next year: we built a tax calendar, tracked income monthly, and filed on February 5. He owed just $400 and got the penalty waived due to “first-time relief.”

Lesson? Early prep = lower tax bill and no surprises.

Tax Deductions and Credits You Might Miss

| Credit/Deduction | Benefit | Eligibility |

|---|---|---|

| Standard Deduction | Up to $29,600 | Everyone |

| Child Tax Credit | $2,000 per child | Parents |

| American Opportunity Credit | $2,500 | College students |

| Lifetime Learning Credit | $2,000 | Higher education |

| Saver’s Credit | Up to $1,000 | Retirement contributors |

| Earned Income Credit | Up to $7,430 | Low/moderate income workers |

IRS Tax Filing Season 2026 – Key Deadlines and When Refunds Are Expected

IRS Refund 2026 – Simple Steps to Track Your Tax Refund Online and Avoid Delays

IRS February 2026 — Who May Receive a $2,000 Direct Deposit and Possible Payment Dates