February Social Security Payments: If you’re one of the 71 million Americans receiving Social Security benefits in 2026, you know that timing matters. For many households, the monthly Social Security check is the backbone of their budget — and February 2026 throws a curveball that’s easy to miss. Whether you receive retirement, disability (SSDI), survivor benefits, or Supplemental Security Income (SSI), this article will walk you through everything you need to know about when your check will arrive, why it might come early, and how to plan around the shift. It’s plain talk from a pro — with no fluff. Let’s dive into what February’s Social Security payment schedule looks like — and what you should do to stay ahead of the curve.

Table of Contents

February Social Security Payments

The February 2026 Social Security payment schedule has a few twists, especially for SSI recipients getting paid early. Understanding when and how your payment arrives helps you avoid budgeting surprises and ensures you get every dollar you’ve earned. Don’t forget — the COLA increase is already in place, and planning ahead will help you make the most of your benefits. Whether you’re a seasoned retiree, new to SSDI, or helping a family member navigate the system, the key is staying informed and sticking to your plan.

| Topic | Details |

|---|---|

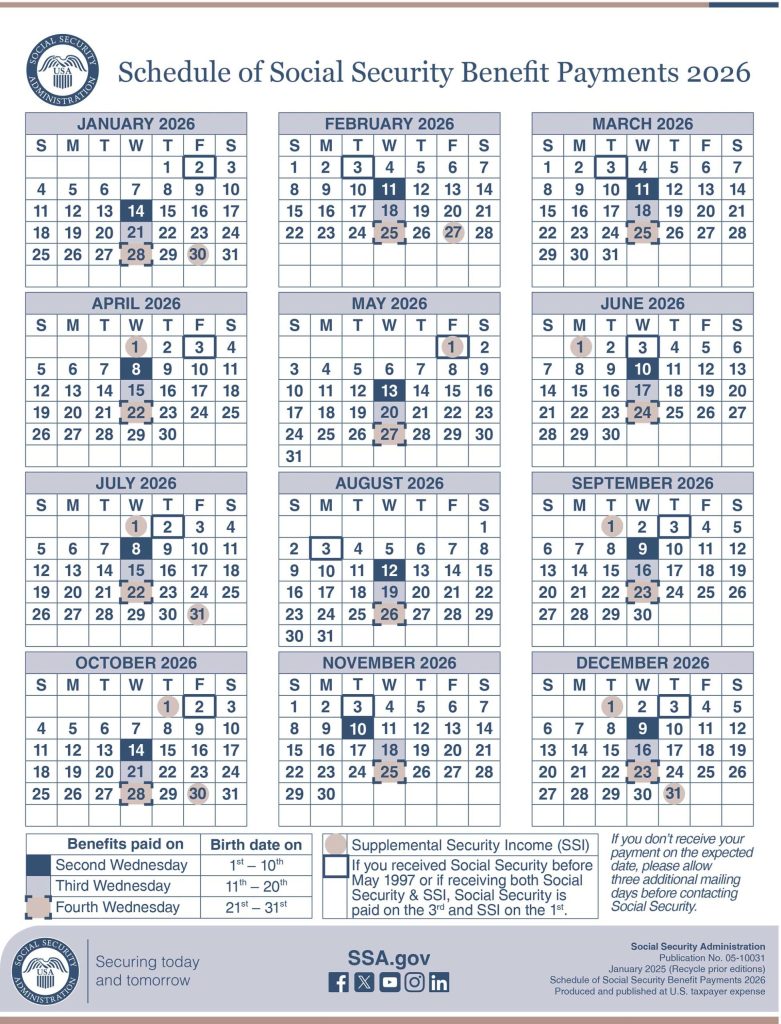

| SSA February Payment Dates | Feb. 3, 11, 18, 25 |

| SSI February Payment Date | Jan. 30, 2026 (early due to weekend) |

| March SSI Payment Date | Feb. 27, 2026 (early) |

| Cost-of-Living Adjustment (COLA) | 3.2% increase applied January 2026 |

| Payment Method Options | Direct deposit, Direct Express card, Paper check |

| Resources | ssa.gov, COLA |

What Is Social Security and Why Does It Matter?

Social Security is more than a paycheck — it’s a promise. Founded in 1935 through the Social Security Act, the program provides a financial safety net for retired workers, disabled individuals, and surviving family members of deceased workers.

It also covers SSI recipients, who are typically low-income Americans aged 65+, blind, or living with a disability. While SSA benefits are based on your work record, SSI is need-based and doesn’t require work history.

For Native and rural communities, these checks often bridge the income gap, supporting everything from groceries and gas to housing and healthcare. That’s why knowing your exact payment date is more than convenience — it’s crucial.

February Social Security Payments: Why Is My Check Coming Early?

This February, the first of the month lands on a Sunday. And just like the mail doesn’t run on Sundays, neither does the U.S. Treasury’s direct deposit system.

That means:

- SSI payments, normally issued on the 1st of each month, will be deposited early — on Friday, Jan. 30.

- March SSI payments are also coming early: Friday, Feb. 27, since March 1 is also a Sunday.

If you see two checks in February, don’t assume it’s a bonus. It’s just the system adjusting for the calendar.

Full February Social Security Payment Schedule

Here’s how things break down depending on the type of benefit you receive and your birthdate.

For SSI Recipients:

- February SSI Payment: Friday, Jan. 30, 2026

- March SSI Payment: Friday, Feb. 27, 2026

For Social Security Recipients (Retirement, SSDI, Survivor Benefits):

If you began receiving benefits before May 1997, you’re part of the early group, and you’ll get your check on:

- Tuesday, Feb. 3, 2026

For all others, your payment is scheduled based on your birthday:

| Birth Day Range | Payment Date |

|---|---|

| 1st–10th | Wednesday, Feb. 11 |

| 11th–20th | Wednesday, Feb. 18 |

| 21st–31st | Wednesday, Feb. 25 |

Tip: If your birthday falls on the 10th or the 20th, you’re included in the earlier bracket.

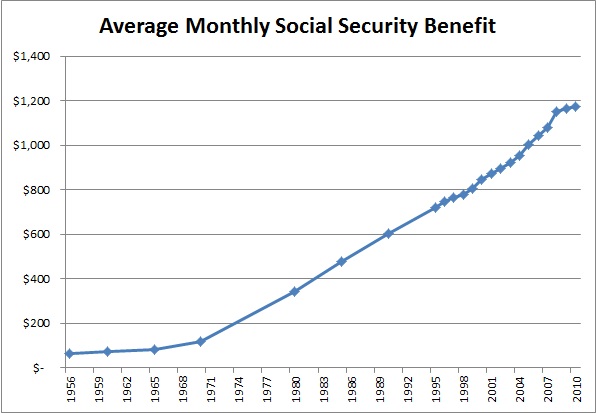

How Much Will You Receive? 2026 COLA in Action

The SSA announced a 3.2% COLA increase for 2026 to keep up with inflation. This means your monthly benefits are slightly higher than last year.

Here are the updated national averages:

- Retired worker: ~$1,909/month

- Disabled worker (SSDI): ~$1,537/month

- SSI individual: ~$943/month

- SSI couple: ~$1,415/month

Note: These are averages. Your benefit may differ based on work history, income, and marital status.

Payment Methods: Know How You’ll Get Paid

The SSA offers several ways to receive your payment:

- Direct Deposit (fastest and safest)

- Direct Express Debit Mastercard

- Paper Check (slowest, prone to delays)

Most folks go with direct deposit — and if you’re not signed up yet, it’s time.

Budgeting Tips for Early or Double Payments

Let’s say you get two payments in February — that could throw off your budget for March if you’re not careful.

Here’s how to stay on track:

- Divide your monthly expenses by the number of weeks between checks — not by calendar months.

- Use envelope budgeting or apps like YNAB or Mint to track spending.

- Stash a week’s worth of expenses in a reserve fund if possible — even $20/week helps.

- If you’re in a low-income household, apply for LIHEAP or SNAP — programs that coordinate well with SSA timing.

Tips for New Social Security Beneficiaries

Just applied or recently approved? Here’s what you need to do:

- Watch for your award letter — it confirms your benefit type and amount.

- Set up a My Social Security account for updates and payment tracking.

- Choose direct deposit — paper checks take longer and are more likely to get lost.

- Understand your redetermination schedule if you’re on SSI.

Pro Tip: Keep all documents in a labeled folder — even if they’re boring. You’ll thank yourself later.

State-by-State Differences

While Social Security is federal, SSI supplements and processing speeds can vary by state. For example:

- California, New York, and Massachusetts offer state SSI supplements.

- Some rural offices have longer processing times due to staff shortages.

- States like Alaska and Hawaii have higher average SSI benefits due to cost-of-living adjustments.

Common Myths About Social Security Payments

Let’s bust a few myths:

- Myth: “Two checks in one month means I got a bonus.”

Truth: It’s an early deposit — next month will have no check. - Myth: “If my birthday is on a weekend, my payment comes later.”

Truth: Your birth date range determines the Wednesday you get paid — weekends don’t matter. - Myth: “Paper checks are faster than direct deposit.”

Truth: Paper checks take longer, are subject to delays, and can get lost.

What If My February Social Security Payments Doesn’t Arrive?

Don’t panic — delays happen. Here’s the plan:

- Wait 3 business days.

- Check your bank — the delay could be on their end.

- Call SSA at 1-800-772-1213 or visit your local office.

- If stolen, SSA will replace it after an investigation.

Social Security February 3 Payments – Who Will Receive Benefits on This Date and Why

SNAP Benefits February Update – Full Payment Schedule and Key Changes You Should Review Now

February SSI Payments – Why Millions of Americans Are Getting Their Checks Early