IRS Refund 2026 Tracker: Every spring, Americans coast to coast file their taxes and wait for that golden moment — the federal tax refund hitting their bank account. But once you file, that’s when the questions start popping up:

“Where’s my refund?” “Did the IRS even get my return?” “Why is it taking so long?” That’s where the IRS Refund 2026 Tracker comes in. Officially called “Where’s My Refund?”, this tool provided by the IRS makes it easy to follow the journey of your refund from submission to deposit. Whether you’re a high school senior doing taxes for the first time, a gig worker juggling 1099s, or a tax preparer helping dozens of clients — this guide lays out everything you need to know.

Table of Contents

IRS Refund 2026 Tracker

The IRS Refund 2026 Tracker is your best tool for staying informed after you file. It’s simple, free, and gives you peace of mind — whether you’re waiting on $200 or $2,000. By following this guide, you’ll be ready to check your refund status without stress or confusion. Remember:

- E-file early

- Use direct deposit

- Check once daily

- Be patient — the IRS is processing millions of returns

| Topic / Guide | Important Facts & Stats |

|---|---|

| What It Is | IRS “Where’s My Refund?” tracker shows refund progress |

| Info Required | SSN or ITIN, Filing Status, Exact Refund Amount |

| When to Check | E‑filed: 24 hrs after filing |

| Average Refund Time | E‑file + direct deposit: ~21 days |

| Paper Returns | 4–6+ weeks processing time |

| Tool Updates | Once daily, usually overnight |

| Where to Check | Web & IRS2Go App |

| Issues That Delay Refunds | Math errors, ID verification, manual review |

What Is the IRS Refund 2026 Tracker?

The IRS Refund Tracker, known officially as “Where’s My Refund?”, is an online tool created by the Internal Revenue Service (IRS) that lets taxpayers track the status of their federal tax refund.

Once your return is submitted and accepted, the IRS updates your status as your refund moves through the system. The tracker provides updates through three main stages:

- Return Received

- Refund Approved

- Refund Sent

The tool is updated once per day (typically overnight), so checking multiple times a day won’t change anything. This is the most accurate and up-to-date source for refund status available to U.S. taxpayers.

Why Use the IRS Refund 2026 Tracker?

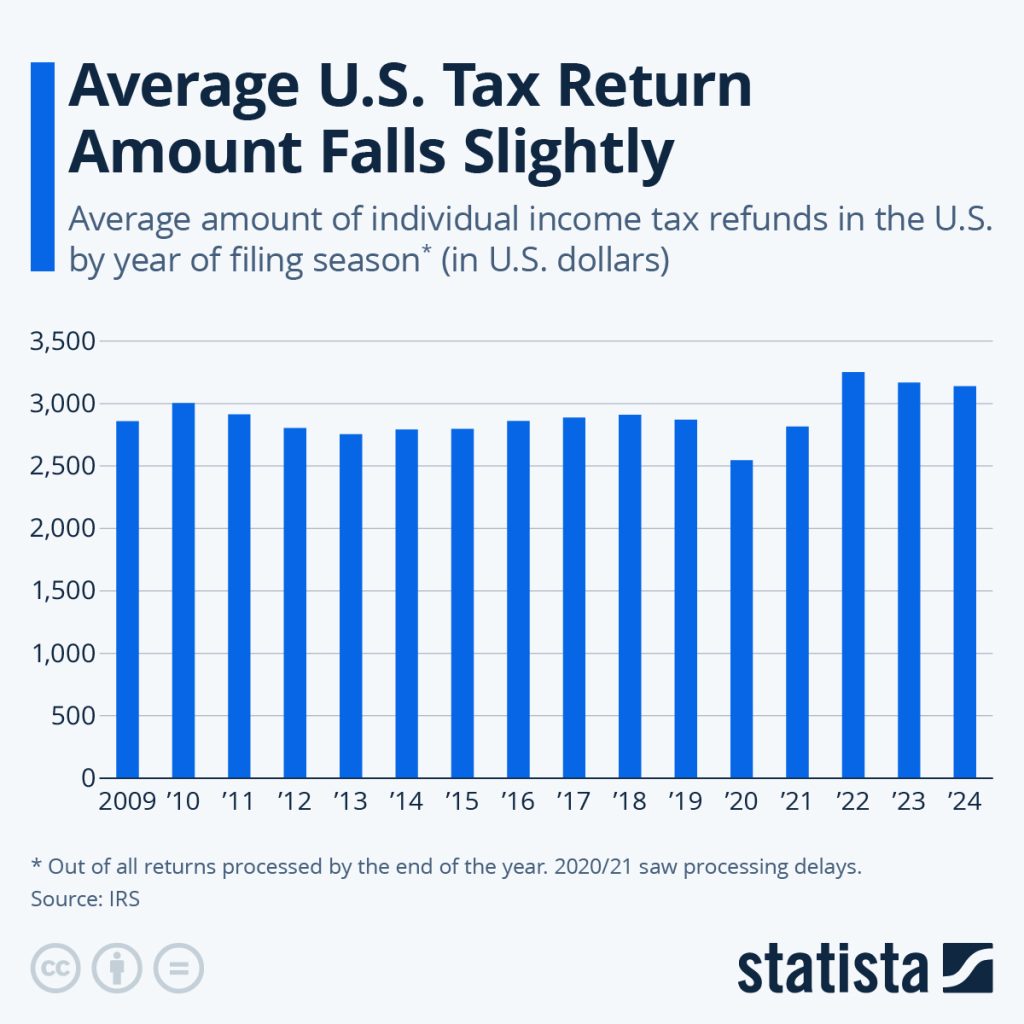

With inflation, rising living expenses, and financial uncertainties, knowing when your refund will arrive is more than just curiosity — it’s about planning and survival.

Tax refunds are often used to:

- Pay off debt

- Catch up on rent or utilities

- Buy groceries or essentials

- Build savings

In 2025, the average refund was $2,753 according to IRS statistics — that’s not small change. Using the refund tracker gives you peace of mind, especially if you’re relying on those funds.

Who Can Use the Refund Tracker?

You’re eligible to use the IRS refund tracker if:

- You filed a federal tax return (not state)

- You filed using Form 1040

- You have your SSN or ITIN

- You know your filing status and refund amount

If you filed jointly, you’ll need the primary filer’s SSN (listed first on the return). It’s available to individuals and businesses who filed federal income taxes.

Note: The tool does not track state tax refunds. For that, visit your state’s Department of Revenue.

Step-by-Step: How to Track Your IRS Refund in 2026

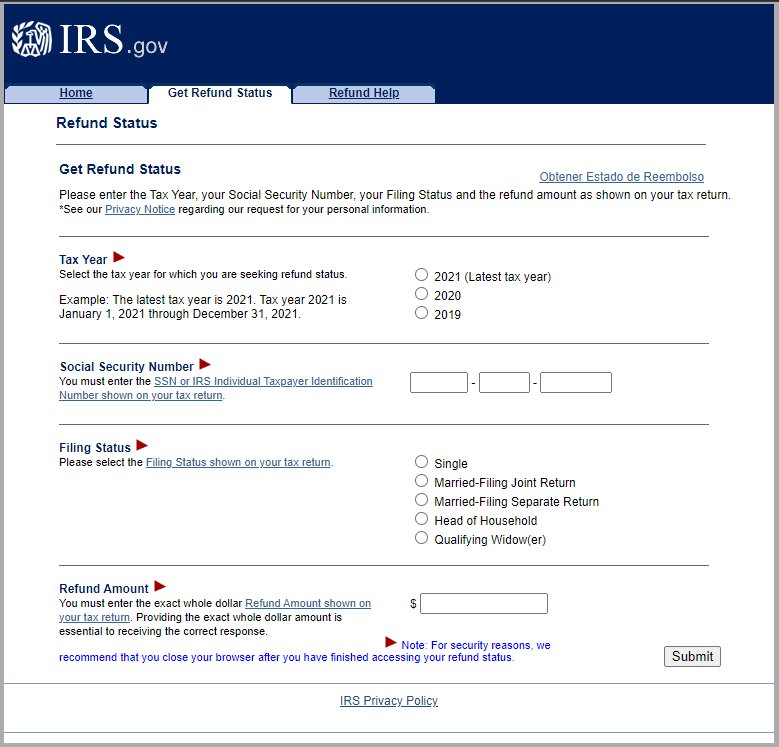

Step 1: Gather the Right Info

Before you go to the IRS site, make sure you have:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Your filing status (e.g., Single, Married Filing Jointly, Head of Household)

- The exact refund amount (from Line 35a of Form 1040)

Entering incorrect information (even $1 off) will prevent the tracker from showing your status.

Step 2: Visit the Refund Tracker

Go to https://www.irs.gov/refunds using any browser.

You can also download the IRS2Go mobile app for iOS and Android.

Avoid third-party “trackers” that ask for personal info — they can be scams.

Step 3: Enter Your Information

On the tracker page, enter:

- SSN or ITIN

- Filing Status

- Exact Refund Amount

Click Submit, and you’ll be shown your refund status immediately.

Step 4: Interpret the Results

Here’s what the statuses mean:

| Status | What It Means |

|---|---|

| Return Received | IRS received your tax return and it’s in the queue |

| Refund Approved | Your return has been processed and approved for payment |

| Refund Sent | Your refund has been sent to your bank or issued as a check |

If your status hasn’t changed for more than 21 days, you might need to contact the IRS.

How Long Does It Take to Get a Refund in 2026?

- E-file + direct deposit: ~21 days

- Paper filed return: 4–6 weeks, sometimes longer

- Paper check delivery: Add 7–14 days after approval

These timelines depend on many factors like IRS workload, holidays, or system outages.

In 2025, IRS processed over 160 million individual returns, so during peak season, expect delays.

Real-Life Use Case: First-Time Filer

Let’s say Jessica, a 21-year-old college student in Oklahoma, filed her taxes on January 30 using TurboTax. She selected direct deposit.

- Jan 30: E-filed return submitted

- Jan 31: IRS “Return Received” status appears

- Feb 8: Status changes to “Refund Approved”

- Feb 11: Refund lands in Jessica’s checking account

Her entire process took 12 days — well below the 21-day average — because she filed early and had no errors.

What Can Delay Your Refund?

Here are the most common reasons:

- Math Errors or Typos – A misentered SSN or wrong banking info can delay or reroute your refund.

- Incomplete Returns – Missing W-2s or schedules can trigger IRS reviews.

- Identity Verification – If flagged for possible identity theft, you’ll need to verify through IRS Identity Verification.

- Earned Income or Child Tax Credit Claims – These returns are legally held until mid-February due to fraud protections.

- Amended Returns (1040-X) – Can take up to 16 weeks or more.

If it’s been more than 21 days (e-file) or 6 weeks (paper) and your refund hasn’t arrived, you can initiate a refund trace.

Tips for Faster Refunds

- File early – The sooner, the better.

- E-file, don’t paper file – Way faster processing.

- Use direct deposit – Avoid mail delays.

- Double-check your entries – Especially routing/account numbers.

- Use IRS-authorized software – Like TurboTax, H&R Block, or Free File.

Security Note: Beware of Tax Scams

Tax season is prime time for fraudsters. Never provide your SSN, refund info, or bank details to anyone calling, texting, or emailing you. The IRS never contacts taxpayers via phone or social media to request sensitive info.

IRS Refund 2026 – Simple Steps to Track Your Tax Refund Online and Avoid Delays

IRS Tax Refund Options Update – Paper Checks Phased Out and New Refund Methods Explained

IRS Tax Filing Season 2026 – Key Deadlines and When Refunds Are Expected